Cypress Fairbanks Isd Tax Office

The Cypress Fairbanks Independent School District (CFISD) in Texas is an educational hub that encompasses a vast geographical area, serving a diverse population of students. Among the various administrative offices that play a pivotal role in the district's operations, the Tax Office stands out as a critical department. This article aims to delve into the workings of the CFISD Tax Office, shedding light on its functions, services, and the impact it has on the local community.

Understanding the Cypress Fairbanks ISD Tax Office

The Tax Office of Cypress Fairbanks ISD is a dedicated unit responsible for managing and overseeing the district’s tax-related affairs. With a mission to ensure efficient and transparent tax administration, the office plays a crucial role in supporting the district’s financial stability and growth. Here’s an in-depth look at its key functions and the services it provides.

Tax Assessment and Collection

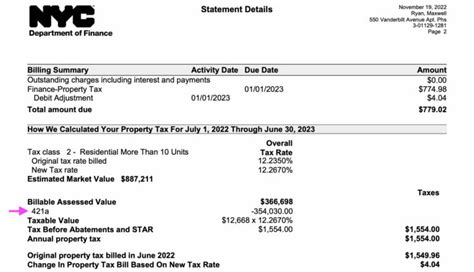

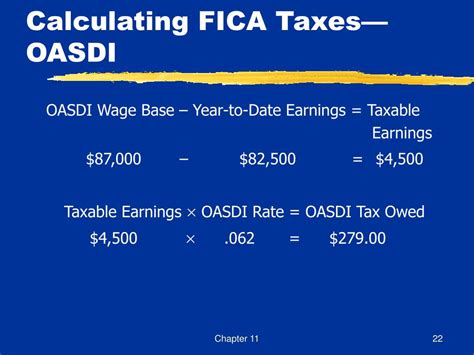

One of the primary responsibilities of the CFISD Tax Office is the assessment and collection of property taxes. These taxes are levied on real estate properties within the district’s boundaries, including residential homes, commercial establishments, and other taxable entities. The office employs a team of skilled professionals who meticulously calculate and determine the taxable value of each property, ensuring accuracy and fairness in the process.

Property owners within the district receive their tax bills, detailing the assessed value and the corresponding tax amount due. The Tax Office provides a transparent and user-friendly online platform where taxpayers can access their account information, view payment history, and make secure online payments. This digital interface enhances convenience and accessibility for taxpayers, allowing them to manage their tax obligations efficiently.

In addition to online payments, the Tax Office offers various payment methods, including traditional methods like checks and money orders. Taxpayers have the flexibility to choose the payment option that best suits their preferences and needs. The office also provides clear guidelines and resources to assist taxpayers in understanding the tax assessment process, ensuring they are well-informed about their rights and responsibilities.

Tax Abatements and Exemptions

The CFISD Tax Office understands that certain property owners may be eligible for tax abatements or exemptions. These programs are designed to provide relief to qualifying individuals or organizations, reducing their tax burden. The office actively promotes awareness about these programs, ensuring that eligible taxpayers can take advantage of the benefits offered.

For instance, the district may offer tax abatements to encourage economic development or support specific community initiatives. These abatements can provide significant savings to businesses and developers, fostering growth and investment within the community. Similarly, exemptions are available for qualifying properties, such as those owned by senior citizens, disabled individuals, or nonprofit organizations.

The Tax Office works closely with the district’s leadership and relevant stakeholders to identify and implement these tax relief programs. By doing so, they contribute to the overall economic well-being of the community, ensuring that taxes are distributed equitably and fairly.

Tax Appeals and Dispute Resolution

In the event of a disagreement or dispute regarding tax assessments, the CFISD Tax Office provides a comprehensive appeals process. Taxpayers who believe their property has been overvalued or wish to challenge their tax assessment have the right to file an appeal. The office ensures a fair and impartial review of such cases, guiding taxpayers through the appeals process and providing necessary information and support.

The appeals process typically involves an initial review by the Tax Office, followed by a formal hearing if the dispute remains unresolved. The office maintains a professional and transparent approach, aiming to resolve disputes amicably and efficiently. By providing a well-defined appeals process, the Tax Office upholds the principle of fairness and ensures that taxpayers’ rights are protected.

Community Engagement and Outreach

Beyond its administrative duties, the CFISD Tax Office actively engages with the community, fostering a sense of transparency and trust. The office organizes regular town hall meetings, workshops, and informational sessions to educate taxpayers about the tax assessment process, payment options, and their rights. These initiatives promote open communication and address any concerns or queries that taxpayers may have.

Additionally, the Tax Office leverages digital platforms and social media to disseminate important tax-related information and updates. By maintaining an active online presence, the office ensures that taxpayers have easy access to resources and can stay informed about any changes or developments. This proactive approach to community engagement strengthens the relationship between the Tax Office and the taxpayers it serves.

Impact on the Community

The CFISD Tax Office’s influence extends beyond its administrative functions, making a significant impact on the local community. The property taxes collected by the office contribute to the district’s overall financial stability, enabling it to provide quality education and essential services to its students and residents.

Supporting Education

A substantial portion of the tax revenue generated by the CFISD Tax Office is allocated towards supporting the district’s educational initiatives. This funding ensures that schools within the district receive the necessary resources, including state-of-the-art facilities, modern technology, and well-equipped classrooms. As a result, students benefit from a high-quality learning environment, which fosters academic excellence and prepares them for future success.

