Tax Deed Sales Florida

Welcome to an in-depth exploration of Tax Deed Sales in Florida, a unique aspect of the state's property market that offers both opportunities and complexities. This article aims to provide a comprehensive guide, shedding light on the ins and outs of this intriguing real estate phenomenon.

Understanding Tax Deed Sales in Florida

Tax Deed Sales, a mechanism employed by various states including Florida, represent a process where properties are auctioned off due to unpaid property taxes. This practice, though seemingly straightforward, entails a series of intricate steps and considerations, making it an intriguing segment of the real estate industry.

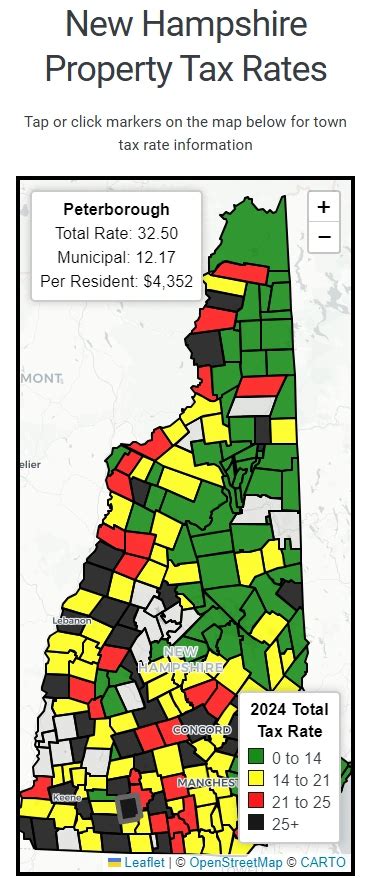

In Florida, the tax deed sale process is governed by the state's Department of Revenue, with each county administering its own procedures. This decentralized approach adds a layer of complexity, as rules and timelines can vary across the state's 67 counties.

For those unfamiliar, the process typically begins when a property owner fails to pay their property taxes for a specified period, often spanning several years. This non-payment leads to the property being listed for a public auction, where it is sold to the highest bidder.

The Auction Process

Florida’s tax deed auctions are public events, open to both seasoned investors and first-time buyers. These auctions are typically conducted by the county, with specific dates and locations announced in advance. The auctions often follow a fast-paced format, with properties being sold in a timely manner.

Bidders must be prepared with their strategies and, often, substantial funds. The auction process can be competitive, with properties attracting multiple interested buyers. The winning bid not only secures the property but also clears any outstanding tax debt, making it an attractive investment opportunity.

| Key Auction Details | Information |

|---|---|

| Auction Dates | Varies by county, typically scheduled quarterly |

| Bid Requirements | Varies, but often includes a deposit and proof of funds |

| Auction Format | Live auctions, with online and proxy bidding options |

Benefits and Risks of Tax Deed Sales

Participating in Tax Deed Sales presents both advantages and potential pitfalls, making it a strategic decision for investors. Understanding these aspects is crucial for anyone considering this investment avenue.

Advantages of Tax Deed Sales

- Discounted Properties: One of the primary appeals is the potential to acquire properties at prices significantly lower than market value. This can be especially attractive for investors looking to flip properties or rent them out.

- Quick Turnaround: The auction process is designed for efficiency, allowing investors to secure properties and start generating returns promptly.

- Clear Title: Winning a tax deed auction ensures a clear title, meaning the property is free of any tax liens or encumbrances, providing a clean slate for the new owner.

Risks and Considerations

- Unknowns about the Property: Properties sold at tax deed auctions often come with limited information, leaving potential buyers with uncertainties about the property’s condition, occupancy status, or any potential legal issues.

- Repairs and Renovations: Properties may require significant repairs or renovations, adding unexpected costs to the investment.

- Legal and Administrative Responsibilities: Buyers must navigate the legal and administrative processes associated with tax deed purchases, which can be complex and time-consuming.

The Florida Market and Tax Deed Sales

Florida’s diverse real estate market plays a significant role in shaping the landscape of Tax Deed Sales. The state’s unique characteristics, including its popularity as a tourist destination and its varied property types, influence the dynamics of these sales.

