Where Is My Virginia Tax Refund

Are you eagerly awaiting your Virginia tax refund and wondering how to check its status? This guide will walk you through the process of tracking your refund and provide insights into when you can expect to receive it. With the Virginia Department of Taxation's efficient systems, you can stay informed every step of the way. Whether you filed your taxes online or by mail, this article will ensure you have all the necessary information to locate your refund quickly and easily.

Tracking Your Virginia Tax Refund: A Step-by-Step Guide

The Virginia Department of Taxation offers convenient options to help taxpayers keep track of their refunds. Here's a comprehensive guide to help you locate the status of your Virginia tax refund efficiently:

Option 1: Utilizing the Virginia Tax Refund Status Lookup Tool

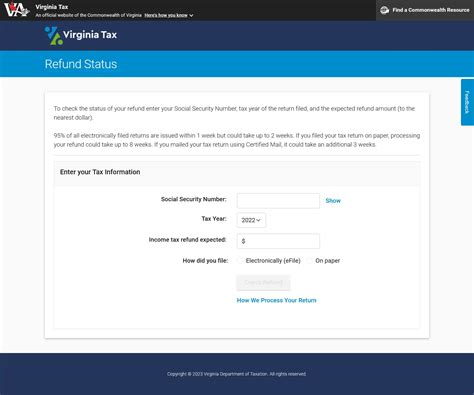

The Virginia Department of Taxation provides an online tool specifically designed to help taxpayers check the status of their refunds. This user-friendly tool is accessible through the department's website. To use it, follow these steps:

- Visit the Virginia Department of Taxation's official website at https://www.tax.virginia.gov. This is your one-stop destination for all tax-related queries and services.

- Navigate to the "Refund Status" section, which is typically located under the Quick Links or Services tab on the homepage. You can also use the website's search function to find it quickly.

- On the refund status page, you will find an online form. This form requires you to enter specific details to locate your refund accurately. The required information includes:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): Enter your unique identification number, which is essential for locating your tax records.

- Refund Amount: Provide the exact refund amount you expect to receive. This information helps the system match your refund details accurately.

- Tax Year: Select the relevant tax year for which you filed your taxes and are awaiting a refund.

- Once you have entered all the required information, click on the Submit button. The system will process your request and display the status of your refund.

- If your refund has been processed, you will see the current status, including the date it was issued and the method of payment. If there are any delays or additional information required, the system will provide relevant updates.

By using the Virginia Tax Refund Status Lookup Tool, you can conveniently check the progress of your refund from the comfort of your home. This online tool is designed to be user-friendly and secure, ensuring your personal information remains protected.

Option 2: Calling the Virginia Department of Taxation's Refund Hotline

If you prefer a more personalized approach or encounter issues with the online tool, you can always reach out to the Virginia Department of Taxation's Refund Hotline. This dedicated hotline is staffed by knowledgeable representatives who can assist you with any refund-related queries.

- Dial the toll-free number provided by the Virginia Department of Taxation. This number is typically listed on the department's website and other official communication channels.

- Follow the automated prompts to navigate through the menu options. You may need to provide certain details, such as your Social Security Number or taxpayer ID, to access your refund information.

- Once connected to a representative, provide them with your taxpayer information, including your name, address, and the tax year for which you are seeking a refund.

- The representative will access your tax records and provide you with an update on the status of your refund. They can also assist you with any other tax-related queries you may have.

By calling the Refund Hotline, you receive personalized assistance and have the opportunity to clarify any doubts or concerns you may have about your Virginia tax refund. The hotline is a valuable resource for taxpayers who prefer a more direct and interactive approach to resolving their refund queries.

Option 3: Checking Your Refund Status Through My Virginia eFile

If you filed your Virginia taxes using the My Virginia eFile system, you can conveniently track your refund status through the same platform. My Virginia eFile is a secure online filing system that offers a range of tax-related services to Virginia taxpayers.

- Log in to your My Virginia eFile account using your unique credentials. If you haven't registered yet, you can do so by visiting the My Virginia eFile website and following the registration process.

- Once logged in, navigate to the "Refund Status" section within your account. This section provides a dedicated area to view the status of your refund.

- On the refund status page, you will find detailed information about your refund, including the date it was issued, the method of payment, and any relevant updates.

- If you encounter any issues or have additional questions, you can reach out to the My Virginia eFile support team through the contact options provided on the website. They are ready to assist you with any technical or refund-related queries.

By using My Virginia eFile, you can conveniently manage your tax filings and track your refund status in one place. This online platform offers a user-friendly interface and secure access to your tax records, making it an efficient way to stay informed about your Virginia tax refund.

Understanding Virginia Tax Refund Processing Times

When it comes to Virginia tax refunds, understanding the processing times can help manage your expectations. The Virginia Department of Taxation aims to process refunds promptly, but several factors can influence the timeline.

Standard Processing Times

Under normal circumstances, the Virginia Department of Taxation strives to process tax refunds within 4 to 6 weeks from the date of filing. This timeline applies to both electronic and paper tax returns.

| Filing Method | Estimated Processing Time |

|---|---|

| Electronic Filing | 4-6 weeks |

| Paper Filing | 4-6 weeks |

However, it's important to note that processing times may vary depending on the complexity of your tax return, the accuracy of the information provided, and the volume of tax returns being processed during a particular period.

