New Jersey Property Taxes

Welcome to an in-depth exploration of the complex world of property taxes in the state of New Jersey. As one of the most densely populated states in the nation, with a unique tax landscape, New Jersey's property tax system is a fascinating subject that impacts homeowners, investors, and businesses alike. In this comprehensive guide, we will delve into the intricacies of New Jersey property taxes, shedding light on how they work, why they are so high, and what strategies exist to manage and potentially reduce these taxes.

Understanding New Jersey Property Taxes

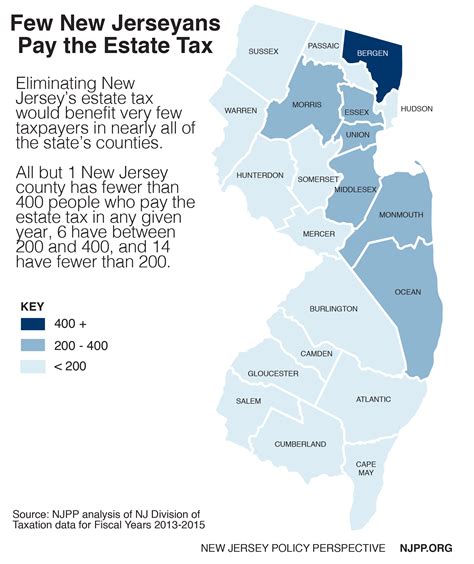

Property taxes in New Jersey are a primary source of revenue for local governments, school districts, and counties. These taxes fund essential public services such as education, emergency services, road maintenance, and other municipal operations. The state’s property tax system is known for its high rates, often ranking among the highest in the nation. Let’s break down the key aspects of this complex tax structure.

How Property Taxes are Calculated in New Jersey

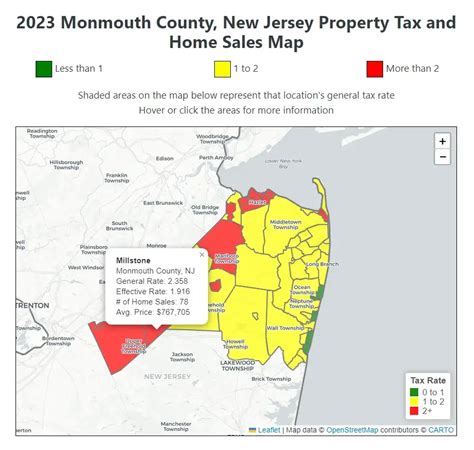

In New Jersey, property taxes are assessed based on the value of the property and the tax rate set by the local municipality. The property’s value is determined through a process called assessment, which takes into account factors like the property’s size, location, age, and recent sales data of similar properties in the area. This assessed value is then multiplied by the local tax rate to calculate the annual property tax bill.

| Property Value | Tax Rate | Annual Tax Bill |

|---|---|---|

| $300,000 | 2% | $6,000 |

| $500,000 | 1.8% | $9,000 |

| $750,000 | 2.2% | $16,500 |

The tax rate, which is expressed as a percentage, varies significantly across the state, with some municipalities having rates as low as 1% and others exceeding 3%. This variability is influenced by the specific needs and expenses of each local government and school district.

The High Cost of Property Taxes in New Jersey

New Jersey’s property taxes are notorious for being among the highest in the country. Several factors contribute to this reputation, including:

- High Cost of Living: New Jersey is known for its high cost of living, which translates to higher property values and, consequently, higher taxes.

- School Funding: A significant portion of property taxes goes towards funding local school districts. The state's commitment to providing quality education often results in higher taxes to support these initiatives.

- Municipal Services: The state's diverse range of municipalities, each with its own set of services and needs, can lead to higher tax rates to maintain and improve infrastructure.

- Property Assessments: Regular assessments, often done every year, can result in increased property values and subsequently higher taxes.

The average effective property tax rate in New Jersey is around 2.26%, which is nearly double the national average. This means that for every $100,000 of property value, homeowners can expect to pay over $2,200 in annual property taxes.

