Pima County Property Tax

In the realm of real estate and finance, understanding property taxes is crucial for both homeowners and investors. This comprehensive guide aims to delve into the specifics of Pima County's property tax system, providing an in-depth analysis and insights to navigate this complex yet essential aspect of homeownership.

Navigating the Pima County Property Tax Landscape

Pima County, located in the vibrant state of Arizona, boasts a diverse range of properties, from sprawling desert ranches to modern urban dwellings. With a rich history dating back to the 1860s, Pima County has evolved into a dynamic region, and its property tax system reflects this evolution.

The property tax system in Pima County is a crucial revenue source for the local government, funding essential services like schools, infrastructure, and public safety. It's a key aspect of the local economy, impacting not only homeowners but also the overall community's well-being.

How Property Taxes are Determined

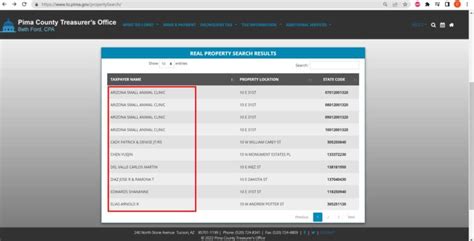

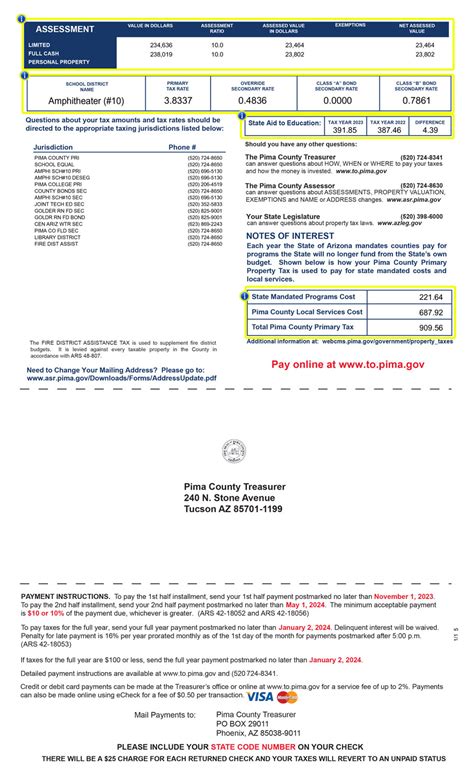

In Pima County, property taxes are calculated based on the assessed value of a property. This assessed value is determined by the Pima County Assessor’s Office, which evaluates properties regularly to ensure fair and accurate taxation.

The assessor's team considers various factors, including:

- Market conditions and recent sales data.

- Property improvements and upgrades.

- Neighborhood characteristics and location.

- Property type (residential, commercial, agricultural, etc.).

Once the assessed value is determined, it's multiplied by the tax rate set by local authorities. This tax rate, or mill rate, is expressed in mills, with one mill representing $1 of tax for every $1,000 of assessed value.

For instance, if your property's assessed value is $200,000 and the mill rate is 50 mills, your property tax liability would be $1,000 ($200,000 x 0.050). This calculation provides a straightforward method to estimate property tax expenses.

Assessed Value and Property Tax Appeals

Property owners have the right to appeal their assessed value if they believe it’s inaccurate. This process, known as a valuation protest, allows homeowners to present evidence and arguments to the Pima County Assessor’s Office to challenge the assessed value.

Successful appeals can lead to a reduced assessed value, resulting in lower property taxes. It's a vital mechanism to ensure fairness and accuracy in the property tax system.

| Property Type | Average Assessed Value |

|---|---|

| Single-Family Homes | $220,000 |

| Condominiums | $185,000 |

| Commercial Properties | $350,000 |

These figures provide a snapshot of the assessed values in Pima County, offering a comparative perspective for different property types.

Payment Options and Due Dates

Pima County offers various payment options to accommodate different financial situations. Property owners can pay their taxes in full by the due date or opt for a payment plan, allowing for monthly installments.

The due dates are typically set for early summer and late fall, providing a predictable schedule for homeowners to budget their finances. Late payments incur penalties, so staying informed about due dates is crucial.

Understanding the Impact of Property Taxes

Property taxes in Pima County play a significant role in the local economy and community development. They fund essential services that directly impact residents’ quality of life, including:

- Education: Property taxes contribute to school districts, ensuring high-quality education for local students.

