Alameda County Property Taxes

In the realm of real estate and financial planning, understanding the intricacies of property taxes is paramount. For residents and property owners in Alameda County, California, this understanding becomes even more critical due to the unique characteristics of the local tax system. This article aims to delve deep into the specifics of Alameda County property taxes, offering a comprehensive guide to help navigate this complex yet essential aspect of homeownership.

Understanding Alameda County Property Taxes

Alameda County, situated in the San Francisco Bay Area, has a diverse landscape of urban centers, suburban communities, and rural areas, each with its own distinct property value dynamics. The property tax system in this county is governed by Proposition 13, a landmark legislation that significantly impacts how property taxes are calculated and assessed.

Proposition 13, passed in 1978, introduced two key changes to California's property tax landscape. Firstly, it limited the annual property tax rate to 1% of the property's assessed value. Secondly, it restricted the annual growth in assessed value for any given property to no more than 2%.

Assessed Value and Proposition 13

Under Proposition 13, the assessed value of a property is its taxable value. This assessed value is based on the property’s market value at the time of purchase, or the last time a change occurred that affected its value (known as a “change in ownership” or “new construction”). This assessed value can only increase by a maximum of 2% each year, regardless of the actual market value of the property.

For instance, if a homeowner in Alameda County purchases a property with an assessed value of $500,000, their property taxes for the first year will be calculated based on this $500,000 assessed value. In subsequent years, the assessed value can increase by a maximum of 2%, meaning the assessed value in the second year could be a maximum of $510,000 ($500,000 x 2%).

| Year | Assessed Value | Taxable Value |

|---|---|---|

| Year 1 | $500,000 | $500,000 |

| Year 2 | $510,000 | $510,000 |

| ... | ... | ... |

| Year 10 | $600,000 | $600,000 |

This system ensures that property taxes remain relatively stable and predictable, providing homeowners with a degree of financial certainty.

Tax Rates and Assessment

In addition to the 1% property tax rate imposed by Proposition 13, there are also various local taxes and special assessments that can increase the overall tax burden. These additional levies can include taxes for schools, cities, counties, and special districts, as well as Mello-Roos assessments, which are used to fund community improvements or services.

For example, a property owner in Alameda County might have a 1% base tax rate, but with additional levies, their total tax rate could exceed 1.5%. These additional taxes are often determined by the specific district or community the property is located in, and they can vary significantly.

| Tax Type | Rate |

|---|---|

| Base Property Tax (Proposition 13) | 1% |

| School District Tax | 0.4% |

| County Service Tax | 0.2% |

| City Improvement Tax | 0.1% |

| Special District Levy | 0.3% |

| Mello-Roos Assessment | 0.5% |

| Total Tax Rate | 2.5% |

In the example above, while the base tax rate is 1%, the total tax rate, including all levies, amounts to 2.5% of the property's assessed value. This highlights the importance of understanding the various taxes and assessments that can impact a property owner's financial obligations.

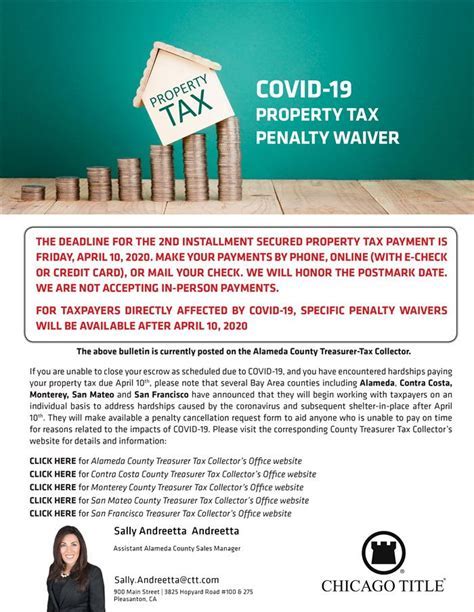

Tax Bills and Payment Schedule

Property tax bills in Alameda County are typically issued twice a year. The first installment is due in November, and if not paid by December 10th, it becomes delinquent and incurs penalties. The second installment is due in April, and again, non-payment by the deadline results in penalties and additional costs.

The tax bill includes the assessed value of the property, the applicable tax rates, and a breakdown of the various taxes and assessments. It's important for property owners to carefully review their tax bills to ensure accuracy and to plan their payments accordingly.

Assessing Property Values in Alameda County

Understanding the process of property value assessment is crucial for homeowners and prospective buyers in Alameda County. This process determines the taxable value of a property, which directly influences the property taxes owed.

Role of the Alameda County Assessor

The Alameda County Assessor’s Office is responsible for assessing the value of all properties within the county. This office ensures that each property’s value is determined fairly and accurately, in accordance with California’s property tax laws, including Proposition 13.

The Assessor's team conducts regular reviews and inspections of properties to determine their market value. This value is then used to calculate the assessed value, which forms the basis for property tax assessments.

Factors Affecting Property Value

Several factors influence the market value of a property in Alameda County:

- Location: Properties in desirable neighborhoods or areas with excellent schools, amenities, and access to public transportation tend to have higher values.

