San Joaquin County Tax

Welcome to this comprehensive guide on the intricate world of San Joaquin County Tax, an essential aspect of financial management and civic duty for residents and businesses within this vibrant California county. In this extensive article, we will delve into the intricacies of the San Joaquin County tax system, exploring its history, current structure, and its impact on the local community.

With a rich agricultural heritage and a diverse population, San Joaquin County presents a unique landscape for tax administration. As we navigate through this guide, we will uncover the various tax types, rates, and exemptions specific to the county, providing a detailed understanding of the financial obligations and opportunities available to taxpayers.

From property taxes to sales and use taxes, income taxes, and more, we will break down each component, offering clear explanations and real-world examples to ensure a thorough grasp of the subject. Additionally, we will explore the role of the San Joaquin County Tax Collector's Office, their services, and the online resources they provide to facilitate taxpayer compliance and ease the tax payment process.

Furthermore, we will examine the financial benefits and incentives offered by the county, such as tax credits and deductions, and discuss how these can be leveraged to optimize tax strategies. By the end of this guide, readers will have a comprehensive understanding of the San Joaquin County tax system, enabling them to make informed decisions and navigate the tax landscape with confidence.

Understanding the San Joaquin County Tax System

The San Joaquin County tax system is a complex yet vital mechanism that supports the county’s operations and development. It is a multifaceted system, encompassing various tax types, each with its own set of rules and regulations. Understanding this system is crucial for taxpayers, as it empowers them to fulfill their financial obligations accurately and take advantage of any available benefits.

At the heart of the San Joaquin County tax system is the Tax Collector's Office, a dedicated government entity responsible for administering and collecting various taxes. This office plays a pivotal role in ensuring the county's financial stability and sustainability. It provides a range of services, including tax assessment, collection, and the management of tax-related inquiries and disputes.

The tax system in San Joaquin County is primarily composed of the following key components:

- Property Taxes: Property taxes are a significant revenue source for the county, assessed on both real and personal property. These taxes are determined based on the assessed value of the property and are often the largest financial obligation for homeowners and businesses.

- Sales and Use Taxes: Sales taxes are imposed on the sale of goods and services within the county, while use taxes are applicable to goods purchased from out-of-state vendors but used within the county. These taxes contribute to the county's general fund and are used to support various public services.

- Income Taxes: Income taxes are levied on individuals and businesses based on their taxable income. San Joaquin County follows the state's income tax laws, which include both personal income taxes and business income taxes.

- Vehicle License Fees: Vehicle license fees are annual charges paid by vehicle owners to register and operate their vehicles within the county. These fees help maintain and improve the county's transportation infrastructure.

- Other Taxes and Fees: In addition to the above, San Joaquin County collects various other taxes and fees, such as hotel occupancy taxes, business license taxes, and utility user taxes. These contribute to specific county programs and services.

Each of these tax types has its own unique assessment and collection process, and understanding these processes is essential for taxpayers to ensure compliance and take advantage of any applicable exemptions or deductions.

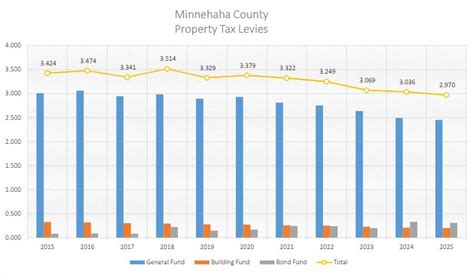

Property Taxes in San Joaquin County

Property taxes are a cornerstone of the San Joaquin County tax system, providing a stable source of revenue for the county’s operations and public services. These taxes are assessed on both real property, such as land and buildings, and personal property, which includes items like vehicles, boats, and business equipment.

The assessment process for property taxes in San Joaquin County is conducted by the Assessor's Office, a separate entity from the Tax Collector's Office. The Assessor's Office is responsible for determining the value of each taxable property within the county. This value, known as the assessed value, forms the basis for calculating the property tax liability.

| Property Type | Assessment Ratio | Tax Rate |

|---|---|---|

| Residential Property | 1% | 1.10% |

| Commercial Property | 1.1% | 1.20% |

| Agricultural Land | 0.6% | 0.75% |

The assessed value of a property is then multiplied by the applicable assessment ratio and tax rate to determine the annual property tax liability. The assessment ratio and tax rate may vary based on the property type, with residential, commercial, and agricultural properties often having different rates.

San Joaquin County offers various property tax exemptions and deductions to eligible taxpayers. These can significantly reduce the property tax burden and provide financial relief. Some common exemptions and deductions include:

- Homeowner's Exemption: This exemption reduces the assessed value of a homeowner's primary residence by a fixed amount, resulting in lower property taxes.

