Is There Taxes On Overtime

The taxation of overtime pay is a complex aspect of the global employment landscape, with varying regulations across different jurisdictions. This article aims to delve into the intricate details of how overtime earnings are taxed, providing a comprehensive understanding of the topic.

Understanding Overtime Taxation

Overtime taxation, a critical component of employment law, varies significantly across countries and even within regions. It is influenced by a multitude of factors, including the legal framework, tax policies, and collective bargaining agreements.

The taxation of overtime pay can be divided into two main categories: regular overtime and premium overtime. Regular overtime refers to the hours worked beyond the standard workweek, while premium overtime typically entails additional compensation for work performed on weekends, holidays, or outside of regular business hours.

Tax Treatment of Overtime Earnings

The tax treatment of overtime earnings is not uniform and often depends on the prevailing tax laws in a particular jurisdiction. In some countries, overtime pay is taxed at the same rate as regular income, meaning that it is subject to the same income tax brackets and deductions. This approach ensures that overtime income is treated as part of an individual’s overall earnings, contributing to their total taxable income.

However, there are jurisdictions where overtime pay is taxed at a different rate or is subject to specific tax rules. In certain cases, a higher tax rate may be applied to overtime earnings to discourage excessive working hours and promote a better work-life balance. Alternatively, some countries offer tax incentives for overtime work, such as lower tax rates or tax credits, to encourage productivity and flexibility in the workforce.

| Country | Overtime Tax Treatment |

|---|---|

| United States | Overtime pay is taxed as ordinary income, subject to federal and state income taxes, Social Security, and Medicare taxes. |

| Canada | Overtime earnings are taxed at the same rate as regular income, with deductions for federal and provincial/territorial taxes. |

| United Kingdom | Overtime pay is included in taxable income and taxed at the applicable income tax rates. National Insurance Contributions also apply. |

| Australia | Overtime income is taxed as part of an individual's total earnings, with the applicable tax rate depending on their overall income. |

| Germany | Overtime pay is generally taxed at a higher rate than regular income, with the exact rate varying based on the individual's income bracket. |

Factors Influencing Overtime Taxation

Several factors play a role in determining how overtime pay is taxed, including the nature of the work, the industry, and the employee’s contractual arrangements.

Industry and Sector-Specific Considerations

The tax treatment of overtime earnings can vary across industries and sectors. For instance, certain industries, such as healthcare or transportation, may have specific regulations governing overtime pay and its taxation. These regulations could be influenced by the need for round-the-clock services or the unique nature of work in these sectors.

Additionally, collective bargaining agreements between employers and unions can also dictate the tax treatment of overtime pay. These agreements may stipulate that overtime earnings are taxed differently or that certain deductions or allowances are applicable.

Employment Contracts and Agreements

Employment contracts and collective agreements often specify the terms and conditions of overtime work, including the applicable pay rates and any additional benefits or allowances. These agreements can also outline the tax treatment of overtime earnings, especially in jurisdictions where there is flexibility in tax policies.

For instance, some contracts may include provisions for tax-free overtime allowances, where a certain portion of overtime pay is exempt from income tax. This can be a significant benefit for employees, especially those who regularly work overtime.

Calculating Overtime Taxes

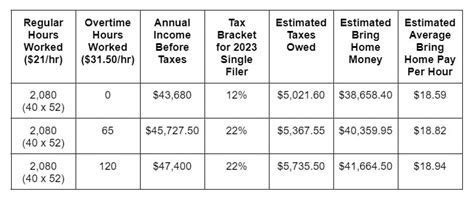

The process of calculating overtime taxes can be complex, as it involves understanding the applicable tax laws, determining the overtime pay rate, and applying the correct tax rates. Here’s a simplified breakdown of the process:

Determining Overtime Pay Rate

The first step in calculating overtime taxes is to determine the overtime pay rate. This rate is typically higher than the regular pay rate and is often set at 1.5 times the regular rate, known as time-and-a-half. However, this can vary depending on the jurisdiction and any applicable collective agreements.

For example, in the United States, the Fair Labor Standards Act (FLSA) mandates that overtime pay is at least one and one-half times the regular rate of pay. However, certain states may have higher minimum overtime pay rates.

