Minnehaha County Property Tax

Understanding property taxes is essential for homeowners and prospective buyers, as these levies can significantly impact your financial planning and overall cost of living. In this comprehensive guide, we delve into the intricacies of property taxes in Minnehaha County, South Dakota, offering a detailed breakdown of rates, assessment processes, and payment options to empower residents with the knowledge they need to navigate this critical aspect of homeownership.

Property Tax Landscape in Minnehaha County

Minnehaha County, home to the vibrant city of Sioux Falls, follows a comprehensive property tax system that plays a pivotal role in funding local government services, schools, and infrastructure projects. Property taxes are a primary source of revenue for the county, contributing to the maintenance and development of essential community amenities.

The property tax system in Minnehaha County operates under a framework set by the South Dakota Department of Revenue, which establishes guidelines for assessment, taxation, and collection. This ensures a standardized approach across the state, providing uniformity and fairness in the property tax landscape.

Tax Rates and Assessment

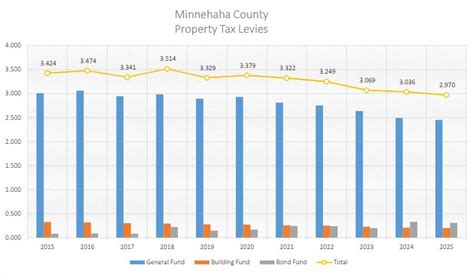

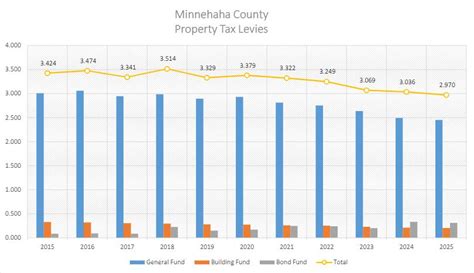

The property tax rate in Minnehaha County is determined annually by the County Commission, taking into account the budgetary needs of various governmental entities, including the county itself, school districts, and special taxing districts.

As of the latest available data, the general tax rate in Minnehaha County stands at 1.219% of the property's assessed value. However, it's important to note that specific tax rates can vary depending on the location within the county and the services provided by the taxing district. For instance, residents in the Sioux Falls School District may face slightly different rates compared to those in other districts.

The assessment process, conducted by the Minnehaha County Assessor's Office, involves valuing each property based on its fair market value. This value is then multiplied by the appropriate tax rate to determine the annual property tax liability. The assessor's office employs a range of methods, including sales comparison, cost approach, and income approach, to ensure accurate valuations.

To illustrate, consider a residential property in Minnehaha County with an assessed value of $250,000. Applying the general tax rate of 1.219%, the annual property tax for this property would amount to approximately $3,047.50. However, it's crucial to factor in any additional mill levies or special assessments that may apply to specific properties.

| Tax Rate Category | Tax Rate |

|---|---|

| General Tax Rate | 1.219% |

| Average Effective Tax Rate | 1.5% |

It's worth noting that Minnehaha County also offers tax relief programs to eligible homeowners, including senior citizens and those with disabilities. These programs aim to alleviate the financial burden of property taxes for qualifying individuals.

Payment Options and Due Dates

Minnehaha County provides homeowners with convenient options to pay their property taxes. The most common methods include online payment through the county’s official website, where taxpayers can securely pay using a credit or debit card. Additionally, traditional methods such as mailing a check or dropping off a payment at the Treasurer’s Office are available.

Property tax payments in Minnehaha County are typically due twice a year, with the first installment due in April and the second in October. However, taxpayers have the flexibility to pay the full amount by the first due date, avoiding the need for subsequent payments. Late payments may incur penalties and interest, so it's essential to stay informed about due dates and make timely payments.

To facilitate timely payments, the Treasurer's Office provides property owners with a convenient reminder service. Taxpayers can opt to receive email or text message notifications, ensuring they stay informed about upcoming due dates and any potential changes to tax rates or assessments.

