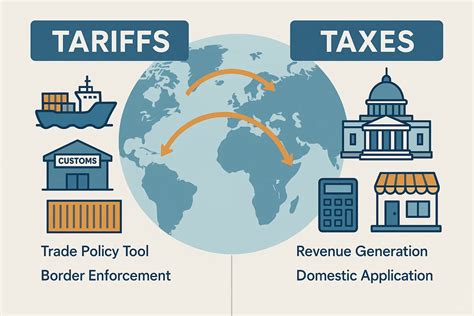

Tariffs Vs Taxes

The economic landscape is often shaped by intricate policies and mechanisms, with tariffs and taxes standing as two of the most influential tools wielded by governments worldwide. While they share the common goal of generating revenue for the state, their purposes, applications, and impacts can be distinct and multifaceted. This article aims to delve into the nuanced differences between tariffs and taxes, exploring their historical contexts, economic implications, and the strategies employed by governments to optimize revenue collection while mitigating adverse effects on businesses and consumers.

Unraveling the Concept: Tariffs

Tariffs, a cornerstone of international trade policies, represent a tax levied on imported goods and services. Governments employ tariffs as a strategic tool to protect domestic industries, regulate trade flows, and generate revenue. The historical trajectory of tariffs is replete with significant events that have shaped global trade relations.

One of the most notable episodes in tariff history is the Smoot-Hawley Tariff Act of 1930 in the United States. This act, which raised tariffs on over 20,000 imported goods, was intended to protect American farmers and businesses during the Great Depression. However, it backfired, triggering a chain reaction of retaliatory tariffs from other nations and exacerbating the economic crisis. This episode serves as a cautionary tale, illustrating the delicate balance that governments must strike when implementing tariff policies.

Types of Tariffs

Tariffs come in various forms, each serving specific purposes. The two primary types are ad valorem tariffs and specific tariffs.

- Ad valorem tariffs are levied as a percentage of the value of the imported goods. These tariffs are flexible and can be adjusted to achieve specific trade objectives. For instance, a country might impose a higher ad valorem tariff on luxury goods to reduce consumption and promote domestic production.

- Specific tariffs, on the other hand, are fixed amounts per unit of the imported product. These tariffs are straightforward and predictable, making them suitable for commodities with stable prices. An example is the tariff on crude oil imports, which remains consistent regardless of fluctuations in oil prices.

Strategic Uses of Tariffs

Governments employ tariffs strategically to achieve a range of economic and political goals. One primary objective is revenue generation, especially for developing countries that heavily rely on imports. Tariffs can provide a substantial source of income, enabling governments to fund essential public services and infrastructure development.

Another critical role of tariffs is protecting domestic industries. By imposing tariffs on foreign competitors, governments can create a level playing field for local businesses, fostering their growth and competitiveness. This protectionist approach is particularly relevant for industries that are vital to a country's economy but may struggle to compete on a global scale.

Furthermore, tariffs can be a negotiating tool in international trade agreements. Countries often use the threat of imposing tariffs to gain leverage in trade negotiations, encouraging reciprocal benefits and fairer trade practices. This strategic use of tariffs can lead to more favorable trade deals and strengthen a country's position on the global stage.

Understanding Taxes: A Domestic Perspective

In contrast to tariffs, taxes are levied by governments on goods, services, income, and assets within their own jurisdiction. Taxes are the primary revenue source for most governments, funding public expenditures and shaping the economic landscape of a country.

Key Types of Taxes

The tax system is intricate, encompassing various types of taxes, each designed to serve specific purposes:

- Income Taxes: Levied on individual and corporate earnings, income taxes are a cornerstone of government revenue. They are typically progressive, meaning higher income earners pay a larger proportion of their income in taxes.

- Sales Taxes: Applied to the sale of goods and services, sales taxes are a common form of taxation. They are usually collected by businesses and remitted to the government, making them a convenient way to generate revenue.

- Property Taxes: Based on the value of real estate or other assets, property taxes are a significant source of revenue for local governments. These taxes fund local services like schools, roads, and public safety.

- Excise Taxes: Targeted at specific goods like alcohol, tobacco, or fuel, excise taxes are often used to discourage consumption of harmful or environmentally detrimental products.

- Corporate Taxes: Imposed on the profits of corporations, these taxes contribute to government revenue and help regulate corporate behavior. They can be structured in various ways, including flat rates or progressive scales.

The Role of Taxes in Economic Development

Taxes play a pivotal role in shaping a country’s economic trajectory. They provide the resources necessary for governments to invest in infrastructure, education, healthcare, and other vital sectors. Effective tax systems can drive economic growth, reduce inequality, and enhance social welfare.

Additionally, taxes can be a powerful tool for redistribution of wealth. Progressive tax systems, where higher-income individuals pay a larger proportion of their income in taxes, can help reduce income disparities and promote social equity. This redistribution can lead to a more resilient and sustainable economy, as it addresses issues of poverty and social exclusion.

However, the implementation of taxes is not without challenges. Tax evasion and avoidance are persistent issues that governments must address to ensure fair revenue collection. Moreover, the complexity of tax systems can create barriers for businesses and individuals, hindering economic activity and growth.

