What Is Texas Sales Tax

The sales tax system in Texas is a vital component of the state's revenue structure, contributing significantly to the state's economic framework. Understanding the nuances of this tax is crucial for both residents and businesses operating within the state, as it impacts everyday purchases and business transactions alike. In this comprehensive guide, we will delve into the specifics of Texas sales tax, covering its definition, rate, applicability, and other key aspects. By the end, you should have a clear understanding of this essential tax and its implications.

The Definition and Nature of Texas Sales Tax

Texas sales tax, by definition, is a consumption tax imposed on the sale or lease of tangible personal property and certain services. It is a percentage of the sales price that is collected by the seller and remitted to the state and, in some cases, local governments. This tax is an essential revenue source for the state, contributing to the funding of public services and infrastructure. The tax is levied on the end consumer, making it a regressive tax as it impacts lower-income individuals relatively more than higher-income individuals.

The state of Texas utilizes a destination-based sales tax system. This means that the sales tax rate applied to a transaction is based on the location where the goods are ultimately consumed or used, not the location of the seller. This is in contrast to an origin-based system, where the tax rate is determined by the seller's location.

Understanding the Texas Sales Tax Rate

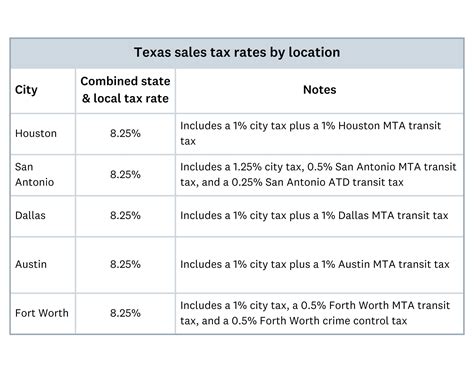

The sales tax rate in Texas is not a uniform percentage across the state. Instead, it is a combination of state, county, and city taxes, which can vary depending on the location of the sale. The state sales tax rate is a flat 6.25% across Texas. However, local governments can also levy additional sales taxes, resulting in a higher combined rate in certain areas.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6.25% |

| County Sales Tax | Up to 2% |

| City Sales Tax | Up to 2% |

As of the latest data available, the average combined sales tax rate in Texas is approximately 8.25%, but this can vary significantly from one location to another. For instance, the city of El Paso has a total sales tax rate of 8.25%, while the city of Dallas has a rate of 8.25% as well. These variations are due to the additional local taxes imposed by counties and cities, which can be as high as 2% each.

Special Sales Tax Districts

In certain areas of Texas, there may be additional taxes or exemptions due to the presence of special sales tax districts. These districts are often established to fund specific projects or initiatives, such as economic development or infrastructure improvements.

For example, the Municipal Management Districts (MMDs) in Houston impose a 2% sales tax for their operations. This tax is in addition to the standard state and local taxes, resulting in a higher overall sales tax rate in these districts.

On the other hand, certain areas in Texas may have tax-free weekends, during which specific items are exempt from sales tax. These weekends are typically designated to encourage shopping and support local businesses. For instance, the state often has tax-free weekends for back-to-school supplies and energy-efficient products.

Sales Tax Applicability and Exemptions

Not all goods and services are subject to sales tax in Texas. Certain items are exempt, either by state law or through specific exemptions granted to certain entities.

Tangible Personal Property

Sales tax in Texas generally applies to the sale of tangible personal property, which includes most physical goods. This encompasses items like clothing, furniture, electronics, and vehicles. However, there are some notable exceptions and exemptions.

For instance, most groceries are exempt from sales tax in Texas, including staple foods, beverages, and agricultural products. This exemption is designed to reduce the tax burden on essential household items.

Additionally, certain medicines and prescription drugs are exempt from sales tax. This exemption is aimed at making healthcare more affordable for Texas residents.

Services

Sales tax in Texas also applies to certain services, particularly those that involve the transfer of title or possession of tangible personal property. This includes services like installation, delivery, and repair of tangible goods. However, many services, especially those that are purely professional or intangible, are not subject to sales tax.

For example, legal services, accounting services, and consulting services are generally not taxable in Texas. This is because these services do not involve the transfer of tangible personal property, but rather provide intellectual or professional expertise.

Exemptions for Certain Entities

Certain entities, such as non-profit organizations and government agencies, are often exempt from sales tax. This exemption is typically granted based on the nature of the organization’s mission or the services it provides.

For instance, charitable organizations and religious institutions are often exempt from sales tax on their purchases, provided they can demonstrate that the items are used for their exempt purposes. Similarly, government entities and educational institutions may also be exempt from sales tax, depending on the nature of their purchases.

