Cpa Tax Accountant

Welcome to an in-depth exploration of the crucial role played by Certified Public Accountants (CPAs) specializing in tax accounting. In the intricate world of finance and taxation, these professionals are indispensable guides, offering expertise and strategic advice to individuals and businesses alike. This article aims to shed light on the complex yet essential work of CPAs, highlighting their unique contributions and the evolving landscape of tax accounting.

The Cornerstone of Tax Compliance and Strategy

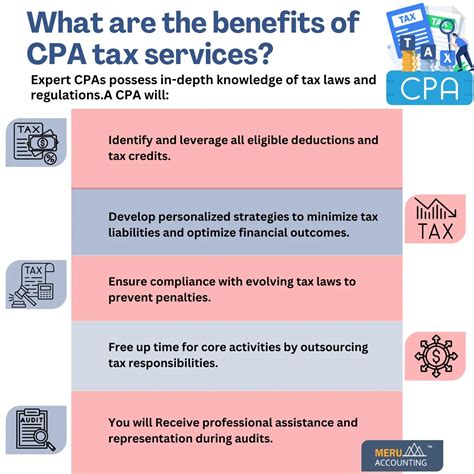

Certified Public Accountants, or CPAs, are highly skilled professionals licensed by the state to provide a range of accounting services. Among their many specializations, tax accounting stands out as one of the most critical and impactful. CPAs who focus on tax matters are not merely number crunchers; they are strategic advisors, offering comprehensive guidance to navigate the complex and ever-changing tax landscape.

The role of a tax accountant extends far beyond the traditional image of someone poring over piles of paperwork during tax season. These professionals are year-round partners, providing essential services to ensure compliance, optimize financial strategies, and minimize tax liabilities. Their expertise is sought by individuals, small businesses, corporations, and even government entities, making them a vital cog in the economic machinery.

The Evolving Nature of Tax Accounting

The field of tax accounting is in a constant state of evolution, driven by legislative changes, economic shifts, and technological advancements. CPAs specializing in this area must stay abreast of these changes to offer their clients the most up-to-date and beneficial advice. From the intricacies of tax code amendments to the strategic utilization of tax credits and incentives, these professionals are at the forefront of guiding their clients through this complex terrain.

For instance, the introduction of the Tax Cuts and Jobs Act in the United States brought about significant changes to tax laws, impacting individuals and businesses alike. CPAs played a pivotal role in helping clients understand and leverage these changes to their advantage, ensuring they remained compliant while optimizing their tax strategies.

| Key Tax Areas | Specialist Focus |

|---|---|

| Income Tax | Filing, planning, and strategies for individuals and businesses |

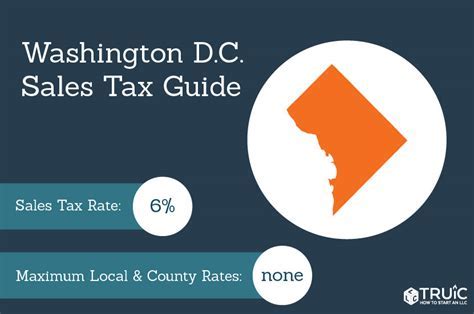

| Sales and Use Tax | Compliance and reporting for businesses |

| Property Tax | Assessment, appeals, and planning for real estate holdings |

| Estate and Gift Tax | Estate planning, trust management, and gift tax compliance |

Key Responsibilities and Services

The services provided by CPAs specializing in tax accounting are multifaceted and cover a broad spectrum of financial activities. Here’s an in-depth look at some of their key responsibilities and how they contribute to the financial well-being of their clients.

Tax Planning and Strategy

Tax planning is a year-round endeavor, and CPAs are integral to this process. They help clients develop long-term financial strategies to minimize tax liabilities, maximize deductions, and optimize their overall financial health. This involves staying updated on the latest tax laws and regulations and understanding how these changes impact their clients’ unique financial situations.

For instance, a CPA might advise a client on the most tax-efficient way to structure a business, or how to best utilize tax-advantaged retirement accounts. They may also suggest tax-saving strategies such as deferring income, accelerating deductions, or taking advantage of tax credits and incentives.

Compliance and Filing

Compliance is a critical aspect of tax accounting. CPAs ensure their clients meet all legal requirements for tax filing, from federal and state income taxes to payroll taxes, sales taxes, and more. This involves meticulous record-keeping, accurate data entry, and timely filing to avoid penalties and interest charges.

In addition to routine compliance, CPAs also assist with more complex compliance issues, such as dealing with tax audits or resolving tax disputes. They are well-versed in the nuances of tax law and can advocate on behalf of their clients to ensure fair and accurate tax assessments.

