Vt Tax Return

The Vermont Department of Taxes plays a crucial role in managing the state's revenue collection and administering various tax programs. The process of filing Vermont state tax returns can be a complex task, especially for individuals and businesses with specific circumstances or unique tax situations. Understanding the requirements, deadlines, and available resources is essential to ensure compliance and avoid penalties.

Navigating Vermont’s Tax Landscape: A Comprehensive Guide

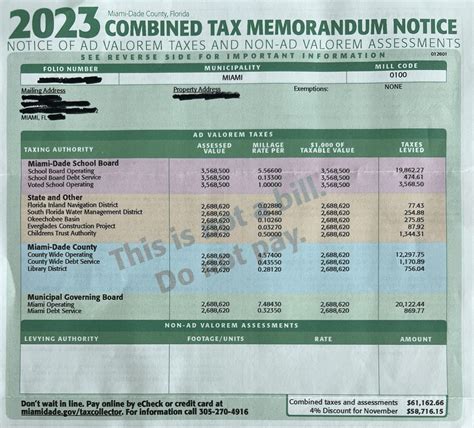

Vermont’s tax system encompasses a range of taxes, including income tax, sales and use tax, meals and rooms tax, property tax, and various other taxes and fees. For individual taxpayers, the primary focus is on personal income tax, while businesses face a more diverse set of tax obligations.

Personal Income Tax in Vermont

Vermont’s personal income tax system is progressive, with tax rates ranging from 3.35% to 8.75%. The tax brackets are based on taxable income, and the rates increase as income rises. For the 2023 tax year, the brackets and rates are as follows:

| Taxable Income Bracket | Tax Rate |

|---|---|

| $0 - $3,350 | 3.35% |

| $3,351 - $8,400 | 3.55% |

| $8,401 - $17,500 | 4.2% |

| $17,501 - $43,000 | 5.25% |

| $43,001 - $250,000 | 6.8% |

| $250,001 and above | 8.75% |

These tax rates are applicable to both single filers and married couples filing jointly. Vermont also offers tax credits and deductions to reduce the taxable income and lower the tax liability. Some of the common deductions and credits include the standard deduction, personal exemptions, dependent deductions, and various tax credits for education, property taxes, and renewable energy investments.

Business Taxes and Filing Requirements

Businesses operating in Vermont are subject to a range of taxes, including corporate income tax, sales and use tax, meals and rooms tax, and various other taxes and fees specific to certain industries. The corporate income tax rate in Vermont is 6.5% for the 2023 tax year.

Businesses must obtain the necessary licenses and permits to operate legally in the state. The Vermont Secretary of State's website provides detailed information on the registration process and the specific requirements for different business types. Additionally, businesses must register with the Vermont Department of Taxes to obtain a tax account number and comply with the state's tax regulations.

Tax Deadlines and Extensions

Vermont tax deadlines align with the federal tax deadlines. The typical deadline for filing Vermont income tax returns is April 15th each year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. For instance, in 2024, the deadline for filing Vermont tax returns is April 15th, as it falls on a Monday.

In certain circumstances, taxpayers may be eligible for an extension to file their tax returns. The standard extension period is six months, extending the filing deadline to October 15th. However, it's important to note that an extension to file does not grant an extension to pay the taxes owed. Taxpayers must estimate their tax liability and make payments by the original deadline to avoid penalties and interest.

Resources and Assistance for Taxpayers

The Vermont Department of Taxes provides a wealth of resources to assist taxpayers in navigating the tax system. The department’s website offers detailed guides, forms, and instructions for various tax types. Additionally, the department provides a comprehensive FAQ section, covering common questions and concerns related to tax filing, payments, and compliance.

For taxpayers seeking personalized assistance, the Department of Taxes offers a dedicated help desk. Taxpayers can reach out to the help desk via phone, email, or live chat to receive guidance on specific tax matters. The help desk staff are well-versed in Vermont's tax laws and can provide accurate and timely information to taxpayers.

E-filing and Paper Filing Options

Vermont offers both electronic filing (e-filing) and paper filing options for tax returns. E-filing is the preferred method as it is faster, more secure, and reduces the risk of errors. The Department of Taxes provides an online filing system, MyTax, which allows taxpayers to file their returns electronically. This system is user-friendly and guides taxpayers through the filing process step by step.

