Covered California Tax Form

For individuals and families in California, understanding the ins and outs of health insurance and the associated tax forms can be a complex and often daunting task. One crucial element in this process is the Covered California Tax Form, which plays a vital role in claiming tax credits and ensuring compliance with the state's health insurance regulations. This article aims to provide a comprehensive guide to the Covered California Tax Form, shedding light on its purpose, requirements, and implications for policyholders.

Understanding the Covered California Tax Form

The Covered California Tax Form, officially known as the Advanced Premium Tax Credit (APTC) Reconciliation Form, is an integral part of the state’s health insurance system. It serves as a tool for individuals and families who have enrolled in a qualified health plan through the Covered California marketplace to claim and reconcile their Advanced Premium Tax Credits (APTCs) when filing their annual tax returns.

APTCs are a form of financial assistance provided by the government to help eligible individuals and families afford their health insurance premiums. These tax credits are advanced, meaning they are estimated and paid directly to the insurance company throughout the year to lower the monthly premium costs. At the end of the tax year, individuals are required to reconcile these credits through the Covered California Tax Form to ensure accuracy and avoid potential penalties.

The Covered California Tax Form is a critical step in the health insurance process, as it not only helps individuals manage their health insurance costs but also ensures compliance with the state's healthcare regulations. Failure to accurately complete and submit this form can lead to over- or under-payment of tax credits, which may result in unexpected tax bills or missed opportunities for financial assistance.

Eligibility and Requirements

Not everyone who enrolls in a health plan through Covered California is eligible for APTCs and, consequently, the Covered California Tax Form. Eligibility for APTCs is primarily based on income and household size. Generally, individuals and families with an annual household income between 100% and 400% of the Federal Poverty Level (FPL) may qualify for these tax credits.

For the 2024 tax year, the income thresholds for eligibility are as follows:

| Household Size | Income Range (100% FPL) | Income Range (400% FPL) |

|---|---|---|

| 1 | $14,280 - $57,120 | $14,280 - $57,120 |

| 2 | $19,240 - $76,960 | $19,240 - $76,960 |

| 3 | $24,200 - $96,800 | $24,200 - $96,800 |

| 4 | $29,160 - $116,640 | $29,160 - $116,640 |

| 5 | $34,120 - $136,480 | $34,120 - $136,480 |

| 6 | $39,080 - $156,320 | $39,080 - $156,320 |

| 7 | $44,040 - $176,160 | $44,040 - $176,160 |

| 8 | $49,000 - $196,000 | $49,000 - $196,000 |

It's important to note that these income ranges are adjusted annually to reflect changes in the cost of living and other economic factors. Additionally, certain life events, such as changes in household size or income, may impact eligibility and the amount of APTCs received. Covered California provides an online tool to help individuals estimate their potential eligibility and APTC amounts.

Income Verification

To ensure the accuracy of APTCs, Covered California requires individuals to verify their income. This is typically done by providing tax returns, pay stubs, or other official income documentation when initially applying for APTCs and again when reconciling them through the Covered California Tax Form.

Life Changes and Adjustments

Life events such as marriage, divorce, birth or adoption of a child, or changes in employment status can significantly impact income and household size. These changes may affect an individual’s eligibility for APTCs and the amount they receive. It is crucial for policyholders to report such life changes to Covered California promptly to ensure their APTCs are adjusted accordingly.

Completing the Covered California Tax Form

The process of completing the Covered California Tax Form can be straightforward for those familiar with tax forms and regulations. However, for many individuals, especially those who may not have a lot of experience with tax filings, it can be a daunting task. Here is a step-by-step guide to help navigate this process:

Step 1: Gather Necessary Information

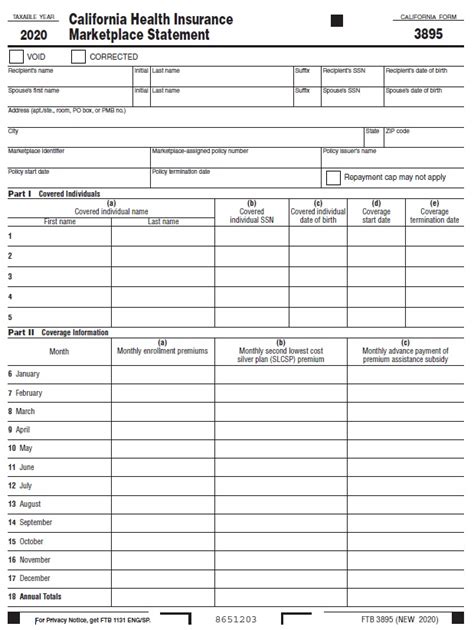

Before starting the form, gather all relevant documents and information. This includes your latest tax return, pay stubs, and any other income documentation. You will also need your Covered California account information, including your application number and household details.

Step 2: Access the Form

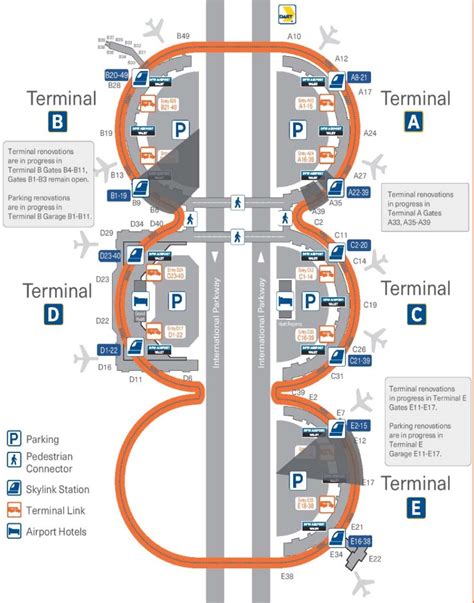

The Covered California Tax Form can be accessed through the Covered California website. You can either download a PDF version to fill out manually or complete it online through their secure portal.

