Pay Nj Estimated Taxes

When you're a resident of New Jersey, it's important to understand the state's tax system, especially when it comes to estimated tax payments. New Jersey, like many other states, requires individuals and businesses to make estimated tax payments throughout the year to ensure that their tax obligations are met. This guide will provide an in-depth analysis of the process of paying estimated taxes in New Jersey, covering all the important aspects and offering valuable insights for taxpayers.

Understanding Estimated Taxes in New Jersey

Estimated taxes are payments made by individuals and businesses to the state of New Jersey to cover their anticipated tax liabilities for the current year. These payments are required if your tax liability for the year is expected to be $1,000 or more, and they help ensure that taxpayers stay compliant with their tax obligations. Estimated taxes are particularly relevant for individuals with variable income streams, such as freelancers, independent contractors, and small business owners, as well as for those who receive income from sources other than wages.

Who Needs to Pay Estimated Taxes in New Jersey?

The requirement to pay estimated taxes in New Jersey applies to various taxpayers, including:

- Individuals with Self-Employment Income: If you’re a sole proprietor, independent contractor, or freelancer, and your net earnings from self-employment are expected to be 400 or more, you must pay estimated taxes.</li> <li><strong>Partners and S Corporation Shareholders</strong>: If you have income from a partnership or S corporation, you're responsible for paying estimated taxes on your share of the entity's income.</li> <li><strong>Trusts and Estates</strong>: Trustees and executors of trusts and estates must also make estimated tax payments on behalf of the trust or estate.</li> <li><strong>Corporations</strong>: C corporations with expected income tax liabilities of 500 or more must pay estimated taxes.

It's important to note that even if you have tax withheld from your wages, you may still need to pay estimated taxes if your other income sources push your total tax liability above the threshold.

When to Pay Estimated Taxes

In New Jersey, estimated tax payments are due four times a year, typically on the 15th of April, June, September, and January. These payment deadlines are set by the state and are crucial for taxpayers to remember. Failure to make timely payments can result in penalties and interest, so it’s essential to plan and make these payments on schedule.

Calculating Your Estimated Tax Payments

Calculating your estimated tax payments involves a few steps to ensure accuracy. Here’s a breakdown of the process:

Step 1: Estimate Your Income

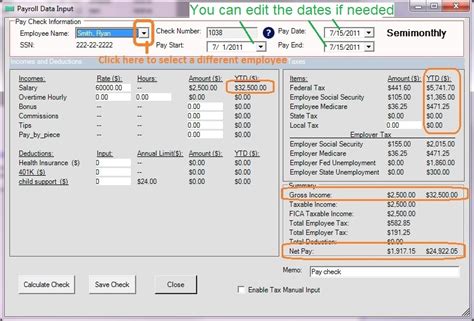

The first step is to estimate your total income for the year. This includes all sources of income, such as wages, self-employment income, rental income, dividends, interest, and any other taxable income. It’s important to be as accurate as possible in this estimation to avoid underpayment penalties.

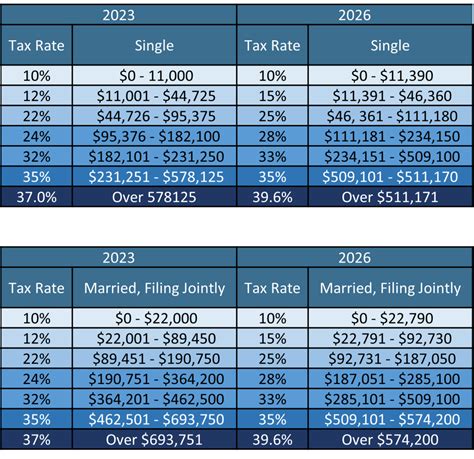

Step 2: Determine Your Tax Liability

Once you have a clear idea of your estimated income, you need to calculate your expected tax liability. This involves considering all applicable taxes, including income tax, self-employment tax, and any other relevant taxes. You can use the New Jersey Division of Taxation’s estimated tax worksheets to help with this calculation.

Step 3: Apply the Safe Harbor Rule

To avoid underpayment penalties, New Jersey has a Safe Harbor Rule. According to this rule, you can avoid penalties if you meet one of the following conditions:

- Your estimated tax payments for the year are at least 100% of your previous year’s tax liability.

- Your estimated tax payments are at least 90% of your current year’s tax liability.

If you meet either of these conditions, you won’t incur any underpayment penalties, even if your actual tax liability turns out to be higher than estimated.

Step 4: Adjust for Withholding and Credits

If you have taxes withheld from your wages or expect to claim certain tax credits, you can adjust your estimated tax payments accordingly. However, it’s important to ensure that your estimated payments still meet the Safe Harbor Rule to avoid penalties.

Methods of Paying Estimated Taxes

New Jersey offers several convenient methods for taxpayers to pay their estimated taxes. Here are the options:

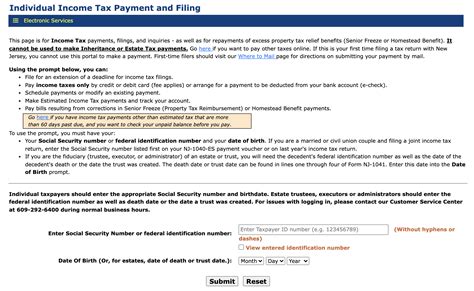

Online Payment

The most common and convenient method is to make your estimated tax payments online through the New Jersey Division of Taxation’s website. You can use your credit or debit card, or even your bank account, to make secure payments. This method is fast, efficient, and allows for easy tracking of your payment history.