Registration and Collection Process

Businesses operating in Texas that meet certain criteria must register with the Texas Comptroller of Public Accounts to collect and remit sales tax. The registration process involves providing detailed information about the business, its location(s), and the goods and services it offers.

Once registered, businesses are assigned a sales tax permit, which they must display at their place of business. This permit serves as proof that the business is authorized to collect and remit sales tax. Businesses must collect the appropriate sales tax rate for each transaction and remit the collected tax to the state on a regular basis, typically monthly or quarterly.

The Texas Comptroller's office provides comprehensive guidance and resources to help businesses understand their sales tax obligations. This includes detailed instructions on how to register, collect, and remit sales tax, as well as how to handle specific situations like refunds or audits.

Sales Tax Remittance and Reporting

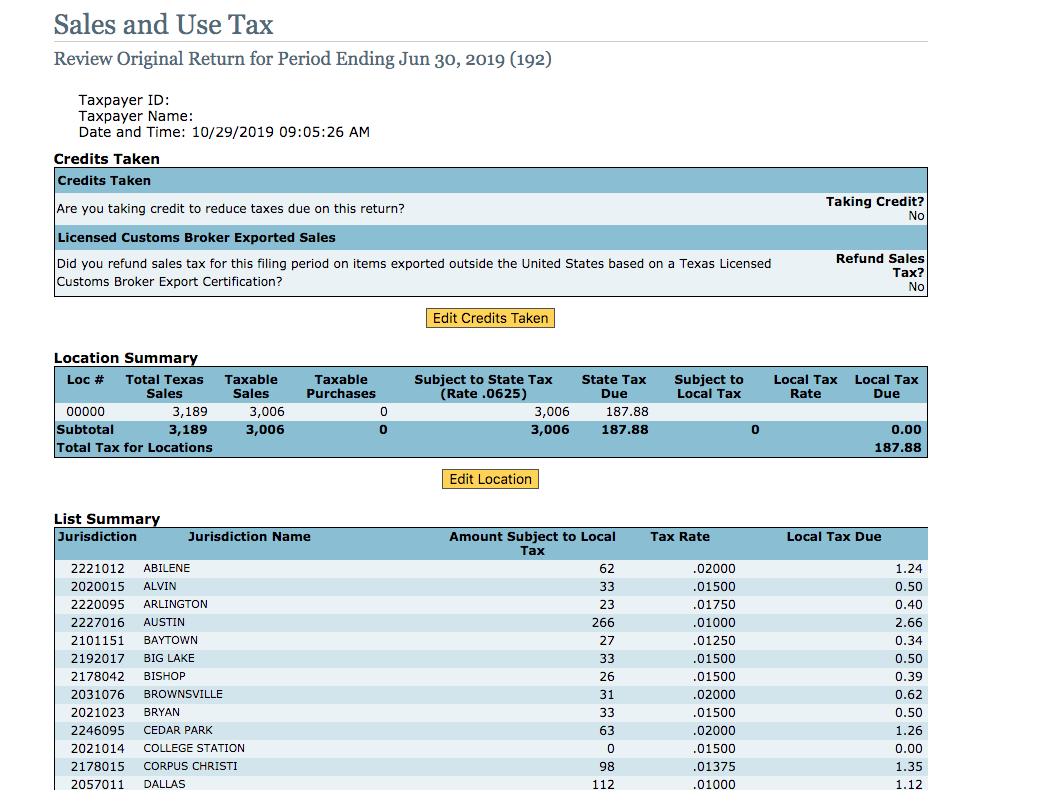

Businesses in Texas are required to remit the collected sales tax to the state on a regular basis. The frequency of remittance depends on the business’s sales volume and can range from monthly to annually. The sales tax remittance process involves submitting a sales tax return, which includes details about the sales transactions during the reporting period, along with the calculated tax amount.

The sales tax return must be filed electronically through the Texas Online Tax System (ECOM). This system allows businesses to file their returns, make payments, and manage their tax accounts online. It also provides a platform for businesses to communicate with the Texas Comptroller's office regarding any tax-related issues.

In addition to the sales tax, businesses may also be required to collect and remit other types of taxes, such as use tax or gross receipts tax, depending on their operations and the nature of their transactions. These additional taxes are often included in the sales tax remittance process.

Compliance and Enforcement

Ensuring compliance with sales tax regulations is crucial for businesses operating in Texas. The Texas Comptroller’s office has robust measures in place to enforce sales tax laws and ensure that businesses are meeting their tax obligations.