Step 3: Complete the Form

The form will require you to provide details about your household, income, and health insurance coverage. Make sure to double-check all the information for accuracy. If you have any questions or uncertainties, Covered California provides a help center with detailed resources and contact information for further assistance.

Step 4: Submit the Form

Once you have completed the form, submit it through the Covered California portal or mail it to the address provided. It’s important to note that late submissions may result in penalties or the loss of APTCs for the upcoming year. Therefore, it is crucial to submit the form by the deadline, which is typically aligned with the federal tax filing deadline.

Implications and Considerations

The Covered California Tax Form is a critical component of the state’s health insurance system, offering financial assistance to eligible individuals and families. However, it also comes with certain implications and considerations that policyholders should be aware of.

Reconciliation and Potential Adjustments

As mentioned earlier, the Covered California Tax Form is used to reconcile the APTCs received throughout the year. This means that the actual amount of tax credits you are eligible for may differ from the estimated amount you received. If you received more APTCs than you were eligible for, you may need to repay the excess amount when filing your taxes. Conversely, if you received less, you may be eligible for an additional tax refund.

Impact on Tax Returns

Completing the Covered California Tax Form can significantly impact your annual tax return. It is essential to consult with a tax professional or use reliable tax preparation software to ensure accurate reporting of your APTCs and any other tax credits or deductions related to your health insurance coverage.

Late Filings and Penalties

Failing to complete and submit the Covered California Tax Form by the deadline can result in penalties. These penalties may include the loss of APTCs for the upcoming year or additional fees and interest on any taxes owed. It is crucial to stay on top of the filing deadlines and seek assistance if needed to avoid these consequences.

Life Changes and Reporting

As mentioned earlier, life changes can impact your eligibility for APTCs. It is vital to report these changes promptly to Covered California to ensure you continue to receive the correct amount of tax credits. Failure to report such changes may result in over- or under-payment of APTCs, which can lead to unexpected tax consequences.

Future Implications and Updates

The landscape of health insurance and tax regulations is constantly evolving. While the Covered California Tax Form remains a crucial component of the state’s health insurance system, there are ongoing efforts to simplify the process and enhance accessibility. Here are some potential future implications and updates to watch for:

Streamlined Processes

Covered California is continuously working to streamline the application and reconciliation processes. This may include the development of more user-friendly online platforms, improved guidance and resources, and potentially automated income verification processes to reduce the administrative burden on policyholders.

Policy Changes and Eligibility Criteria

Changes in state or federal policies can impact the eligibility criteria and the amount of APTCs available. It is essential to stay informed about any updates to the Affordable Care Act (ACA) or state-specific health insurance regulations. Covered California provides regular updates and resources on their website to keep policyholders informed about any changes that may affect their coverage and tax benefits.

Expanded Eligibility and Outreach

Efforts are underway to expand eligibility for APTCs and increase outreach to ensure that more individuals and families can access affordable health insurance. This may include adjustments to income thresholds, targeted outreach campaigns, and collaborations with community organizations to reach underserved populations.

Conclusion

The Covered California Tax Form is a critical tool for individuals and families enrolled in health plans through the Covered California marketplace. It allows eligible policyholders to claim and reconcile their Advanced Premium Tax Credits, making health insurance more affordable and accessible. While the process may seem complex, with the right guidance and resources, it can be successfully navigated. Covered California provides a wealth of resources and support to ensure policyholders can accurately complete and submit their tax forms, ultimately ensuring compliance with state health insurance regulations and maximizing their financial benefits.

FAQ

What happens if I don’t complete the Covered California Tax Form by the deadline?

+

Failing to complete and submit the Covered California Tax Form by the deadline can result in penalties. These penalties may include the loss of Advanced Premium Tax Credits (APTCs) for the upcoming year or additional fees and interest on any taxes owed. It is crucial to stay on top of the filing deadlines to avoid these consequences.

How do I know if I’m eligible for Advanced Premium Tax Credits (APTCs)?

+

Eligibility for APTCs is primarily based on income and household size. Generally, individuals and families with an annual household income between 100% and 400% of the Federal Poverty Level (FPL) may qualify. Covered California provides an online tool to help estimate eligibility and potential APTC amounts.

Can I complete the Covered California Tax Form online or do I need to mail it in?

+

The Covered California Tax Form can be completed and submitted either online through their secure portal or by downloading a PDF version and mailing it to the address provided. The online option may be more convenient and efficient, but the choice is up to the individual.

What if my income or household size changes during the year?

+

Life changes such as marriage, divorce, birth or adoption of a child, or changes in employment status can impact eligibility for APTCs. It is crucial to report such changes promptly to Covered California to ensure you continue to receive the correct amount of tax credits. Failure to report these changes may result in over- or under-payment of APTCs.

Are there any resources available to help me complete the Covered California Tax Form?

+

Covered California provides a comprehensive help center with detailed resources and contact information for further assistance. They also offer a specific guide for completing the Covered California Tax Form. Additionally, tax professionals and reliable tax preparation software can provide guidance and support throughout the process.