Cobb County Real Estate Taxes

Welcome to a comprehensive guide on Cobb County's real estate taxes, an essential aspect of property ownership in this vibrant Georgia county. This article aims to delve deep into the intricacies of real estate taxes, offering an in-depth analysis for both current and prospective homeowners in the region. From understanding the tax assessment process to exploring strategies for efficient tax management, we'll cover it all. As an expert in the field, I'll ensure this guide is both informative and engaging, providing valuable insights into one of the key financial considerations for property owners in Cobb County.

Understanding Cobb County Real Estate Taxes

Cobb County, nestled in the heart of Georgia, boasts a thriving real estate market, attracting both families and businesses with its vibrant communities and economic opportunities. However, with the privilege of owning property comes the responsibility of understanding and managing real estate taxes. These taxes are an essential component of the county’s revenue stream, contributing to the development and maintenance of local infrastructure, schools, and public services.

The process of real estate taxation in Cobb County involves a series of steps, starting with the annual assessment of property values. This assessment, conducted by the Cobb County Board of Tax Assessors, is a crucial determinant of the tax liability for each property owner. The assessed value is then utilized to calculate the tax amount, which is typically due in two installments throughout the year.

Tax Assessment Process

The tax assessment process in Cobb County is meticulous and transparent. It begins with the collection of data on all taxable properties within the county. This data includes details such as the property’s size, location, improvements made, and any recent sales or transfers. The Board of Tax Assessors then employs a systematic approach to determine the fair market value of each property, ensuring that the assessment is accurate and equitable.

Once the assessment is complete, property owners receive a notice of assessment, detailing the estimated value of their property and the subsequent tax liability. This notice serves as a critical document, allowing homeowners to review and verify the accuracy of the assessment. In the event of a disagreement with the assessed value, Cobb County provides a comprehensive appeals process, ensuring property owners have the opportunity to challenge the assessment and seek a fair resolution.

| Key Dates | Tax Assessment Timeline |

|---|---|

| January to April | Data Collection and Initial Assessments |

| April to May | Notice of Assessment Sent to Property Owners |

| May to June | Appeal Period for Property Owners |

| July | Final Assessment Roll Completion |

| October | First Tax Installment Due |

| March | Second Tax Installment Due |

Calculating Real Estate Taxes

The calculation of real estate taxes in Cobb County involves a straightforward formula. The assessed value of the property is multiplied by the applicable tax rate, which is set by the county government and other local taxing authorities. This rate, often referred to as the millage rate, can vary based on the location of the property and the services it receives.

For instance, if a property in Cobb County is assessed at $200,000 and the millage rate is 15 mills, the annual tax liability would be calculated as follows: $200,000 x 0.015 = $3,000. This amount is then divided into two installments, with the first due in October and the second in March.

| Property Value | Millage Rate | Annual Tax |

|---|---|---|

| $150,000 | 15 mills | $2,250 |

| $250,000 | 16 mills | $4,000 |

| $300,000 | 14 mills | $4,200 |

Managing Real Estate Taxes in Cobb County

Effective management of real estate taxes is a critical aspect of homeownership, and Cobb County offers several strategies and resources to assist property owners in this endeavor.

Homestead Exemption

One of the most beneficial tools for Cobb County homeowners is the homestead exemption. This exemption allows eligible homeowners to reduce the assessed value of their primary residence, thereby lowering their annual tax liability. To qualify for the homestead exemption, homeowners must meet certain criteria, including being the legal owner of the property and using it as their primary residence.

The homestead exemption in Cobb County provides a reduction of up to $2,000 on the assessed value of the property. For example, if a homeowner's property is assessed at $200,000 and they qualify for the homestead exemption, the assessed value for tax purposes would be reduced to $198,000, resulting in a potential savings of $30 on their annual tax bill.

Tax Relief Programs

Cobb County is committed to supporting its residents, particularly those who may face financial challenges. The county offers several tax relief programs aimed at providing assistance to eligible homeowners. These programs include:

- Senior Citizen Exemption: This program provides a reduction in the assessed value for homeowners who are 65 years or older and meet certain income requirements.

- Disabled Veteran Exemption: Cobb County offers an exemption for disabled veterans, reducing their tax liability based on the level of disability.

- Disability Tax Relief: Property owners with a disability can apply for this relief, which provides a reduction in their tax liability based on their income and the severity of their disability.

Appealing Property Assessments

If a homeowner believes their property has been overvalued, Cobb County provides a comprehensive appeals process. This process allows homeowners to challenge the assessed value and potentially reduce their tax liability. The appeal can be made based on factors such as an incorrect property description, a recent decrease in property value, or an unequal assessment compared to similar properties in the area.

The appeal process typically involves the following steps:

- Review of the Notice of Assessment: Homeowners should carefully examine the notice they receive after the initial assessment.

- Research and Documentation: Gather evidence to support your claim, such as recent property sales in the area or professional appraisals.

