Navigating the Journey of an NJ Sales Tax Return: What You Need to Know

For anyone engaged in sales within New Jersey, understanding the intricacies of the NJ sales tax return process isn’t just a bureaucratic hurdle—it's an essential component of responsible business operation. With a dense web of regulations, reporting deadlines, and compliance expectations, navigating this landscape demands clarity, precision, and strategic foresight. This comprehensive guide aims to demystify the process, equipping you with expert knowledge to handle NJ sales tax returns confidently and efficiently, foster compliance, and optimize your financial health.

Understanding the Fundamentals of NJ Sales Tax and Its Jurisdictional Context

New Jersey imposes a State sales tax primarily aimed at broadening the tax base from retail transactions. As of 2023, the standard state sales tax rate stands at 6.625%, but local municipalities can impose additional levies, making the total applicable rate vary from city to city. This layered tax environment necessitates meticulous attention to regional rates, point-of-sale computations, and taxable versus non-taxable items—a foundational understanding for accurate reporting.

At its core, NJ sales tax applies to tangible personal property, certain services, and digital products, with specific exemptions carved out for necessities like groceries, prescription drugs, and manufacturing equipment. Knowing what constitutes a taxable sale is the starting point for diligently compiling your returns:

- Sales of tangible goods (clothing, electronics, furniture)

- Some digital products and access services

- Specified repair and maintenance services

Conversely, exempt items and sales—such as wholesale transactions or sales to exempt organizations—must be carefully documented to avoid misreporting and potential penalties.

Deciphering the NJ Sales Tax Return Filing Requirements

New Jersey mandates periodic filing of sales tax returns, with frequency primarily dictated by the volume of taxable sales. The key categories include:

| Filing Frequency | Threshold / Criteria |

|---|---|

| Monthly | Typically for businesses with over 100,000 in annual taxable sales or more than 200 transactions per month</td></tr> <tr><td>Quarterly</td><td>For those below the above thresholds but exceeding 4,000 in monthly sales on average |

| Semi-Annual or Annual | For small-volume retailers (less than $4,000 monthly sales), with filings typically due in July and January |

The critical deadlines are usually the 20th day of the month following the reporting period, but leaves room for extensions in certain circumstances. Accurate categorization and timely filing are paramount to avoid late penalties, interest accruals, and audit risks.

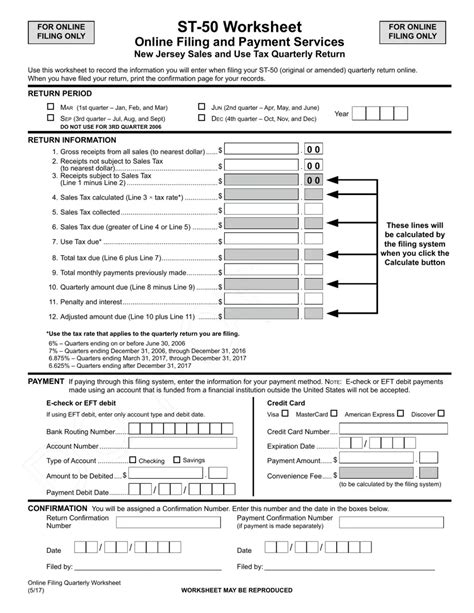

Key Components of the NJ Sales Tax Return

The NJ-990 forms serve as the primary submissions, requiring detailed disclosures across:

- Total gross sales

- Total nontaxable sales

- Taxable sales, segregated by jurisdiction when applicable

- Collected sales tax amount

- Input tax credits, if any—such as tax paid on inventory purchases

Integrating precise ledger data, point-of-sale records, and exemption certificates into your reporting process ensures compliance and audit readiness.

Practical Steps to Prepare and Submit Your NJ Sales Tax Return

Preparing your NJ sales tax return involves a well-orchestrated series of tasks, beginning well before the filing deadline. Each step merits careful execution, as neglect can trigger penalties and jeopardize your business’s standing:

Data Collection and Recordkeeping

Begin with consolidating detailed sales records. Cross-reference sales invoices, receipts, and transaction logs with your exemption certificates, refund records, and purchase invoices to delineate taxable and non-taxable activities accurately. Use accounting software integrated with sales tax modules; this aids in automating calculations, tracking patterns, and flagging anomalies—especially beneficial for businesses with high transaction volume.

