Tax Lien Property Listings

Tax lien property listings are a unique and often intriguing segment of the real estate market, offering both opportunities and challenges to investors and buyers. These properties, which come into the market due to tax-related issues, provide a glimpse into the complexities of property ownership and the potential for lucrative investments. This article aims to delve into the world of tax lien property listings, exploring their origins, the process involved, the risks and rewards, and the strategies that can lead to successful acquisitions.

Understanding Tax Lien Property Listings

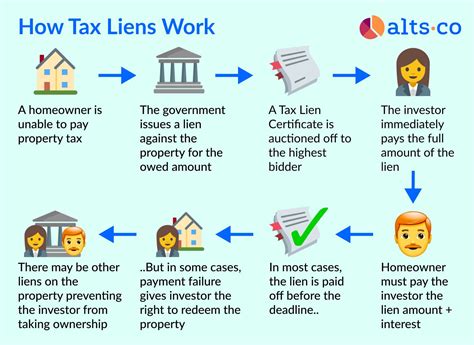

Tax lien properties are residential or commercial real estate assets that have been affected by tax-related issues. These issues typically arise when property owners fail to pay their property taxes for an extended period, often resulting in the government imposing a tax lien on the property. A tax lien is a legal claim against the property, which gives the government the right to collect the outstanding taxes, plus any penalties and interest accrued.

When a tax lien is placed on a property, it essentially means the government has a secured interest in the property. If the taxes remain unpaid, the local government or tax authority may choose to auction off the tax lien to investors, who then have the right to pursue repayment of the debt, including interest and penalties. If the debt is not repaid within a specified period, the investor who holds the tax lien may have the opportunity to acquire the property through a tax deed sale, essentially becoming the new owner.

The Process: From Lien to Auction

The process of a tax lien property listing varies slightly depending on the jurisdiction and local laws. However, the general steps often include the following:

Tax Lien Sale Announcement

When a property owner fails to pay their property taxes, the local government or tax authority will issue a Notice of Tax Lien. This notice serves as a warning and an opportunity for the owner to pay their taxes before the lien is sold at auction. If the taxes remain unpaid, the lien will be scheduled for auction.

Tax Lien Auction

The tax lien auction is an event where investors can bid on the right to collect the outstanding taxes. These auctions are often competitive, with experienced investors and sometimes even property owners themselves participating. The highest bidder wins the right to collect the taxes and any associated fees, along with interest.

The winning bidder receives a tax lien certificate, which serves as proof of their investment and right to the debt. At this stage, the original property owner still retains ownership of the property, but the investor now has a legal claim against it.

Redemption Period

After the auction, there is a redemption period, which is a grace period during which the property owner can pay off the taxes, penalties, and interest, along with a small fee, to retain ownership of the property. The length of the redemption period varies and is set by local laws. During this time, the investor who holds the tax lien collects interest on their investment.

The Rewards and Risks of Tax Lien Properties

Investing in tax lien properties can be lucrative, but it’s essential to understand the risks and rewards associated with this niche market.

Rewards

- High Returns: Tax lien investments can offer significant returns, especially if the property owner fails to redeem the property during the redemption period. Investors can earn interest on their investment, and if the property is acquired through a tax deed sale, they may also benefit from the potential increase in property value.

- Potential for Ownership: Successful investors who acquire the property through a tax deed sale become the new owners, providing an opportunity to profit from the sale or rental of the property.

- Reduced Competition: Tax lien auctions often attract fewer investors compared to traditional real estate auctions, potentially offering a more favorable environment for those who understand the process.

Risks

- Uncertainty: Tax lien investing is inherently uncertain, as the outcome depends on the property owner’s actions. There is a risk that the property owner will redeem the property, and the investor may not receive the expected return on their investment.

- Property Condition: Tax lien properties may be in various states of disrepair, and the investor may need to invest in repairs or renovations, which can impact their potential profits.

- Legal Complexity: The process of acquiring a tax lien property can be legally complex, and investors should be prepared to navigate the legal aspects of the transaction.

Strategies for Success in Tax Lien Investing

To succeed in the world of tax lien property listings, investors should consider the following strategies:

Research and Due Diligence

Thorough research is crucial. Investors should investigate the property, its history, and the owner’s financial situation. Understanding the local real estate market and the property’s potential value is essential for making informed decisions.

Understanding Local Laws

Each jurisdiction has unique laws and regulations regarding tax liens and property auctions. Investors should familiarize themselves with these laws to ensure they understand the process and their rights as an investor.

Attend Auctions and Learn

Attending tax lien auctions, even if not bidding, can provide valuable insights into the process and the strategies of experienced investors. It’s an opportunity to learn and network with professionals in the field.

Consider Partnering or Consulting

For those new to tax lien investing, partnering with an experienced investor or consulting with a real estate professional can be beneficial. They can provide guidance and help navigate the complexities of the process.

Diversify and Manage Risk

Diversifying your investments and managing risk is essential. Spreading your investments across multiple properties and considering the potential risks and rewards of each can help mitigate the uncertainty inherent in tax lien investing.

Conclusion: A Unique Investment Opportunity

Tax lien property listings present a unique investment opportunity, offering a glimpse into the world of tax-related real estate issues. While the process can be complex and the outcomes uncertain, the potential for high returns and property ownership make it an intriguing prospect for savvy investors. With thorough research, understanding of local laws, and a well-planned strategy, investors can navigate the world of tax lien properties and potentially reap significant rewards.

What is a tax lien certificate, and how does it work?

+A tax lien certificate is a document that proves an investor’s right to collect the outstanding taxes, penalties, and interest on a property. It’s issued to the highest bidder at a tax lien auction. The certificate serves as a legal claim against the property, allowing the investor to pursue repayment or potentially acquire the property through a tax deed sale if the owner fails to redeem.

Can a property owner redeem their property after the tax lien auction?

+Yes, during the redemption period, which is set by local laws, the property owner has the right to pay off the taxes, penalties, and interest, along with a small fee, to retain ownership of the property. If the owner redeems, the investor who holds the tax lien certificate receives the repayment, including interest earned during the redemption period.

What happens if a property owner doesn’t redeem during the redemption period?

+If the property owner fails to redeem, the investor who holds the tax lien certificate has the opportunity to acquire the property through a tax deed sale. This process varies by jurisdiction but typically involves the investor applying for a tax deed, which transfers ownership of the property to them.

Are tax lien properties always in poor condition?

+Not necessarily. While some tax lien properties may be in disrepair, others may be well-maintained. The condition of the property can vary widely and should be assessed on a case-by-case basis. Investors should conduct thorough due diligence to understand the property’s condition and potential repair costs.