Estimated Tax Payments New Jersey

Understanding tax obligations is crucial for individuals and businesses, especially when it comes to estimated tax payments. In the state of New Jersey, the process of making estimated tax payments involves a series of steps and considerations to ensure compliance with state tax laws. This article aims to provide an in-depth analysis of estimated tax payments in New Jersey, covering the necessary steps, requirements, and potential implications.

Navigating Estimated Tax Payments in New Jersey

Estimated tax payments are an essential component of the tax system, particularly for those who are self-employed, freelancers, or business owners. These payments are made throughout the year to cover tax liabilities that are not withheld from regular income sources. In New Jersey, estimated tax payments are mandated for individuals and businesses whose estimated tax liability for the year exceeds certain thresholds.

Determining Eligibility for Estimated Tax Payments

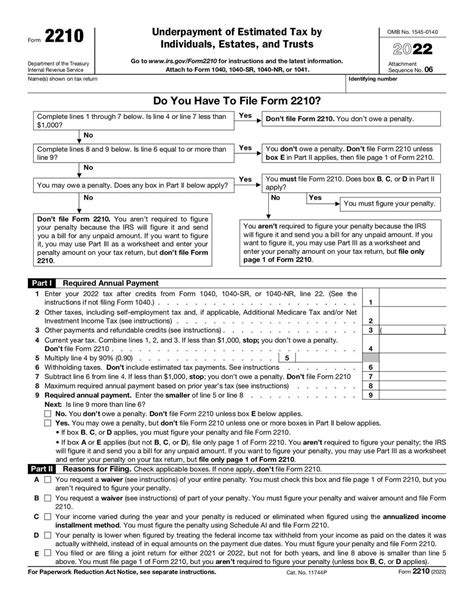

To understand whether you are required to make estimated tax payments in New Jersey, it’s crucial to assess your tax liability. Generally, individuals and businesses with an estimated tax liability of $1,000 or more for the year are subject to estimated tax payments. This threshold includes both state and local income taxes.

For example, let's consider a self-employed individual in New Jersey with an annual income of $120,000. If their tax liability, including state and local taxes, is estimated to be $4,000 or more, they would fall under the requirement to make estimated tax payments.

Payment Frequency and Due Dates

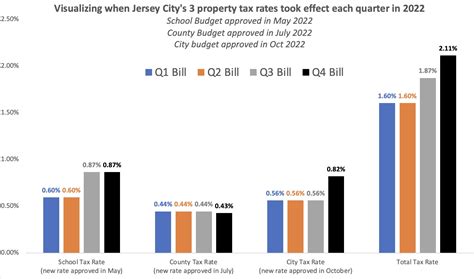

Estimated tax payments in New Jersey are typically due on specific dates throughout the year. The payment schedule is divided into four payment periods, with due dates falling on April 15, June 15, September 15, and January 15 of the following year. These dates align with the federal tax calendar, providing a consistent framework for tax payments.

Each payment period covers a specific portion of the annual estimated tax liability. For instance, the payment due on April 15 covers the period from January 1 to March 31, while the June 15 payment covers April 1 to May 31. This system ensures that tax obligations are distributed evenly throughout the year.

| Payment Period | Due Date | Coverage Period |

|---|---|---|

| 1st Payment | April 15 | January 1 - March 31 |

| 2nd Payment | June 15 | April 1 - May 31 |

| 3rd Payment | September 15 | June 1 - August 31 |

| 4th Payment | January 15 | September 1 - December 31 |

It's important to note that failure to make estimated tax payments on time can result in penalties and interest charges. To avoid these penalties, taxpayers should carefully calculate their estimated tax liability and make timely payments.

Calculating Estimated Tax Liability

Calculating estimated tax liability is a crucial step in the process. Taxpayers must estimate their income, deductions, credits, and other relevant factors to determine the amount of tax they owe for the year. The calculation should consider both federal and state tax obligations, as well as any applicable local taxes.

To illustrate, consider a small business owner in New Jersey with an expected annual income of $250,000. By estimating their taxable income, deductions, and applicable taxes, they determine that their estimated tax liability for the year is $15,000. This calculation would guide their estimated tax payments throughout the year.

Methods of Payment

New Jersey offers various methods for taxpayers to make their estimated tax payments. The most common methods include:

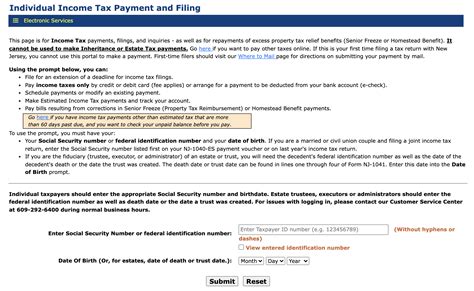

- Electronic Funds Transfer (EFT): This method allows taxpayers to transfer funds directly from their bank account to the state's tax authority. It is a secure and efficient way to make payments and is often preferred for its convenience.

- Credit Card or Debit Card: Taxpayers can use their credit or debit cards to make estimated tax payments online or over the phone. This method provides flexibility and can be convenient for those who prefer card payments.

- Check or Money Order: Traditional payment methods, such as checks or money orders, are also accepted. Taxpayers can mail these payments to the designated address provided by the state tax authority.

It's important to note that each payment method may have its own processing times and associated fees. Taxpayers should consider these factors when choosing their preferred method of payment.

Resources and Assistance

The New Jersey Division of Taxation provides valuable resources and guidance to taxpayers navigating estimated tax payments. The official website offers comprehensive information, including tax forms, payment instructions, and calculators to assist in estimating tax liabilities.

Additionally, taxpayers can seek assistance from tax professionals or enrolled agents who can provide personalized advice and support throughout the process. These experts can help with complex tax situations and ensure compliance with state tax laws.

Conclusion: Navigating the Complexities

Estimated tax payments in New Jersey require careful planning and adherence to specific guidelines. By understanding the eligibility criteria, payment schedules, and calculation methods, taxpayers can navigate this process with confidence. Staying informed and seeking assistance when needed can help ensure compliance and avoid potential penalties.

As with any tax-related matter, it's essential to stay updated with the latest regulations and guidelines. The state tax authority regularly provides updates and announcements, ensuring taxpayers have the most accurate information.

Frequently Asked Questions

How do I know if I need to make estimated tax payments in New Jersey?

+If your estimated tax liability for the year, including state and local taxes, is $1,000 or more, you are likely required to make estimated tax payments. This threshold applies to individuals and businesses.

What happens if I miss an estimated tax payment deadline in New Jersey?

+Missing an estimated tax payment deadline can result in penalties and interest charges. It’s important to make payments on time to avoid these additional costs and maintain compliance with state tax laws.

Can I make estimated tax payments online in New Jersey?

+Yes, New Jersey offers online payment options through its official website. You can make payments using Electronic Funds Transfer (EFT) or credit/debit cards. These methods provide convenience and efficiency for taxpayers.

Are there any tax benefits for making estimated tax payments in New Jersey?

+Making estimated tax payments can help you avoid underpayment penalties and ensure you meet your tax obligations throughout the year. Additionally, it allows you to plan your finances more effectively and potentially avoid a large tax bill at the end of the year.

Where can I find more information and resources about estimated tax payments in New Jersey?

+The New Jersey Division of Taxation’s official website is a valuable resource, providing comprehensive information, forms, and calculators related to estimated tax payments. You can also seek assistance from tax professionals or enrolled agents for personalized guidance.