Why Do I Pay Medicare Tax

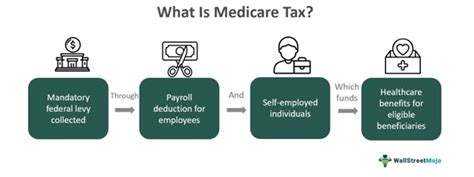

Medicare tax is an essential component of the healthcare system in the United States, ensuring that millions of individuals have access to vital medical services and insurance coverage. This tax, often a topic of curiosity and discussion, plays a crucial role in funding Medicare, a federal program that provides health insurance to eligible individuals, primarily seniors and certain individuals with disabilities. Understanding why you pay Medicare tax is key to grasping the significance of this contribution to the healthcare landscape.

The Role of Medicare Tax in Healthcare Funding

Medicare tax serves as a dedicated funding source for the Medicare program, which is divided into several parts, each covering different aspects of healthcare.

Medicare Part A: Hospital Insurance

Part A of Medicare covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. The Medicare tax funds this critical aspect of healthcare, ensuring that individuals have access to these services without facing significant financial burdens.

Medicare Part A is especially important for seniors, as it covers the costs associated with extended hospital stays and post-hospital care, providing a safety net during times of intense medical need.

Medicare Part B: Medical Insurance

Part B of Medicare covers outpatient medical services, including doctor visits, lab tests, and certain preventive services. The Medicare tax contributes to funding these essential services, which are vital for maintaining good health and managing chronic conditions.

Medicare Part B is a crucial component for many individuals, especially those with ongoing medical conditions that require regular monitoring and treatment.

Medicare Part C: Medicare Advantage Plans

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Part A and B). It combines Part A and Part B coverage and often includes additional benefits like prescription drug coverage and extra healthcare services. The Medicare tax helps support the availability and accessibility of these plans, offering a more comprehensive and tailored healthcare option.

Medicare Part D: Prescription Drug Coverage

Part D of Medicare provides coverage for prescription drugs. The Medicare tax plays a vital role in funding this aspect of healthcare, which is particularly important for individuals with chronic conditions who rely on medication to manage their health.

Medicare Part D has significantly improved access to essential medications, reducing the financial burden for many individuals and improving overall health outcomes.

Who Pays Medicare Tax and How It’s Calculated

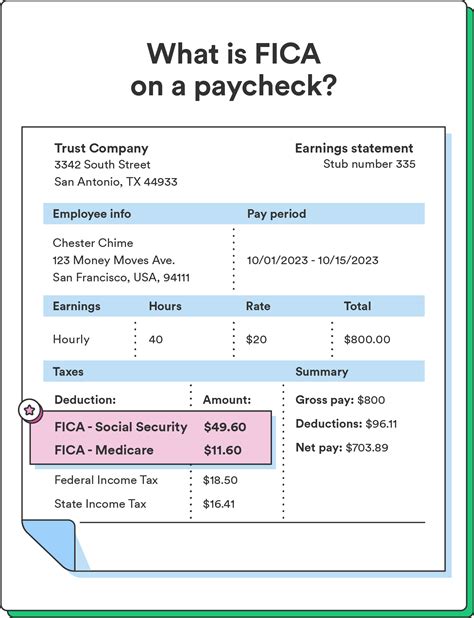

The Medicare tax is typically withheld from employee wages and salaries, with employers matching the contribution. However, it’s important to note that not everyone pays Medicare tax in the same way.

Employees and Medicare Tax Withholding

For most employees, Medicare tax is automatically deducted from their paychecks. The current Medicare tax rate for employees is 1.45% of their earnings, up to a maximum amount ($200,000 in 2023) after which no additional Medicare tax is withheld. This contribution is matched by the employer, ensuring that a total of 2.9% of the employee’s earnings go towards Medicare funding.

Self-Employed Individuals and Medicare Tax

Self-employed individuals have a different approach to Medicare tax. They are responsible for paying both the employee and employer portions of the tax, resulting in a total Medicare tax rate of 2.9% of their net earnings from self-employment. This amount is typically paid through quarterly estimated tax payments.

High-Income Earners and the Additional Medicare Tax

For individuals with high incomes, there is an additional Medicare tax to ensure that the Medicare program remains adequately funded. This additional tax is 0.9% of earnings above a certain threshold (200,000 for single filers, 250,000 for married couples filing jointly, and $125,000 for married individuals filing separately in 2023). The additional Medicare tax is also withheld from employee wages and is the responsibility of self-employed individuals.

