What Is The Ma State Sales Tax

When discussing the state sales tax in Massachusetts, we delve into the intricate world of state revenue systems and consumer taxation. Understanding the intricacies of sales tax is essential for both businesses and individuals operating within the state, as it significantly impacts financial planning and overall economic activity.

The Massachusetts Sales Tax Landscape

Massachusetts, like many other states in the U.S., imposes a sales and use tax on the sale of tangible personal property and certain services. The primary purpose of this tax is to generate revenue for state and local governments, funding essential public services and infrastructure.

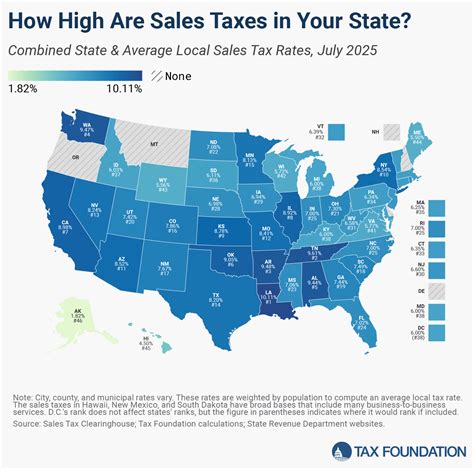

As of [Last Updated Date], the state sales tax rate in Massachusetts stands at 6.25%, which is applied to the sale of most goods and certain services. This rate, often referred to as the "combined rate," represents the uniform sales tax rate across the state, excluding any potential local add-on taxes that may be applicable in certain jurisdictions.

It's crucial to note that while the state sales tax rate is consistent, local governments within Massachusetts have the authority to levy additional sales taxes. These local add-on taxes, also known as "municipal taxes," can vary significantly, resulting in a wide range of sales tax rates across different cities and towns.

Examples of Local Sales Tax Variations

To illustrate the diversity in sales tax rates, consider the following examples of actual sales tax rates in some Massachusetts cities:

| City/Town | Sales Tax Rate |

|---|---|

| Boston | 6.625% |

| Cambridge | 6.75% |

| Springfield | 7.00% |

| Worcester | 6.25% |

As seen in the table, the actual sales tax rate can vary significantly, with some cities surpassing the state sales tax rate by more than a percentage point. These local variations highlight the importance of understanding the specific sales tax rate applicable to a particular location within Massachusetts.

Sales Tax Exemptions and Special Considerations

While the majority of tangible personal property and certain services are subject to the Massachusetts sales tax, there are specific exemptions and special considerations that can reduce or eliminate the tax liability.

Exemptions

The state of Massachusetts offers exemptions for certain goods and services, including:

- Prescription medications

- Food items for home consumption

- Clothing and footwear under a certain value

- Certain agricultural products

- Newspaper and magazine subscriptions

It's essential to note that these exemptions are subject to specific criteria and may not apply universally. For instance, while clothing and footwear are generally exempt up to a certain value, this exemption may not apply to luxury items or specialty footwear.

Special Considerations

In addition to exemptions, Massachusetts has implemented several special considerations to encourage specific economic activities or support particular industries. These include:

- Early Sales Tax Payment Program: This program allows businesses to prepay their sales tax liability, providing a discount on the total amount due. It’s designed to improve cash flow management for businesses and reduce the state’s administrative costs.

- Sales Tax Holidays: Massachusetts occasionally offers sales tax holidays, typically during back-to-school or holiday seasons. During these periods, specific categories of goods are exempt from sales tax, encouraging consumer spending and providing a temporary boost to the economy.