Calculating Accurate Tax Liabilities

Tax calculation demands attention to jurisdictional variations and the application of prevailing rates. The process should include:

- Applying correct tax rates based on sales destinations or locations

- Validating exemption certificates’ validity and applicability

- Accounting for tax paid on business inputs (input tax credits)

Key Points

- Meticulous recordkeeping simplifies audit processes and reduces error risk

- Use automation tools for real-time tax rate application and calculation accuracy

- Regular reconciliation helps identify discrepancies early

- Maintain proper exemption documentation for non-taxable sales

- Early preparation ensures timely submission and avoids penalties

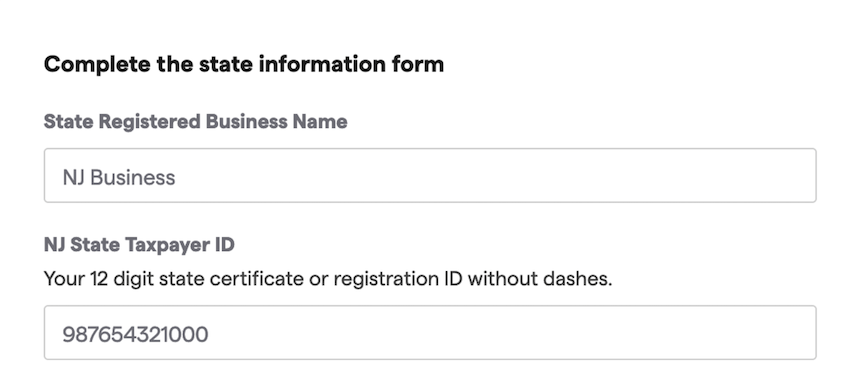

Filing and Payment Procedures

Once your calculations are complete, access the NJ Online Business Portal—NJ Division of Taxation’s digital hub—for electronic filing. The platform simplifies submission, facilitates payment via ACH transfer or credit card, and provides confirmation receipts. For paper filings (less common), forms must be mailed to the designated processing center, but digital channels are recommended for efficiency and recordkeeping.

Strategies for Audits and Disputes

Even with diligent compliance, audits can arise. Proactive audit preparedness involves keeping comprehensive documentation, such as:

- Sale and purchase receipts

- Exemption certificates

- Regular reconciliation reports

- Correspondence with tax authorities

In the event of a dispute, engaging with a tax professional adept in NJ sales tax nuances ensures a strategic and legally backed approach, often reducing penalties or liabilities.

Emerging Trends and Policy Changes Impacting NJ Sales Tax Compliance

The landscape of sales tax is dynamically shifting, influenced by technological, legislative, and economic factors. Notably, recent movements include:

- E-commerce Electronic Marketplace Regulations: New Jersey has expanded its nexus rules and tax collection obligations for online marketplaces, nipping at the heels of broader federal efforts to regulate digital commerce.

- Digital Taxation Evolution: States are progressively taxing digital products and services, with NJ following suit, demanding updates to taxable item classifications.

- Legislative Adjustments: Revisions to local surtax thresholds and exemption criteria periodically redefine compliance parameters, necessitating ongoing monitoring.

Conclusion: Mastering the NJ Sales Tax Return Journey

Achieving mastery over the NJ sales tax return process goes beyond rote compliance. It entails cultivating meticulous recordkeeping, leveraging technological tools, understanding nuanced legislative shifts, and proactively engaging with the tax authorities. As an essential aspect of operational integrity and financial clarity, navigating this path confidently positions your business for sustainable growth and compliance excellence. Remember, each meticulously filed return isn’t just a regulatory obligation; it’s a strategic investment in your enterprise’s credibility and resilience.

How often do I need to file sales tax returns in New Jersey?

+The filing frequency depends on your total taxable sales volume. Commonly, businesses exceeding $100,000 annually or conducting more than 200 transactions monthly must file monthly returns. Smaller volumes may qualify for quarterly or semi-annual filings, with specific deadlines typically falling on the 20th of the month following the reporting period.

What records should I retain to support my NJ sales tax filings?

+Maintain detailed sales and purchase invoices, exemption certificates, sales summaries, and reconciliation reports. Also, keep records of any adjustments, refunds, or disputes. These records ensure compliance, ease audits, and substantiate your reported figures.

Are digital products subject to NJ sales tax?

+Yes, as of recent legislative updates, certain digital products and online access services are taxable in NJ, especially when delivered electronically for consumer use. Staying updated on evolving classifications is crucial for compliance.

What penalties exist for late or incorrect filing?

+Late filings can incur penalties of 1.5% of the unpaid tax amount per month, with a maximum penalty cap. Additional interest accrues on unpaid balances. Incorrect filings, especially with negligence or willful misrepresentation, may result in audits, fines, and suspension of business privileges.