Florida’s Real Estate Market

Florida boasts a vibrant real estate market, driven by its attractive climate, diverse landscapes, and strong economy. The state is known for its mix of residential, commercial, and vacation properties, catering to a wide range of buyers and investors.

The market's diversity extends to property types, with options ranging from luxurious beachfront condos to rural acreages and everything in between. This variety ensures a steady stream of properties entering the tax deed sale process, offering a wide array of investment opportunities.

Market Impact on Tax Deed Sales

The health and trends of Florida’s real estate market directly influence the volume and nature of tax deed sales. During periods of economic downturn or market correction, for instance, the number of properties entering the tax deed process tends to increase.

Conversely, during robust market conditions, the volume of tax deed sales may decrease as property owners are more likely to stay current with their tax payments. This dynamic nature of the market adds an element of unpredictability to tax deed sales, making it a challenging yet intriguing investment arena.

Preparing for a Tax Deed Sale

Success in Tax Deed Sales requires meticulous preparation and an understanding of the intricate processes involved. Here’s a comprehensive guide to help investors navigate this complex yet rewarding investment avenue.

Research and Due Diligence

Thorough research is the cornerstone of a successful tax deed investment strategy. This involves understanding the specific rules and procedures of the county where the property is located, as well as conducting comprehensive due diligence on the property itself.

Investors should delve into the property's history, including any past tax issues, ownership changes, and potential legal encumbrances. This information can be obtained from county records and property databases. Additionally, a physical inspection of the property is highly recommended to assess its condition and potential for development or renovation.

Financial Planning and Bid Strategy

Financial preparedness is critical in tax deed auctions. Investors should have a clear understanding of their financial capacity and bidding strategy. This includes having access to sufficient funds to cover the purchase price, any outstanding taxes, and potential renovation costs.

Developing a bid strategy involves setting a maximum bid based on the property's estimated value and the investor's financial goals. It's important to consider not just the initial purchase price but also the ongoing costs associated with ownership, such as maintenance, taxes, and potential renovation expenses.

| Financial Considerations | Details |

|---|---|

| Purchase Price | Varies based on property value and market conditions |

| Renovation Costs | Can range from minimal to substantial, depending on property condition |

| Ongoing Expenses | Includes property taxes, insurance, and maintenance costs |

Post-Auction Process and Ownership

Securing a property through a Tax Deed Sale is just the beginning. The post-auction process and the responsibilities of ownership present a new set of challenges and opportunities.

Completing the Purchase

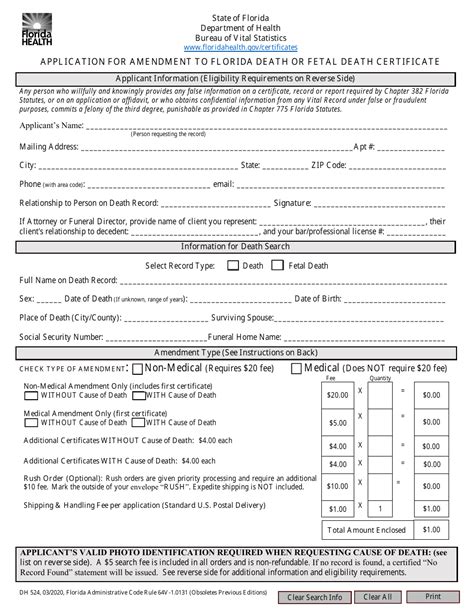

Following a successful bid at a tax deed auction, the buyer has a limited time frame, typically a few days, to complete the purchase. This involves paying the full bid amount, any applicable fees, and clearing any remaining taxes on the property.

The buyer will also need to obtain a tax deed from the county, which serves as proof of ownership. This document should be recorded with the county clerk to officially transfer ownership.

Occupancy and Legal Considerations

One of the key considerations post-auction is the occupancy status of the property. If the previous owner was living in the property, the buyer may need to initiate an eviction process to gain possession. This can be a complex and time-consuming process, requiring legal expertise.

Additionally, buyers should be aware of any potential liens or encumbrances that may have been missed during the due diligence process. These could include mortgages, judgments, or other claims against the property. Resolving these issues is crucial to ensuring a clear and marketable title.

Case Studies: Successful Tax Deed Investments

Examining real-world examples of successful Tax Deed Sales can provide valuable insights into the strategies and approaches that lead to profitable investments. These case studies highlight the diverse paths to success in this unique investment arena.

