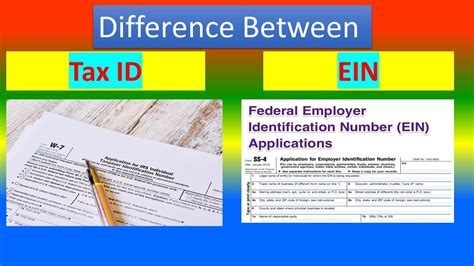

Is Tax Id Number Same As Ein

The Employer Identification Number (EIN) and the Taxpayer Identification Number (TIN) are both crucial elements in the US tax system, but they serve distinct purposes and are not the same. While they are often used interchangeably in casual conversation, understanding the differences is essential for businesses and individuals navigating the complex world of taxation.

Understanding the EIN

The EIN, also known as the Federal Employer Identification Number, is a unique nine-digit identifier assigned to businesses by the Internal Revenue Service (IRS). It functions as a business’s social security number, serving various purposes in the corporate world.

Businesses need an EIN to identify themselves to the IRS and other government agencies. It's required for various activities, including:

- Filing business tax returns

- Opening a business bank account

- Applying for loans or credit

- Hiring employees and paying payroll taxes

- Establishing a retirement plan for employees

- Obtaining licenses and permits

The EIN is structured with a prefix, indicating the assignment office, followed by two hybrid digits and four additional digits. The prefix can vary based on the type of entity, such as sole proprietorships, partnerships, corporations, or non-profit organizations.

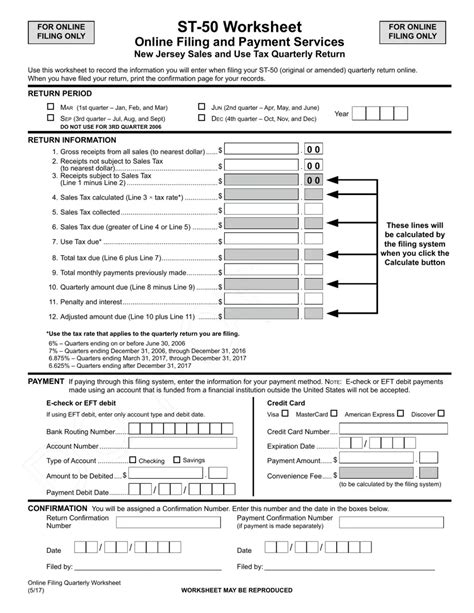

Businesses can obtain an EIN by completing Form SS-4, "Application for Employer Identification Number," either by mail or online through the IRS website. The process is straightforward and typically takes around 10-15 minutes to complete.

Types of Businesses that Require an EIN

The following types of businesses are required to obtain an EIN:

- Corporations, including S corporations

- Partnerships

- Limited liability companies (LLCs) treated as corporations

- Certain trusts and estates

- Employee benefit plans

- Real estate mortgage investment conduits (REMICs)

- Common law employees

However, sole proprietors and independent contractors may not need an EIN if they operate as a single-member LLC and have no employees. Instead, they can use their Social Security Number (SSN) for tax purposes.

EIN for Non-Profit Organizations

Non-profit organizations, including charitable organizations and churches, also require an EIN. It serves as a unique identifier for tax-exempt entities, helping the IRS and donors track contributions and ensure compliance with tax laws.

The application process for non-profits is similar to that of for-profit businesses, but they may need to provide additional information, such as the organization's mission statement and details about its activities.

Unraveling the TIN

The TIN, on the other hand, is a broader term encompassing several types of identification numbers used by the IRS to track taxpayers. It is a generic term used to refer to any number assigned by the IRS to identify individuals, businesses, or other entities for tax purposes.

While the EIN is a specific type of TIN, there are other forms of TINs, including:

- Social Security Number (SSN): A nine-digit number assigned to individuals, used for personal tax identification and reporting wages.

- Individual Taxpayer Identification Number (ITIN): A nine-digit number issued by the IRS to individuals who are not eligible for an SSN but need to file US tax returns, such as foreign nationals and their spouses.

- Adoption Taxpayer Identification Number (ATIN): A temporary number assigned to an adopted child when the child's SSN is not yet available, used for tax reporting purposes during the adoption process.

The TIN is used by the IRS to track tax payments, refunds, and other financial transactions related to individuals and businesses. It is a critical component in the tax system, ensuring accurate reporting and compliance.

When to Use a TIN

TINs are used in various situations, including:

- Reporting wages and other income on tax returns

- Filing tax forms, such as W-2, 1099, and 1040

- Identifying taxpayers on IRS notices and correspondence

- Tracking tax payments and refunds

- Establishing credit and financial accounts

The choice of TIN depends on the individual's or business's specific circumstances and tax obligations. For example, a sole proprietor might use their SSN for tax purposes, while a corporation would use its EIN.

Key Differences between EIN and TIN

While both the EIN and TIN are essential for tax purposes, they serve different functions and have distinct characteristics:

| Characteristic | EIN | TIN |

|---|---|---|

| Definition | A unique identifier for businesses | A general term for various taxpayer identification numbers |

| Use | Identifies businesses for tax and legal purposes | Tracks individuals and entities for tax purposes |

| Structure | Nine-digit number with a specific prefix | Varies depending on the type of taxpayer (e.g., SSN, ITIN) |

| Application | Obtained through Form SS-4 | Depends on the specific TIN type (e.g., SSN application, ITIN application) |

| Entities Requiring It | Businesses, including corporations, partnerships, and LLCs | Individuals, businesses, and other entities for tax reporting |

When to Use EIN vs. TIN

The choice between using an EIN or TIN depends on the context and the entity’s tax obligations. Here are some guidelines:

- Businesses: Corporations, partnerships, LLCs, and other business entities should use their EIN for tax and legal purposes.

- Sole Proprietors: If operating as a single-member LLC with no employees, the owner can use their SSN for tax purposes. Otherwise, an EIN may be required.

- Individuals: For personal tax identification and reporting wages, individuals typically use their SSN. Foreign nationals and others ineligible for an SSN may use an ITIN.

FAQs

Can I use my EIN as my TIN for tax purposes?

+Yes, your EIN is a specific type of TIN, so it can be used for tax purposes when applicable. However, individuals and sole proprietors may need to use their SSN or ITIN for personal tax identification.

Do I need an EIN if I operate as a sole proprietor?

+If you operate as a sole proprietor with no employees, you may not need an EIN. Instead, you can use your SSN for tax purposes. However, if you have employees or plan to hire them, you’ll need to obtain an EIN.

How do I apply for an ITIN if I’m not eligible for an SSN?

+To apply for an ITIN, you’ll need to complete Form W-7, “Application for IRS Individual Taxpayer Identification Number.” You’ll also need to provide supporting documentation, such as a passport or other government-issued ID.

Can I use my TIN to open a business bank account?

+Yes, you’ll need to provide your TIN (either your SSN or EIN) when opening a business bank account. The bank will use this information to report your financial transactions to the IRS.

What happens if I use the wrong TIN on my tax forms?

+Using the wrong TIN can result in tax filing errors and delays in processing your return. It’s crucial to use the correct TIN for accurate reporting. If you’re unsure, consult a tax professional or the IRS guidelines.