Commercial Tax Officer Jobs

The role of a Commercial Tax Officer is a vital position within the tax administration and revenue collection systems of many countries. These professionals play a crucial role in ensuring compliance with commercial tax laws, regulating business activities, and generating government revenue. With a focus on integrity, accuracy, and efficiency, Commercial Tax Officers contribute to the overall economic stability and growth of a nation.

In this article, we will delve into the world of Commercial Tax Officers, exploring their responsibilities, the skills required for the job, the application process, and the benefits of pursuing a career in this field. By the end of this comprehensive guide, you'll have a thorough understanding of what it takes to become a Commercial Tax Officer and the impact they have on the economic landscape.

The Role and Responsibilities of a Commercial Tax Officer

Commercial Tax Officers are responsible for enforcing and administering a wide range of taxes levied on businesses and commercial activities. These taxes may include income tax, sales tax, value-added tax (VAT), corporate tax, and other levies specific to the jurisdiction they operate in. Their duties are diverse and critical to the smooth functioning of a country’s tax system.

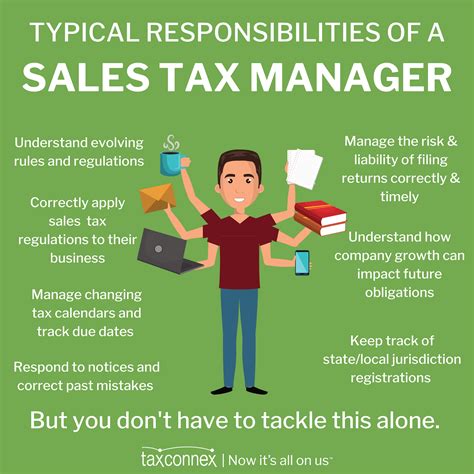

Key responsibilities of a Commercial Tax Officer include:

- Tax Assessment: Officers are tasked with assessing the tax liabilities of businesses, ensuring that the correct amount of tax is paid. This involves evaluating financial records, conducting audits, and verifying the accuracy of tax returns.

- Tax Collection: They are responsible for collecting taxes from businesses, which often involves setting up payment plans, negotiating with delinquent taxpayers, and taking enforcement actions when necessary.

- Compliance and Enforcement: Commercial Tax Officers play a pivotal role in promoting tax compliance. They educate businesses on their tax obligations, investigate potential tax evasion, and take legal actions against non-compliant taxpayers.

- Research and Analysis: Officers often conduct research to stay updated on tax laws and regulations. They analyze trends in tax evasion and non-compliance to develop strategies for improvement.

- Stakeholder Engagement: Engaging with businesses, tax advisors, and other stakeholders is crucial. Officers must maintain professional relationships, provide guidance, and resolve tax-related issues efficiently.

The work of Commercial Tax Officers contributes significantly to a country's fiscal health and stability. Their efforts ensure that businesses pay their fair share of taxes, which in turn funds public services, infrastructure, and social programs.

Skills and Qualifications for Commercial Tax Officer Jobs

The role of a Commercial Tax Officer demands a unique skill set and a specific set of qualifications. Here are some of the key attributes that employers typically look for in candidates:

- Education and Training: A bachelor’s degree in accounting, finance, business, economics, or a related field is often a minimum requirement. Additionally, many Commercial Tax Officers pursue advanced certifications like the Chartered Accountant (CA) or Certified Public Accountant (CPA) designation to enhance their expertise.

- Technical Proficiency: Officers must be adept at using tax software and other technology to process tax returns, analyze financial data, and manage tax records efficiently.

- Analytical and Critical Thinking: The ability to analyze complex financial information, identify potential issues, and make informed decisions is crucial. Commercial Tax Officers must think critically to solve tax-related problems and ensure compliance.

- Communication Skills: Effective communication is essential. Officers must explain tax regulations, guide taxpayers, and negotiate with taxpayers who may have differing viewpoints. Strong written and verbal communication skills are a must.

- Attention to Detail: Given the intricate nature of tax laws and regulations, a high level of attention to detail is necessary. Officers must be able to spot discrepancies, errors, and potential tax evasion attempts.

- Ethical Behavior: Commercial Tax Officers handle sensitive financial information and have a responsibility to act with integrity and confidentiality. Adherence to ethical standards is non-negotiable.

- Time Management and Organization: The role often involves managing multiple tasks and deadlines. Excellent organizational skills and time management are essential to ensure that all responsibilities are met promptly.