Applying Tax Rates

Once the overtime pay rate is determined, the applicable tax rates need to be identified. As mentioned earlier, overtime pay is often taxed at the same rate as regular income. However, in some cases, it may be subject to a different tax rate, such as in Germany where overtime pay is taxed at a higher rate.

Employers or tax authorities will calculate the taxes owed on overtime earnings by applying the appropriate tax rates to the overtime pay amount. This calculation takes into account the employee's overall income, deductions, and tax credits, ensuring that the correct amount of tax is withheld.

Impact of Overtime Taxation on Employers and Employees

The taxation of overtime pay has implications for both employers and employees. For employers, it can influence their labor costs and overall payroll expenses. The tax treatment of overtime earnings can impact the financial viability of offering overtime work and the structure of employment contracts.

For employees, the tax implications of overtime work can significantly affect their take-home pay. Understanding the tax treatment of overtime earnings is crucial for financial planning and budgeting. Employees should be aware of the tax rates applicable to their overtime pay to accurately estimate their net income from overtime work.

Employer Considerations

Employers need to consider the tax implications of overtime work when planning their labor strategies. They must ensure compliance with tax laws and regulations, which can be complex, especially in jurisdictions with varying tax rates for overtime earnings.

Additionally, employers may need to factor in the impact of overtime taxation on their payroll expenses. If overtime pay is taxed at a higher rate, it can increase the cost of labor, which may influence decisions about offering overtime work or adjusting work schedules.

Employee Awareness

Employees should be well-informed about the tax treatment of their overtime earnings. This awareness is essential for making informed decisions about accepting overtime work and understanding the financial implications of their overtime hours.

Employers can play a role in educating their employees about overtime taxation. Providing clear and concise information about the tax rates applicable to overtime pay, as well as any tax-related benefits or allowances, can help employees make more informed choices about their work hours and financial planning.

Future Trends and Potential Changes

The taxation of overtime pay is subject to ongoing discussions and potential changes, driven by factors such as changing labor dynamics, economic conditions, and policy shifts.

Potential Policy Reforms

There is a growing debate around the taxation of overtime earnings, with some advocating for tax reforms to encourage or discourage overtime work. Some countries may consider implementing tax incentives to promote overtime work, especially in sectors facing labor shortages or skill gaps.

Conversely, there may be proposals to increase tax rates on overtime earnings to discourage excessive working hours and promote a healthier work-life balance. These proposals often consider the potential health and well-being implications of long working hours and aim to create a more sustainable work environment.

Technological Advancements

Technological advancements in payroll management and tax compliance software can also influence the taxation of overtime pay. These tools can streamline the process of calculating and withholding taxes on overtime earnings, making it easier for employers to comply with tax regulations.

Furthermore, these technologies can provide real-time insights into the tax implications of overtime work, helping employers and employees make more informed decisions. For instance, employees can use these tools to estimate their net income from overtime work, aiding in their financial planning.

Conclusion

The taxation of overtime pay is a multifaceted issue that requires a nuanced understanding of tax laws, employment regulations, and industry practices. It is a critical aspect of the employment landscape, impacting both employers and employees.

As the world of work continues to evolve, the taxation of overtime earnings will remain a dynamic topic, influenced by economic, social, and policy factors. Staying informed about these changes is essential for employers, employees, and policymakers to ensure compliance, financial planning, and the development of effective labor strategies.

What is the purpose of taxing overtime pay?

+Taxing overtime pay is a way for governments to generate revenue and ensure that overtime earnings are fairly taxed alongside regular income. It also helps maintain a balance between encouraging productivity and promoting a healthy work-life balance.

Are there any tax benefits for overtime work?

+Yes, in some jurisdictions, there may be tax incentives for overtime work, such as lower tax rates or tax credits. These incentives aim to promote productivity and flexibility in the workforce.

How can I calculate my taxes on overtime pay?

+Calculating taxes on overtime pay involves determining your overtime pay rate, identifying the applicable tax rates, and applying those rates to your overtime earnings. It’s best to consult with a tax professional or use reliable tax calculation tools to ensure accuracy.