Tax Papers How Long To Keep

When it comes to tax-related documents and records, knowing how long to retain them is essential for both individuals and businesses. The length of time you should keep tax papers varies depending on several factors, including the type of tax return, the nature of the documents, and the jurisdiction's specific regulations. This comprehensive guide will delve into the details of tax paper retention, offering valuable insights and expert advice to help you navigate this crucial aspect of financial management.

Understanding the Basics of Tax Paper Retention

Tax paper retention refers to the practice of keeping tax-related documents, records, and receipts for a specified period. These records are vital for various reasons, including supporting tax returns, resolving tax disputes, and ensuring compliance with tax laws. Different countries and tax authorities have their own guidelines on how long these documents should be retained, and it’s crucial to understand these regulations to avoid potential penalties and legal issues.

The Importance of Record-Keeping for Tax Purposes

Maintaining organized and accurate records is fundamental for several reasons. Firstly, tax records serve as evidence of income, expenses, and deductions claimed on your tax returns. In the event of an audit or inquiry by tax authorities, having accessible and reliable records can significantly streamline the process and provide a clear audit trail. Secondly, tax records are essential for calculating and supporting your tax liabilities accurately. They help in determining the correct tax amounts and ensuring timely payments.

Key Documents to Consider for Retention

When determining which tax papers to keep, it’s essential to consider a range of documents. These include:

- Income Statements: Wage statements, self-employment income records, investment income, and any other sources of income.

- Expense Records: Receipts for business expenses, charitable donations, medical expenses, and other deductions.

- Tax Returns: Copies of previously filed tax returns, both for individuals and businesses.

- Supporting Documents: Invoices, contracts, bank statements, and any other documents that support the information reported on your tax returns.

- Property Records: Deeds, mortgages, and records of home improvements for property-related tax deductions.

- Retirement Account Records: Statements and contribution records for retirement accounts like 401(k)s and IRAs.

- Educational Expenses: Records of tuition fees, student loan interest, and other educational-related expenses for potential tax credits.

Retention Periods: Navigating the Legal Requirements

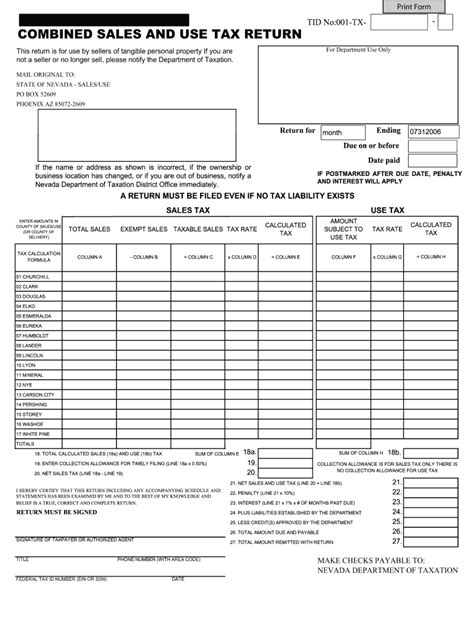

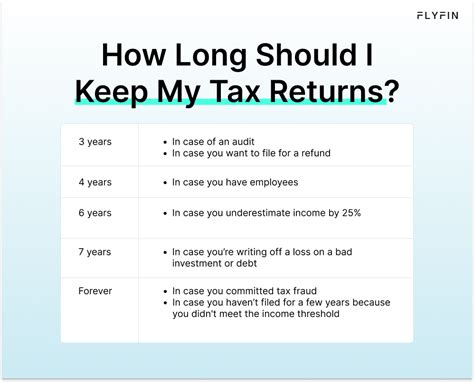

The duration for which tax papers should be kept varies based on the jurisdiction and the type of tax return. In the United States, for instance, the Internal Revenue Service (IRS) has specific guidelines for different types of tax returns.

Individual Tax Returns (Form 1040)

For individual tax returns, the IRS generally recommends keeping records for a minimum of three years. This includes supporting documents for income, deductions, and credits claimed on your tax return. However, if you fail to report income or underreport your income by more than 25%, the IRS has six years to audit your return. In cases of fraud or filing a false return, there is no time limit for the IRS to conduct an audit.

Business Tax Returns

Businesses, whether sole proprietorships, partnerships, or corporations, should retain tax records for at least three years. However, certain records, such as those related to assets, should be kept for longer periods. For example, records of depreciable property should be retained until the period of depreciation has passed and the property is disposed of.