Financial Analysis and Reporting

CPAs play a crucial role in financial analysis and reporting. They review financial statements, prepare tax returns, and provide insights into a client’s financial health and performance. This analysis can help identify areas for improvement, such as cost-cutting measures or opportunities to increase revenue.

For businesses, CPAs often assist with financial forecasting and budgeting, helping management make informed decisions about future financial strategies. They may also prepare financial reports for stakeholders, investors, or lenders, ensuring transparency and accuracy in financial reporting.

Business Advisory Services

Beyond tax compliance and planning, CPAs offer a range of business advisory services. This can include guidance on business structure, entity formation, and business operations. They may also provide strategic advice on mergers and acquisitions, business expansions, or other significant financial decisions.

For example, a CPA might advise a small business owner on the pros and cons of incorporating their business, or help them navigate the complex world of international tax law if they're considering expanding their operations overseas.

Personalized Tax Solutions

Every client has unique financial circumstances, and CPAs tailor their services to meet these individual needs. Whether it’s helping a high-net-worth individual manage their complex tax portfolio, guiding a family through estate planning, or advising a startup on tax-efficient growth strategies, CPAs provide personalized solutions to optimize their clients’ financial positions.

In addition, CPAs can offer specialized services such as tax-efficient retirement planning, education savings strategies, or advice on tax-effective investments. They may also assist with charitable giving strategies, helping clients achieve their philanthropic goals while also optimizing their tax positions.

The Impact of Technology

The rise of technology has had a profound impact on the field of tax accounting. CPAs now have access to powerful software and tools that streamline many routine tax accounting tasks, allowing them to focus more on strategic advice and complex problem-solving.

For example, tax preparation software can automate many of the basic calculations and data entry tasks, reducing the risk of errors and freeing up CPAs' time. Cloud-based accounting software also allows for real-time collaboration and data sharing, making it easier for CPAs to work with clients and access the information they need.

Additionally, data analytics tools are transforming the way CPAs approach tax planning. By analyzing large sets of data, CPAs can identify trends, patterns, and opportunities that might not be apparent through traditional methods. This allows them to provide even more strategic and tailored advice to their clients.

Future Trends in Tax Accounting

Looking ahead, the field of tax accounting is likely to continue evolving, driven by technological advancements, economic changes, and evolving tax laws. CPAs will need to stay abreast of these changes to continue providing the highest level of service to their clients.

One key trend is the continued integration of technology into the tax accounting process. This includes the use of artificial intelligence and machine learning to automate routine tasks, as well as the development of more sophisticated data analytics tools. These advancements will further enhance CPAs' ability to provide strategic advice and personalized solutions to their clients.

Another trend is the increasing focus on tax transparency and compliance. With the rise of international tax regulations and the continued efforts to combat tax evasion and fraud, CPAs will play a crucial role in helping their clients navigate these complex issues and ensure they remain in compliance with all applicable laws.

In conclusion, Certified Public Accountants specializing in tax accounting are essential partners for individuals and businesses navigating the complex world of taxation. Their expertise, strategic insights, and commitment to compliance make them invaluable advisors, helping their clients optimize their financial positions and achieve their goals. As the field of tax accounting continues to evolve, CPAs will remain at the forefront, guiding their clients through the complexities of tax law and offering tailored solutions to meet their unique needs.

What is the difference between a CPA and a regular accountant when it comes to tax accounting?

+While both CPAs and regular accountants can provide tax accounting services, CPAs have additional qualifications and responsibilities. CPAs are licensed by the state and must meet rigorous educational and experience requirements, including passing the Uniform CPA Examination. They are also held to a high ethical standard and must adhere to strict professional standards. CPAs have a broader scope of practice and can offer a wider range of services, including tax planning, compliance, and business advisory services, making them a trusted partner for individuals and businesses with complex tax needs.

How often should I consult with a tax accountant?

+The frequency of consultations with a tax accountant depends on your individual needs and circumstances. For most individuals and businesses, it is recommended to consult with a tax accountant at least once a year, typically around tax season, to ensure compliance and optimize your tax strategies. However, if you have complex financial affairs, significant life changes, or are facing a tax audit, you may benefit from more frequent consultations throughout the year. Regular check-ins can help you stay on top of tax changes, take advantage of tax-saving opportunities, and address any compliance issues promptly.

What should I look for when choosing a tax accountant?

+When choosing a tax accountant, it’s important to consider their qualifications, experience, and areas of specialization. Look for a CPA who is licensed and has a solid understanding of the tax laws and regulations relevant to your situation. Consider their track record of success and client testimonials. It’s also beneficial to choose an accountant who specializes in your specific needs, whether that’s individual tax planning, small business accounting, or complex estate planning. Finally, ensure they are accessible, responsive, and committed to providing personalized service tailored to your unique circumstances.