Madison County Property Tax Search

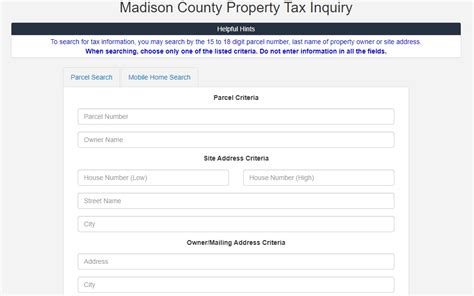

The Madison County Property Tax Search is an essential tool for homeowners, investors, and individuals interested in understanding the property tax landscape in Madison County. This online platform offers a convenient way to access detailed information about property taxes, assessments, and relevant data for any given property within the county. With a user-friendly interface, it provides transparency and accessibility, ensuring that residents and stakeholders can make informed decisions regarding their real estate holdings.

Navigating the Madison County Property Tax Search

The Madison County Property Tax Search portal is designed to be intuitive and efficient. Users can quickly locate specific properties by entering an address, parcel number, or even performing a general search by street name. The search results provide a comprehensive overview, including the property’s assessed value, tax history, and any relevant exemptions or special assessments.

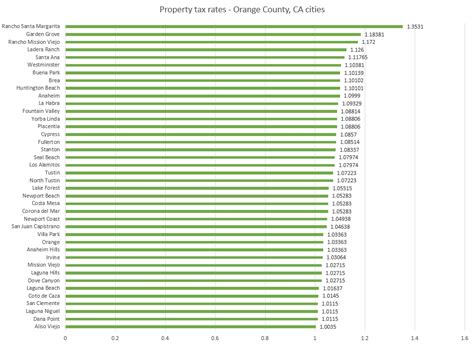

One of the standout features of this platform is its ability to offer a visual representation of property tax data. Users can view maps that highlight different tax zones and rates, providing a spatial understanding of how property taxes vary across the county. This visual tool is particularly beneficial for those considering real estate investments or comparing different neighborhoods.

Key Features and Benefits

- Real-Time Data: The platform is updated regularly, ensuring that users have access to the most current property tax information. This is crucial for staying informed about any changes or adjustments to tax rates or assessments.

- Detailed Reports: Users can generate customized reports for specific properties. These reports include historical tax data, assessment trends, and other pertinent details, offering a comprehensive analysis for property owners and potential buyers.

- Online Payment Portal: For convenience, the Madison County Property Tax Search integrates an online payment system. Property owners can settle their tax liabilities securely and efficiently without the need for physical visits to tax offices.

- Appeal Process Guidance: Recognizing that property owners may have concerns or disagreements with assessments, the platform provides resources and guidance on the appeal process. This ensures that taxpayers are aware of their rights and the steps to follow if they wish to challenge an assessment.

The Madison County Property Tax Search serves as a valuable resource for property owners, real estate professionals, and local government officials. By offering transparent and accessible tax information, the platform fosters a well-informed community and facilitates efficient property management and planning.

Case Study: The Impact on Real Estate Transactions

The implementation of the Madison County Property Tax Search has had a significant impact on the local real estate market. For instance, consider the experience of Mr. Johnson, a recent homebuyer in the county. With the help of the tax search platform, Mr. Johnson was able to make a more informed decision about his purchase.

By accessing the platform, Mr. Johnson could quickly verify the property's tax history, ensuring that there were no unexpected liabilities or discrepancies. He also utilized the visual mapping feature to compare tax rates in different neighborhoods, which played a crucial role in his decision to choose a specific area.

The transparency provided by the Madison County Property Tax Search not only benefited Mr. Johnson but also contributed to a more stable and predictable real estate market. Prospective buyers and investors can now make purchases with a clearer understanding of their financial obligations, leading to smoother transactions and reduced risks.

Comparative Analysis with Other Counties

In a comparative analysis, the Madison County Property Tax Search platform stands out for its user-friendly design and comprehensive features. While many counties offer similar online tax search tools, Madison County’s platform is praised for its intuitive navigation and the inclusion of visual mapping. This sets it apart from other counties that may rely solely on textual data presentation.

| Feature | Madison County | Other Counties |

|---|---|---|

| Visual Mapping | Yes | Limited or None |

| Real-Time Updates | Regularly Updated | Varies, Often Delayed |

| Appeal Process Resources | Detailed Guidance | Varies, Often Limited |

The table above highlights some of the key differences between Madison County's Property Tax Search and those of other counties. Madison County's platform is recognized for its proactive approach to providing resources and ensuring transparency, which enhances the user experience and empowers taxpayers.

Future Prospects and Innovations

As technology advances, the Madison County Property Tax Search is expected to evolve further. Potential future enhancements include integrating artificial intelligence for more accurate property value assessments and offering personalized tax projection tools. These innovations could streamline the tax assessment process and provide even greater convenience for taxpayers.

Additionally, the platform could explore partnerships with local real estate agencies and financial institutions to provide integrated services. This could involve seamless property tax information sharing during the home buying process, ensuring a smoother transition for new homeowners.

In conclusion, the Madison County Property Tax Search is a powerful tool that revolutionizes how property tax information is accessed and understood. By combining user-friendly design with comprehensive data, it empowers residents and stakeholders, fostering a more transparent and efficient real estate environment.

How often is the Madison County Property Tax Search updated with new data?

+The Madison County Property Tax Search is updated regularly, with data refreshed at least quarterly. This ensures that users have access to the most current property tax information.

Can I pay my property taxes online through this platform?

+Yes, the Madison County Property Tax Search integrates an online payment system. Property owners can securely pay their taxes online, providing a convenient and efficient alternative to traditional payment methods.

What if I disagree with the assessed value of my property?

+If you have concerns about your property’s assessed value, the Madison County Property Tax Search platform provides resources and guidance on the appeal process. This ensures that taxpayers are aware of their rights and the steps to challenge an assessment.