Gilbert Az Sales Tax

Gilbert, Arizona, a vibrant and rapidly growing city, is known for its sunny climate, diverse community, and thriving economy. As a resident or a business owner in Gilbert, understanding the intricacies of the sales tax landscape is crucial. This comprehensive guide will delve into the specifics of Gilbert's sales tax, providing an in-depth analysis of the rates, exemptions, and unique features that make it an essential topic for both locals and entrepreneurs.

Unraveling the Gilbert Sales Tax: A Comprehensive Overview

Gilbert’s sales tax system is a dynamic interplay of state, county, and municipal taxes, each with its own purpose and rate. Understanding this multi-tiered structure is key to navigating the financial responsibilities associated with doing business or residing in this vibrant community.

The Foundation: Arizona State Sales Tax

Arizona’s state sales tax stands at 5.6%, a rate that applies uniformly across the state. This base rate is a fundamental component of the sales tax structure, serving as the foundation upon which additional local taxes are built.

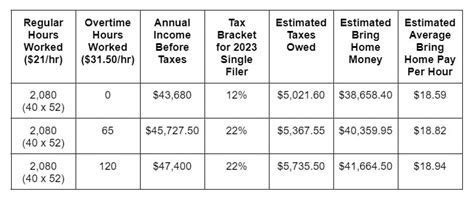

| Taxing Entity | Sales Tax Rate |

|---|---|

| Arizona State | 5.6% |

| Maricopa County | 1.3% |

| Gilbert Municipal | 1.9% |

On top of the state sales tax, Maricopa County levies an additional 1.3%, bringing the total to 6.9%. This county tax contributes to the overall tax burden and is a significant consideration for businesses operating within the county.

The Gilbert Municipal Tax: A Local Perspective

Gilbert, like many other municipalities, imposes its own sales tax. This local tax, set at 1.9%, is unique to the city and plays a vital role in funding local initiatives and services. When combined with the state and county taxes, the total sales tax rate in Gilbert stands at 8.2%.

This breakdown highlights the cumulative effect of sales taxes, with each taxing entity contributing to the overall rate. For businesses and consumers, this multi-layered tax structure means a more complex financial landscape to navigate.

Exemptions and Special Considerations

Gilbert’s sales tax system, while relatively straightforward, does offer certain exemptions and special provisions. These exceptions can provide significant financial relief for specific industries or transactions, making them an important aspect of the tax landscape.

- Food for Home Consumption: Sales of unprepared food items, including groceries and non-alcoholic beverages, are generally exempt from sales tax in Gilbert.

- Prescription Medications: Sales of prescription drugs and certain medical devices are exempt from sales tax, providing a vital relief for healthcare expenses.

- Manufacturing: Many manufacturing-related sales and purchases may be exempt or qualify for reduced tax rates, depending on the specific products and processes involved.

- Aircraft Sales: Aircraft purchases and related services often benefit from reduced or zero-rated sales tax, making Gilbert an attractive hub for aviation-related businesses.

Compliance and Reporting: Navigating Gilbert’s Sales Tax System

Compliance with Gilbert’s sales tax regulations is a critical aspect of doing business in the city. Accurate reporting and timely remittance of sales taxes are essential to maintain good standing with local authorities and avoid penalties.

Registration and Permits

Businesses operating in Gilbert must obtain a Transaction Privilege Tax (TPT) License from the city. This license authorizes the collection and remittance of sales taxes and is a prerequisite for conducting business within the city limits.

The process of obtaining a TPT license involves registering with the Gilbert Finance Department and providing relevant business details. The license must be renewed periodically to ensure continued compliance.

Sales Tax Remittance and Filing

Sales tax remittance in Gilbert follows a monthly schedule, with taxes due on the 20th of each month for the previous month’s sales. Businesses are required to file accurate sales tax returns, providing detailed information on taxable sales and the corresponding tax amounts.

The city offers online filing options through its Gilbert Tax Portal, providing a convenient and efficient way to manage sales tax obligations. This portal also allows for the tracking of payments and the retrieval of historical tax data.

Penalties and Interest

Failure to comply with Gilbert’s sales tax regulations can result in significant penalties and interest charges. Late payments, inaccurate filings, or non-compliance with registration requirements can trigger these penalties, which can quickly accumulate and become a substantial financial burden.

