Wv Property Tax

West Virginia, nestled in the Appalachian Mountains, is known for its picturesque landscapes, vibrant communities, and a rich history that spans centuries. One aspect that often captures the attention of both residents and prospective homeowners is the West Virginia Property Tax system. This article delves into the intricacies of WV property taxes, offering a comprehensive guide for those looking to understand this essential aspect of homeownership in the Mountain State.

Understanding WV Property Tax Assessments

The process of property tax assessment in West Virginia is a fundamental component of the state’s revenue system. Each year, the County Assessor’s Office plays a pivotal role in determining the taxable value of properties within their respective counties. This value, often referred to as the assessed value, is a critical factor in calculating property taxes.

West Virginia employs a uniform system of assessment, ensuring that properties are valued consistently across the state. This system aims to promote fairness and equity in property taxation. The assessed value is typically based on the property's fair market value, which is the price that a willing buyer and seller would agree upon in an open and competitive market.

Property owners should be aware that the assessed value of their property may not always align with the purchase price or the current market value. This discrepancy often arises due to the periodic nature of assessments, which may not capture short-term fluctuations in property values.

Assessment Cycles and Appeal Process

West Virginia operates on a biennial assessment cycle, meaning property assessments are conducted every two years. During these assessments, the County Assessor’s Office considers various factors, including:

- Sales Data: Recent property sales in the area are analyzed to determine market trends and values.

- Property Characteristics: Features such as size, age, condition, and any improvements made to the property are taken into account.

- Market Conditions: The overall real estate market in the county and specific neighborhoods is assessed to ensure accurate valuations.

Property owners who believe their assessment is inaccurate or unfair have the right to appeal the decision. The appeal process typically involves a review by the County Board of Equalization and Review, followed by a potential hearing before the State Tax Commissioner if necessary.

Property Tax Rates and Calculations

Once the assessed value of a property is determined, the actual property tax amount is calculated using a straightforward formula. West Virginia’s property tax system is a local tax, meaning the tax rates and collections are managed by individual counties.

The property tax rate, often referred to as the millage rate, is expressed in mills, where one mill equals one-thousandth of a dollar ($0.001). This rate is applied to the assessed value of the property to calculate the tax amount. For instance, if a property has an assessed value of $100,000 and the millage rate is 100 mills, the property tax would be $100.

The millage rate is set by local government bodies, such as county commissions or city councils, based on their budgetary needs and the desired level of services they wish to provide. These rates can vary significantly from one county to another, leading to differences in property tax burdens across the state.

Homestead Exemption and Other Tax Reliefs

West Virginia offers several property tax relief programs to assist homeowners, particularly those with limited incomes or specific circumstances. The most notable relief is the Homestead Exemption, which reduces the assessed value of a primary residence for property tax purposes.

To qualify for the Homestead Exemption, homeowners must meet certain criteria, including:

- Being a resident of West Virginia for at least six months prior to applying.

- Owning and occupying the property as their primary residence.

- Having a total household income that meets the program's guidelines.

Eligible homeowners can receive a reduction in their property's assessed value, typically up to $20,000. This reduction directly lowers the property tax burden, providing significant savings for homeowners who qualify.

| Property Tax Relief Programs in West Virginia |

|---|

| Homestead Exemption |

| Disabled Veteran Exemption |

| Senior Citizen Tax Relief |

| Low-Income Tax Relief |

In addition to the Homestead Exemption, West Virginia offers other tax relief programs aimed at specific groups, such as disabled veterans and senior citizens. These programs further demonstrate the state's commitment to supporting its residents and ensuring that property taxes remain manageable.

Property Tax Payment and Due Dates

Property taxes in West Virginia are typically due in two installments, with the payment deadlines falling on July 1st and December 1st of each year. Homeowners receive a tax bill from their county’s tax office, which outlines the amount due, payment options, and any applicable penalties for late payments.

Timely payment of property taxes is crucial to avoid penalties and potential legal consequences. The state offers various payment methods, including online payments, direct debit, and traditional methods like mailing a check or dropping off a payment in person.

Property Tax Delinquency and Consequences

Failure to pay property taxes on time can lead to delinquency, which carries significant consequences. When a property tax payment is delinquent, the county may impose late fees and interest charges on the outstanding balance. If the delinquency persists, the county can initiate a tax lien against the property, which can ultimately lead to the property being sold at a tax sale to satisfy the debt.

To avoid these severe consequences, it's essential for homeowners to stay current on their property tax payments. Many counties in West Virginia offer online payment portals and automatic payment plans to make the process more convenient and ensure timely payments.

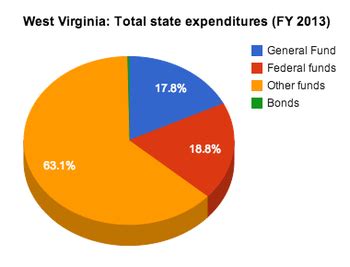

The Impact of Property Taxes on the WV Economy

Property taxes play a vital role in the economic landscape of West Virginia. They serve as a primary source of revenue for local governments, funding essential services such as schools, public safety, infrastructure, and social services.

A well-managed property tax system ensures that these services are adequately funded, benefiting the entire community. However, it's crucial to strike a balance to avoid placing an excessive burden on homeowners, especially those with limited means.

West Virginia's property tax system, with its focus on local control and various relief programs, aims to achieve this balance. By providing targeted tax relief and maintaining a fair assessment process, the state ensures that property taxes remain manageable for residents while still generating the revenue needed to support local communities.

Conclusion: Navigating WV Property Taxes

The West Virginia property tax system, while comprehensive and fair, requires homeowners to stay vigilant and informed. By understanding the assessment process, tax rates, and available relief options, residents can manage their property tax obligations effectively. This ensures a stable and prosperous future for the Mountain State and its communities.

Frequently Asked Questions

How often are property assessments conducted in West Virginia?

+

Property assessments in West Virginia are conducted every two years, following a biennial assessment cycle. This ensures that property values are regularly updated to reflect market changes.

What happens if I disagree with my property assessment value?

+

If you believe your property assessment value is inaccurate, you have the right to appeal. The appeal process involves a review by the County Board of Equalization and Review, and if necessary, a hearing before the State Tax Commissioner. It’s important to gather evidence and present a strong case to support your appeal.

How are property tax rates determined in West Virginia?

+

Property tax rates, known as millage rates, are set by local government bodies such as county commissions or city councils. These rates are based on the budgetary needs of the local government and the desired level of services they wish to provide. Rates can vary significantly between counties.

What is the Homestead Exemption, and who is eligible for it?

+

The Homestead Exemption is a property tax relief program in West Virginia that reduces the assessed value of a primary residence for tax purposes. To be eligible, homeowners must reside in West Virginia for at least six months, occupy the property as their primary residence, and meet specific income guidelines.

What happens if I fail to pay my property taxes on time?

+

Failure to pay property taxes on time can lead to delinquency. Delinquent taxpayers may face late fees, interest charges, and potentially a tax lien against their property. In extreme cases, the property may be sold at a tax sale to satisfy the outstanding debt. It’s crucial to stay current on your property tax payments to avoid these consequences.