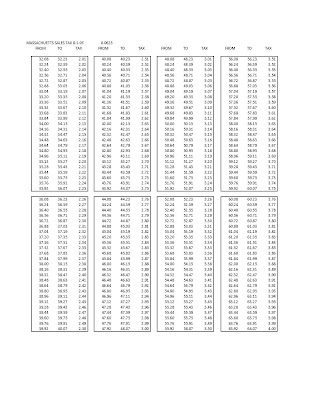

Ma Sales Tax Rate

Ma Sales Tax Rate is a critical component of doing business in the state of Massachusetts, USA. This sales tax is a consumption tax levied on the sale of goods and services within the state. It is an important revenue source for the state government and plays a significant role in the state's economy. In this comprehensive guide, we will delve into the intricacies of the Ma Sales Tax Rate, covering its history, current rates, exemptions, and its impact on businesses and consumers.

A Brief History of Ma Sales Tax

The history of sales tax in Massachusetts dates back to the early 20th century. The state first introduced a sales tax in 1966, with an initial rate of 5%. Over the years, the tax rate has undergone several adjustments to meet the evolving financial needs of the state. These adjustments have been influenced by economic factors, budgetary requirements, and the state’s commitment to maintaining a balanced approach to taxation.

One of the key milestones in the history of Ma Sales Tax was the passage of the Massachusetts Budget Reform Act of 2009. This act temporarily increased the sales tax rate to 6.25% as a measure to address the state's budget deficit during the economic downturn. While this increase was intended to be temporary, it eventually became a permanent fixture in the state's tax landscape.

Since then, there have been ongoing discussions and proposals to further adjust the sales tax rate. However, any changes to the tax structure require careful consideration and alignment with the state's economic goals and the needs of its residents and businesses.

Understanding the Current Ma Sales Tax Rate

As of my last update in January 2023, the general sales tax rate in Massachusetts stands at 6.25%. This rate applies to a wide range of goods and services sold within the state, including tangible personal property, certain services, and admissions to certain entertainment events.

It's important to note that while the state sets the general sales tax rate, local jurisdictions, such as cities and towns, may impose additional sales taxes. These local option taxes can vary across different regions, resulting in a combined sales tax rate that can exceed the state's 6.25% rate. Businesses operating in multiple localities need to be aware of these variations to ensure compliance with local tax laws.

The current Ma Sales Tax Rate is applied to the total sales price of taxable goods and services, including any applicable shipping, handling, and delivery charges. However, there are certain categories of goods and services that are exempt from this tax, and understanding these exemptions is crucial for both businesses and consumers.

Exemptions and Special Cases

Massachusetts has a comprehensive list of items that are exempt from sales tax. These exemptions are designed to provide relief to certain sectors, promote specific industries, or accommodate unique circumstances. Some notable exemptions include:

-

Groceries and Food Items: Many staple food items, including most groceries, are exempt from sales tax in Massachusetts. This exemption aims to reduce the tax burden on essential household items.

-

Prescription Drugs: Sales of prescription medications are exempt from sales tax, making healthcare more affordable for residents.

-

Clothing and Footwear: Massachusetts offers a sales tax holiday for certain clothing and footwear items, providing a temporary relief for shoppers during designated periods.

-

Agricultural Equipment: Sales of agricultural equipment and supplies are exempt, supporting the state's agricultural industry.

-

Educational Materials: Textbooks, educational supplies, and certain services related to education are exempt from sales tax, encouraging investment in education.

While these exemptions provide benefits to specific sectors and consumers, it's essential to stay informed about the constantly evolving tax landscape in Massachusetts. The state regularly reviews and updates its tax policies, so staying abreast of these changes is crucial for compliance and financial planning.

Impact on Businesses and Consumers

The Ma Sales Tax Rate has a significant impact on both businesses and consumers within the state. For businesses, understanding and complying with the sales tax regulations is essential for maintaining a positive relationship with customers and avoiding legal consequences.

