Ma State Sales Tax

In Massachusetts, sales tax is an important aspect of the state's revenue generation and plays a significant role in the economy. Understanding the state sales tax rates, their application, and the impact on businesses and consumers is crucial for anyone living or doing business within the state's borders. This comprehensive guide will delve into the intricacies of Massachusetts' sales tax system, providing valuable insights and clarity on this essential topic.

Massachusetts Sales Tax: An Overview

Massachusetts, like many other states, imposes a sales and use tax on the retail sale, lease, or rental of tangible personal property and certain services. This tax is administered by the Massachusetts Department of Revenue (DOR) and is a significant source of revenue for the state, funding various public services and infrastructure projects.

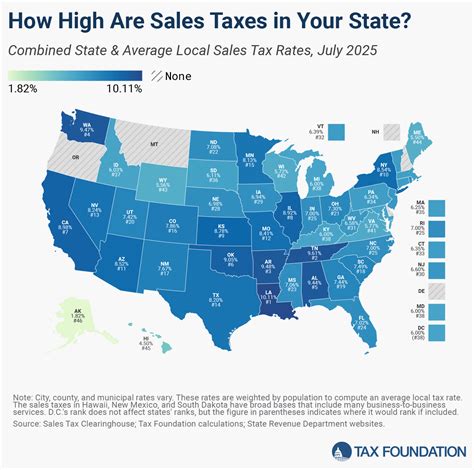

The state sales tax rate in Massachusetts is currently set at 6.25%, which is applicable to most retail transactions. This base rate, however, is just one piece of the sales tax puzzle in the state, as various exemptions, local additions, and special considerations come into play, making the tax system more complex.

Sales Tax Exclusions and Exemptions

Not all goods and services are subject to the standard sales tax rate in Massachusetts. The state offers a range of exclusions and exemptions that can significantly impact the tax liability of businesses and consumers.

For instance, groceries, including food products and certain beverages, are exempt from sales tax, providing a significant relief to households. Other notable exemptions include sales to certain government entities, sales of prescription medications, and sales of certain medical equipment.

The state also offers sales tax holidays during specific periods, often aligned with back-to-school shopping or energy-efficient appliance purchases. During these holidays, certain categories of goods are exempt from sales tax, providing an incentive for consumers to make larger purchases.

Local Option Sales Tax

In addition to the state sales tax, many cities and towns in Massachusetts impose a Local Option Sales Tax (LOST). This additional tax rate varies across municipalities and can significantly increase the total sales tax burden for consumers. For example, the city of Boston imposes a 1.5% LOST on top of the state sales tax, resulting in a combined rate of 7.75% for consumers shopping within city limits.

The LOST is often used by local governments to fund specific projects or services, such as transportation infrastructure or public safety initiatives. It is important for businesses and consumers to be aware of these local variations to accurately calculate their tax liabilities.

Sales Tax Registration and Compliance

Businesses operating in Massachusetts or selling goods into the state are required to register with the DOR and obtain a sales and use tax permit. This permit allows businesses to collect and remit sales tax on behalf of the state.

The registration process involves providing detailed information about the business, including its legal structure, location, and the types of goods and services it offers. Once registered, businesses are assigned a unique identification number and are responsible for complying with all sales tax regulations.

Sales Tax Filing and Remittance

Sales tax in Massachusetts is generally collected by the seller at the point of sale and is due to the state on a periodic basis. The frequency of filing and remittance can vary depending on the size and sales volume of the business. Most businesses are required to file and remit sales tax on a monthly or quarterly basis.

The filing process involves submitting a sales tax return, which details the total sales, applicable tax rates, and any applicable exemptions or deductions. The return is accompanied by the remittance of the collected sales tax, which is due to the state by a specific deadline.

Sales Tax Audits and Enforcement

The DOR conducts audits to ensure compliance with sales tax regulations. These audits can be random or targeted, depending on various factors such as business size, sales volume, and industry sector. During an audit, the DOR may review sales records, tax returns, and other relevant documents to verify the accuracy of reported sales and tax liabilities.

Non-compliance with sales tax regulations can result in penalties and interest charges. In some cases, the DOR may also pursue legal action against businesses that consistently underreport sales or fail to remit taxes.

Impact on Businesses and Consumers

The sales tax system in Massachusetts has a significant impact on both businesses and consumers. For businesses, the sales tax can affect pricing strategies, competitiveness, and cash flow management. The need to collect, report, and remit sales tax adds an administrative burden, especially for smaller businesses.

Consumers, on the other hand, bear the direct brunt of the sales tax in the form of higher prices. The tax can significantly impact their purchasing power, especially for large ticket items or frequent purchases. However, the exemptions and tax holidays can provide some relief and encourage spending during specific periods.

Competitive Landscape

The sales tax system can also influence the competitive landscape within the state. Businesses located in areas with higher combined sales tax rates may face challenges in attracting customers, especially if there are competing businesses in lower-tax regions. This can lead to a concentration of businesses in certain areas and a potential loss of business for others.

Future Implications and Potential Changes

The sales tax system in Massachusetts, like in many other states, is subject to ongoing discussions and potential reforms. There are several factors that could influence future changes to the sales tax rates or structure.

Economic Considerations

The state’s economic health and revenue needs are key factors in any sales tax discussions. If the state faces budgetary shortfalls or economic downturns, there may be pressure to increase sales tax rates to generate more revenue. Conversely, during periods of economic growth, there may be calls to reduce or stabilize rates to encourage spending and investment.

Political Landscape

Political factors can also play a significant role in sales tax decisions. The political climate and the priorities of elected officials can influence whether sales tax rates are increased, decreased, or maintained. Additionally, the views and preferences of voters and special interest groups can shape the sales tax debate.

Technological Advances

The rise of e-commerce and online sales has presented new challenges for sales tax collection and compliance. Massachusetts, like many states, is exploring ways to adapt its sales tax system to ensure it can effectively capture tax revenues from online transactions. This may involve new regulations or partnerships with online marketplaces.

Conclusion

Massachusetts’ sales tax system is a complex interplay of state and local taxes, exemptions, and special considerations. Understanding this system is crucial for businesses and consumers alike, as it impacts pricing, competitiveness, and the overall economic landscape of the state. While the current sales tax rates and regulations provide a solid framework, the future of the sales tax system in Massachusetts is likely to be shaped by a combination of economic, political, and technological factors.

What is the current sales tax rate in Massachusetts for online purchases?

+

Massachusetts imposes the same sales tax rate on online purchases as it does on in-store transactions. This means that the standard sales tax rate of 6.25% applies to most online purchases made within the state. However, it’s important to note that certain online retailers may be required to collect and remit this tax, while others may not. It’s always advisable to check with the specific retailer or consult the Massachusetts Department of Revenue for more information.

Are there any upcoming changes to the sales tax rates in Massachusetts?

+

As of my last update in January 2023, there were no announced plans to change the sales tax rates in Massachusetts. However, it’s important to stay informed as sales tax regulations can be subject to change. It’s always a good idea to periodically check with the Massachusetts Department of Revenue or consult a tax professional for the most up-to-date information.

How can businesses ensure they are compliant with sales tax regulations in Massachusetts?

+

Businesses operating in Massachusetts should register with the Department of Revenue and obtain a sales and use tax permit. They should also stay updated on any changes to sales tax regulations and ensure they are properly collecting, reporting, and remitting sales tax. It’s beneficial to consult tax professionals or utilize reliable tax compliance software to ensure compliance.