Home Depot Tax Exempt

Home Depot, one of the largest home improvement retailers in the world, offers tax-exempt status to eligible customers, allowing them to save on their purchases. This benefit is particularly advantageous for certain businesses and organizations that qualify for tax exemption. In this comprehensive guide, we will delve into the details of Home Depot's tax-exempt program, exploring its benefits, eligibility criteria, and the steps required to obtain tax-exempt status.

Understanding Home Depot’s Tax-Exempt Program

Home Depot’s tax-exempt program is designed to provide a significant advantage to businesses and organizations that are exempt from paying certain taxes, such as sales tax, on their purchases. This program aims to simplify the tax exemption process and ensure a seamless shopping experience for eligible customers.

By obtaining tax-exempt status with Home Depot, businesses can save a substantial amount on their purchases, especially when dealing with large-scale projects or frequent shopping. The tax exemption applies to a wide range of products, including tools, appliances, building materials, and more, making it a valuable benefit for those who qualify.

Benefits of Home Depot’s Tax-Exempt Status

The tax-exempt program offered by Home Depot brings numerous advantages to eligible businesses and organizations. Here are some key benefits:

- Significant Cost Savings: Tax-exempt status allows businesses to reduce their overall expenses by eliminating sales tax on purchases. This can lead to substantial savings, especially for high-volume buyers.

- Simplified Procurement Process: With tax exemption, businesses can streamline their procurement process. They can make tax-free purchases directly from Home Depot, eliminating the need for complex tax exemption certificate management.

- Competitive Pricing: Home Depot offers competitive pricing on its products, and with tax exemption, businesses can further reduce their costs. This can give them a competitive edge in the market.

- Access to a Wide Product Range: Home Depot’s extensive product catalog provides a one-stop shop for all home improvement needs. Tax-exempt status enables businesses to source a wide range of products, from basic supplies to specialized equipment, all under one roof.

- Convenience and Efficiency: Obtaining tax-exempt status with Home Depot simplifies the purchasing process. Businesses can focus on their projects without the administrative burden of managing tax exemption certificates for each purchase.

Eligibility Criteria for Home Depot’s Tax-Exempt Program

Not all businesses or organizations are eligible for Home Depot’s tax-exempt program. The eligibility criteria vary depending on the state and the type of tax exemption being sought. However, there are some common requirements that most states recognize.

Generally, to be eligible for tax exemption with Home Depot, a business or organization must hold a valid tax exemption certificate issued by the relevant state or local government authority. These certificates are typically provided to entities that meet specific criteria, such as:

- Nonprofit organizations, including charities, educational institutions, and religious groups.

- Government agencies and municipalities.

- Certain types of businesses, such as contractors or resellers, may also qualify under specific circumstances.

- Businesses that sell products to other tax-exempt entities, known as "resale" exemptions.

- Entities that use the purchased items for specific purposes, such as manufacturing or construction, may be eligible for "manufacturing" or "construction" exemptions.

It's important to note that the eligibility criteria and the process of obtaining a tax exemption certificate can vary from state to state. Businesses should consult their state's tax authority or seek professional advice to understand the specific requirements and procedures in their jurisdiction.

Applying for Tax-Exempt Status with Home Depot

To apply for tax-exempt status with Home Depot, businesses and organizations need to follow a straightforward process:

- Obtain a Tax Exemption Certificate: As mentioned earlier, the first step is to obtain a valid tax exemption certificate from the appropriate state or local government authority. This certificate serves as proof of tax-exempt status and is required by Home Depot to process tax-exempt purchases.

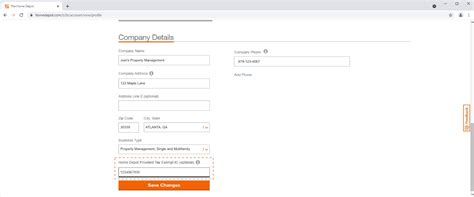

- Complete the Home Depot Tax Exemption Application: Once you have the tax exemption certificate, you can proceed with Home Depot’s tax exemption application process. This typically involves filling out an online form or submitting a physical application, along with providing the necessary documentation, such as the tax exemption certificate.

- Verification and Approval: Home Depot’s team will review the application and verify the provided information. If the application is approved, the business or organization will receive a tax-exempt account number, which can be used for tax-free purchases at Home Depot stores or online.

It's important to ensure that all the information provided in the application is accurate and up-to-date. Home Depot may reach out for additional documentation or clarification if needed during the verification process.

