Atlanta Sales Tax

In the bustling city of Atlanta, Georgia, understanding the intricacies of sales tax is crucial for both residents and businesses alike. Sales tax is a significant revenue source for the state, and its proper implementation and compliance are essential for the city's economic growth. This comprehensive guide will delve into the world of Atlanta's sales tax, exploring its rates, applicability, exemptions, and the impact it has on the local economy.

Unraveling Atlanta’s Sales Tax Landscape

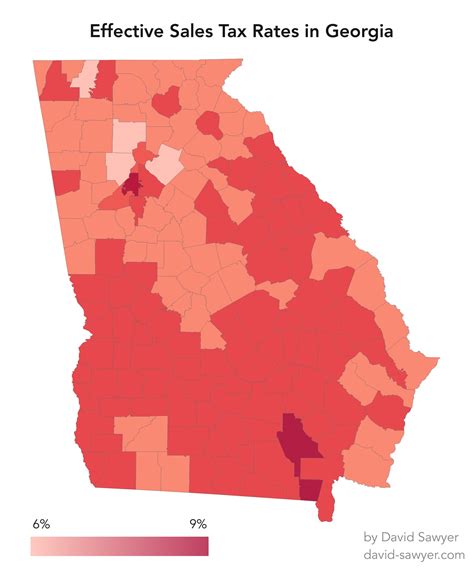

Atlanta, known for its vibrant culture and thriving businesses, operates within a complex sales tax system. The sales tax rate in Atlanta is not a uniform percentage but rather a combination of state, county, and city taxes, creating a layered structure that can be intricate to navigate.

As of 2023, the state sales tax rate in Georgia stands at 4%, which serves as the foundation for all sales tax calculations. However, this is just the beginning. Atlanta, being the bustling hub it is, has its own city sales tax rate added on top, bringing the total to 8.9%. This city-specific tax rate is a significant contributor to Atlanta's unique sales tax landscape.

But wait, there's more! Fulton County, where Atlanta is located, also imposes its own county sales tax, adding a further 1% to the total. This means that when you make a purchase in Atlanta, you are not only contributing to the state's revenue but also to the city and county's coffers.

To illustrate, let's consider a hypothetical purchase of a laptop priced at $1000. With the combined sales tax rates of 4% state tax, 4.9% city tax, and 1% county tax, the total sales tax on this purchase would amount to $64. This breakdown highlights the layered nature of Atlanta's sales tax system.

| Tax Component | Rate | Amount on $1000 Purchase |

|---|---|---|

| State Sales Tax | 4% | $40 |

| City Sales Tax | 4.9% | $49 |

| County Sales Tax | 1% | $10 |

| Total Sales Tax | N/A | $64 |

It's important to note that these rates are subject to change, and it is the responsibility of businesses and consumers to stay updated on any modifications. The city of Atlanta, through its official website and tax authorities, provides regular updates on sales tax rates and regulations to ensure compliance.

Navigating Exemptions and Special Cases

While the layered sales tax structure in Atlanta may seem straightforward, it is important to understand the exemptions and special cases that can impact certain transactions. These exemptions are designed to encourage specific economic activities or support particular industries.

For instance, groceries are a notable category exempt from sales tax in Atlanta. This means that when you purchase essential food items, you are not subject to the additional sales tax burden. This exemption is a welcome relief for households and contributes to making essential goods more affordable.

Additionally, certain types of manufacturing equipment and machinery are exempt from sales tax. This exemption is aimed at promoting industrial growth and investment in Atlanta's manufacturing sector. By incentivizing businesses to invest in advanced machinery, the city aims to boost its economic competitiveness.

Furthermore, prescription medications and medical devices are exempt from sales tax, ensuring that healthcare-related purchases are not burdened with additional costs. This exemption aligns with the city's commitment to making healthcare more accessible and affordable for its residents.

However, it is crucial to note that these exemptions are not absolute and may have specific conditions or limitations. For instance, while groceries are generally exempt, certain luxury food items or prepared meals might still be subject to sales tax. It is advisable to consult the official sales tax guidelines or seek professional advice to understand the nuances of these exemptions.

Compliance and Reporting

Ensuring compliance with Atlanta’s sales tax regulations is a critical aspect for businesses operating in the city. Non-compliance can lead to penalties, fines, and even legal repercussions. Therefore, it is essential for businesses to maintain accurate records, calculate sales tax correctly, and remit payments promptly.

The Georgia Department of Revenue provides comprehensive guidelines and resources to assist businesses in understanding their sales tax obligations. They offer tools for calculating sales tax, guidance on record-keeping, and support for electronic filing of tax returns. By staying informed and utilizing these resources, businesses can navigate the complex sales tax landscape with confidence.

Impact on the Local Economy

Atlanta’s sales tax system plays a pivotal role in shaping the city’s economic landscape. The revenue generated from sales tax contributes to essential public services, infrastructure development, and social welfare programs. It is a key component in the city’s fiscal planning and budget allocation.

The layered structure of Atlanta's sales tax rates ensures that a significant portion of the revenue generated remains within the city. This localized revenue stream allows the city to invest in its own development, creating a positive feedback loop that stimulates economic growth. The funds collected through sales tax support initiatives such as public transportation improvements, educational programs, and community development projects.

Moreover, the sales tax system encourages a fair distribution of tax burden among businesses and consumers. By imposing sales tax on a wide range of goods and services, the city ensures that those who benefit from Atlanta's vibrant economy also contribute to its maintenance and growth. This inclusive approach fosters a sense of shared responsibility and strengthens the city's overall economic resilience.

Conclusion: A Complex Yet Vital System

Atlanta’s sales tax landscape is a complex interplay of state, county, and city taxes, creating a unique and dynamic system. While it may present challenges in terms of understanding and compliance, the revenue generated plays a crucial role in the city’s economic development and the well-being of its residents.

By staying informed, businesses and consumers can navigate this intricate tax system with confidence. The resources provided by the Georgia Department of Revenue and the city's official websites are invaluable tools for ensuring compliance and understanding the nuances of Atlanta's sales tax regulations.

As Atlanta continues to thrive as a bustling hub of commerce and culture, its sales tax system remains a vital component of its economic foundation. With a layered approach that ensures a fair distribution of tax burden, the city can continue to invest in its future, creating a vibrant and prosperous environment for all.

How often are sales tax rates updated in Atlanta?

+Sales tax rates in Atlanta can be updated periodically, typically in response to legislative changes or budgetary needs. It is advisable to check the official websites of the Georgia Department of Revenue and the City of Atlanta for the most current information on sales tax rates.

Are there any online resources to calculate sales tax in Atlanta accurately?

+Yes, the Georgia Department of Revenue provides online calculators and tools to assist businesses and consumers in accurately calculating sales tax. These resources consider the layered structure of Atlanta’s sales tax rates and provide up-to-date information.

What happens if a business fails to comply with sales tax regulations in Atlanta?

+Non-compliance with sales tax regulations can result in penalties, fines, and potential legal consequences for businesses. It is crucial for businesses to stay informed, maintain accurate records, and remit sales tax payments promptly to avoid any issues.