To avoid penalties, it is crucial for businesses to stay informed about their sales tax obligations, maintain accurate records, and ensure timely filings. Seeking professional guidance or utilizing tax compliance software can also help mitigate the risk of non-compliance.

The Impact of Sales Tax on Gilbert’s Economy

Sales tax is a significant revenue stream for Gilbert, contributing to the city’s fiscal health and the funding of essential services. The tax revenue supports a wide range of public services and infrastructure projects, playing a vital role in the city’s overall economic development.

Funding Essential Services

A substantial portion of the sales tax revenue is allocated to fund critical public services such as law enforcement, fire protection, and emergency medical services. These services are the backbone of the community, ensuring the safety and well-being of residents and visitors alike.

The sales tax also contributes to the maintenance and improvement of Gilbert's infrastructure, including roads, parks, and public facilities. These investments enhance the quality of life for residents and create a more attractive environment for businesses and investors.

Economic Development and Business Incentives

Gilbert’s sales tax structure is designed to promote economic growth and attract new businesses. The city offers a range of incentives and tax breaks to encourage investment and job creation, making it an appealing destination for entrepreneurs and established companies alike.

These incentives can take various forms, including reduced tax rates for specific industries, tax holidays for new businesses, or tax credits for job creation. By offering these incentives, Gilbert aims to foster a business-friendly environment that drives economic growth and prosperity.

Comparative Analysis: Gilbert’s Sales Tax in Context

Gilbert’s sales tax rate of 8.2% positions it slightly above the average for Arizona cities. While this rate may be seen as a potential drawback for businesses, it is important to consider the overall business environment and the benefits that Gilbert offers.

| City | Total Sales Tax Rate |

|---|---|

| Gilbert | 8.2% |

| Phoenix | 8.3% |

| Tucson | 8.1% |

| Mesa | 7.8% |

| Chandler | 8.3% |

When compared to other major cities in Arizona, Gilbert's sales tax rate is competitive. While slightly higher than some cities, it is balanced by the city's strong economy, vibrant community, and attractive business environment.

Additionally, Gilbert's exemptions and special provisions can provide significant tax savings for certain businesses, further enhancing its appeal as a business destination.

Conclusion: A Comprehensive Sales Tax Strategy for Gilbert

Understanding and effectively managing Gilbert’s sales tax landscape is a critical aspect of successful business operations in the city. By navigating the multi-tiered tax structure, leveraging exemptions, and staying compliant with reporting and remittance requirements, businesses can optimize their tax obligations and contribute to the vibrant economic ecosystem of Gilbert.

For residents, a clear understanding of sales tax rates and exemptions can help make informed financial decisions and support the community's growth and development. Gilbert's sales tax system, while complex, is an integral part of the city's fiscal health and economic vitality.

Stay Informed, Stay Compliant

Staying informed about Gilbert’s sales tax regulations and seeking professional guidance when needed is essential. The sales tax landscape can be dynamic, with frequent changes and updates, so keeping abreast of these changes is crucial for both businesses and individuals.

By embracing a proactive approach to sales tax management, Gilbert's residents and businesses can ensure they are meeting their financial obligations while maximizing the benefits of the city's tax system. This comprehensive understanding of sales tax not only fosters compliance but also contributes to the continued success and prosperity of the Gilbert community.

What is the current sales tax rate in Gilbert, Arizona?

+

The total sales tax rate in Gilbert is 8.2%, comprising the state sales tax of 5.6%, Maricopa County tax of 1.3%, and the Gilbert municipal tax of 1.9%.

Are there any sales tax exemptions in Gilbert?

+

Yes, Gilbert offers several sales tax exemptions, including food for home consumption, prescription medications, certain manufacturing-related sales, and aircraft purchases.

How often do businesses need to remit sales tax in Gilbert?

+

Businesses are required to remit sales tax on a monthly basis, with taxes due on the 20th of each month for the previous month’s sales.

What are the penalties for non-compliance with Gilbert’s sales tax regulations?

+

Non-compliance with Gilbert’s sales tax regulations can result in significant penalties and interest charges. Late payments, inaccurate filings, or non-compliance with registration requirements can trigger these penalties.

How does Gilbert’s sales tax revenue contribute to the city’s economy?

+

Sales tax revenue is a significant contributor to Gilbert’s fiscal health, funding essential public services, infrastructure projects, and economic development initiatives.