Fica Oasdi Tax

The Fica Oasdi Tax, a fundamental component of the U.S. social security system, plays a pivotal role in shaping the financial landscape for millions of Americans. Understanding this tax is crucial, as it directly impacts individuals' retirement plans and overall financial well-being. This comprehensive guide aims to demystify the FICA OASDI tax, offering a detailed exploration of its purpose, calculation methods, and implications for taxpayers.

Unraveling the FICA OASDI Tax

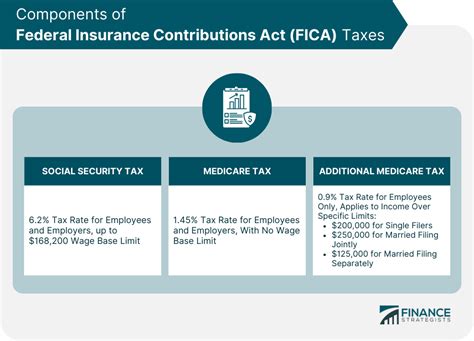

The Federal Insurance Contributions Act (FICA) is a cornerstone of the U.S. tax system, imposing a mandatory tax on both employees and employers to fund social security and Medicare. OASDI, an acronym for Old-Age, Survivors, and Disability Insurance, represents the social security portion of this tax. This tax is a vital source of funding for crucial social safety net programs, ensuring the financial security of millions of Americans.

Purpose and Significance of OASDI

The OASDI tax serves as the primary funding mechanism for Social Security benefits, which include retirement, disability, and survivor benefits. These benefits provide financial support to individuals and their families during times of need, making this tax an essential component of the nation’s social safety net.

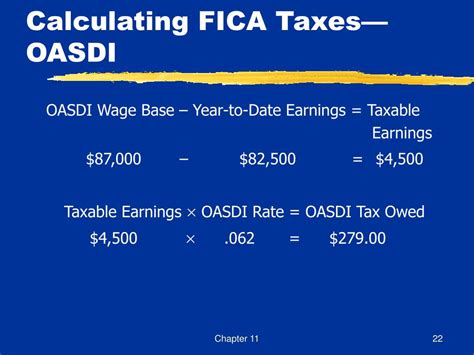

The tax is calculated as a percentage of an employee's wages or self-employment income, with the rate subject to annual adjustments. The current OASDI tax rate is 6.2% for employees and employers each, totaling 12.4% of the employee's wages. This tax is applicable up to a certain wage threshold, beyond which the tax is no longer deducted.

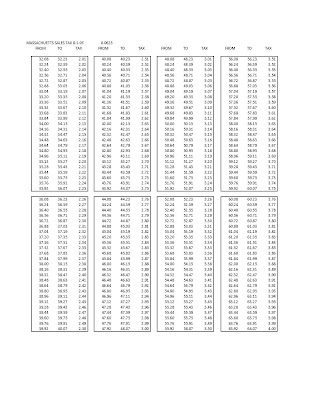

Tax Calculation and Wage Base Limit

For the year 2023, the OASDI tax is applied to the first $160,200 of an employee’s earnings. This wage base limit, also known as the Social Security taxable maximum, is adjusted annually to account for inflation. Earnings above this limit are not subject to the OASDI tax, but may be subject to other taxes.

| Year | Wage Base Limit |

|---|---|

| 2023 | $160,200 |

| 2022 | $147,000 |

| 2021 | $142,800 |

It's important to note that the OASDI tax is separate from the Medicare tax, which is also part of the FICA tax. The Medicare tax has a different rate and wage base limit, and is used to fund the Medicare program, providing health insurance for seniors and certain disabled individuals.

Impact on Taxpayers

The FICA OASDI tax has a significant impact on taxpayers’ financial planning, especially in the context of retirement. The tax deductions directly affect the amount of income an individual receives during their working years, influencing their ability to save and invest for the future. Moreover, understanding the tax is crucial for effective retirement planning, as it determines the benefits one can expect to receive from Social Security.

The Future of FICA OASDI Tax

As the U.S. population ages and life expectancies increase, the FICA OASDI tax faces significant challenges. The Social Security Trust Fund, which is funded by the OASDI tax, is projected to deplete by 2034, highlighting the urgency of addressing the long-term sustainability of the program.