- File an Appeal: Submit a formal appeal with the Cobb County Board of Equalization within the specified timeframe.

- Hearing: Present your case to the Board of Equalization, providing all relevant documentation and arguments.

- Decision: The Board will review the evidence and make a decision, which will be communicated to the homeowner.

The Impact of Real Estate Taxes on Property Owners

Real estate taxes in Cobb County not only contribute to the county’s revenue but also play a significant role in the financial planning and decision-making of property owners. Understanding the impact of these taxes is crucial for both current and prospective homeowners.

Financial Planning and Budgeting

Real estate taxes are a recurring expense that property owners must factor into their annual budgets. The timely payment of these taxes is essential to avoid penalties and maintain a positive credit history. By understanding their tax liability, homeowners can plan their finances effectively, ensuring they have sufficient funds to cover the tax installments.

Additionally, the potential for tax savings through exemptions and appeals can significantly impact a homeowner's financial outlook. For instance, a successful appeal or exemption can result in hundreds or even thousands of dollars in savings annually, providing homeowners with more disposable income or the opportunity to invest in their property.

Impact on Property Value and Sales

The real estate tax rate in Cobb County can influence the overall property values and the local housing market. A competitive tax rate can make the county more attractive to potential buyers, especially for those relocating from areas with higher tax burdens. Conversely, a higher tax rate could potentially impact the marketability of properties, especially in a competitive real estate landscape.

For sellers, understanding the tax implications can be crucial in pricing their properties competitively. Buyers often consider the tax burden when making an offer, so sellers who are transparent about tax liability and potential savings (through exemptions or recent appeals) may have an advantage in the market.

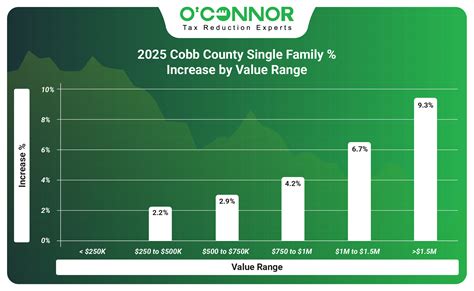

Future Outlook and Potential Changes

As with any aspect of local governance, the real estate tax landscape in Cobb County is subject to change. While the county has a stable and well-managed tax system, various factors can influence future tax rates and policies.

Economic Factors

The economic health of Cobb County plays a significant role in determining future tax rates. During periods of economic growth, the county may experience an increase in property values, leading to higher tax revenues. Conversely, economic downturns can result in reduced property values and a subsequent decrease in tax revenue.

The county's ability to manage its finances effectively and maintain a balanced budget will be crucial in navigating economic fluctuations. A well-managed budget can help mitigate the impact of economic downturns, ensuring that essential services and infrastructure are maintained without excessive tax burdens on homeowners.

Legislative Changes

Changes in state or local legislation can also impact the real estate tax landscape in Cobb County. For instance, modifications to the homestead exemption criteria or the introduction of new tax relief programs can provide additional benefits to homeowners. Conversely, changes in tax laws could potentially increase tax liabilities.

Staying informed about any proposed or enacted legislative changes is essential for homeowners. Understanding these changes can help property owners plan for potential increases or take advantage of new benefits, ensuring they remain financially prepared.

Conclusion

Understanding and effectively managing real estate taxes is a critical aspect of homeownership in Cobb County. By staying informed about the tax assessment process, utilizing available exemptions and relief programs, and being proactive in appealing assessments, homeowners can optimize their tax liability and ensure a positive financial outlook.

As Cobb County continues to thrive and evolve, the real estate tax landscape will remain a dynamic and crucial element of local governance. By staying engaged and informed, property owners can actively participate in shaping the future of their community while effectively managing their financial responsibilities.

FAQ

When is the deadline to appeal a property assessment in Cobb County?

+

The deadline to appeal a property assessment in Cobb County is typically in late May or early June. It’s crucial to stay updated with the specific deadline each year, as it may vary slightly.

How often are property values reassessed in Cobb County?

+

Property values in Cobb County are reassessed every year. This annual assessment ensures that the tax liability is based on the current value of the property.

Are there any online resources to estimate real estate taxes in Cobb County before receiving the official notice?

+

Yes, Cobb County provides an online tax estimator tool. This tool allows homeowners to estimate their real estate taxes based on their property’s assessed value and the current millage rate. It’s a helpful resource for budgeting and financial planning.

Can homeowners negotiate their tax liability with the county?

+

While direct negotiation with the county is not typical, homeowners can challenge their tax liability through the formal appeal process. This process provides an opportunity to present evidence and arguments to support a reduction in the assessed value.

Are there any penalties for late payment of real estate taxes in Cobb County?

+

Yes, late payment of real estate taxes in Cobb County can result in penalties and interest. It’s essential to ensure timely payment to avoid these additional charges and maintain a positive credit history.