Virginia 529 Tax Deduction

In the world of education savings, understanding the intricacies of tax benefits can be a game-changer for families planning for their children's future. Among the various options available, the Virginia 529 Tax Deduction stands out as a compelling choice for residents of the Commonwealth of Virginia. This article delves into the specifics of this tax benefit, offering a comprehensive guide for those looking to maximize their savings.

Unraveling the Virginia 529 Tax Deduction

The Virginia 529 Tax Deduction is a powerful incentive designed to encourage Virginia residents to save for their children’s education. It allows eligible individuals to deduct contributions made to a Virginia 529 college savings plan from their state taxable income. This deduction not only provides immediate tax savings but also significantly boosts the overall growth of the college savings fund.

One of the key advantages of the Virginia 529 Tax Deduction is its accessibility. Unlike some other tax benefits that come with complex eligibility criteria, this deduction is available to a wide range of Virginia taxpayers, making it an inclusive and beneficial option for many families.

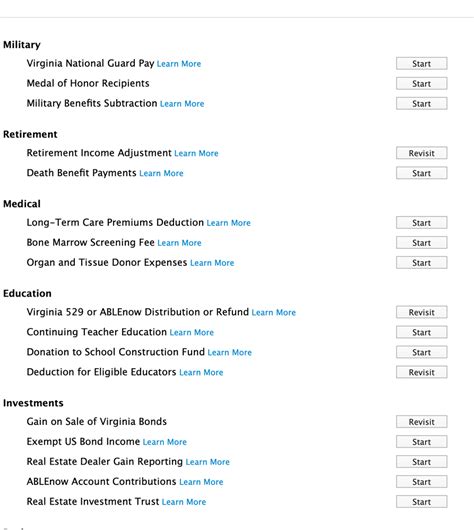

How the Virginia 529 Tax Deduction Works

The Virginia 529 Tax Deduction operates on a straightforward principle. When you contribute to a Virginia 529 plan, you can deduct those contributions from your Virginia taxable income, up to certain limits. This means that the money you put into the 529 plan not only grows tax-free but also reduces your state tax liability in the year of contribution.

For example, let's consider a Virginia resident, John, who contributes $5,000 to a Virginia 529 plan. With the tax deduction, John can reduce his taxable income by $5,000, potentially resulting in significant tax savings. The exact amount of savings depends on the individual's tax bracket and other factors.

| Contribution Limit | Deduction Amount |

|---|---|

| Single Filers | $4,000 |

| Married Filing Jointly | $8,000 |

The contribution limits are set annually and are subject to change. It's crucial for taxpayers to stay updated with the latest limits to maximize their deductions.

Eligibility and Requirements

To be eligible for the Virginia 529 Tax Deduction, individuals must be Virginia residents and have a 529 plan established with a Virginia-authorized 529 plan provider. The account owner and beneficiary of the 529 plan must also be Virginia residents. This requirement ensures that the tax benefit is utilized by those who contribute to the growth and prosperity of the Commonwealth.

Additionally, the 529 plan must be used for qualified higher education expenses, which include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. This flexibility allows families to save for a wide range of educational needs, from undergraduate programs to vocational courses.

The Impact of Virginia 529 Tax Deduction on Savings

The Virginia 529 Tax Deduction can have a significant impact on the growth of a 529 plan. By reducing the taxable income, individuals can save more of their earnings for their child’s education. Over time, this can lead to substantial savings, especially when combined with the tax-free growth of the 529 plan.

Let's illustrate this with an example. Consider a family that contributes $5,000 annually to a Virginia 529 plan for 18 years. With an average annual return of 7%, the total savings at the end of the period would be approximately $175,000. However, with the Virginia 529 Tax Deduction, they could potentially save thousands of dollars in state taxes over the same period, further boosting their overall savings.

Comparing Virginia 529 Tax Deduction with Other States

While Virginia offers a generous tax deduction for 529 plan contributions, it’s important to compare it with other states to understand its uniqueness and value. Many states offer either tax deductions or tax credits for 529 plan contributions, but the specifics vary widely.

For instance, some states offer tax credits, which directly reduce the tax liability dollar-for-dollar, while others provide tax deductions similar to Virginia. The amount of the deduction or credit, as well as the eligibility criteria, can differ significantly, making it crucial for taxpayers to compare and contrast the benefits offered by their state.

Moreover, some states may have additional incentives, such as matching contributions or state-specific scholarships, which can further enhance the value of saving for college.

Maximizing the Benefits: Strategies and Tips

To make the most of the Virginia 529 Tax Deduction, here are some strategies and tips to consider:

- Start Early: The earlier you begin saving, the more time your contributions have to grow. Compounding interest over time can significantly boost your savings.

- Maximize Annual Contributions: Ensure you're contributing up to the annual limit to take full advantage of the tax deduction. Every dollar saved is a step closer to your education funding goal.

- Consider Automatic Contributions: Setting up automatic contributions can make saving easier and ensure consistent growth of your 529 plan.

- Diversify Your Investment Options: Virginia 529 plans offer a range of investment options. Consider diversifying your portfolio to manage risk and potentially maximize returns.

- Stay Informed: Keep yourself updated with changes in tax laws and 529 plan regulations. This ensures you're making the most informed decisions about your savings.

The Future of Virginia 529 Tax Deduction

The future of the Virginia 529 Tax Deduction looks promising. With the increasing focus on education and the growing cost of higher education, the state is likely to continue supporting and promoting this tax benefit. However, as with any tax provision, it’s subject to change based on legislative decisions and economic conditions.

It's essential for taxpayers to stay informed about any updates or changes to the Virginia 529 Tax Deduction to ensure they're taking full advantage of this beneficial program. Regular reviews of 529 plan strategies and contributions can help optimize savings and maximize the impact of this tax incentive.

Can I still deduct contributions if my child attends an out-of-state college or university?

+Yes, the Virginia 529 Tax Deduction is applicable regardless of where your child attends college. As long as the contributions are made to a Virginia 529 plan and used for qualified higher education expenses, you can deduct them from your taxable income.

Are there any income limits to be eligible for the deduction?

+No, there are no income limits for the Virginia 529 Tax Deduction. It's available to all Virginia taxpayers who meet the residency and 529 plan requirements.

Can I use the deduction if I'm already claiming other education tax benefits, like the American Opportunity Tax Credit (AOTC)?

+Yes, the Virginia 529 Tax Deduction can be claimed in conjunction with other federal and state education tax benefits. However, it's important to understand the rules and restrictions to avoid double-dipping and ensure compliance with tax regulations.

What happens if I withdraw funds from my 529 plan for non-qualified expenses?

+Withdrawing funds for non-qualified expenses may result in a 10% penalty at the federal level and could impact your eligibility for the Virginia 529 Tax Deduction. It's crucial to understand the qualified expenses and use the funds accordingly to maximize the benefits.

Are there any age limits for beneficiaries of the Virginia 529 plan?

+No, there are no age limits for beneficiaries of the Virginia 529 plan. The plan can be used for qualified higher education expenses for individuals of any age, making it a versatile savings option.

The Virginia 529 Tax Deduction is a valuable tool for Virginia residents looking to save for their children’s education. By understanding the specifics of this tax benefit and employing effective savings strategies, families can maximize their college savings and ensure a secure financial future for their loved ones.