Proposed Reforms and Solutions

To ensure the long-term viability of the Social Security program, various reforms have been proposed. These include increasing the OASDI tax rate, adjusting the wage base limit, and modifying the benefit calculation formula. Some proposals also advocate for encouraging private retirement savings and promoting economic growth to enhance the overall financial health of the program.

Additionally, there are calls for more equitable distribution of benefits, especially for lower-income individuals who often rely heavily on Social Security for their retirement income. This could involve adjusting the benefit formula to provide a higher replacement rate for lower earners, ensuring that the program remains a vital safety net for all Americans.

The Role of Economic Growth

Economic growth is a key factor in the long-term sustainability of the FICA OASDI tax and the Social Security program. A growing economy generates more taxable income, increasing the funds available for the program. This, in turn, can lead to higher benefits for retirees and better financial security for future generations.

Promoting economic growth involves a range of strategies, from encouraging business investment and job creation to enhancing workforce productivity. These efforts can not only strengthen the Social Security program but also contribute to a more robust and resilient economy overall.

Navigating the Complexities of FICA OASDI

Understanding the FICA OASDI tax is a crucial aspect of financial literacy, especially for individuals planning for their retirement. The tax is a significant contributor to the Social Security program, which provides essential benefits for millions of Americans. By grasping the intricacies of this tax, individuals can make more informed decisions about their financial future and retirement planning.

The Importance of Financial Planning

Financial planning is a key strategy for navigating the complexities of the FICA OASDI tax and its impact on retirement benefits. By understanding the tax and its implications, individuals can develop effective strategies to maximize their savings and investment potential. This includes optimizing contributions to retirement accounts, managing taxable income, and making informed decisions about when to claim Social Security benefits.

Moreover, financial planning allows individuals to adapt to changes in the tax landscape and the Social Security program. As the program undergoes reforms and adjustments, having a well-thought-out financial plan can help individuals stay prepared and minimize the impact of these changes on their retirement income.

The Role of Professional Guidance

Given the complexity of the FICA OASDI tax and the Social Security program, seeking professional guidance can be invaluable. Financial advisors and tax professionals can provide personalized advice and strategies tailored to an individual’s unique financial situation. They can help navigate the tax implications, maximize benefits, and ensure compliance with tax laws and regulations.

Additionally, professional guidance can offer a comprehensive view of an individual's financial health, including retirement planning, investment strategies, and tax optimization. This holistic approach can lead to more effective financial management and a secure retirement.

Conclusion: The Significance of FICA OASDI Tax

The FICA OASDI tax is more than just a deduction from one’s paycheck. It is a critical component of the U.S. social safety net, providing financial security to millions of Americans during their retirement years and in times of disability or loss. Understanding this tax is not only essential for effective financial planning but also for appreciating the broader social and economic implications it carries.

As the nation navigates the challenges of an aging population and evolving economic landscapes, the FICA OASDI tax and the Social Security program remain at the forefront of policy discussions. Ensuring the long-term sustainability of these programs is not just a financial challenge but a societal responsibility, impacting the lives of current and future generations.

How is the FICA OASDI tax calculated?

+The FICA OASDI tax is calculated as a percentage of an employee’s wages or self-employment income. The current rate is 6.2% for employees and employers each, totaling 12.4% of the employee’s wages. This tax is applicable up to a certain wage threshold, which is adjusted annually.

What is the wage base limit for the FICA OASDI tax in 2023?

+The wage base limit for the FICA OASDI tax in 2023 is $160,200. This means that earnings above this amount are not subject to the OASDI tax, but may be subject to other taxes.

How does the FICA OASDI tax impact my retirement planning?

+The FICA OASDI tax directly affects the amount of income you receive during your working years, influencing your ability to save and invest for retirement. Understanding the tax is crucial for effective retirement planning, as it determines the benefits you can expect to receive from Social Security.

What are the proposed reforms for the FICA OASDI tax and Social Security program?

+Proposed reforms include increasing the OASDI tax rate, adjusting the wage base limit, and modifying the benefit calculation formula. There are also calls for more equitable distribution of benefits, especially for lower-income individuals.

Why is economic growth important for the FICA OASDI tax and Social Security program?

+Economic growth generates more taxable income, increasing the funds available for the Social Security program. This can lead to higher benefits for retirees and better financial security for future generations. Promoting economic growth involves strategies such as encouraging business investment and enhancing workforce productivity.