From a consumer perspective, the sales tax adds to the cost of goods and services, impacting purchasing decisions and overall financial planning. However, the tax also contributes to essential public services and infrastructure development, ensuring a balanced approach to state governance.

One of the key considerations for businesses is the sales tax collection and remittance process. Businesses are responsible for collecting the appropriate sales tax from customers and remitting it to the state on a regular basis. Failure to comply with these obligations can result in penalties and legal repercussions.

To assist businesses in navigating the complex world of sales tax, Massachusetts provides comprehensive resources and guidelines. These resources include detailed tax rate schedules, exemption certificates, and guidelines for specific industries. By leveraging these resources, businesses can ensure compliance and minimize the risk of tax-related issues.

Sales Tax Compliance and Strategies

Ensuring sales tax compliance is a multifaceted process that involves understanding the tax laws, accurately calculating and collecting the applicable taxes, and timely remittance to the state. To simplify this process, businesses can leverage sales tax automation tools that integrate with their existing accounting and e-commerce platforms.

These tools automate the calculation of sales tax based on the customer's location, apply the appropriate tax rates and exemptions, and generate accurate sales tax reports for easy remittance. By automating these processes, businesses can reduce the risk of errors and save valuable time and resources.

Additionally, businesses should consider registering for a sales tax permit with the Massachusetts Department of Revenue. This permit authorizes businesses to collect and remit sales tax on behalf of the state. Obtaining this permit is a critical step towards compliance and ensures that businesses are meeting their legal obligations.

For consumers, understanding the sales tax rate and its implications is crucial for making informed purchasing decisions. By factoring in the sales tax, consumers can accurately budget for their purchases and plan their expenses accordingly. Moreover, staying informed about sales tax holidays and exemptions can provide opportunities for savings, especially during promotional periods.

Future Implications and Considerations

As the economic landscape continues to evolve, the Ma Sales Tax Rate is likely to remain a subject of ongoing discussions and potential adjustments. The state’s commitment to maintaining a balanced approach to taxation means that any changes will be carefully considered in the context of the state’s economic goals and the needs of its residents and businesses.

One of the key considerations for the future of Ma Sales Tax is the potential impact of e-commerce and the digital economy. With the rapid growth of online sales, the state may need to adapt its tax policies to ensure that businesses operating online are contributing fairly to the state's revenue. This could involve exploring concepts like wayfair laws, which would require out-of-state sellers to collect and remit sales tax, even if they don't have a physical presence in the state.

Additionally, the state may explore options to streamline the sales tax collection process, especially for small businesses. This could involve implementing simplified tax rates or providing more support and resources to help businesses navigate the complex world of sales tax compliance.

As Massachusetts continues to adapt to the changing economic landscape, the Ma Sales Tax Rate will remain a critical component of the state's fiscal strategy. By staying informed about the tax laws, leveraging available resources, and adapting to emerging trends, businesses and consumers can navigate the sales tax landscape with confidence and contribute to the state's economic growth.

What is the current Ma Sales Tax Rate for 2023?

+The current general sales tax rate in Massachusetts for 2023 is 6.25%.

Are there any local option taxes in Massachusetts?

+Yes, local jurisdictions in Massachusetts can impose additional sales taxes, resulting in a combined rate that may exceed the state’s 6.25% rate.

What are some common exemptions from the Ma Sales Tax?

+Common exemptions include groceries, prescription drugs, clothing, footwear, agricultural equipment, and educational materials.

How can businesses ensure sales tax compliance in Massachusetts?

+Businesses can ensure compliance by registering for a sales tax permit, leveraging sales tax automation tools, and staying updated with the latest tax regulations and guidelines.

What impact does the Ma Sales Tax have on consumers’ purchasing decisions?

+The sales tax adds to the cost of goods and services, influencing consumers’ purchasing decisions and financial planning. However, it also contributes to essential public services.