Comparative Analysis: Tariffs vs. Taxes

While tariffs and taxes serve distinct purposes, they are often used in conjunction to achieve optimal revenue collection and economic goals. Let’s delve into a comparative analysis of these two economic tools.

Revenue Generation

Both tariffs and taxes are vital sources of revenue for governments. However, their effectiveness and impact on the economy can vary. Tariffs, especially on imports, can be a significant revenue generator, particularly for countries with high levels of trade. For instance, a country with a strong export sector might leverage tariffs on imports to boost its revenue without significantly impacting its own businesses.

On the other hand, taxes, especially income and sales taxes, are a more stable and consistent source of revenue. They are less susceptible to fluctuations in international trade and can provide a steady stream of income for governments. Additionally, taxes can be designed to be more progressive, ensuring that higher-income individuals and corporations contribute a larger share of their wealth to public finances.

Economic Impact

The economic impact of tariffs and taxes is a complex issue that requires careful consideration. Tariffs, when applied strategically, can protect domestic industries and promote local employment. However, they can also lead to increased prices for consumers and reduced competitiveness for exporting businesses. Moreover, tariffs can spark trade wars, as seen in the post-World War II era, when countries retaliated against each other’s tariffs, leading to a decline in global trade.

Taxes, especially income taxes, can have a more nuanced impact on the economy. Progressive income taxes can reduce income inequality and stimulate economic growth by providing resources for public investments. However, high taxes can also discourage entrepreneurship and investment, potentially hindering economic activity. Finding the right balance between tax rates and economic incentives is a delicate task for policymakers.

Strategic Considerations

Governments must consider various factors when deciding between tariffs and taxes. For instance, in the context of international trade, tariffs can be a powerful tool to negotiate better trade deals and protect domestic industries. However, the threat of retaliatory tariffs from trading partners must be carefully weighed.

Within a country's borders, taxes offer more flexibility and control. Governments can adjust tax rates and structures to encourage certain behaviors, such as promoting investment in renewable energy or discouraging the consumption of harmful substances. Taxes can also be designed to support specific industries or regions, providing targeted economic development.

The Future of Tariffs and Taxes

As the global economy evolves, so too will the role and application of tariffs and taxes. In an era of increasing globalization and interconnectedness, the impact of these economic tools will be felt across borders.

One notable trend is the move towards free trade agreements and regional economic blocs. These agreements often involve the reduction or elimination of tariffs, promoting free trade and economic integration. While this can lead to increased trade and economic growth, it also presents challenges for governments reliant on tariff revenue.

In response, governments are exploring alternative revenue sources, such as value-added taxes (VAT) and digital services taxes. VAT, a consumption tax added at each stage of the production process, is becoming increasingly popular as it can be applied to both domestic and imported goods, providing a stable revenue stream. Digital services taxes, on the other hand, target the growing digital economy, ensuring that tech giants contribute their fair share to public finances.

Additionally, the rise of environmental concerns is shaping the future of taxes and tariffs. Governments are implementing carbon taxes and environmental levies to discourage harmful practices and promote sustainable development. These taxes can generate revenue while also addressing critical environmental issues.

Conclusion

Tariffs and taxes are essential tools in the economic arsenal of governments worldwide. They serve diverse purposes, from protecting domestic industries to funding public services and shaping the economic landscape. Understanding the nuances of these economic mechanisms is crucial for policymakers, businesses, and individuals alike.

As we've explored, tariffs and taxes have a rich history and a significant impact on the global economy. They can be strategic instruments for economic development, but they also present challenges and potential pitfalls. The ongoing evolution of these tools in response to changing economic and environmental realities ensures that they will remain a critical focus for policymakers and a key area of study for economists and analysts.

Further Reading and Resources

For those interested in delving deeper into the world of tariffs and taxes, here are some recommended resources:

- “The International Trade and Tariff Database” - A comprehensive database providing historical and current tariff data for over 100 countries.

- “Tax Policy and the Economy” - An annual publication by the National Bureau of Economic Research, offering in-depth analysis of tax policies and their economic impacts.

- “The World Trade Organization: Law, Practice, and Policy” - A comprehensive guide to international trade law, including the role of tariffs in global trade.

What is the primary difference between tariffs and taxes?

+Tariffs are taxes imposed on imported goods and services, while taxes are levied on a wide range of goods, services, income, and assets within a country’s jurisdiction.

How do tariffs impact international trade relations?

+Tariffs can either foster or hinder international trade relations. They can be used as a negotiating tool to secure better trade deals, but they can also lead to trade wars and reduced global trade if not implemented strategically.

What are the key considerations for governments when setting tax policies?

+Governments must balance the need for revenue generation with the potential impact on economic growth, social equity, and business competitiveness. They must also consider the complexity of the tax system and its potential for evasion or avoidance.

How do tariffs and taxes affect consumers and businesses?

+Tariffs can increase the prices of imported goods for consumers and reduce competitiveness for exporting businesses. Taxes, especially income taxes, can impact the disposable income of individuals and the profitability of businesses, influencing consumption and investment patterns.