Case Study 1: Flipping a Tax Deed Property

Investor: John D.

Property: 3-bedroom, 2-bathroom single-family home in Miami-Dade County.

Auction Price: 120,000</p> <p>Renovation Costs: 25,000

Sold Price: $220,000

John, an experienced real estate investor, spotted a tax deed auction for a property in a desirable Miami neighborhood. Despite the property's run-down condition, he recognized its potential due to its location and size. He successfully bid on the property, securing it for $120,000.

Post-auction, John invested in extensive renovations, including updating the kitchen and bathrooms, repairing structural issues, and modernizing the electrical and plumbing systems. These improvements added significant value to the property.

Within a year, John listed the property for sale, attracting multiple offers. He eventually sold it for $220,000, realizing a substantial profit and showcasing the potential of tax deed investments when coupled with strategic renovations.

Case Study 2: Long-Term Rental Investment

Investor: Sarah B.

Property: 2-bedroom, 1-bathroom condo in Orlando.

Auction Price: 65,000</p> <p>Renovation Costs: 10,000

Monthly Rent: $1,200

Sarah, a seasoned investor with a focus on long-term rentals, attended a tax deed auction in Orlando, Florida. She identified a condo in a well-maintained complex with a strong rental history. She successfully bid on the property for $65,000.

After some minor renovations, including new flooring and paint, Sarah listed the condo for rent. Due to its central location and proximity to tourist attractions, the property was in high demand. Sarah was able to secure a reliable tenant and collect $1,200 in monthly rent, generating a steady stream of income.

Over the years, Sarah has continued to invest in the property, performing regular maintenance and upgrades. This has not only maintained the property's value but also kept the tenants happy and willing to renew their lease.

The Future of Tax Deed Sales in Florida

As we look ahead, the future of Tax Deed Sales in Florida holds both promise and challenges. The state’s dynamic real estate market, coupled with its unique tax deed process, creates a landscape that is both exciting and uncertain for investors.

Market Trends and Predictions

Florida’s real estate market is expected to continue its upward trajectory, driven by a strong economy, population growth, and ongoing tourism. This growth is likely to influence the volume and nature of tax deed sales, potentially increasing the number of properties available at auction.

However, rising property values may also lead to higher bid prices at tax deed auctions, making it more competitive for investors. As such, the future of tax deed sales in Florida will be a delicate balance between opportunity and challenge.

Impact of Technological Advancements

The integration of technology in the real estate industry, including the use of online platforms for property auctions, is set to revolutionize the tax deed sale process. Online auctions can increase accessibility and participation, attracting a wider range of investors.

Additionally, the use of data analytics and AI in property valuation and market analysis can provide investors with more accurate information, helping them make informed decisions. This technological evolution is expected to streamline the tax deed sale process, making it more efficient and transparent.

Legislative and Regulatory Changes

The future of tax deed sales in Florida is also contingent on legislative and regulatory changes. Any alterations to the state’s tax laws or auction procedures could significantly impact the dynamics of these sales. Investors and stakeholders must stay abreast of these changes to navigate the market effectively.

Conclusion

Tax Deed Sales in Florida offer a unique and dynamic investment opportunity, presenting both challenges and rewards. Through this comprehensive guide, we’ve explored the intricacies of this process, from the auction to ownership, and examined real-world case studies that showcase the potential for success.

As the future unfolds, investors will need to stay agile and informed to navigate the evolving landscape of Tax Deed Sales. With a strong understanding of the market, meticulous preparation, and a strategic approach, investors can harness the potential of this exciting investment avenue.

How often do Tax Deed Sales occur in Florida counties?

+Tax Deed Sales are typically scheduled by counties on a quarterly basis. However, some counties may hold sales more frequently, depending on the volume of properties and local regulations.

Are there any restrictions on who can participate in Tax Deed Sales?

+While there are no specific restrictions, participants must be prepared with the necessary funds and understand the auction process and its legal implications. Some counties may require bidders to be registered or have a valid ID.

What happens if a property doesn’t receive a winning bid at auction?

+If a property doesn’t receive a winning bid, it may be offered for sale again at a later auction. Alternatively, the county may decide to retain the property, which could then be sold through other means, such as a private sale.