Sales Tax Collection and Compliance

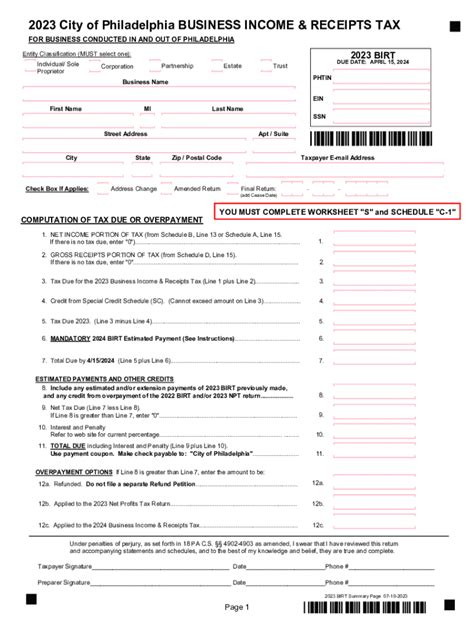

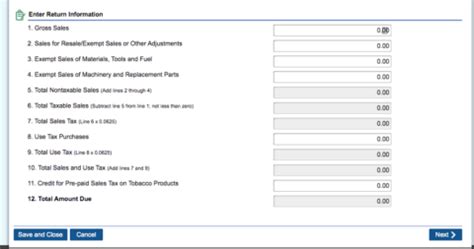

The responsibility of collecting and remitting sales tax falls on the seller, known as the “vendor” in Massachusetts. Vendors are required to register with the Massachusetts Department of Revenue and obtain a sales tax permit. This permit authorizes the vendor to collect and remit sales tax on behalf of the state.

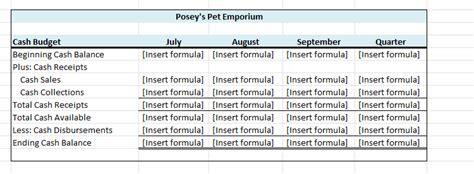

Sales tax collection and remittance processes can vary depending on the type of business and the frequency of sales. For most businesses, sales tax is collected at the point of sale and remitted to the state on a monthly or quarterly basis. Larger businesses or those with complex operations may be required to remit sales tax more frequently.

Compliance with sales tax regulations is critical for businesses. Failure to collect and remit sales tax accurately can result in significant penalties, interest charges, and potential legal consequences. The Massachusetts Department of Revenue conducts regular audits to ensure compliance, and businesses are advised to maintain accurate records and seek professional advice when necessary.

Remote Sellers and Sales Tax Nexus

With the rise of e-commerce, the concept of “sales tax nexus” has become increasingly important. Sales tax nexus refers to the connection or presence a business has within a state that triggers the obligation to collect and remit sales tax. In Massachusetts, remote sellers, or those with no physical presence in the state, may still have sales tax nexus if they meet certain criteria, such as having a certain level of sales or transactions within the state.

Remote sellers with sales tax nexus in Massachusetts are required to register with the Department of Revenue, collect and remit sales tax on their Massachusetts sales, and comply with the same regulations as in-state businesses. This ensures a level playing field for all businesses operating within the state, regardless of their physical location.

Conclusion

Understanding the Massachusetts sales tax landscape is essential for businesses and consumers alike. The state’s sales tax system, with its uniform state rate and varying local add-ons, provides a complex yet crucial framework for generating revenue and funding public services. By comprehending the sales tax rates, exemptions, and compliance requirements, businesses can ensure accurate tax collection and remittance, while consumers can make informed purchasing decisions.

Staying informed about sales tax regulations and seeking professional guidance when necessary are key steps toward maintaining compliance and financial health. As the economic landscape continues to evolve, especially in the digital age, staying abreast of changes in sales tax laws and practices is more important than ever.

What happens if I make a mistake in my sales tax calculations or payments?

+

If you make a mistake in your sales tax calculations or payments, it’s important to correct the error as soon as possible. The Massachusetts Department of Revenue provides guidance on how to handle such situations. You may need to file an amended return and pay any additional tax due, along with any applicable penalties and interest. It’s always a good idea to consult with a tax professional to ensure you are handling the situation correctly.

Are there any online resources or tools to help calculate sales tax in Massachusetts?

+

Yes, there are several online tools and calculators available to assist with sales tax calculations in Massachusetts. The Massachusetts Department of Revenue provides a Sales Tax Calculator on its official website. This calculator allows you to input the total sale amount and the location of the sale to determine the applicable sales tax rate. Additionally, there are numerous third-party websites and apps that offer sales tax calculators for Massachusetts and other states.

How often do sales tax rates change in Massachusetts?

+

Sales tax rates in Massachusetts are relatively stable, and changes are not frequent. However, it’s important to stay updated on any potential changes, as they can impact your business or personal finances. The state’s sales tax rate has remained at 6.25% for several years, but local add-on taxes may change from time to time. It’s advisable to check the official websites of the Massachusetts Department of Revenue and your local government for the most current information on sales tax rates.

Are there any sales tax filing requirements for small businesses with low sales volumes in Massachusetts?

+

Yes, even small businesses with low sales volumes in Massachusetts are generally required to register for sales tax and file returns. The specific requirements may vary depending on the nature of your business and your sales volume. The Massachusetts Department of Revenue provides resources and guidelines to help small businesses understand their sales tax obligations. It’s recommended to consult these resources or seek professional advice to ensure compliance.