For taxpayers who prefer paper filing, the necessary forms can be downloaded from the Department of Taxes website. The completed forms must be mailed to the address specified on the form. It's important to note that paper filing may result in longer processing times and a higher risk of errors compared to e-filing.

Tax Payment Options and Penalties

Taxpayers have several options for paying their Vermont state taxes. These include electronic payments through MyTax, credit card payments, direct debit, and paper checks. The Department of Taxes website provides detailed instructions on how to make payments using each method.

It's crucial for taxpayers to pay their taxes on time to avoid penalties and interest. Late payments can result in a penalty of 5% of the unpaid tax for each month or part of a month the tax remains unpaid, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax at a rate of 1% per month, or part of a month, until the tax is paid in full.

Amending Vermont Tax Returns

In certain situations, taxpayers may need to amend their Vermont tax returns. This could be due to mistakes, overlooked deductions or credits, or changes in tax laws. To amend a tax return, taxpayers must file Form VT-1040X, which is available on the Department of Taxes website.

It's important to note that amending a tax return can impact the taxpayer's refund or balance due. If the amended return results in a larger refund, the Department of Taxes will process the refund within approximately 12 weeks of receiving the amended return. If the amended return results in a balance due, the taxpayer must pay the additional tax by the due date to avoid penalties and interest.

Future Implications and Tax Reform

Vermont’s tax landscape is subject to ongoing changes and reforms. The state government periodically reviews and adjusts tax laws and regulations to ensure fairness, simplicity, and compliance with federal tax policies. These changes can impact tax rates, deductions, credits, and filing requirements.

For instance, in recent years, Vermont has implemented several tax reforms to promote economic growth and support low- and middle-income taxpayers. These reforms include expanding the earned income tax credit, introducing a property tax circuit breaker program, and reducing the state's reliance on sales tax revenue.

Staying informed about these changes is crucial for taxpayers to ensure compliance and take advantage of any new benefits or deductions. The Vermont Department of Taxes website is a valuable resource for staying up-to-date on tax law changes and understanding their implications.

How do I register my business for tax purposes in Vermont?

+To register your business for tax purposes in Vermont, you must obtain the necessary licenses and permits from the Vermont Secretary of State. Visit their website for detailed information on the registration process. Additionally, you must register with the Vermont Department of Taxes to obtain a tax account number. The Department of Taxes website provides comprehensive guides and instructions for business registration.

What are the common deductions and credits available for Vermont taxpayers?

+Vermont taxpayers can take advantage of various deductions and credits to reduce their taxable income. Common deductions include the standard deduction, personal exemptions, and dependent deductions. Additionally, there are credits available for education expenses, property taxes, and renewable energy investments. The Vermont Department of Taxes website provides detailed information on these deductions and credits, including eligibility criteria and calculation methods.

Can I file my Vermont tax return electronically, and what are the benefits?

+Yes, Vermont offers electronic filing (e-filing) as a preferred method for filing tax returns. E-filing is faster, more secure, and reduces the risk of errors compared to paper filing. The Department of Taxes provides an online filing system, MyTax, which guides taxpayers through the e-filing process. Benefits of e-filing include quicker processing times, the ability to track the status of your return, and automatic calculations to ensure accuracy.

What happens if I miss the tax filing deadline in Vermont?

+If you miss the tax filing deadline in Vermont, you may be subject to penalties and interest. The standard penalty for late filing is 5% of the unpaid tax for each month or part of a month the tax remains unpaid, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax at a rate of 1% per month until the tax is paid in full. However, taxpayers can apply for an extension to file their tax returns, which provides an additional six months to file.

How can I stay updated on changes to Vermont’s tax laws and regulations?

+To stay updated on changes to Vermont’s tax laws and regulations, it’s essential to regularly visit the Vermont Department of Taxes website. The website provides comprehensive information on tax law changes, including amendments to tax rates, deductions, credits, and filing requirements. Additionally, taxpayers can subscribe to the Department’s email notifications or follow their social media accounts to receive updates directly.