- Veteran's Exemption: Qualified veterans and their spouses may be eligible for a property tax exemption based on their military service.

- Senior Citizen's Exemption: Senior citizens who meet certain income and residency requirements may qualify for a property tax exemption or a reduced tax rate.

- Disabled Veteran's Exemption: Disabled veterans may be eligible for a full or partial property tax exemption, depending on the extent of their disability.

- Greenbelt Land Exemption: Owners of agricultural land may qualify for an exemption if their land is designated as a greenbelt and used for agricultural purposes.

It's important for property owners to stay informed about these exemptions and deductions and to work closely with the Assessor's Office to ensure they are receiving all applicable benefits.

Sales and Use Taxes: Supporting Local Businesses and Services

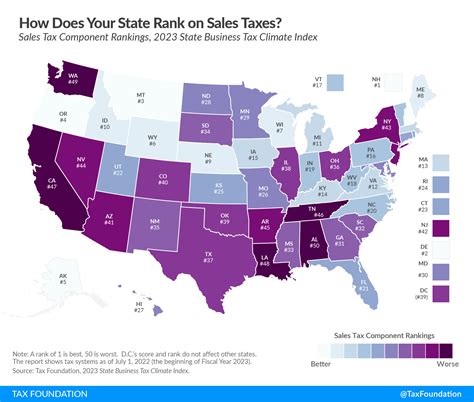

Sales and use taxes are a critical component of the San Joaquin County tax system, contributing significantly to the county’s general fund and supporting various public services. These taxes are levied on the sale of goods and services within the county and on the use of goods purchased from out-of-state vendors but used within the county.

The sales tax is a transaction-based tax, meaning it is charged at the point of sale for most tangible personal property and certain services. The tax rate for sales within San Joaquin County typically includes both a state and a local component, with the local rate determined by the county and any applicable city or district.

| Sales Tax Rate | Components |

|---|---|

| 7.25% | State: 6.00% County: 1.25% |

The use tax, on the other hand, is imposed on the storage, use, or consumption of tangible personal property purchased from out-of-state vendors and brought into San Joaquin County for use. The use tax rate is typically the same as the sales tax rate, ensuring that there is no tax advantage to purchasing goods from out-of-state vendors.

San Joaquin County also offers sales tax exemptions for certain types of transactions, such as purchases made by qualified nonprofit organizations or government entities. Additionally, certain goods, such as food products, clothing, and prescription medications, may be exempt from sales tax, providing financial relief to consumers.

Businesses operating within San Joaquin County are responsible for collecting and remitting sales and use taxes to the California Department of Tax and Fee Administration (CDTFA). The CDTFA provides comprehensive guidelines and resources to help businesses understand their tax obligations and comply with the law.

Income Taxes: Contributing to the County’s Financial Stability

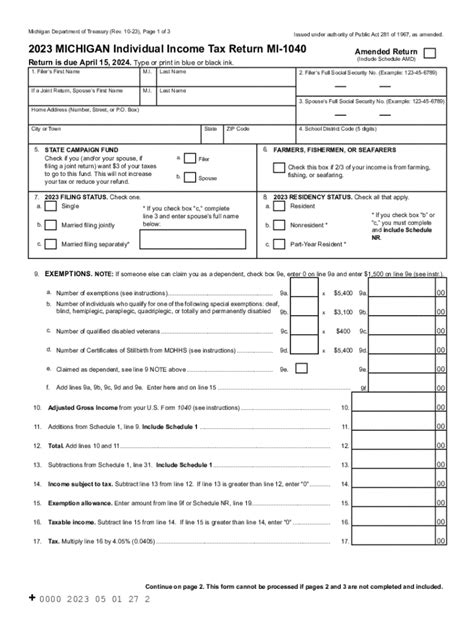

Income taxes play a crucial role in the financial stability of San Joaquin County, providing a significant source of revenue for the county’s operations and public services. Both individuals and businesses are subject to income taxes, with rates and regulations following the state’s guidelines.

For individuals, income taxes are assessed based on their taxable income, which includes wages, salaries, interest, dividends, and other forms of income. The tax rate structure is progressive, with higher income levels subject to higher tax rates. San Joaquin County follows the state's tax brackets and rates, ensuring a consistent and fair taxation system.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $9,050 | 1% |

| $9,051 - $24,600 | 2% |

| $24,601 - $47,700 | 4% |

| $47,701 - $88,300 | 6% |

| $88,301 - $263,600 | 8% |

| $263,601 and above | 9.3% |

For businesses, income taxes are levied on their taxable income, which includes profits from operations, capital gains, and other business-related income. The tax rate structure for businesses is also progressive, with higher income levels subject to higher tax rates.

