Faulkner County Tax Collector

In the heart of Arkansas, Faulkner County stands as a bustling hub, and at the center of its financial operations lies the pivotal role of the Faulkner County Tax Collector.

The Role and Responsibilities of the Faulkner County Tax Collector

The Faulkner County Tax Collector, an integral part of the county’s administration, plays a multifaceted role in managing the county’s financial affairs. Their primary duty is to collect various taxes and fees on behalf of the county government, ensuring a steady revenue stream for essential public services.

The tax collector's office is responsible for the efficient and accurate collection of property taxes, vehicle registration fees, and other miscellaneous taxes. This involves maintaining an up-to-date database of taxpayers, assessing the correct tax liabilities, and facilitating timely payments.

Property Tax Collection

Property taxes form a significant portion of the county’s revenue. The Faulkner County Tax Collector’s office carefully evaluates the taxable value of properties within the county, taking into account factors such as location, improvements, and market conditions. Property owners are then notified of their tax liabilities, with payments due by a specified deadline.

To facilitate easy payment, the tax collector's office offers various payment methods, including online payment portals, in-person transactions, and mail-in options. Late payments are subject to penalties and interest, as outlined in the county's tax code.

| Tax Type | Collection Period | Payment Methods |

|---|---|---|

| Property Tax | Twice a year (typically) | Online, In-Person, Mail |

| Vehicle Registration Fee | Annually | Online, In-Person, Mail |

| Miscellaneous Taxes | Varies | Dependent on tax type |

Vehicle Registration and Fees

Vehicle registration and associated fees are another critical responsibility of the Faulkner County Tax Collector. Vehicle owners must register their vehicles annually, paying the requisite fees to keep their registration valid. The tax collector’s office ensures that all registered vehicles meet the necessary standards and are correctly classified for taxation purposes.

In addition to the registration fee, vehicle owners may also be subject to additional taxes based on the value of their vehicle or other specific factors. These taxes contribute to the county's infrastructure development and maintenance.

Miscellaneous Taxes and Fees

The Faulkner County Tax Collector’s responsibilities extend beyond property and vehicle taxes. They also collect a range of miscellaneous taxes and fees, including but not limited to:

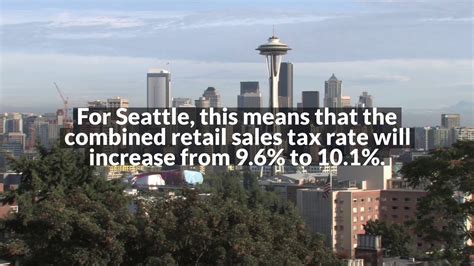

- Sales and use taxes

- Business license fees

- Special assessment taxes

- Hunting and fishing license fees

- Estate taxes

Each of these taxes serves a specific purpose, whether it's supporting local businesses, funding conservation efforts, or maintaining public infrastructure.

The Impact and Importance of the Faulkner County Tax Collector

The Faulkner County Tax Collector’s office is a linchpin of the county’s financial health and stability. The revenue collected by this office is vital for funding a wide array of public services and initiatives, including:

- Education: Funding for schools, teacher salaries, and educational resources.

- Public Safety: Supporting the county's police, fire, and emergency services.

- Infrastructure: Maintaining roads, bridges, and other public works.

- Health and Social Services: Providing essential healthcare and social support programs.

- Economic Development: Investing in initiatives to attract businesses and boost the local economy.

In addition to revenue collection, the tax collector's office also plays a role in ensuring compliance with tax laws and regulations. They work closely with other county departments, such as the Assessor's Office and the Treasurer's Office, to ensure a seamless and efficient tax process.

Furthermore, the tax collector's office provides valuable assistance to taxpayers, offering guidance on tax payments, answering queries, and resolving issues related to tax liabilities. Their commitment to transparency and taxpayer education fosters a positive relationship between the county government and its residents.

Future Initiatives and Innovations

As technology advances and tax systems evolve, the Faulkner County Tax Collector’s office is continually seeking ways to improve its services. Some of the potential future initiatives include:

- Implementing a more robust online payment system, offering a secure and convenient way for taxpayers to manage their accounts.

- Exploring the use of blockchain technology to enhance data security and transparency in tax records.

- Integrating artificial intelligence for more accurate and efficient tax assessments and collections.

- Expanding outreach and education programs to ensure all taxpayers are aware of their rights and responsibilities.

By embracing these innovations, the Faulkner County Tax Collector aims to enhance taxpayer satisfaction, streamline operations, and maintain the county's financial health.

Conclusion

The Faulkner County Tax Collector stands as a cornerstone of the county’s governance, ensuring the smooth collection of taxes and fees that fund essential public services. Their dedication to efficiency, transparency, and taxpayer support is crucial to the county’s prosperity and development. As the county moves forward, the tax collector’s office will continue to adapt and innovate, maintaining its vital role in the community.

How can I pay my property taxes in Faulkner County?

+Faulkner County offers several payment methods for property taxes. You can pay online through the county’s website, in person at the Tax Collector’s office, or by mailing a check to the specified address. Late payments are subject to penalties and interest.

What are the deadlines for vehicle registration in Faulkner County?

+Vehicle registration in Faulkner County is an annual process. The specific deadline for your registration renewal depends on the last digit of your vehicle’s license plate. It’s important to stay updated on these deadlines to avoid late fees and penalties.

How can I get assistance with my tax liabilities or queries?

+The Faulkner County Tax Collector’s office provides dedicated support to taxpayers. You can visit their office during business hours, call their helpline, or send an email. They offer guidance on tax payments, assessments, and any other tax-related concerns you may have.