Explore How to Manage Your Dupage County Taxes Effectively

Managing property taxes in Dupage County presents a multifaceted challenge, compounded by complex assessment procedures, fluctuating property values, and shifting tax codes. Despite common perceptions, many residents believe that once taxes are set, there is little room for intervention. In reality, a thorough understanding of local assessments, available exemptions, appeals processes, and strategic financial planning can significantly influence your tax obligations. Navigating these pathways effectively can lead to substantial savings, fostering a more equitable burden distribution across the county’s diverse property landscape.

Debunking Myths About Dupage County Property Taxes

Before diving into strategic management techniques, it’s crucial to debunk widespread misconceptions that cloud residents’ understanding of local taxation. Many assume that property taxes are immutable after assessment, or that appealing them is a complex, futile task reserved for legal experts. Others believe that market fluctuations minimally impact assessed values, disregarding how valuation strategies, property classification, and county policies influence tax determinations. Addressing these myths requires an evidence-based analysis rooted in the county’s tax code, assessment methodology, and legal avenues for taxpayer relief.

Myth 1: Property Taxes in Dupage County Are Fixed and Unchangeable

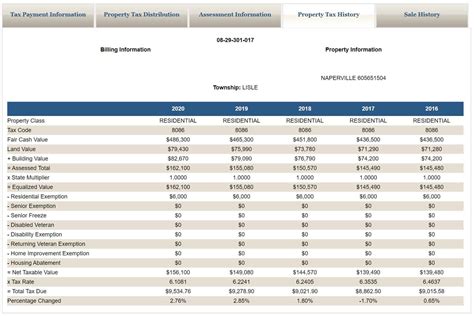

The belief that property taxes are set in stone is a persistent misconception. In Dupage County, property tax assessments are reviewed annually through a formal process that allows property owners to challenge their valuations. The assessment is based on the market value as determined by county assessors, but these values are subject to adjustments following appeals or legislative changes. For instance, if market conditions shift or new data demonstrate an overvaluation, property owners can file for reassessment, potentially lowering their tax burden.

Moreover, property taxes are not solely determined by assessed value. They are influenced by tax rate allocations across various jurisdictions—county, municipal, school district, and special districts. These percentages can change annually, reflecting policy adjustments aimed at funding public services. Thus, residents retain significant influence over their final tax obligations through participation in local governance and rebate programs.

Myth 2: Appealing Your Property Tax Assessment Is Ineffective or Overly Complicated

Challenging your assessment isn’t just possible; it’s often straightforward when approached with proper knowledge and documentation. The Dupage County Assessor’s Office provides a clear process for appeals, including deadlines—commonly around 30 days from notice—and the required forms. Submitting evidence such as recent sales data, independent appraisals, or comparables from similar properties is critical in substantiating a request for reassessment.

Expertise in compiling and presenting these documents greatly improves success rates. Notably, data from the Dupage County Clerk’s Office reveals that a significant percentage of appeals result in reduced assessments—often saving property owners hundreds to thousands of dollars annually. This process exemplifies how proactive engagement can yield tangible financial benefits.

Key Strategies to Manage Dupage County Property Taxes Effectively

Successfully managing property taxes calls for a multifaceted approach, integrating legal, financial, and strategic participation. These tactics empower property owners to optimize their tax liability while complying with legal requirements.

Understanding and Utilizing Exemptions and Credits

One of the most accessible yet underutilized avenues for reducing taxes involves exemptions and credits. Dupage County offers several options, such as the Senior Citizens Exemption, Disabled Persons Exemption, and Homestead Improvement Exemption. Eligibility criteria vary, but qualifying for these reductions can significantly decrease annual tax bills.

For example, applying for the senior exemption can yield savings of approximately 10-20% of the assessed value, depending on jurisdictional rules. In addition, the county provides property tax rebates for veterans or residents who meet specific income thresholds, which require timely applications and proper documentation.

| Relevant Category | Substantive Data |

|---|---|

| Senior Citizens Exemption | Reduces taxable value by up to 10% for residents aged 65 or older, saving an average of $200-$400 annually depending on property value. |

| Veterans Rebate Program | Offers rebates of up to $250 to qualifying veterans, with applications due by September 30 every year. |

| Homestead Improvement Exemption | Provides a 5% reduction in assessed value for major improvements, such as additions or renovations, effective in the tax year following the upgrade. |

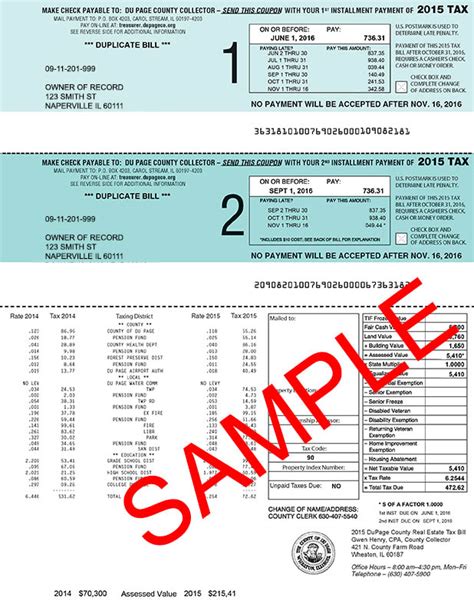

Mastering the Tax Appeal Process

Filing an appeal is a vital tool for residents seeking to challenge perceived over-assessment. The process begins with reviewing your property’s valuation notice meticulously, corroborating figures with recent comparable sales, and gathering independent appraisals if necessary. Once prepared, the appeal can be filed online or via mail with the Dupage County Assessment Office within the stipulated timeframe.