- Property Characteristics: The size, age, condition, and unique features of a property, such as views, architectural details, or modern upgrades, can significantly impact its value.

- Market Conditions: The overall real estate market in Alameda County, influenced by supply and demand, economic factors, and interest rates, plays a pivotal role in determining property values.

- Recent Sales: The sale prices of similar properties in the area can provide a benchmark for assessing the value of a specific property.

For instance, a recently renovated home in a desirable neighborhood with excellent schools and easy access to public transportation is likely to have a higher market value compared to an older, less maintained property in a less desirable area.

Challenging Property Assessments

Homeowners in Alameda County have the right to appeal their property’s assessed value if they believe it is inaccurate or unfair. This process involves submitting an appeal to the Alameda County Assessment Appeals Board, providing evidence to support the requested change in assessment.

Common reasons for appealing an assessment include:

- Recent changes to the property that have decreased its value, such as damage from natural disasters or necessary repairs.

- Overvaluation compared to similar properties in the area.

- Mistakes in the assessment, such as incorrect square footage or an outdated condition report.

If the appeal is successful, the assessed value of the property is adjusted, leading to a potential reduction in property taxes.

Impact of Property Taxes on Real Estate Transactions

Property taxes play a significant role in real estate transactions, influencing both buyers’ purchasing decisions and sellers’ strategies.

Buyer Considerations

When considering a property purchase in Alameda County, buyers often factor in the potential property taxes. High property taxes can significantly impact a buyer’s monthly budget and overall affordability. Therefore, understanding the property tax rate and the potential for future increases is crucial for buyers.

Additionally, the Proposition 13 system can offer benefits to buyers. When a property changes ownership, the new owner's assessed value is based on the purchase price, which can be lower than the previous owner's assessed value if the market value has increased. This can result in lower property taxes for the new owner, at least initially.

Seller Strategies

Sellers in Alameda County often use property taxes as a selling point, especially in areas with relatively low tax rates. Highlighting the stability and predictability of property taxes can be a compelling factor for potential buyers.

However, in areas with higher tax rates or where the assessed value is close to the market value, sellers might need to consider strategies to offset the impact of high property taxes. This could include offering concessions or negotiating a higher sales price to compensate for the potential tax burden.

Future Outlook and Potential Changes

While the property tax system in Alameda County, as governed by Proposition 13, provides stability and predictability for homeowners, there are ongoing discussions and proposals for potential changes.

Proposition 15

In 2020, California voters approved Proposition 15, which made changes to the property tax system for commercial and industrial properties. While this proposition did not directly impact residential properties, it has sparked conversations about potential future changes to the residential property tax system.

Proposition 15 allows commercial and industrial properties with a market value exceeding $3 million to be taxed based on their current market value rather than their acquisition value. This change was designed to increase tax revenue for local governments and school districts, but it also highlights the potential for similar changes to be proposed for residential properties in the future.

Potential Impacts and Considerations

If changes were to be made to the residential property tax system in Alameda County, it could have significant implications for homeowners. Here are some potential impacts and considerations:

- Increased Tax Burden: Removing the protections of Proposition 13 could lead to higher property taxes for homeowners, especially in areas where market values have significantly increased since the property was purchased.

- Fairness and Equity: Some argue that Proposition 13's protections lead to an unfair system where long-time homeowners pay significantly lower property taxes than new homeowners, despite potentially having similar properties.

- Stability and Predictability: While Proposition 13 provides stability for homeowners, it also limits the tax base for local governments and schools, impacting the funding for essential services and infrastructure.

The future of property taxes in Alameda County remains uncertain, but staying informed about potential changes and their potential impacts is essential for both homeowners and prospective buyers.

How are property taxes calculated in Alameda County?

+Property taxes in Alameda County are calculated by applying a tax rate, which includes the base 1% rate and any additional levies, to the assessed value of the property. The assessed value is based on the property’s market value at the time of purchase or the last change in ownership, with a maximum annual increase of 2%.

What is Proposition 13 and how does it affect property taxes?

+Proposition 13, passed in 1978, limits the annual property tax rate to 1% of the property’s assessed value and restricts the annual growth in assessed value to a maximum of 2%. This provides homeowners with a degree of stability and predictability in their property taxes.

Can property owners appeal their assessed value?

+Yes, homeowners in Alameda County have the right to appeal their property’s assessed value if they believe it is inaccurate or unfair. The appeal process involves submitting evidence to support the requested change in assessment to the Alameda County Assessment Appeals Board.

How often are property tax bills issued in Alameda County?

+Property tax bills in Alameda County are typically issued twice a year. The first installment is due in November, with a deadline of December 10th, and the second installment is due in April, with a similar deadline for payment.

What factors influence the market value of a property in Alameda County?

+Several factors influence the market value of a property in Alameda County, including location, property characteristics, market conditions, and recent sales of similar properties in the area. These factors collectively determine the assessed value, which forms the basis for property tax assessments.