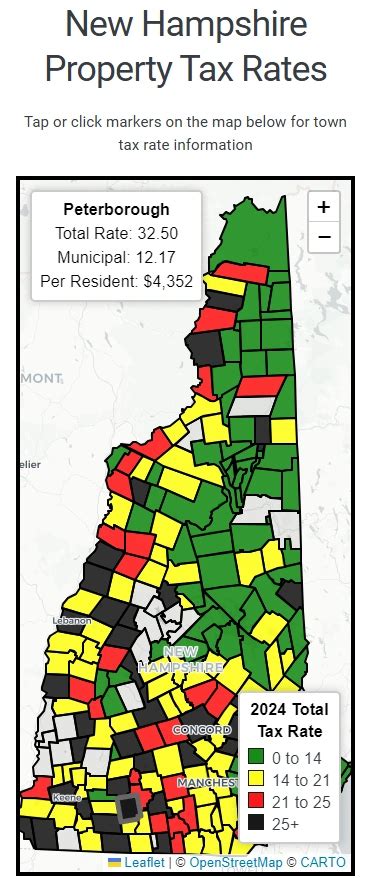

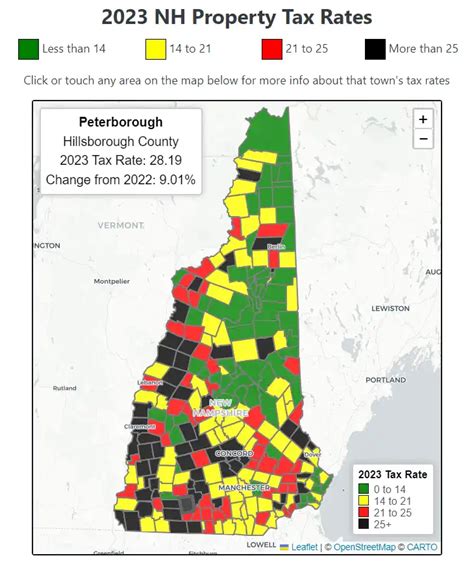

Nh Property Tax Rates

Welcome to our in-depth exploration of the New Hampshire Property Tax Rates, a critical aspect of financial planning for homeowners and investors in the Granite State. Understanding these rates is essential for making informed decisions about property purchases, managing tax liabilities, and optimizing your financial strategy.

An Overview of NH Property Tax Landscape

New Hampshire’s property tax system is renowned for its local control, with each of the state’s 234 municipalities setting its own tax rates. This decentralized approach ensures that property taxes are tailored to the specific needs and characteristics of each community, offering a unique financial landscape for homeowners and investors.

The property tax rate is typically expressed as a mill rate, where each mill represents $1 of tax for every $1,000 of assessed property value. For instance, a mill rate of 20 mills would equate to $20 in taxes for every $1,000 of assessed value. This means that a home valued at $300,000 would incur an annual tax liability of $6,000 if the mill rate is 20 mills.

It's worth noting that the assessed value of a property is not necessarily the same as its market value. New Hampshire utilizes a revaluation cycle, which is a process to update property assessments to reflect current market conditions. This cycle typically occurs every 5 to 7 years, with some towns conducting revaluations more frequently. During a revaluation, property values may increase, decrease, or remain unchanged, which in turn impacts the tax liability.

The property tax system in New Hampshire is designed to be transparent and fair. Property owners have the right to appeal their assessments if they believe the value is inaccurate or unfair. This process, known as abatement, provides a mechanism for property owners to ensure they are paying taxes based on a fair assessment of their property's value.

A Deep Dive into NH Property Tax Rates

To truly grasp the nuances of New Hampshire’s property tax rates, we must delve into the specifics. Let’s explore the key components that make up these rates and how they impact homeowners and investors.

Local Tax Rates

As mentioned earlier, each municipality in New Hampshire sets its own tax rate. This means that the tax burden can vary significantly from one town to another, even within the same county. For instance, the mill rate in the town of Bedford for the 2023 tax year is 19.25 mills, while in the neighboring town of Manchester, it is 22.25 mills. This difference of 3 mills equates to a 300 difference in taxes for a property valued at 100,000.

| Town | Mill Rate (2023) |

|---|---|

| Bedford | 19.25 mills |

| Manchester | 22.25 mills |

These local tax rates are determined by the town's budget requirements. Factors such as the cost of maintaining roads, funding public schools, and providing municipal services all play a role in setting the tax rate. As a result, towns with higher service demands or lower property values may have higher mill rates to generate sufficient revenue.

