Does Missouri Have State Tax

Missouri, like many other states in the United States, has a system of state taxes to generate revenue for various public services and infrastructure. Understanding the tax landscape of Missouri is crucial for individuals and businesses operating within the state. This article aims to provide a comprehensive overview of Missouri's state tax system, its components, rates, and how it impacts taxpayers.

The Missouri State Tax System: An Overview

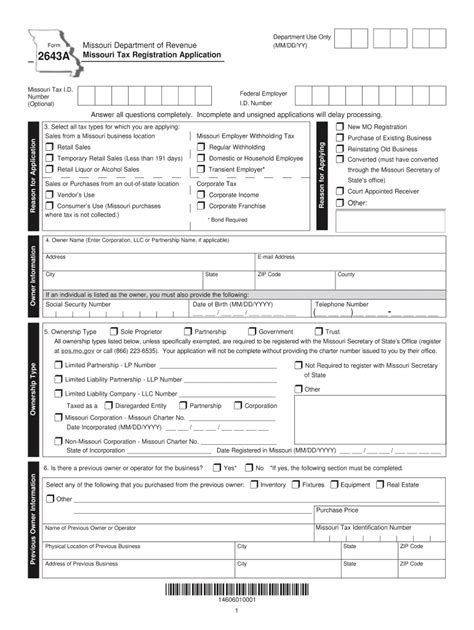

Missouri’s state tax system consists of several key components, each designed to contribute to the state’s revenue stream. These taxes are administered by the Missouri Department of Revenue, which ensures compliance and facilitates the collection process. The state tax structure in Missouri can be broken down into the following categories:

- Income Tax: Missouri imposes an individual income tax on residents and non-residents with income sourced from the state. The income tax rate in Missouri is progressive, meaning the tax rate increases as income levels rise. The state offers various deductions and credits to help taxpayers manage their tax liabilities.

- Sales and Use Tax: Missouri levies a sales tax on the sale of tangible personal property and certain services. The state sales tax rate is 4.225%, and local jurisdictions can add additional sales tax, resulting in varying total sales tax rates across the state. Use tax is applied to purchases made outside the state but used within Missouri.

- Property Tax: Property taxes are primarily administered by local governments in Missouri. The state's property tax system is decentralized, with rates and assessments varying across counties and municipalities. Property taxes fund essential services like schools, fire departments, and local infrastructure.

- Corporate Income Tax: Businesses operating in Missouri are subject to corporate income tax. The tax rate for corporations varies based on the type of business and its revenue. The state offers incentives and tax credits to attract and support businesses.

- Excise Taxes: Missouri imposes excise taxes on specific goods and services, such as motor fuels, tobacco products, and alcoholic beverages. These taxes are often used to fund specific programs or infrastructure projects related to the taxed item.

Income Tax: A Progressive Approach

Missouri’s income tax system is designed to be progressive, meaning higher-income earners pay a larger proportion of their income in taxes. As of my last update in January 2024, the state’s income tax rates are as follows:

| Tax Rate | Income Range |

|---|---|

| 1.5% | Up to $1,000 |

| 2.0% | $1,000.01 - $2,000 |

| 2.5% | $2,000.01 - $3,000 |

| 3.0% | $3,000.01 - $4,000 |

| 3.5% | $4,000.01 - $6,000 |

| 4.0% | $6,000.01 - $9,000 |

| 4.5% | $9,000.01 - $12,000 |

| 5.0% | $12,000.01 - $16,000 |

| 5.5% | $16,000.01 - $20,000 |

| 5.8% | Over $20,000 |

These rates apply to both single and joint filers. Additionally, Missouri allows for various deductions, such as standard deductions, personal exemptions, and itemized deductions, to reduce taxable income.

Sales and Use Tax: Impact on Consumers

The sales and use tax in Missouri can significantly impact consumers’ purchasing power. While the state sales tax rate is 4.225%, local jurisdictions have the authority to add their own sales taxes, resulting in a combined sales tax rate that can vary from one location to another. As of my knowledge cutoff, the highest combined sales tax rate in Missouri was 9.65% in certain jurisdictions.

The use tax, on the other hand, ensures that out-of-state purchases are not tax-free if they are brought into Missouri and used within the state. This tax is designed to level the playing field for in-state businesses and prevent tax evasion.

Property Tax: A Localized Approach

Property taxes in Missouri are a significant source of revenue for local governments, primarily funding public education, fire protection, and other essential services. The state’s property tax system is highly localized, with assessment procedures and tax rates varying across counties and municipalities.

Property tax rates are typically expressed as a percentage of the assessed value of the property. The assessed value is determined by local assessors, who consider factors such as the property's location, condition, and market value. Property owners can appeal their assessments if they believe the value is inaccurate.

Corporate Income Tax: Supporting Business Growth

Missouri’s corporate income tax system aims to support business growth and investment within the state. The tax rate for corporations varies based on their type and revenue. As of my last update, the tax rates for corporations are as follows:

| Tax Rate | Income Range |

|---|---|

| 4.0% | Up to $25,000 |

| 5.25% | Over $25,000 |

However, it's important to note that Missouri offers various tax incentives and credits to attract and retain businesses. These incentives can significantly reduce a corporation's tax liability, making the state an attractive destination for businesses.

Excise Taxes: Funding Specific Programs

Excise taxes in Missouri are levied on specific goods and services, and the revenue generated is often earmarked for specific programs or infrastructure projects related to the taxed item. For instance, the excise tax on motor fuels funds transportation projects, while the excise tax on tobacco products supports health initiatives.

The following are some of the key excise taxes in Missouri:

- Motor Fuel Excise Tax: 17.4 cents per gallon for gasoline and 22.0 cents per gallon for diesel fuel.

- Tobacco Products Excise Tax: $0.17 per cigarette pack, and various rates for other tobacco products.

- Alcoholic Beverage Excise Tax: Varies based on the type of beverage and its alcohol content.

The Impact of Missouri’s State Tax System

Missouri’s state tax system plays a crucial role in funding public services and infrastructure projects. The revenue generated from these taxes supports essential functions like education, healthcare, public safety, and transportation. Additionally, the tax incentives and credits offered by the state can stimulate economic growth and attract businesses.

However, the state tax system also has implications for taxpayers. Income taxes can impact individuals' disposable income, while sales and use taxes affect the cost of living. Property taxes, though localized, can significantly impact homeowners and businesses, especially in areas with high tax rates.

Understanding Missouri's state tax system is essential for individuals and businesses to plan their financial strategies effectively. By staying informed about tax rates, deductions, and incentives, taxpayers can optimize their tax liabilities and contribute to the state's economic growth.

What is the average property tax rate in Missouri?

+

The average effective property tax rate in Missouri is approximately 1.04%, which ranks the state 17th in the nation in terms of property taxes.

Are there any tax incentives for renewable energy in Missouri?

+

Yes, Missouri offers tax incentives for renewable energy projects, including a 35% investment tax credit for solar energy systems and a 35% investment tax credit for wind energy systems.

How does Missouri’s sales tax compare to other states?

+

Missouri’s sales tax rate is on the lower end compared to many other states. As of my knowledge cutoff, the average state sales tax rate in the U.S. was around 6.6%, while Missouri’s state sales tax rate is 4.225%, with the potential for additional local taxes.