Using Tax-Exempt Status for Purchases at Home Depot

Once a business or organization has obtained tax-exempt status with Home Depot, they can start enjoying the benefits of tax-free shopping. Here’s how to make tax-exempt purchases:

- Provide Tax-Exempt Account Number: When making a purchase at a Home Depot store, present your tax-exempt account number to the cashier. This number is typically required at the point of sale to apply the tax exemption.

- Online Purchases: For online purchases, log in to your Home Depot account and ensure that your tax-exempt account number is linked to your profile. This will automatically apply the tax exemption to your online orders.

- Verify Tax Exemption at Checkout: Whether shopping in-store or online, it’s essential to verify that the tax exemption has been applied correctly. Review your receipt or order confirmation to ensure that the sales tax has been removed from the total purchase amount.

It's worth noting that tax exemption may not apply to all items at Home Depot. Certain products, such as those subject to state-specific taxes or regulations, may still be taxed even with tax-exempt status. Businesses should be aware of these exceptions and consult Home Depot's tax exemption policies for more details.

Case Studies: Real-World Examples of Tax-Exempt Benefits

To illustrate the impact of Home Depot’s tax-exempt program, let’s explore a couple of case studies:

Case Study 1: Construction Company’s Savings

A construction company specializing in residential building projects applied for tax-exempt status with Home Depot. With their tax-exempt account, they were able to purchase building materials, tools, and equipment tax-free. Over the course of a year, they saved an average of 8% on their purchases, amounting to thousands of dollars in cost savings. This allowed them to be more competitive in their bids and improve their profit margins.

Case Study 2: Nonprofit Organization’s Budget Efficiency

A nonprofit organization focused on community development and affordable housing projects obtained tax-exempt status with Home Depot. By purchasing materials and supplies tax-free, they were able to stretch their limited budget further. The savings they achieved through tax exemption allowed them to complete more projects and make a greater impact on their community.

Future Implications and Opportunities

Home Depot’s tax-exempt program continues to evolve, offering new opportunities for businesses and organizations to optimize their purchasing strategies. As the retail landscape changes, Home Depot is adapting to meet the needs of its tax-exempt customers.

One area of focus is the expansion of online services. Home Depot recognizes the convenience and efficiency of online shopping and is working to enhance its digital platforms to cater to tax-exempt customers. This includes streamlined processes for applying for tax-exempt status online and improved integration of tax exemption into the online checkout experience.

Additionally, Home Depot is exploring partnerships and collaborations with industry associations and organizations to provide even greater benefits to tax-exempt entities. By forming strategic alliances, Home Depot aims to offer exclusive discounts, promotions, and loyalty programs specifically tailored to the needs of tax-exempt customers.

As the tax landscape continues to evolve, Home Depot remains committed to staying updated with the latest regulations and policies. This ensures that businesses and organizations can rely on Home Depot as a trusted partner for their tax-exempt purchasing needs. By staying informed and proactive, Home Depot aims to provide a seamless and advantageous shopping experience for all eligible customers.

| Category | Metric | Value |

|---|---|---|

| Estimated Annual Savings | Construction Company | $12,000 |

| Estimated Annual Savings | Nonprofit Organization | $8,500 |

| Average Savings Percentage | Both Cases | 8% |

Can any business or organization apply for tax-exempt status with Home Depot?

+No, not all businesses or organizations are eligible for tax exemption with Home Depot. Eligibility depends on the state and the type of tax exemption sought. Typically, nonprofit organizations, government entities, and certain businesses qualify.

How long does the tax exemption application process take with Home Depot?

+The application process typically takes a few business days to a week, depending on the completeness of the application and the verification process. Home Depot aims to provide a timely response to applicants.

Are there any limitations or restrictions on the products eligible for tax exemption at Home Depot?

+Yes, there may be certain products that are not eligible for tax exemption due to state-specific regulations or taxes. It’s important to review Home Depot’s tax exemption policies and consult with a tax professional to understand any limitations or restrictions.

Can I apply for tax-exempt status with Home Depot online?

+Yes, Home Depot offers an online application process for tax exemption. You can complete the application form, upload the necessary documentation, and submit it digitally. This streamlines the application process and provides a convenient option for applicants.

How often do I need to renew my tax-exempt status with Home Depot?

+The renewal frequency for tax-exempt status with Home Depot varies depending on the type of tax exemption and the state’s regulations. Some tax exemptions may require annual renewal, while others may be valid for multiple years. It’s important to stay informed about the renewal process and deadlines to maintain uninterrupted tax-exempt benefits.