How To Get Old Tax Returns

Have you misplaced or lost your old tax returns and are now faced with the daunting task of retrieving them? Whether it's for personal record-keeping, financial planning, or addressing a tax-related issue, having access to past tax returns is crucial. This guide will walk you through the process of obtaining your old tax returns, offering a comprehensive step-by-step approach and valuable insights to ensure a smooth and efficient retrieval process.

Understanding the Importance of Tax Returns

Tax returns serve as a vital record of your financial history, providing crucial information about your income, deductions, and tax payments for a given year. They are essential for various reasons, including:

- Personal Financial Management: Tax returns help individuals keep track of their financial activities, expenses, and investments over time.

- Legal and Compliance: In many jurisdictions, retaining tax returns is a legal requirement for a specified period. They are often needed for audits, tax investigations, or to resolve disputes with tax authorities.

- Loan and Mortgage Applications: Lenders and financial institutions frequently request tax returns as part of the application process to assess an individual’s financial stability and creditworthiness.

- Planning for the Future: Past tax returns can guide future financial decisions, helping individuals understand their tax obligations and plan for potential deductions or credits.

Steps to Retrieve Your Old Tax Returns

The process of obtaining old tax returns can vary depending on your circumstances and the availability of records. Here’s a detailed guide to help you navigate this process:

1. Check Your Records

Before initiating a formal request, it’s essential to check your personal records and storage spaces. Tax returns are often filed away with other important documents, so a thorough search might yield positive results.

- Look through filing cabinets, storage boxes, and digital folders on your computer or cloud storage.

- If you’ve recently moved, ensure you’ve checked storage spaces at your previous residence.

- Consider using a digital document management system to organize and securely store your tax returns and other important files.

2. Contact Your Tax Professional

If you’ve sought professional tax preparation services in the past, your tax preparer might have retained copies of your tax returns. Contact them and inquire about the availability of past returns.

- Provide them with the specific years for which you need the tax returns.

- Discuss any associated fees for providing copies of the returns.

- Ensure you receive the returns in a secure and confidential manner.

3. Request Copies from the IRS

If you’re unable to locate your tax returns through personal records or your tax professional, you can request copies directly from the Internal Revenue Service (IRS). The IRS maintains records of filed tax returns for a specified period.

- Visit the IRS Get Transcript page to access your tax return information.

- You’ll need to provide personal details, including your Social Security Number (SSN), date of birth, and filing status.

- Choose the type of transcript you need: “Tax Return Transcript” provides most of the line entries of your tax return, while a “Tax Account Transcript” shows basic data, such as marital status, adjusted gross income, taxable income, and any refunds.

4. Utilize Third-Party Services

Various third-party services can assist in obtaining old tax returns. These services often have access to extensive databases and can retrieve returns for a fee.

- Research reputable tax return retrieval services online.

- Compare fees, turnaround times, and the scope of services offered.

- Ensure the service provider is legitimate and maintains data security and confidentiality.

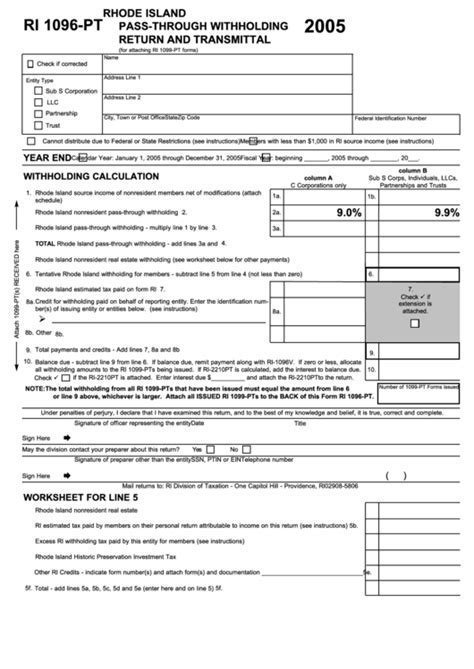

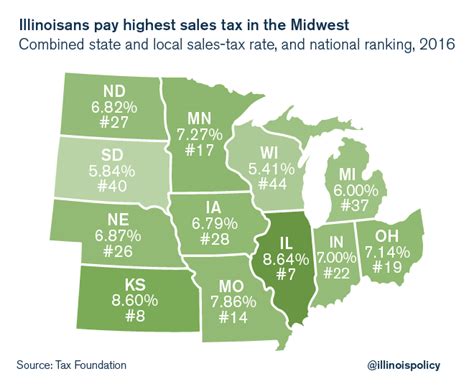

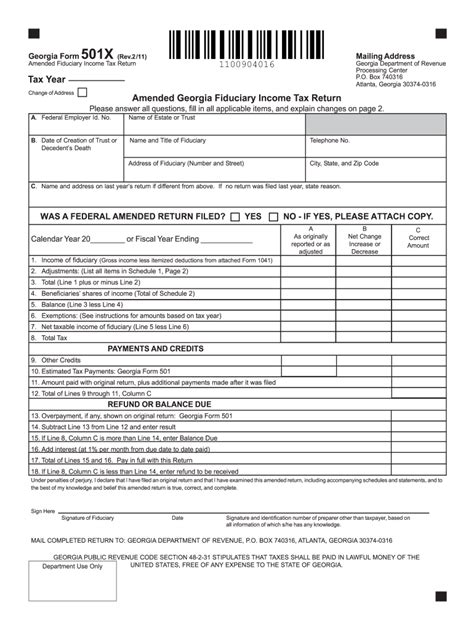

5. Explore State-Level Resources

Some states have their own tax return retrieval processes. Check with your state’s tax authority to see if they offer a similar service to the IRS’s “Get Transcript” program.

- Visit your state’s official tax website for information on how to request tax returns.

- Gather the necessary information, such as your state tax ID or Social Security Number, and the specific tax year(s) you require.

6. Consider Using Tax Software

If you’ve used tax preparation software in the past, check if the software provider offers a tax return retrieval feature.

- Log into your account with the software provider and look for an option to retrieve past tax returns.

- Some software might require a subscription or additional fees for this service.

Frequently Asked Questions (FAQs)

How long does the IRS keep tax return records?

+The IRS generally keeps tax returns for three years from the date they were filed or two years from the date the tax was paid, whichever is later. However, in cases of significant underreporting of income, the IRS can retain records for up to six years. For returns with no reported income, the IRS can keep records indefinitely.

What if I need tax returns from before the IRS retention period?

+If you require tax returns from a year that falls outside the IRS retention period, you may need to contact your tax preparer or use a third-party tax return retrieval service. These services can often access older records for a fee.

Can I retrieve tax returns if I filed them electronically (e-filed)?

+Yes, you can retrieve tax returns even if they were e-filed. The IRS has records of electronically filed returns, and you can access them through the “Get Transcript” service or by contacting the IRS directly.

How long does it take to receive tax return copies from the IRS?

+The IRS aims to provide tax return transcripts within 10 business days. However, during peak tax seasons or if there are any issues with your request, it may take longer. Consider using the IRS online retrieval service for faster access.

Are there any fees associated with retrieving tax returns from the IRS?

+The IRS does not charge a fee for retrieving tax return transcripts. However, if you require an actual copy of your tax return, there may be a fee involved. Always check the IRS website for the latest information on fees and services.

By following these steps and utilizing the available resources, you can efficiently retrieve your old tax returns. Remember to maintain secure storage practices for your tax documents to avoid future complications.