Electronic Funds Transfer (EFT)

If you prefer not to use a credit or debit card, you can set up an Electronic Funds Transfer (EFT) with your bank. This method allows you to authorize the state to withdraw the estimated tax amount directly from your bank account on the due date. It’s a secure and automatic way to ensure your payments are made on time.

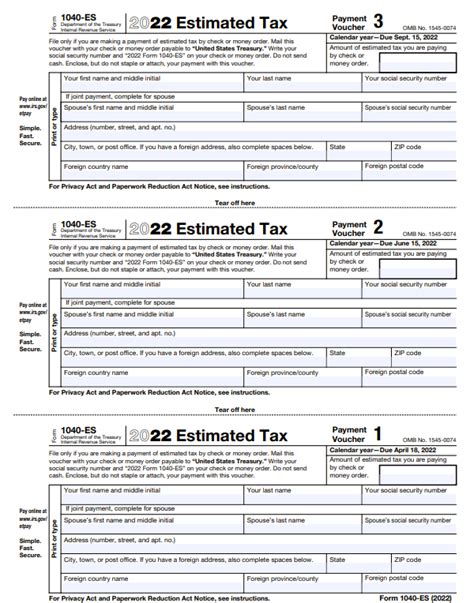

Check or Money Order

For those who prefer traditional methods, you can pay your estimated taxes by check or money order. Simply fill out the Estimated Tax Payment Voucher (Form NJ-ES) and mail it, along with your payment, to the address provided on the form. Make sure to allow sufficient time for your payment to arrive before the due date to avoid late fees.

Common Mistakes and How to Avoid Them

When it comes to estimated taxes, there are a few common mistakes that taxpayers often make. Being aware of these pitfalls can help you avoid them and ensure a smoother tax-paying experience:

Underestimating Income

One of the most common mistakes is underestimating your income for the year. This can lead to underpayment penalties, as your estimated tax payments may not cover your actual tax liability. To avoid this, be conservative in your income estimation and consider all possible sources of income.

Forgetting Payment Deadlines

Estimated tax payments have specific due dates, and missing these deadlines can result in penalties and interest. Set reminders for yourself or use tax software that can alert you to upcoming payment deadlines. Staying organized and proactive is key to avoiding late fees.

Not Meeting the Safe Harbor Rule

The Safe Harbor Rule is in place to protect taxpayers from underpayment penalties. Make sure you understand this rule and ensure that your estimated tax payments meet one of the two conditions to avoid additional charges.

Resources for Further Assistance

If you have questions or need further assistance with your estimated tax payments, New Jersey provides several resources to guide you:

- New Jersey Division of Taxation Website: The official website offers a wealth of information, including tax forms, publications, and helpful guides. You can also find contact information for the Division of Taxation if you need to reach out directly.

- Taxpayer Advocate Services: If you're facing financial hardship or have other complex tax issues, the Taxpayer Advocate Services can provide personalized assistance. They can help resolve issues related to estimated taxes and offer solutions tailored to your situation.

- Tax Preparation Software: Utilizing tax preparation software can simplify the process of calculating and paying your estimated taxes. These tools often provide step-by-step guidance and can help ensure accuracy in your tax calculations.

Conclusion

Paying estimated taxes in New Jersey is an important responsibility for many taxpayers. By understanding the process, calculating your payments accurately, and utilizing the available payment methods, you can ensure compliance with state tax laws. Remember to stay organized, plan ahead, and take advantage of the resources provided by the New Jersey Division of Taxation to make your estimated tax payments a seamless part of your financial strategy.

How do I know if I need to pay estimated taxes in New Jersey?

+

If your tax liability for the year is expected to be $1,000 or more, you are required to pay estimated taxes in New Jersey. This applies to individuals with self-employment income, partners and S corporation shareholders, trusts and estates, and corporations with certain income thresholds.

What happens if I miss an estimated tax payment deadline in New Jersey?

+

Missing an estimated tax payment deadline can result in penalties and interest. It’s important to stay organized and plan your payments to avoid these additional charges. If you anticipate financial hardship, you may consider reaching out to the New Jersey Division of Taxation or Taxpayer Advocate Services for assistance.

Can I pay my estimated taxes online in New Jersey?

+

Yes, online payment is one of the most convenient methods for paying estimated taxes in New Jersey. You can use your credit or debit card, or even your bank account, to make secure online payments through the New Jersey Division of Taxation’s website.

How can I estimate my tax liability for the year accurately?

+

To estimate your tax liability accurately, consider all sources of income, including wages, self-employment income, rental income, dividends, interest, and other taxable income. Use the estimated tax worksheets provided by the New Jersey Division of Taxation to help with your calculations. Being conservative in your estimation can help avoid underpayment penalties.