Beyond simple valuation disputes, appeals can contest classification errors, such as misclassified rental properties or commercial holdings, which often carry higher tax rates. Appealing classification errors can be particularly rewarding, potentially resulting in tens of thousands of dollars in annual tax savings for large-volume property owners.

Experts recommend establishing a comprehensive appeal log, documenting all interactions, and engaging formally through written correspondence. An adversarial approach isn’t always necessary; often, a well-argued, data-driven appeal can lead to amicable adjustments, especially if the county recognizes systemic valuation inaccuracies or reflects market downturn adjustments.

Analyzing the Impact of Local Tax Policies and Market Conditions

Taxes in Dupage County are dynamic, heavily influenced by broader economic and policy-related factors. Local government budgets, school district funding requirements, and state legislation continuously reshape the tax landscape. Residents must understand these macro factors to anticipate their future obligations confidently.

Effect of Property Market Fluctuations on Taxation

While assessments are updated annually, market conditions can cause dramatic shifts in property value. During periods of rapid appreciation, such as post-pandemic housing booms, assessments may lag behind actual market value, leading to higher tax bills unless appeals or adjustments are pursued. Conversely, declining markets can prompt reassessments that lower tax bills, provided property owners act promptly.

For example, data from the Illinois Association of Assessing Officers suggests that between 2020 and 2023, some Dupage properties experienced valuation increases exceeding 15% per year, contributing to rising tax burdens for homeowners. Regular valuation review and timely appeals are essential for balancing these fluctuations.

The Role of Legislative and Policy Changes in Tax Rates

Tax rate policies are subject to annual vote by local governments and can fluctuate based on budgetary needs or political priorities. Incremental increases are common; for example, a 0.2% rise in the county’s lifeline tax rate can translate into hundreds of dollars accumulated annually per household. Staying informed and participating in public hearings can influence these decisions, making collective voice and involvement particularly impactful.

| Relevant Category | Substantive Data |

|---|---|

| Market Value Changes (2020-2023) | Average property assessed value increased by 12% across Dupage County, with some neighborhoods experiencing 20% increases. |

| Tax Rate Adjustments | The county’s aggregate tax rate rose from 2.35% to 2.55% over three years, adding approximately $500 in additional annual taxes for a median-valued home ($350,000). |

Long-term Planning: Strategies for Sustainable Tax Management

Beyond immediate appeals and exemptions, long-term strategies involve holistic planning. Investing in property improvements that qualify for exemptions, diversifying property portfolios, or considering geographic relocation based on tax efficiency are options that can distribute fiscal risk and optimize affordability.

Implementing a Structured Tax Monitoring System

Establishing a calendar to track assessment notices, appeal deadlines, exemption application dates, and legislative sessions ensures proactive management. Utilizing digital tools or engaging third-party services specializing in tax monitoring enhances accuracy and compliance, translating into sustainable savings over time.

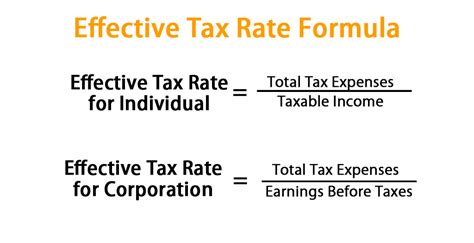

Financial and Investment Planning Including Tax Strategies

Integrating property tax strategies into broader financial planning, including retirement and estate considerations, aligns fiscal responsibility with personal goals. Proper structuring can leverage tax credits, deferments, or phased assessments to mitigate short-term burdens and foster long-term wealth preservation.

Key Points

- Strategic engagement with assessment appeals and exemption applications can significantly lower property tax bills.

- Understanding market trends, legislative shifts, and classification issues is crucial for effective tax management.

- Proactive long-term planning, combined with regular monitoring, sustains fiscal health amid fluctuating property values and policy landscapes.

- Expert advice and community involvement amplify residents' capacity to influence tax policies and optimize relief opportunities.

- Utilizing data-driven evidence is central to successful appeals and exemption applications, ensuring justified reductions.

What are the most effective ways to lower my property taxes in Dupage County?

+Applying for exemptions, filing appeals on assessed value discrepancies, and participating in local policy discussions are among the most effective strategies for reducing property tax burdens. Regular review of assessment notices and staying informed about legislative changes further enhance your ability to manage taxes proactively.

How often should I review my property assessment and taxes?

+Annual reviews are recommended, especially shortly after receiving assessment notices. This ensures timely appeals if values seem inflated and allows you to stay informed of any policy or rate changes affecting your property taxes.

Are there specific programs for seniors or veterans to reduce their property taxes in Dupage?

+Yes, Dupage County offers specific exemption programs for seniors, veterans, and disabled residents, often coupled with rebates or additional credits. Consulting the county assessor’s office or legal experts can help you identify and maximize eligible benefits.