- Infrastructure: From roads and bridges to public transportation, property taxes maintain and improve the county's infrastructure.

- Public Safety: Funding for police, fire departments, and emergency services is largely dependent on property taxes.

- Community Programs: These taxes support various community initiatives, promoting cultural events, recreational activities, and social services.

By understanding the direct correlation between property taxes and the community's well-being, homeowners can appreciate the significance of their tax contributions.

Exemptions and Reductions

Pima County offers several exemptions and reductions to eligible property owners, providing relief from the financial burden of property taxes. These include:

- Homestead Exemption: Available to homeowners who use their property as their primary residence, this exemption reduces the assessed value by a fixed amount.

- Senior Citizen Exemption: Elderly homeowners can benefit from a reduced assessed value, making property taxes more manageable.

- Veteran Exemption: Active-duty military personnel and veterans are eligible for tax exemptions as a token of appreciation for their service.

- Disability Exemption: Individuals with disabilities can apply for an exemption to ease their financial burden.

These exemptions and reductions demonstrate Pima County's commitment to supporting its residents, especially those who may face financial challenges.

The Role of Property Taxes in Real Estate Investments

For real estate investors, property taxes are a crucial consideration. They impact the overall profitability of an investment, influencing cash flow and potential returns.

Investors should factor in property taxes when calculating their return on investment (ROI). A higher tax burden can reduce the net income from a rental property, affecting the overall financial strategy.

Additionally, property taxes can impact investment decisions. Areas with lower tax rates may be more attractive to investors, offering a competitive advantage in the real estate market.

Navigating the Future: Property Tax Trends in Pima County

As Pima County continues to grow and evolve, its property tax system will likely adapt to meet the changing needs of the community. Here are some insights into the potential future of property taxes in the county:

Potential Tax Rate Adjustments

Local authorities may consider adjusting the tax rate to accommodate rising costs of services or infrastructure projects. While this could increase the tax burden on homeowners, it also ensures the sustainability of essential services.

Historical data suggests that tax rate adjustments have been relatively infrequent, with the focus primarily on maintaining a balanced budget rather than increasing revenue through tax hikes.

Technological Advancements in Assessment

The Pima County Assessor’s Office has been proactive in embracing technological advancements to streamline the assessment process. This includes the use of advanced data analytics and digital tools to enhance accuracy and efficiency.

As technology continues to evolve, the assessment process may become even more precise, ensuring fair and transparent property tax calculations.

Community Engagement and Transparency

Pima County has a reputation for fostering community engagement and transparency. The county’s leadership values open communication with residents, ensuring that property tax decisions are made with the community’s best interests in mind.

Public meetings, online resources, and educational initiatives provide homeowners with the information they need to understand and navigate the property tax system effectively.

Impact of Economic Shifts

Economic fluctuations can significantly impact property values and, consequently, property taxes. In times of economic prosperity, property values may rise, leading to increased tax revenue. Conversely, economic downturns can result in reduced property values and a subsequent decrease in tax revenue.

Pima County's diverse economy, with its strong emphasis on technology, tourism, and agriculture, provides a certain level of resilience against economic shifts. However, the county's leadership will need to remain vigilant and adaptable to ensure a stable and sustainable tax base.

Frequently Asked Questions

What is the current mill rate in Pima County?

+The current mill rate in Pima County is 50 mills. This rate is set by local authorities and is subject to change based on budgetary needs and community feedback.

How often are property values assessed in Pima County?

+Property values in Pima County are typically assessed every two years. However, certain circumstances, such as significant improvements or changes in market conditions, may trigger an assessment outside of this schedule.

Can I appeal my property’s assessed value if I believe it’s inaccurate?

+Absolutely! Property owners have the right to appeal their assessed value if they believe it doesn’t accurately reflect the property’s worth. The Pima County Assessor’s Office provides a detailed process for valuation protests, allowing homeowners to present their case.

Are there any online resources available to estimate my property taxes?

+Yes, Pima County offers an online property tax estimator tool on its official website. This tool provides a rough estimate of your property taxes based on your assessed value and the current tax rate. It’s a valuable resource for budgeting and financial planning.

How can I stay informed about changes to the property tax system in Pima County?

+Pima County maintains an informative website with updates and news related to property taxes. Additionally, local news outlets and community forums often cover relevant tax-related topics, ensuring residents stay informed about any changes or proposed adjustments.