Impact on Homeownership

Property taxes are a significant consideration for anyone buying or owning a home in Minnehaha County. Understanding the tax landscape can help prospective buyers make informed decisions about their financial capabilities and the overall cost of homeownership.

For instance, when comparing properties, it's essential to factor in the potential tax implications. A property with a higher assessed value may offer more living space or desirable features, but it could also result in a higher annual tax burden. On the other hand, a property with a lower assessed value might provide a more affordable option, especially for those on a tighter budget.

Additionally, property taxes can influence the overall financial health of a community. Well-managed tax revenues can lead to improved infrastructure, better schools, and enhanced public services, making the county an attractive place to live and invest. Conversely, inadequate tax management could result in lagging development and a reduced quality of life.

Strategies for Managing Property Taxes

Homeowners in Minnehaha County have several strategies at their disposal to manage their property tax obligations effectively.

- Tax Appeals: If a homeowner believes their property has been overvalued, they can file an appeal with the Minnehaha County Assessor's Office. This process allows for a review of the assessment, potentially leading to a reduction in the property's assessed value and, consequently, a lower tax burden.

- Homestead Exemptions: Minnehaha County offers a homestead exemption program that can reduce the taxable value of a property for homeowners who qualify. This exemption is particularly beneficial for seniors and individuals with disabilities, providing them with some financial relief.

- Payment Plans: For homeowners facing temporary financial difficulties, the Treasurer's Office may offer payment plans to help manage property tax obligations. These plans allow taxpayers to spread their payments over a longer period, making it more manageable to stay current with their tax liabilities.

Community Impact and Future Outlook

Property taxes in Minnehaha County are not merely a financial obligation but a vital contributor to the overall well-being and development of the community. The revenue generated through property taxes plays a significant role in shaping the county’s future, influencing the quality of education, infrastructure, and overall living standards.

As the county continues to grow and evolve, the property tax system will need to adapt to meet the changing needs of the community. This may involve adjustments to tax rates, assessment methodologies, and the implementation of new tax relief programs to ensure that the system remains fair, equitable, and sustainable.

Furthermore, the ongoing development of Sioux Falls and its surrounding areas presents both opportunities and challenges. While economic growth can lead to increased property values and a larger tax base, it also necessitates careful planning to manage the associated tax implications and ensure that the benefits are distributed equitably throughout the community.

Conclusion: Navigating the Minnehaha County Property Tax Landscape

Understanding the intricacies of property taxes in Minnehaha County is a crucial aspect of responsible homeownership. From assessment processes and tax rates to payment options and relief programs, this guide has provided a comprehensive overview of the county’s property tax system.

By staying informed and engaged with the local tax landscape, homeowners can effectively manage their property tax obligations, leverage available resources, and contribute to the vibrant community of Minnehaha County. As the county continues to thrive and grow, property taxes will remain a key driver of its success, making it essential for residents to stay abreast of any changes and developments in this critical area of local governance.

What factors influence property tax rates in Minnehaha County?

+Property tax rates in Minnehaha County are primarily influenced by the budgetary needs of various governmental entities, including the county itself, school districts, and special taxing districts. These entities determine their required revenue levels, which then translate into tax rates based on the assessed value of properties within their jurisdictions.

How often are property assessments conducted in Minnehaha County?

+Property assessments in Minnehaha County are typically conducted every two years. However, the county may perform reassessments more frequently in certain situations, such as when there are significant changes to a property or if there is a need to adjust valuations to ensure fairness and accuracy.

Are there any tax relief programs available for homeowners in Minnehaha County?

+Yes, Minnehaha County offers tax relief programs to eligible homeowners. These programs include homestead exemptions, which reduce the taxable value of a property for homeowners who qualify. Additionally, the county provides information on other state-level tax relief programs, such as the Property Tax Relief Credit (PTRC) and the Senior Citizens’ Property Tax Deferral Program.