Spartanburg County Sc Tax Office

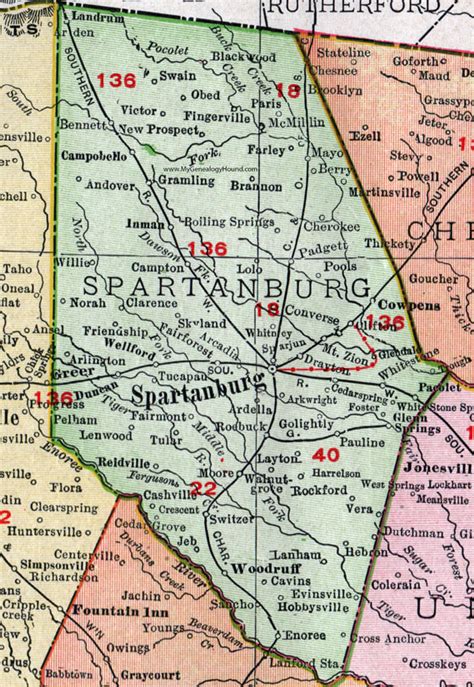

Nestled in the heart of South Carolina, Spartanburg County is a vibrant region known for its thriving businesses, diverse communities, and picturesque landscapes. At the heart of its administrative operations lies the Spartanburg County Tax Office, a pivotal entity responsible for managing property taxes and facilitating efficient tax-related services for residents and businesses alike. This article aims to delve into the intricacies of the Spartanburg County Tax Office, shedding light on its operations, services, and impact on the local community.

The Role of the Spartanburg County Tax Office

The Spartanburg County Tax Office stands as a critical hub for the assessment, collection, and distribution of property taxes within the county. It operates under the purview of the Spartanburg County government, playing a pivotal role in funding essential public services, including education, infrastructure development, and emergency response systems. The office’s primary mandate is to ensure fair and accurate taxation, contributing significantly to the overall financial stability and growth of the county.

The tax office is headed by the Spartanburg County Tax Assessor, an elected official tasked with overseeing property assessments and maintaining transparency in the taxation process. This office also houses a dedicated team of professionals, including appraisers, accountants, and customer service representatives, who collectively strive to provide efficient and accessible tax-related services to the community.

Property Assessment and Taxation Process

At the core of the Spartanburg County Tax Office’s operations is the intricate process of property assessment and taxation. Here’s a step-by-step breakdown of how this process typically unfolds:

Property Appraisal

The journey towards property taxation begins with a comprehensive appraisal process. Certified appraisers from the tax office conduct thorough inspections of each property within the county. These inspections consider various factors, such as the property’s size, location, condition, and recent sales data of comparable properties, to determine a fair market value. This value forms the basis for subsequent tax calculations.

Tax Rate Determination

Once the assessed value of a property is established, the tax office applies the relevant tax rate to determine the property’s tax liability. The tax rate is set annually by the Spartanburg County Council, taking into account the budgetary needs of various public services and the overall economic climate. This rate is expressed as a millage rate, which represents the amount of tax per $1,000 of assessed property value.

Tax Bill Generation

Based on the assessed value and the applicable tax rate, the tax office generates tax bills for each property owner. These bills are typically sent out annually and include the property’s assessed value, the tax rate, and the total tax amount due. Property owners are provided with a clear breakdown of how their tax liability was calculated, fostering transparency and accountability in the taxation process.

Payment Options and Deadlines

The Spartanburg County Tax Office offers a range of convenient payment options, including online payments, mail-in payments, and in-person payments at the tax office. Property owners are encouraged to adhere to the specified payment deadlines to avoid late fees and penalties. The tax office also provides flexibility by allowing taxpayers to pay their taxes in installments, easing the financial burden for some property owners.

Services Offered by the Spartanburg County Tax Office

Beyond the assessment and collection of property taxes, the Spartanburg County Tax Office provides a suite of essential services to enhance transparency, efficiency, and accessibility for taxpayers.

Online Tax Services

Recognizing the importance of digital accessibility, the tax office has embraced technology to offer a range of online services. Property owners can access their tax records, view their current and past tax bills, and make payments securely online. This platform also provides real-time updates on tax due dates, penalty information, and any relevant tax-related announcements, keeping taxpayers well-informed.

