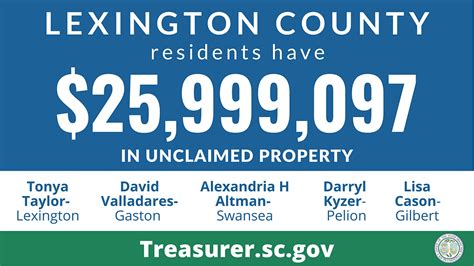

Lexington County Property Taxes

Lexington County, located in the heart of South Carolina, is renowned for its vibrant communities, scenic beauty, and diverse real estate offerings. Amidst the allure of this region, the topic of property taxes often arises as a critical consideration for both homeowners and prospective buyers. This comprehensive guide delves into the intricacies of Lexington County property taxes, offering a detailed analysis to help navigate this essential aspect of homeownership.

Understanding Lexington County’s Property Tax Landscape

The property tax system in Lexington County operates under a set of regulations aimed at assessing and collecting taxes to support the county’s infrastructure, education, and services. These taxes are an essential revenue stream for local governments, ensuring the continued development and maintenance of the community.

The process begins with an assessment of each property's value, which is then used to calculate the tax amount. This value is determined by the Lexington County Assessor's Office, which employs a systematic approach to ensure fairness and accuracy. The assessed value is then multiplied by the millage rate, a tax rate expressed in mills (where one mill equals $1 of tax for every $1,000 of assessed value), to calculate the property tax due.

Lexington County's millage rate is set annually by the county council and other taxing authorities, such as school districts and municipalities. These rates can vary depending on the location of the property within the county and the services provided by these authorities.

Key Factors Influencing Property Taxes in Lexington County

Several factors play a role in determining property taxes in Lexington County:

- Property Value: The higher the assessed value of a property, the higher the potential tax liability. Property values can fluctuate due to market conditions, improvements made to the property, or reassessments conducted by the county.

- Millage Rate: The millage rate is a critical determinant of property taxes. A higher millage rate results in higher taxes, while a lower rate reduces the tax burden. The county council and other taxing authorities have the authority to adjust these rates annually.

- Property Type: Different types of properties, such as residential, commercial, or agricultural, may have varying tax rates or assessments. Additionally, certain properties may be eligible for exemptions or special assessments.

- Location: Property taxes can vary significantly within Lexington County due to differences in services provided and millage rates set by various taxing authorities. Properties located in different school districts or municipalities may face different tax rates.

Assessing Your Property Tax in Lexington County

Understanding your property tax obligation is crucial for effective financial planning and budgeting. Here’s a step-by-step guide to help you assess your property tax in Lexington County:

Step 1: Obtain Your Property Assessment Information

The first step is to obtain the assessed value of your property. You can access this information online through the Lexington County Assessor’s Office website or by contacting the assessor’s office directly. Your property assessment will provide details on the value assigned to your property, which forms the basis for calculating your taxes.

Step 2: Determine the Millage Rate

The millage rate applicable to your property is a key factor in calculating your tax liability. This rate is typically published annually by the county and can be found on the Lexington County official website or by contacting the county treasurer’s office. The millage rate may vary based on the location of your property and the services it receives.

Step 3: Calculate Your Property Taxes

To calculate your property taxes, you’ll multiply the assessed value of your property by the applicable millage rate. For instance, if your property is assessed at 200,000 and the millage rate is 100 mills, your annual property tax would be 2,000 ($200,000 x 0.0100). This calculation provides an estimate of your tax liability, but it’s essential to confirm the final amount with the county treasurer’s office, as there may be additional adjustments or exemptions applicable to your situation.

| Sample Calculation | Assessed Value | Millage Rate | Estimated Annual Tax |

|---|---|---|---|

| Residential Property | $200,000 | 100 mills | $2,000 |

| Commercial Property | $350,000 | 120 mills | $4,200 |

| Agricultural Property | $150,000 | 80 mills | $1,200 |

Property Tax Exemptions and Discounts in Lexington County

Lexington County offers several property tax exemptions and discounts to eligible homeowners, providing financial relief and encouraging homeownership. Here’s an overview of some of these programs:

Homestead Exemption

The Homestead Exemption program is a significant benefit for homeowners in Lexington County. It allows eligible homeowners to exclude a portion of their home’s assessed value from taxation, effectively reducing their property tax liability. To qualify, homeowners must meet certain criteria, such as owning and occupying the property as their primary residence and having a total household income below a specified threshold.

Senior Citizen Discount

Lexington County provides a Senior Citizen Discount for homeowners aged 65 or older. This discount reduces the property’s assessed value, resulting in lower taxes. To be eligible, seniors must meet specific income and residency requirements and apply for the discount annually.

Disabled Veterans Exemption

The county also offers a Disabled Veterans Exemption to honorably discharged veterans with service-connected disabilities. This exemption excludes a portion of the veteran’s primary residence from taxation, providing financial relief to those who have served our country. Veterans must provide documentation of their disability rating and discharge status to qualify.

