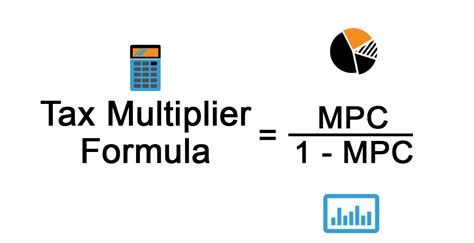

Tax Multiplier Formula

The concept of the tax multiplier is a fundamental principle in economics, especially in the field of macroeconomics. It plays a crucial role in understanding the impact of government tax policies on a nation's economy. The tax multiplier quantifies how changes in taxes affect the overall economic output, often referred to as the Gross Domestic Product (GDP). In this article, we will delve into the intricacies of the tax multiplier formula, its calculation, and its implications for economic policy.

Understanding the Tax Multiplier

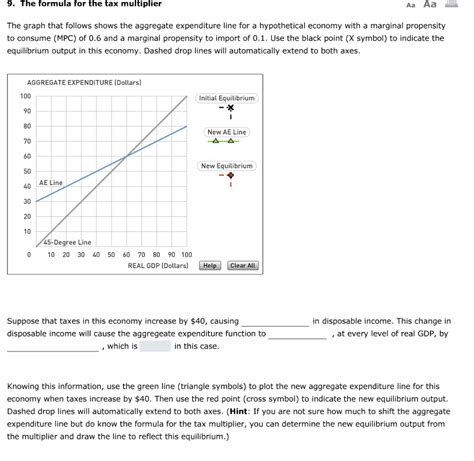

The tax multiplier is a concept that arose from the theories of Keynesian economics, which emphasizes the role of aggregate demand in influencing economic growth and output. It measures the multiplier effect of a change in taxes on the overall economy. In simpler terms, it tells us how much the GDP will change in response to a change in taxes.

When the government imposes taxes, it directly reduces the disposable income of individuals and businesses. This reduction in income can lead to a decrease in spending, which in turn affects the demand for goods and services. The tax multiplier formula helps us quantify this relationship and understand the magnitude of the impact.

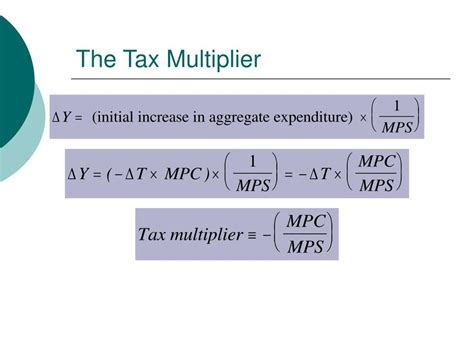

The Tax Multiplier Formula: A Mathematical Expression

The tax multiplier formula is expressed as:

Tax Multiplier (TM) = Change in Taxes (ΔT) / Change in National Income (ΔY)

In this formula, ΔT represents the change in taxes, and ΔY represents the corresponding change in national income or GDP. This formula provides a measure of the sensitivity of the economy to changes in tax policy.