Audit Process

The Texas Comptroller’s office may conduct sales tax audits to verify that businesses are accurately collecting and remitting sales tax. These audits can be triggered by various factors, such as random selection, suspicious activity, or complaints. During an audit, the Comptroller’s office will review the business’s records, including sales transactions, tax returns, and other relevant documents, to ensure compliance with sales tax laws.

If an audit reveals that a business has underreported its sales or failed to remit the appropriate tax amount, the business may be subject to penalties and interest. These penalties can be significant and can have a substantial impact on a business's finances.

Penalties and Interest

Businesses that fail to comply with their sales tax obligations may face a range of penalties and interest charges. These can include late payment penalties, underpayment penalties, and failure to file penalties. The specific penalties and interest rates can vary depending on the nature and severity of the violation.

For instance, a business that fails to file a sales tax return on time may be subject to a 5% penalty of the tax due, with an additional 1% penalty for each month the return is late, up to a maximum of 25%. Additionally, interest may accrue on the unpaid tax amount at a rate of 1% per month, compounding monthly.

Sales Tax and the Economy

The sales tax in Texas plays a significant role in the state’s economy, providing a substantial source of revenue for the state and local governments. This revenue is used to fund a wide range of public services and infrastructure projects, impacting the lives of Texas residents in numerous ways.

Revenue Generation and Allocation

Sales tax is one of the primary sources of revenue for the state of Texas, contributing billions of dollars to the state’s general fund each year. This revenue is crucial for funding essential services such as education, healthcare, public safety, and transportation infrastructure.

The revenue generated from sales tax is allocated based on state laws and policies. Generally, a portion of the sales tax revenue goes to the state's general fund, while the remaining portion is distributed to local governments, including counties and cities. This allocation process ensures that the revenue generated from sales tax is utilized to benefit the communities where it was collected.

Economic Impact and Growth

The sales tax in Texas has a significant impact on the state’s economic growth and development. It encourages businesses to locate and operate in the state, as it provides a stable and predictable source of revenue for public services and infrastructure. This, in turn, attracts investment, creates jobs, and fosters economic prosperity.

Moreover, the sales tax system in Texas is designed to promote economic fairness and efficiency. By imposing a flat rate across the state, it ensures that all businesses and consumers are treated equally. Additionally, the destination-based system ensures that sales tax is collected where the goods are ultimately consumed, providing a more accurate representation of economic activity and supporting local economies.

Future Implications and Policy Considerations

As the economy and consumer behavior evolve, the sales tax system in Texas may need to adapt to remain effective and equitable. There are ongoing discussions and policy considerations around various aspects of the sales tax, including rates, exemptions, and enforcement.

One key area of focus is the potential impact of e-commerce and online sales on the sales tax system. With the rise of online shopping, there is a need to ensure that these transactions are subject to the appropriate sales tax, even if the seller is located outside of Texas. This can be a complex issue, as it involves navigating interstate tax laws and ensuring compliance without imposing undue burdens on businesses or consumers.

Another consideration is the potential for sales tax rate changes, either at the state or local level. While the state sales tax rate has remained relatively stable, local governments may adjust their tax rates to meet specific needs or fund particular projects. These rate changes can significantly impact the overall sales tax burden on businesses and consumers, so they are closely monitored and evaluated.

Conclusion

Texas sales tax is a complex yet essential component of the state’s economic framework. It plays a vital role in funding public services and infrastructure, while also impacting the daily lives of residents and the operations of businesses. Understanding the nuances of this tax, from its rate and applicability to its compliance and economic implications, is crucial for all stakeholders in the Texas economy.

As the state and its economy continue to evolve, the sales tax system will need to adapt to remain effective and fair. By staying informed and engaged with these developments, residents and businesses can navigate the sales tax landscape more effectively and contribute to the continued prosperity of Texas.

What is the current state sales tax rate in Texas?

+The current state sales tax rate in Texas is 6.25% as of [date]. This rate is applied uniformly across the state.

Are there any special sales tax districts in Texas?

+Yes, there are special sales tax districts in Texas, such as Municipal Management Districts (MMDs) in Houston, which impose an additional 2% sales tax for their operations.

Are there any tax-free weekends in Texas?

+Yes, Texas often has tax-free weekends for specific items like back-to-school supplies and energy-efficient products. These weekends are designed to encourage shopping and support local businesses.

Are all services subject to sales tax in Texas?

+No, not all services are subject to sales tax in Texas. Services that do not involve the transfer of tangible personal property, such as legal services or consulting services, are generally not taxable.