San Joaquin County offers income tax deductions and credits to eligible taxpayers, providing financial incentives and reducing the overall tax burden. These may include deductions for business expenses, charitable contributions, and certain personal exemptions.

The Franchise Tax Board (FTB) is responsible for administering and collecting income taxes in California, including those for San Joaquin County. The FTB provides comprehensive resources and guidelines to help individuals and businesses understand their tax obligations and comply with the law.

Vehicle License Fees: Maintaining Transportation Infrastructure

Vehicle license fees are an essential component of the San Joaquin County tax system, providing dedicated funding for the maintenance and improvement of the county’s transportation infrastructure. These fees are paid annually by vehicle owners to register and operate their vehicles within the county.

The amount of the vehicle license fee is determined based on the vehicle's make, model, and year, with newer and more valuable vehicles typically incurring higher fees. The fee also takes into account the vehicle's weight, with heavier vehicles subject to additional charges.

San Joaquin County utilizes these vehicle license fees to fund a range of transportation-related projects and initiatives, including road maintenance, bridge repairs, and public transit improvements. These funds are critical for ensuring the county's transportation network remains safe, efficient, and well-maintained.

Vehicle owners in San Joaquin County are required to pay their license fees when registering their vehicles or renewing their registration. The fees are collected by the Department of Motor Vehicles (DMV) and are due annually, typically coinciding with the vehicle's registration renewal date.

To facilitate the payment process, the DMV provides online resources and payment options, allowing vehicle owners to pay their license fees conveniently and securely. Additionally, the DMV offers assistance and guidelines for those facing financial hardships or needing support with their license fee obligations.

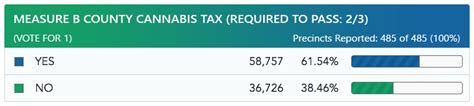

Other Taxes and Fees: Supporting Specific County Programs

In addition to the core tax types, San Joaquin County collects various other taxes and fees to support specific county programs and services. These additional revenue streams play a vital role in funding initiatives that enhance the quality of life for residents and businesses within the county.

One such tax is the hotel occupancy tax, which is levied on the rental of hotel rooms within the county. This tax is typically passed on to guests as part of their room rate and is used to support tourism-related programs and initiatives, such as marketing campaigns and visitor center operations.

San Joaquin County also collects business license taxes from certain types of businesses operating within the county. These taxes contribute to the county's general fund and support a range of public services, including public safety, health, and social services.

Additionally, the county imposes utility user taxes on various utility services, such as electricity, gas, and telecommunications. These taxes are typically included in the customer's utility bill and provide dedicated funding for specific county programs and services.

Each of these additional taxes and fees plays a crucial role in the financial health and sustainability of San Joaquin County, ensuring that essential programs and services can be adequately funded and maintained.

The Role of the San Joaquin County Tax Collector’s Office

The San Joaquin County Tax Collector’s Office is a critical entity within the county’s tax system, responsible for a wide range of essential services and functions. This office plays a pivotal role in ensuring the efficient and effective administration and collection of taxes, as well as providing valuable resources and support to taxpayers.

The primary responsibilities of the Tax Collector's Office include:

- Tax Assessment: Working closely with the Assessor's Office, the Tax Collector's Office is responsible for assessing the tax liability of taxpayers based on the assessed value of their properties or other applicable tax bases.

- Tax Collection: The office collects various taxes, including property taxes, vehicle license fees, and other local taxes. It processes tax payments, issues receipts, and maintains accurate records of taxpayer accounts.

- Taxpayer Services: The Tax Collector's Office provides a range of services to assist taxpayers, including answering inquiries, resolving disputes, and offering payment plans for those facing financial difficulties.

- Online Resources: The office maintains an informative website, offering online tools and resources to facilitate taxpayer compliance. These resources include tax calculators, payment portals, and guides on various tax-related topics.

The Tax Collector's Office is committed to ensuring transparency, fairness, and accessibility in the tax collection process. It strives to provide clear and concise information to taxpayers, helping them understand their obligations and rights.

One of the key online resources provided by the Tax Collector's Office is the Property Tax Payment Portal. This portal allows taxpayers to make secure online payments for their property taxes, view their account information, and access payment history. It simplifies the tax payment process and provides taxpayers with convenient access to their account details.

Additionally, the Tax Collector's Office offers a Taxpayer Assistance Program, designed to help taxpayers who are facing financial hardships or have difficulty paying their taxes. This program provides guidance, support, and potential payment plan options to ensure taxpayers can meet their obligations while managing their financial situation.

By offering these comprehensive services and resources, the San Joaquin County Tax Collector's Office plays a crucial role in maintaining the financial health of the county and supporting its residents and businesses.

Financial Benefits and Incentives in San Joaquin County

San Joaquin County offers a range of financial benefits and incentives