The Impact of Medicare Tax on Your Benefits

The Medicare tax is a vital part of the funding mechanism for Medicare, a program that provides a safety net for millions of Americans. By contributing to Medicare tax, you’re ensuring that you and your fellow citizens have access to essential healthcare services when needed.

The tax also plays a critical role in shaping the future of Medicare. As the population ages and healthcare costs continue to rise, the Medicare tax helps ensure that the program remains solvent and can adapt to changing healthcare needs and advancements.

Understanding Your Medicare Benefits

It’s important to familiarize yourself with your Medicare benefits to ensure you’re making the most of the program. Medicare Part A and Part B provide a comprehensive base of coverage, but additional coverage options like Part C and Part D can further enhance your healthcare experience.

Part C, for example, offers the flexibility to choose a Medicare Advantage plan that suits your specific needs, often including additional benefits like dental, vision, and hearing coverage. Part D, on the other hand, provides crucial coverage for prescription medications, which can be a significant cost saver for many individuals.

The Future of Medicare and Its Funding

The future of Medicare is a topic of ongoing discussion and policy development. As the baby boomer generation continues to age and life expectancies increase, the demand for Medicare services is expected to rise. This, coupled with the increasing costs of healthcare, presents significant challenges for the sustainability of the Medicare program.

Policy Initiatives and Reforms

To address these challenges, policymakers are exploring various initiatives and reforms. These include efforts to control healthcare costs, improve efficiency in the healthcare system, and explore innovative ways to deliver and pay for healthcare services.

One key area of focus is the use of technology and data to improve the quality and efficiency of healthcare. This includes the adoption of electronic health records, telemedicine, and precision medicine, which can lead to more targeted and effective treatments, reducing overall healthcare costs.

The Role of Innovation and Technology

Innovation in healthcare delivery and technology is expected to play a crucial role in the future of Medicare. Advancements in telemedicine, for instance, can improve access to healthcare services, particularly in rural and underserved areas. Precision medicine, which tailors treatments to an individual’s unique genetic makeup, has the potential to improve health outcomes and reduce the need for costly interventions.

Additionally, the integration of artificial intelligence and machine learning in healthcare can enhance diagnostic accuracy, improve treatment planning, and optimize resource allocation, all of which can contribute to a more sustainable healthcare system.

Addressing Cost Concerns

Cost containment is a significant aspect of ensuring the long-term viability of Medicare. This involves a multifaceted approach, including negotiating drug prices, streamlining administrative processes, and incentivizing value-based care models that focus on outcomes rather than volume of services.

Furthermore, promoting preventive care and healthy lifestyles can reduce the incidence and severity of chronic diseases, leading to lower healthcare costs over time. Encouraging individuals to take an active role in their health through lifestyle modifications, regular check-ups, and early disease detection can significantly impact the overall cost and quality of healthcare.

Conclusion: Your Contribution to a Sustainable Healthcare System

In conclusion, the Medicare tax is not just a financial obligation; it’s a crucial investment in the healthcare system and the well-being of millions of Americans. By contributing to Medicare tax, you’re playing a vital role in ensuring that the program remains strong and adaptable, capable of meeting the evolving healthcare needs of the population.

As we look to the future, the continued support and thoughtful evolution of Medicare remain essential. With the right policies, innovations, and public awareness, we can work towards a healthcare system that is sustainable, accessible, and responsive to the diverse needs of our society.

How is Medicare tax different from other taxes I pay?

+Medicare tax is dedicated specifically to funding the Medicare program, which provides health insurance coverage for eligible individuals. Unlike other taxes, it is used solely for healthcare-related purposes.

Do I need to pay Medicare tax if I’m not eligible for Medicare benefits?

+Yes, if you’re an employee or self-employed, you’re required to pay Medicare tax regardless of your eligibility for Medicare benefits. The tax funds the Medicare program, which serves a broad population of individuals, not just those currently eligible for benefits.

What happens if I don’t pay the Medicare tax?

+Failure to pay Medicare tax can result in significant penalties and interest. It’s important to ensure that you pay the correct amount of Medicare tax, either through payroll withholding or estimated tax payments, to avoid these consequences.