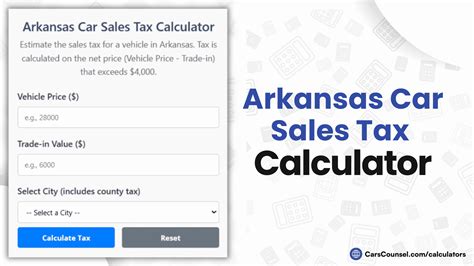

Ct Sales Tax On Cars

When purchasing a car in the state of Connecticut, it's important to understand the sales tax implications to ensure a seamless and informed transaction. The sales tax on cars in Connecticut is a crucial aspect that impacts both dealers and buyers, and a clear understanding of the regulations and rates can make the process more transparent and efficient.

Understanding the Connecticut Sales Tax on Cars

The sales tax in Connecticut, like in many other states, is a percentage-based tax applied to the purchase price of a vehicle. This tax is collected by the state to generate revenue for various public services and infrastructure projects. While the sales tax rate may seem straightforward, there are certain nuances and exemptions that buyers and dealers should be aware of.

The Connecticut Sales Tax Rate

As of my last update in January 2023, the standard sales tax rate in Connecticut is 6.35%. This rate is applied to the total purchase price of the vehicle, including any optional features, extended warranties, and add-ons. However, it’s important to note that this rate may be subject to change, so it’s advisable to verify the current tax rate with the Connecticut Department of Revenue Services before finalizing any car purchase.

The sales tax is calculated based on the total cost of the vehicle, including any additional fees and charges. For example, if you purchase a car for $30,000, the sales tax would be calculated as follows:

| Purchase Price | Sales Tax Rate | Sales Tax Amount |

|---|---|---|

| $30,000 | 6.35% | $1,905 |

In this scenario, the buyer would pay an additional $1,905 in sales tax, bringing the total cost of the vehicle to $31,905.

Exemptions and Special Considerations

While the standard sales tax rate applies to most vehicle purchases, there are certain exemptions and special considerations in Connecticut that buyers should be aware of. These exemptions can significantly impact the overall cost of the vehicle and should be carefully reviewed.

- Trade-Ins: If you trade in your old vehicle when purchasing a new one, the sales tax may be calculated based on the difference between the trade-in value and the purchase price. This can result in a reduced tax liability for the buyer.

- Vehicle Type: Certain types of vehicles, such as motorcycles, may have different tax rates or calculations. It's important to understand the specific regulations for the type of vehicle you're purchasing.

- Military Exemptions: Active-duty military personnel may be eligible for tax exemptions or reductions when purchasing a vehicle in Connecticut. These exemptions are designed to support military members and should be explored if applicable.

- Disability Exemptions: Individuals with disabilities may also qualify for sales tax exemptions or reductions on vehicle purchases. These exemptions aim to provide financial relief and encourage accessibility.

The Impact on Dealers and Buyers

The sales tax on cars in Connecticut has a significant impact on both dealers and buyers. For dealers, understanding the tax regulations and accurately calculating the tax is essential to maintaining compliance and building trust with customers. Dealers should have clear and transparent pricing structures, including tax calculations, to ensure a positive buying experience.

Buyers, on the other hand, need to be aware of the tax implications to make informed purchasing decisions. Understanding the tax rate and any applicable exemptions can help buyers budget effectively and negotiate better deals. Additionally, being knowledgeable about the sales tax process can streamline the paperwork and ensure a smoother transaction.

Tips for Buyers

- Research Beforehand: Before visiting dealerships or making a purchase, research the current sales tax rate and any potential exemptions that may apply to your situation. This will give you an advantage in negotiations and help you understand the overall cost.

- Compare Dealer Offers: Different dealers may have varying approaches to sales tax calculations and inclusions. Compare offers from multiple dealers to ensure you’re getting the best deal and to understand the standard practices in the market.

- Negotiate Smartly: While the sales tax is a mandatory expense, there may be room for negotiation on the purchase price itself. Negotiate the price of the vehicle to potentially offset some of the tax liability.

- Consider Financing Options: Financing a car purchase can provide flexibility and potential tax benefits. Explore financing options and consult with financial advisors to understand the tax implications and find the most advantageous arrangement.

Conclusion

Understanding the sales tax on cars in Connecticut is an essential part of the car-buying process. By being aware of the standard tax rate, potential exemptions, and the impact on both dealers and buyers, individuals can make informed decisions and navigate the process with confidence. Remember to stay updated on any changes to the tax regulations and consult with professionals when needed to ensure a seamless and compliant transaction.

Frequently Asked Questions

Are there any additional fees or taxes besides the sales tax on car purchases in Connecticut?

+

Yes, in addition to the sales tax, there may be other fees and taxes associated with car purchases in Connecticut. These can include title fees, registration fees, and environmental fees. It’s important to review the full breakdown of costs provided by the dealership to understand all the associated expenses.

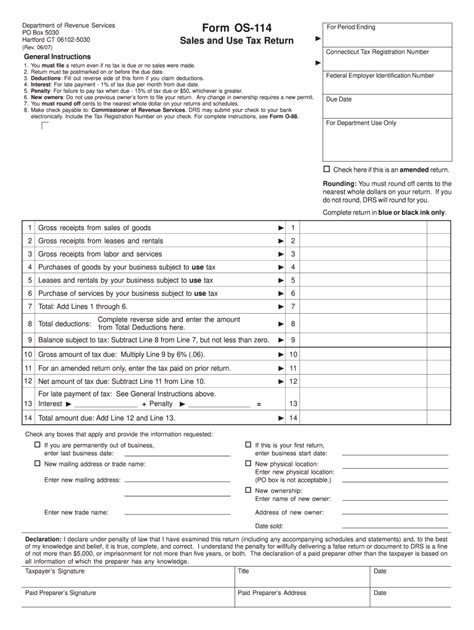

How is the sales tax calculated for leased vehicles in Connecticut?

+

The sales tax calculation for leased vehicles in Connecticut is based on the total capitalized cost of the lease, which includes the vehicle’s price, any down payment, and additional fees. The tax is typically paid upfront at the beginning of the lease term.

Are there any special considerations for electric vehicles (EVs) regarding sales tax in Connecticut?

+

Connecticut offers a sales and use tax exemption for the purchase or lease of electric vehicles. This exemption applies to the first $50,000 of the purchase price, and the remaining amount is taxed at the standard rate. It’s important to consult with the Department of Revenue Services for the most up-to-date information on EV tax incentives.