Application Process and Career Path

The application process for Commercial Tax Officer jobs typically involves several stages, including submitting a detailed resume or curriculum vitae (CV), completing online assessments, and participating in interviews. Some jurisdictions may also require candidates to pass a background check and a drug test.

The career path of a Commercial Tax Officer offers opportunities for growth and specialization. With experience, officers can advance to senior positions, such as team leaders or supervisors, where they oversee the work of other officers and contribute to policy development.

Additionally, Commercial Tax Officers can pursue further education and certifications to enhance their skills and knowledge. This can lead to specialized roles in areas like international tax, transfer pricing, or tax policy, opening up global career prospects.

Benefits of a Career as a Commercial Tax Officer

Choosing a career as a Commercial Tax Officer comes with several advantages, including:

- Job Security: The role is essential to the functioning of a country’s tax system, providing a high level of job security. Commercial Tax Officers are in demand and play a critical role in government revenue collection.

- Competitive Salaries: Salaries for Commercial Tax Officers are often competitive, with opportunities for performance-based bonuses and increments.

- Work-Life Balance: The work environment is typically stable and offers a good work-life balance. Officers have regular working hours and are not often required to work long or erratic shifts.

- Professional Growth: The role provides opportunities for continuous learning and skill development. Commercial Tax Officers can specialize in various tax domains, expanding their expertise and career prospects.

- Impact on Society: Commercial Tax Officers have a direct impact on society by ensuring fair tax collection, which funds essential public services and contributes to the overall economic health of the country.

A career as a Commercial Tax Officer is rewarding, offering a unique opportunity to contribute to the economic stability and growth of a nation while enjoying competitive benefits and a stable work environment.

The Future of Commercial Tax Officer Jobs

The field of commercial tax is evolving rapidly, driven by technological advancements and changing tax policies. As a result, the role of Commercial Tax Officers is also transforming, with a growing emphasis on data analytics, artificial intelligence, and digital tax systems.

Here are some key trends and future implications for Commercial Tax Officer jobs:

- Digital Transformation: Tax authorities are increasingly adopting digital technologies to streamline tax processes. Commercial Tax Officers will need to adapt to these changes, learning new skills to navigate digital tax systems and analyze large datasets.

- Data Analytics: The use of data analytics is becoming crucial for identifying tax evasion, fraud, and non-compliance. Officers will be expected to have a strong understanding of data analysis techniques and tools.

- International Tax: With the rise of cross-border transactions and global businesses, Commercial Tax Officers may need to specialize in international tax laws and regulations. This expertise will be valuable in navigating the complex world of multinational taxation.

- Continuous Learning: The tax landscape is dynamic, with frequent changes in laws and regulations. Officers must commit to ongoing learning to stay updated and provide accurate guidance to taxpayers.

- Ethical Considerations: As tax authorities enhance their enforcement capabilities, Commercial Tax Officers must maintain high ethical standards. The role requires a strong sense of integrity and adherence to professional conduct guidelines.

In conclusion, the role of a Commercial Tax Officer is evolving to meet the challenges and opportunities of the digital age. While the core responsibilities remain critical to tax administration, officers must embrace new technologies and stay informed about changing tax laws to deliver effective and efficient services.

FAQ

What are the key qualifications for becoming a Commercial Tax Officer?

+A bachelor’s degree in a relevant field such as accounting, finance, or economics is typically required. Advanced certifications like CA or CPA can enhance your chances. Technical proficiency, analytical skills, and strong communication abilities are also essential.

What are the main duties of a Commercial Tax Officer?

+Key duties include tax assessment, collection, and compliance. Officers assess tax liabilities, collect taxes, promote compliance, and investigate tax evasion. They also engage with stakeholders and provide guidance on tax matters.

How can I prepare for a career as a Commercial Tax Officer?

+Start by obtaining a relevant degree and gaining practical experience through internships or entry-level tax positions. Consider pursuing advanced certifications like CA or CPA. Stay updated on tax laws and regulations, and develop strong analytical and communication skills.

What are the career growth opportunities for Commercial Tax Officers?

+With experience, Commercial Tax Officers can advance to senior positions, such as team leaders or supervisors. They can also specialize in areas like international tax, transfer pricing, or tax policy, leading to global career prospects.

How is the future of Commercial Tax Officer jobs shaping up?

+The future looks promising with a growing emphasis on digital transformation, data analytics, and international tax. Commercial Tax Officers will need to adapt to these changes and stay updated on evolving tax laws and regulations.