Other Types of Tax Returns

For specific types of tax returns, such as estate and gift tax returns, the retention period is generally six years. This is also the case for taxpayers who fail to report income or underreport their income by more than 25%.

| Tax Return Type | Recommended Retention Period |

|---|---|

| Individual Tax Returns (Form 1040) | 3 years |

| Business Tax Returns | 3 years, longer for asset-related records |

| Estate and Gift Tax Returns | 6 years |

Digital vs. Physical Storage: Best Practices

With the increasing digitization of records, many taxpayers are opting for digital storage solutions for their tax papers. While this offers convenience and easy accessibility, it’s essential to ensure that digital records are properly secured and backed up. Here are some best practices for digital and physical storage:

Digital Storage

- Cloud Storage: Utilizing secure cloud storage services can provide an added layer of protection and accessibility. Ensure you choose a reputable service and implement strong security measures, including encryption.

- External Hard Drives: Storing digital tax records on external hard drives can be a reliable option. Regularly back up your data and keep the drive in a secure location.

- Document Scanning: If you prefer a hybrid approach, scan physical documents and store them digitally. This reduces the risk of physical damage and makes searching for specific records more efficient.

Physical Storage

- Secure Location: Store physical tax records in a secure and fireproof location. Consider using a safe or a fire-resistant filing cabinet.

- Organized Filing System: Develop an organized filing system that allows for easy retrieval of specific documents. Label folders and use a consistent naming convention.

- Regular Review: Periodically review your physical records to ensure they are up-to-date and relevant. Discard outdated or unnecessary documents to maintain a streamlined filing system.

The Impact of Tax Amendments and Audits on Retention

In certain situations, such as filing an amended tax return or undergoing a tax audit, the retention period for tax papers may be extended. Here’s what you need to know:

Amended Tax Returns

If you file an amended tax return, the IRS recommends keeping records related to the amendment for at least three years from the date you filed the original return or two years from the date you paid the tax, whichever is later. This ensures that you have the necessary documentation to support any changes made to your tax return.

Tax Audits

In the event of a tax audit, the IRS may request additional documentation to support your tax returns. It’s essential to cooperate fully and provide the requested information. The audit process can vary in length, and it’s advisable to retain the relevant tax papers until the audit is resolved and any potential appeals are finalized.

Future Considerations: Evolving Tax Laws and Digital Records

As tax laws and regulations evolve, it’s crucial to stay informed about any changes that may impact the retention of tax papers. Additionally, the increasing use of digital records and online tax filing platforms introduces new considerations for record-keeping. Here are some future-oriented practices to consider:

Stay Informed on Tax Law Changes

Regularly review official tax publications and consult with tax professionals to stay updated on any changes to tax laws and regulations. This ensures that your record-keeping practices remain compliant with the latest requirements.

Digital Record Management

As more tax-related processes move online, ensure that you have a robust system for managing digital records. This includes implementing strong cybersecurity measures to protect your data from potential breaches or cyberattacks.

Cloud-Based Solutions

Consider utilizing cloud-based accounting and tax software that offers secure storage and easy access to your tax records. These solutions often provide automatic backup and synchronization, reducing the risk of data loss.

Data Retention Policies

Develop and implement data retention policies that align with your tax record-keeping needs. This ensures that you retain records for the appropriate duration and dispose of them securely when they are no longer required.

Conclusion: A Comprehensive Approach to Tax Paper Retention

Navigating the complexities of tax paper retention is an essential aspect of financial management. By understanding the legal requirements, implementing best practices for storage, and staying informed about evolving tax laws, you can ensure that your tax records are well-organized and accessible when needed. Whether you choose digital or physical storage, or a combination of both, a comprehensive and proactive approach to tax paper retention will provide peace of mind and help you avoid potential pitfalls.

How long should I keep tax records for an LLC or corporation?

+For LLCs and corporations, it is recommended to retain tax records for at least three years, similar to individual tax returns. However, certain records related to assets and financial transactions may need to be kept for longer periods, especially if they are relevant to ongoing business operations or legal matters.

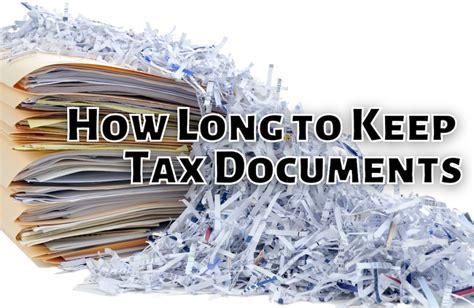

Can I shred tax records after the recommended retention period?

+While you can dispose of tax records after the recommended retention period, it is essential to ensure that you no longer require them for any ongoing tax matters or legal purposes. If in doubt, consult with a tax professional to confirm when it is safe to dispose of specific records.

What happens if I fail to keep tax records for the recommended period?

+Failing to keep tax records for the recommended period can lead to various issues. In the event of an audit, you may struggle to provide the necessary documentation to support your tax returns, potentially resulting in penalties and additional taxes. It is crucial to maintain accurate and up-to-date records to avoid such complications.

Are there any tax records that should be kept indefinitely?

+While most tax records have a recommended retention period, certain documents, such as birth certificates, marriage certificates, and real estate deeds, should be kept indefinitely. These records often have long-term relevance beyond tax purposes and should be stored securely.