State-Wide Average Tax Rates

While local tax rates vary widely, it’s possible to get a sense of the overall tax burden by looking at state-wide average tax rates. For the 2023 tax year, the state-wide average effective tax rate in New Hampshire was approximately 1.66%. This means that, on average, homeowners in New Hampshire pay about 1,660 in property taxes for every 100,000 of their home’s assessed value.

| Year | State-Wide Average Effective Tax Rate |

|---|---|

| 2023 | 1.66% |

| 2022 | 1.65% |

| 2021 | 1.64% |

It's important to note that while the state-wide average provides a useful benchmark, individual tax burdens can deviate significantly from this average based on local tax rates and property values.

The Impact of Property Value on Taxes

Property value is a critical factor in determining tax liability. In New Hampshire, properties are assessed based on their fair market value, which is the price a willing buyer would pay to a willing seller in an open market. This value is then used to calculate the property’s tax liability.

For instance, consider two properties in the same town with identical mill rates. If Property A is valued at $250,000 and Property B is valued at $500,000, Property B would incur double the tax liability of Property A, assuming all other factors are equal. This relationship highlights the importance of property value in understanding tax liabilities.

Analyzing NH Property Tax Performance

To gain a comprehensive understanding of New Hampshire’s property tax landscape, we must examine how these taxes perform over time. Let’s explore historical trends, future projections, and the overall health of the property tax system in the Granite State.

Historical Tax Rate Trends

New Hampshire’s property tax rates have exhibited a relatively stable trend over the past decade. While there have been slight fluctuations from year to year, the overall trajectory has been one of gradual increase. For instance, the state-wide average effective tax rate in 2014 was 1.58%, compared to the current rate of 1.66% in 2023.

| Year | State-Wide Average Effective Tax Rate |

|---|---|

| 2014 | 1.58% |

| 2015 | 1.59% |

| 2016 | 1.60% |

| ... | ... |

| 2022 | 1.65% |

| 2023 | 1.66% |

This gradual increase can be attributed to a variety of factors, including rising property values, increasing municipal budgets, and the need to fund critical services. Despite these increases, New Hampshire's property tax rates remain competitive when compared to other states in the region.

Future Projections and Market Implications

Looking ahead, experts project that New Hampshire’s property tax rates will continue to increase modestly over the next decade. This is due in part to the state’s growing population and the associated demand for public services, as well as the need to maintain and improve infrastructure.

While these increases may be manageable for many homeowners, they could present challenges for investors and those on fixed incomes. It's crucial for these groups to carefully consider the long-term tax implications when making property purchase decisions.

Furthermore, the real estate market in New Hampshire is closely intertwined with the state's property tax system. As tax rates rise, they can influence property values and market trends. For instance, higher tax rates could potentially slow down the housing market, as buyers may be less willing to take on the increased tax burden. On the other hand, rising property values can also lead to higher tax revenues, which can benefit the local community.

Conclusion: Navigating NH Property Tax Landscape

Understanding New Hampshire’s property tax rates is a critical step in making informed financial decisions. The state’s decentralized tax system, with its varying mill rates and assessment practices, presents a unique financial landscape for homeowners and investors.

By analyzing historical trends, understanding the impact of property value on taxes, and considering future projections, individuals can make strategic decisions about property purchases and tax planning. Whether you're a long-time resident or a new investor, staying informed about NH property tax rates is essential for financial success in the Granite State.

How often are property values reevaluated in New Hampshire?

+Property values in New Hampshire are typically reevaluated every 5 to 7 years, although some towns may conduct revaluations more frequently.

What is the process for appealing a property assessment in NH?

+Property owners can appeal their assessments by filing an abatement request with their town’s assessor’s office. The process involves providing evidence to support the appeal, such as recent sales of similar properties or other relevant data.

Are there any tax relief programs for senior citizens or low-income homeowners in NH?

+Yes, New Hampshire offers various tax relief programs for eligible senior citizens and low-income homeowners. These programs include the Property Tax Relief Program, which provides a direct credit on property tax bills, and the Senior Citizens Real Estate Tax Abatement Program, which can reduce the assessed value of a property for tax purposes.