Tax Relief Programs

The Spartanburg County Tax Office is committed to supporting local residents and businesses by offering various tax relief programs. These programs aim to ease the tax burden for eligible individuals and entities, ensuring that property ownership remains accessible and sustainable. Some of the notable relief programs include the Homestead Exemption, which reduces property taxes for primary homeowners, and the Veterans Exemption, which provides tax relief to honorably discharged veterans.

Tax Appeals and Grievance Process

Understanding that property assessments are not always without dispute, the tax office has established a formal appeals process. Property owners who believe their assessed value is inaccurate or unfair can file an appeal, presenting their case to the Board of Assessment Appeals. This board, comprising impartial members, carefully reviews each appeal, ensuring that taxpayers have a fair opportunity to challenge their assessments.

Community Outreach and Education

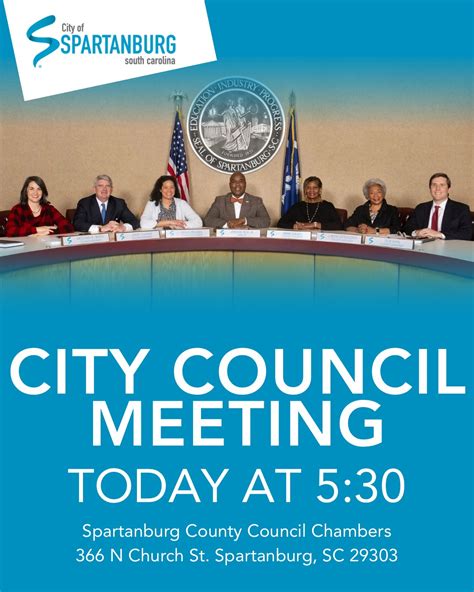

The Spartanburg County Tax Office actively engages with the community to foster understanding and trust in the taxation process. It organizes informational workshops, town hall meetings, and online webinars to educate taxpayers about their rights, responsibilities, and the overall taxation system. By demystifying the complexities of property taxation, the tax office empowers residents to actively participate in the democratic process and make informed decisions regarding their tax obligations.

Impact on the Spartanburg County Community

The operations and services of the Spartanburg County Tax Office have a profound impact on the local community, shaping its economic landscape and contributing to its overall well-being.

Funding Public Services

The tax revenues collected by the tax office are a vital source of funding for essential public services. These revenues support the local school districts, ensuring that students receive quality education. They also contribute to the maintenance and development of infrastructure, including roads, bridges, and public facilities, enhancing the overall quality of life for residents.

Economic Stability and Growth

The tax office’s fair and efficient taxation practices create a stable economic environment, attracting businesses and investors to the county. By providing reliable revenue streams, the tax office enables the county to plan and execute long-term economic development strategies, fostering job creation and economic growth. This, in turn, benefits the community by increasing employment opportunities and improving the overall financial health of the region.

Community Engagement and Trust

Through its commitment to transparency, accessibility, and community education, the Spartanburg County Tax Office has built a strong foundation of trust with its residents. By actively engaging with the community, addressing concerns, and providing clear and concise information, the tax office has earned the respect and cooperation of taxpayers. This collaborative relationship fosters a sense of civic duty and encourages active participation in the democratic process, strengthening the social fabric of the county.

Conclusion

The Spartanburg County Tax Office stands as a vital pillar of the local administration, playing a pivotal role in the financial health and well-being of the community. Through its meticulous assessment and taxation processes, coupled with a suite of accessible services, the tax office ensures that the county’s public services are adequately funded, fostering economic growth and stability. By embracing technology, offering tax relief programs, and engaging with the community, the tax office exemplifies best practices in local governance, earning the trust and cooperation of the residents it serves.

What is the contact information for the Spartanburg County Tax Office?

+The Spartanburg County Tax Office can be contacted via phone at (864) 596-2531 or through their official website: Spartanburg County Tax Office. The office is located at 366 N. Church Street, Spartanburg, SC 29303.

When are property taxes due in Spartanburg County?

+Property taxes in Spartanburg County are due by January 15th of each year. However, taxpayers have the option to pay their taxes in two installments, with the first installment due by January 15th and the second by June 15th. Late payments incur interest and penalties.

How can I appeal my property assessment in Spartanburg County?

+To appeal your property assessment, you must file an appeal with the Spartanburg County Board of Assessment Appeals within 30 days of receiving your tax bill. The appeal process involves submitting documentation and evidence to support your case. You can find more detailed information and the necessary forms on the Spartanburg County website.