Factors Affecting Processing Times

Several factors can impact the processing time of your Virginia tax refund. These include:

- Accuracy of Information: Inaccurate or incomplete tax returns may require additional review, which can delay the processing of your refund.

- Tax Law Changes: Updates or amendments to tax laws may require additional time for the department to process and apply the changes to your refund.

- Volume of Returns: During peak tax seasons, such as the annual tax filing deadline, the volume of tax returns being processed increases significantly. This can lead to slightly longer processing times as the department works to manage the increased workload.

- Payment Method: The method of payment you choose for your refund can also affect the processing time. Electronic payments, such as direct deposit, are typically processed faster than paper checks.

What to Do if Your Refund is Delayed

If you have not received your Virginia tax refund within the estimated processing time, there could be several reasons for the delay. Here are some steps you can take to investigate and resolve the issue:

- Check the Refund Status: Use one of the methods outlined above, such as the online lookup tool or the Refund Hotline, to check the status of your refund. This will provide you with an update on whether your refund has been processed or if there are any outstanding issues.

- Review Your Tax Return: Carefully review your tax return for any errors or discrepancies. Inaccurate information or missing details can lead to delays in processing. If you find any mistakes, consider filing an amended return to rectify the issue.

- Contact the Department: If you have checked the refund status and reviewed your tax return without finding any issues, it's advisable to contact the Virginia Department of Taxation directly. Their customer service representatives can provide further assistance and investigate any potential delays.

Receiving Your Virginia Tax Refund: Payment Methods and Options

Once your Virginia tax refund has been processed, you will receive your refund through the payment method you selected when filing your taxes. The Virginia Department of Taxation offers multiple payment options to accommodate different preferences and needs.

Direct Deposit

Direct deposit is the most efficient and convenient way to receive your tax refund. When you file your taxes, you can provide your bank account details to have your refund deposited directly into your account. This method is secure, fast, and eliminates the risk of lost or stolen checks.

Paper Check

If you prefer a traditional method, you can opt to receive your Virginia tax refund as a paper check. The department will mail the check to the address provided on your tax return. It's important to ensure that your mailing address is accurate to avoid any delays or misdelivery.

Combining Multiple Refunds

If you have multiple tax refunds coming your way, such as a state refund and a federal refund, you can choose to have them combined into a single payment. This option simplifies the process and ensures you receive your refunds together, making it more convenient to manage your finances.

Refund Anticipation Loans (RALs)

Refund Anticipation Loans (RALs) are short-term loans offered by some tax preparation companies. These loans are typically based on the expected amount of your tax refund. While RALs can provide quick access to funds, it's important to carefully consider the terms and conditions, including interest rates and fees, before opting for this option.

Staying Informed: Tips for a Smooth Tax Refund Process

To ensure a smooth and stress-free tax refund process, consider the following tips:

- File Early: Submitting your tax return early in the tax season can help reduce processing times and potential delays. It also gives you more time to address any issues that may arise.

- Accurate Information: Double-check your tax return for accuracy. Incorrect or missing information can lead to delays and additional processing steps.

- Direct Deposit: Opt for direct deposit as your preferred payment method. It's the fastest and most secure way to receive your refund.

- Monitor Your Refund Status: Regularly check the status of your refund using the methods outlined above. This way, you can stay informed and take prompt action if any issues arise.

- Keep Important Documents: Retain all your tax-related documents, including your tax return and any correspondence from the Virginia Department of Taxation. These documents can be useful for reference and resolving any refund-related queries.

Conclusion

Navigating the Virginia tax refund process can be straightforward with the right tools and information. By utilizing the online lookup tool, calling the Refund Hotline, or tracking your refund through My Virginia eFile, you can stay informed about the status of your refund. Understanding the standard processing times and potential factors that can affect them will help manage your expectations. Remember to file early, provide accurate information, and choose a convenient payment method to receive your refund promptly. With these tips and the resources provided by the Virginia Department of Taxation, you can confidently track and receive your Virginia tax refund without any unnecessary delays.

How long does it typically take to receive my Virginia tax refund after filing my taxes?

+Under normal circumstances, the Virginia Department of Taxation aims to process tax refunds within 4 to 6 weeks from the date of filing. However, processing times may vary depending on various factors, including the accuracy of your tax return and the volume of tax returns being processed.

Can I track my Virginia tax refund online?

+Yes, you can track your Virginia tax refund online using the Virginia Tax Refund Status Lookup Tool. This user-friendly tool is available on the Virginia Department of Taxation’s official website. You will need to provide your Social Security Number or Individual Taxpayer Identification Number, the refund amount, and the tax year to locate your refund status.

What should I do if I haven’t received my Virginia tax refund within the estimated processing time?

+If you haven’t received your refund within the estimated processing time, there could be several reasons for the delay. Start by checking the status of your refund using the online lookup tool or by calling the Refund Hotline. Review your tax return for any errors or discrepancies, and contact the Virginia Department of Taxation for further assistance if needed.

Can I combine multiple tax refunds into a single payment?

+Yes, you have the option to combine multiple tax refunds, such as state and federal refunds, into a single payment. This simplifies the process and allows you to receive your refunds together. When filing your taxes, indicate your preference for combining refunds, and the department will process them accordingly.

Is direct deposit the fastest way to receive my Virginia tax refund?

+Yes, direct deposit is the fastest and most secure way to receive your tax refund. When you file your taxes, provide your bank account details to have your refund deposited directly into your account. This method eliminates the risk of lost or stolen checks and ensures a quicker turnaround time.