Other Exemptions and Discounts

Lexington County provides additional exemptions and discounts, including those for certain agricultural properties, historic properties, and conservation lands. These programs aim to support specific sectors and promote the preservation of the county’s unique character.

Property Tax Payment Options and Due Dates

Understanding your property tax payment options and due dates is essential to avoid penalties and maintain a positive relationship with the county. Here’s an overview of the payment process in Lexington County:

Payment Options

Lexington County offers various payment methods to accommodate different preferences and needs. Homeowners can choose from the following options:

- Online Payment: The most convenient method, allowing you to pay your taxes securely through the Lexington County Treasurer's Office website. You'll need your account number and a valid payment method.

- Mail-In Payment: You can send your payment by mail to the Lexington County Treasurer's Office. Include your account number and a check or money order made payable to the "Lexington County Treasurer."

- In-Person Payment: Visit the Lexington County Treasurer's Office during business hours to make your payment in person. Acceptable forms of payment include cash, check, money order, or credit/debit card (fees may apply for card payments).

Due Dates

Property taxes in Lexington County are due semi-annually, with payments typically due in January and June. However, it’s essential to confirm the exact due dates each year, as they may vary slightly. Late payments are subject to penalties and interest, so it’s advisable to plan and budget accordingly.

Payment Plans

Lexington County offers payment plans for homeowners facing financial difficulties. These plans allow you to spread your tax payments over a specified period, making them more manageable. To apply for a payment plan, you’ll need to contact the Lexington County Treasurer’s Office and provide documentation supporting your financial situation.

Appealing Your Property Assessment in Lexington County

If you believe your property has been overvalued or incorrectly assessed, you have the right to appeal the assessment. The process for appealing a property assessment in Lexington County involves the following steps:

Step 1: Review Your Assessment Notice

When you receive your property assessment notice, carefully review the details to ensure they are accurate. Check the property’s physical description, square footage, and any recent improvements that may have affected its value. If you notice any discrepancies, gather evidence to support your case.

Step 2: Contact the Assessor’s Office

If you believe your assessment is incorrect, contact the Lexington County Assessor’s Office to discuss your concerns. The assessor’s office may be able to provide clarification or adjust the assessment if errors are identified.

Step 3: File an Appeal

If you’re still dissatisfied with your assessment after contacting the assessor’s office, you can file a formal appeal. The process involves submitting an appeal application to the Lexington County Board of Assessment Appeals, providing detailed evidence and arguments supporting your case. It’s beneficial to seek professional guidance from a tax consultant or attorney to ensure your appeal is well-prepared and meets all necessary requirements.

Step 4: Attend the Hearing

Once your appeal is filed, you’ll receive a hearing date from the Board of Assessment Appeals. It’s crucial to attend this hearing, where you’ll present your case and provide evidence supporting your claim. The board will consider your appeal and make a decision based on the information presented.

The Impact of Property Taxes on Lexington County’s Economy

Property taxes play a vital role in the economic health and development of Lexington County. These taxes are a significant source of revenue for the county, funding essential services, infrastructure projects, and public education. The stability and predictability of property taxes contribute to the county’s overall economic prosperity and resilience.

The revenue generated from property taxes is used to support various sectors, including education, public safety, transportation, and social services. This funding ensures the county can provide high-quality services to its residents and maintain a thriving community.

Furthermore, property taxes encourage responsible land use and development. By imposing taxes on properties, the county incentivizes property owners to maintain and improve their properties, contributing to the overall aesthetic and economic value of the community. This, in turn, attracts businesses and residents, fostering economic growth and development.

How often are property assessments conducted in Lexington County?

+Property assessments in Lexington County are typically conducted every five years. However, the assessor’s office may reassess a property if significant improvements or changes are made that could affect its value.

Can I appeal my property tax bill if I disagree with the assessed value or millage rate?

+Yes, you have the right to appeal your property tax bill if you believe the assessed value or millage rate is incorrect. The process involves submitting an appeal to the Lexington County Board of Assessment Appeals and attending a hearing to present your case.

What happens if I miss the property tax payment deadline in Lexington County?

+Missing the property tax payment deadline in Lexington County can result in late fees, penalties, and interest charges. It’s important to stay informed about the due dates and consider setting up reminders to avoid any financial penalties.

Are there any online resources to help me estimate my property taxes in Lexington County?

+Yes, the Lexington County Assessor’s Office provides an online tool called the 2023 Revaluation Calculator that allows homeowners to estimate their property taxes based on various scenarios. This tool can be a valuable resource for budgeting and financial planning.

How can I stay informed about changes to property tax rates and assessments in Lexington County?

+To stay informed about changes to property tax rates and assessments in Lexington County, you can subscribe to email updates from the Lexington County Assessor’s Office and the Lexington County official website. These sources provide timely updates and announcements regarding property tax-related matters.