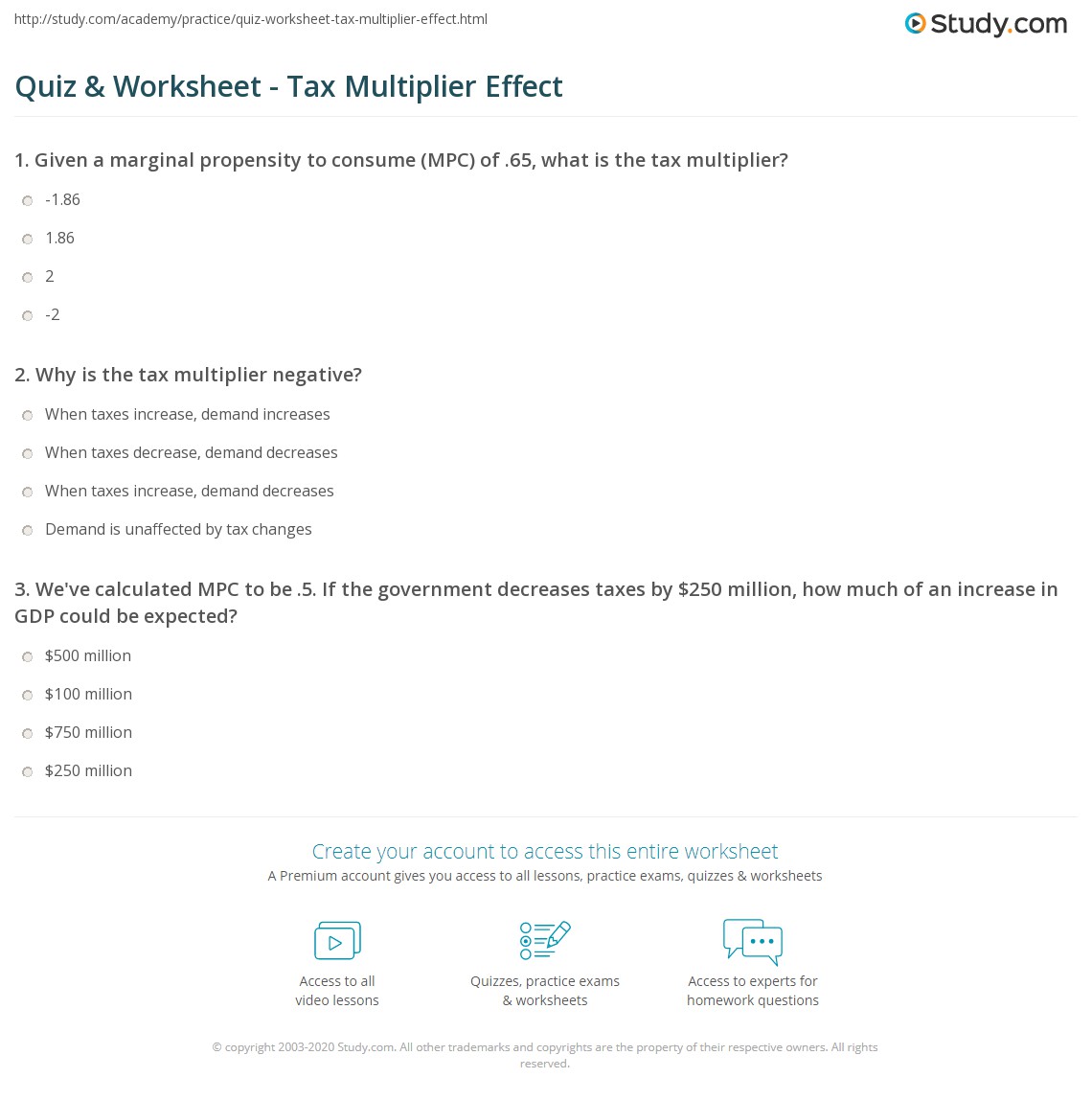

Calculating the Tax Multiplier

Let’s consider an example to illustrate the calculation of the tax multiplier. Suppose a government increases taxes by 50 billion (ΔT = 50 billion). As a result, the national income decreases by 100 billion (ΔY = -100 billion). Using the tax multiplier formula, we can calculate the tax multiplier as follows:

TM = ΔT / ΔY = $50 billion / -$100 billion = -0.5

In this case, the tax multiplier is -0.5. This negative value indicates that an increase in taxes leads to a decrease in national income. The magnitude of -0.5 suggests that for every $1 increase in taxes, the national income decreases by $0.50.

Implications of the Tax Multiplier

The tax multiplier has significant implications for economic policy and decision-making. A high tax multiplier indicates that changes in taxes have a significant impact on the economy. It suggests that tax policy adjustments can be a powerful tool for influencing economic growth and managing economic downturns.

On the other hand, a low tax multiplier implies that changes in taxes have a relatively smaller effect on the economy. In such cases, tax policy may have less influence on economic output, and other factors might dominate the economic landscape.

| Tax Multiplier | Economic Impact |

|---|---|

| High (e.g., > 1) | Tax changes have a significant impact on GDP, indicating a sensitive economy. |

| Low (e.g., < 1) | Tax changes have a limited effect, suggesting a less sensitive economy. |

Real-World Applications and Considerations

The tax multiplier formula provides a valuable tool for economists and policymakers to assess the potential outcomes of tax policy changes. However, it is essential to consider several real-world factors that can influence the accuracy of the tax multiplier:

- Time Horizon: The tax multiplier's impact may vary over different time periods. Short-term effects might differ from long-term consequences.

- Fiscal Policy Mix: The interaction between tax and spending policies can affect the overall impact. Changes in both taxes and government spending can have combined effects.

- Economic Conditions: The state of the economy, such as whether it is in a recession or expansion, can influence the tax multiplier's effectiveness.

- Behavioral Responses: Individuals and businesses may adjust their spending and investment behavior in response to tax changes, impacting the multiplier effect.

Comparative Analysis: Tax vs. Spending Multiplier

It is worth noting the distinction between the tax multiplier and the spending multiplier, another concept in Keynesian economics. While the tax multiplier focuses on the impact of tax changes, the spending multiplier measures the effect of changes in government spending on the economy.

The spending multiplier is generally considered to be higher than the tax multiplier, indicating that increases in government spending have a more significant impact on economic output compared to tax changes. This difference arises because government spending directly stimulates demand, while tax changes primarily affect disposable income and, consequently, spending decisions.

Conclusion: Navigating Tax Policy with Precision

The tax multiplier formula is a powerful analytical tool that allows economists and policymakers to understand the intricate relationship between tax policies and economic output. By quantifying the impact of tax changes, decision-makers can make informed choices about fiscal policy, especially during economic downturns or periods of desired economic growth.

While the tax multiplier provides valuable insights, it is essential to approach its application with caution, considering the real-world complexities and interactions that can influence its effectiveness. By combining theoretical understanding with practical considerations, policymakers can navigate the intricate world of tax policy with precision and contribute to the overall economic well-being of a nation.

How does the tax multiplier differ from the spending multiplier?

+The tax multiplier focuses on the impact of tax changes on economic output, while the spending multiplier measures the effect of changes in government spending. The spending multiplier is generally higher, indicating a stronger impact of government spending on the economy compared to tax changes.

What factors influence the tax multiplier’s effectiveness?

+Several factors can influence the tax multiplier’s effectiveness, including the time horizon, the fiscal policy mix, economic conditions, and behavioral responses of individuals and businesses to tax changes.

Can the tax multiplier be used to predict economic outcomes accurately?

+While the tax multiplier provides valuable insights, it is a theoretical construct that may not always accurately predict real-world economic outcomes. Real-world complexities, such as behavioral responses and interactions with other economic factors, can influence the actual impact of tax changes.