The Tax Office’s commitment to education extends beyond physical infrastructure. The tax revenue also supports various programs and initiatives aimed at enhancing student learning and development. These may include extracurricular activities, after-school programs, and specialized courses that cater to diverse interests and talents. By investing in these initiatives, the Tax Office plays a vital role in shaping the future of the district’s youth.

Economic Development

The CFISD Tax Office’s role in tax assessment and collection has a direct impact on the district’s economic landscape. The property taxes collected from commercial establishments and businesses contribute to the overall economic growth and development of the area. These taxes support infrastructure projects, such as road improvements, public transportation, and community amenities, which, in turn, attract new businesses and investors.

Furthermore, the Tax Office’s efforts to promote tax abatements and exemptions encourage economic development by incentivizing businesses to establish or expand their operations within the district. This not only generates employment opportunities but also enhances the local tax base, leading to a thriving and vibrant community.

Community Initiatives

Beyond its core responsibilities, the CFISD Tax Office actively participates in community initiatives and projects. The office understands the importance of giving back to the community it serves and actively contributes to various charitable causes and social programs. Whether it’s supporting local food banks, organizing community clean-up drives, or participating in fundraising events, the Tax Office demonstrates its commitment to making a positive impact beyond its administrative duties.

By engaging in these initiatives, the Tax Office fosters a sense of unity and collaboration within the community. It strengthens the bond between the district and its residents, creating a supportive and caring environment where everyone can thrive.

Future Outlook

As the Cypress Fairbanks Independent School District continues to grow and evolve, the Tax Office remains committed to adapting and improving its services. With advancements in technology and changing tax landscapes, the office strives to stay at the forefront of tax administration, ensuring it remains efficient, transparent, and responsive to the needs of the community.

Digital Transformation

The CFISD Tax Office recognizes the importance of embracing digital technologies to enhance its operations. By investing in digital transformation, the office aims to streamline processes, improve efficiency, and provide even better services to taxpayers. This includes further developing its online platform, incorporating advanced data analytics, and implementing secure digital payment systems.

Through digital transformation, the Tax Office aims to reduce administrative burdens, minimize errors, and provide taxpayers with a seamless and user-friendly experience. By leveraging technology, the office can focus on providing valuable insights and guidance, ensuring that taxpayers receive the support they need to navigate the tax assessment and collection process effectively.

Community Collaboration

Looking ahead, the CFISD Tax Office aims to strengthen its collaboration with the community and other district departments. By fostering open communication and partnership, the office can better understand the needs and challenges faced by taxpayers. This collaborative approach will enable the Tax Office to tailor its services and initiatives to meet the unique requirements of the district’s diverse population.

Additionally, the office plans to expand its outreach programs, ensuring that all taxpayers, regardless of their background or circumstances, have equal access to information and support. By actively engaging with the community, the Tax Office can build trust, promote transparency, and create a positive tax culture within the district.

Sustainable Practices

In its future endeavors, the CFISD Tax Office is committed to adopting sustainable practices and promoting environmental responsibility. The office aims to minimize its environmental impact by implementing eco-friendly initiatives, such as digital documentation, energy-efficient systems, and waste reduction programs. By embracing sustainability, the Tax Office sets an example for the community, inspiring others to adopt greener practices.

Furthermore, the office plans to explore innovative solutions to reduce its carbon footprint, such as implementing renewable energy sources and promoting energy-efficient building designs. By integrating sustainability into its operations, the Tax Office demonstrates its dedication to creating a brighter and more sustainable future for the district and its residents.

Conclusion

The Cypress Fairbanks Independent School District Tax Office is a vital component of the district’s administrative framework, playing a crucial role in supporting the community’s growth and development. Through its dedicated team and efficient processes, the Tax Office ensures fair and transparent tax administration, contributing to the district’s financial stability and educational excellence. As the district continues to thrive, the Tax Office remains committed to adapting, innovating, and serving the community with integrity and professionalism.

How can I calculate my property taxes in Cypress Fairbanks ISD?

+To calculate your property taxes in Cypress Fairbanks ISD, you can use the online tax calculator provided by the Tax Office. This calculator considers factors such as your property’s assessed value, applicable tax rates, and any eligible exemptions or abatements. It offers a convenient way to estimate your tax liability before receiving your official tax bill.

What are the payment options available for tax payments?

+The CFISD Tax Office offers a range of payment options to cater to different preferences. You can make payments online through the secure payment portal, by mail using checks or money orders, or in person at the Tax Office during designated hours. Additionally, the office may accept payments via phone or through authorized payment service providers.

How can I appeal my property tax assessment if I disagree with it?

+If you believe your property tax assessment is inaccurate or unfair, you have the right to appeal. The CFISD Tax Office provides clear guidelines on the appeals process. You can start by submitting a formal protest, detailing your reasons for disagreement. The office will then review your case and schedule a hearing if necessary. It’s important to gather relevant documentation and evidence to support your appeal.

Are there any tax exemptions or abatements available for senior citizens or disabled individuals?

+Yes, CFISD offers tax exemptions and abatements to eligible senior citizens and disabled individuals. These programs aim to provide financial relief and support to those who qualify. To find out more about the specific requirements and application process, you can visit the Tax Office website or contact their dedicated support team for guidance.

How does the Tax Office ensure transparency and accountability in its operations?

+The CFISD Tax Office is committed to maintaining transparency and accountability in its operations. They achieve this through various measures, including regular audits, public meetings, and open communication channels. The office provides detailed tax information, publishes annual reports, and ensures compliance with relevant tax laws and regulations. By fostering transparency, the Tax Office builds trust with taxpayers and the community at large.