Managing and Reducing New Jersey Property Taxes

Given the high property tax rates in New Jersey, many homeowners and investors seek strategies to manage and potentially reduce their tax burden. Here are some effective approaches:

Appealing Property Assessments

Property owners have the right to appeal their property’s assessed value if they believe it is inaccurate or too high. This process, known as a tax assessment appeal, can result in a reduced assessed value and subsequently lower taxes. It’s important to note that the success of an appeal depends on various factors, including the strength of the evidence presented and the specific guidelines of the local municipality.

Utilizing Tax Abatement Programs

New Jersey offers several tax abatement programs aimed at promoting economic development and homeownership. These programs can provide significant tax savings for qualifying properties. For instance, the Urban Enterprise Zone Program offers a reduced sales tax rate for businesses located in designated zones, while the New Jersey Homeowner-Occupied Property Tax Deduction Program provides a deduction for homeowners based on their income and property tax liability.

Taking Advantage of Tax Credits

New Jersey provides various tax credits that can help reduce the overall tax burden. These credits include the Senior Freeze Program, which provides a property tax reimbursement to eligible senior citizens, and the FamilyCare Premium Assistance Program, which offers premium assistance for eligible families enrolled in the state’s FamilyCare health insurance program.

Exploring Tax Incentives for Renewable Energy

The state encourages the adoption of renewable energy sources through tax incentives. Homeowners who install solar panels, for example, can benefit from the Solar Renewable Energy Certificate (SREC) Program, which provides financial incentives based on the amount of solar energy produced. This not only reduces the property’s carbon footprint but can also lead to substantial tax savings.

The Impact of Property Taxes on the Real Estate Market

New Jersey’s high property taxes have a significant influence on the state’s real estate market. They can affect buying decisions, rental prices, and overall market dynamics. Here’s a deeper look at these impacts:

Buyer Considerations

When purchasing a property in New Jersey, potential buyers often factor in the property tax rates. High taxes can deter buyers, especially those on a tight budget or those who are sensitive to long-term financial commitments. As a result, properties in areas with lower tax rates tend to be more attractive to buyers.

Rental Market Dynamics

In the rental market, property taxes are often passed on to tenants through increased rent. Landlords must consider the tax burden when setting rental rates, which can lead to higher rents in areas with higher property taxes. This dynamic can impact the affordability of rental properties and influence tenant turnover rates.

Investment Strategies

Investors looking to buy and hold properties in New Jersey must carefully consider the impact of property taxes on their investment returns. Strategies such as tax-efficient financing, property upgrades to increase value, and exploring tax-advantaged investment structures can help mitigate the impact of high taxes.

Looking Ahead: The Future of New Jersey Property Taxes

As New Jersey continues to evolve, the state’s property tax landscape is also likely to undergo changes. Here are some potential future developments and their implications:

Potential Tax Reform

There have been ongoing discussions about tax reform in New Jersey, with proposals to cap property tax increases or implement a flat tax rate across the state. While these reforms could provide relief to taxpayers, they also present challenges, such as ensuring adequate funding for local governments and school districts.

Technological Innovations in Tax Assessment

Advancements in technology may lead to more efficient and accurate property assessments. Automated valuation models and machine learning algorithms could reduce the variability in assessments, potentially leading to more consistent and fair tax rates.

Population Trends and Urban Development

Changes in population distribution and urban development patterns can influence property values and tax rates. As certain areas experience growth and development, property values may increase, leading to higher taxes. Conversely, declining areas may see property values and taxes decrease.

Frequently Asked Questions

What is the average property tax rate in New Jersey?

+

The average effective property tax rate in New Jersey is approximately 2.26% as of 2023. This means that for every 100,000 of property value, homeowners can expect to pay around 2,260 in annual property taxes.

How can I appeal my property tax assessment in New Jersey?

+

To appeal your property tax assessment in New Jersey, you must file a formal appeal with your local tax assessor’s office. The process typically involves submitting documentation to support your claim, such as recent sales data of comparable properties in your area. It’s advisable to consult a tax professional or attorney for guidance.

Are there any tax abatement programs available in New Jersey?

+

Yes, New Jersey offers several tax abatement programs. These include the Urban Enterprise Zone Program, which provides a reduced sales tax rate for businesses in designated zones, and the New Jersey Homeowner-Occupied Property Tax Deduction Program, which offers a deduction for homeowners based on income and property tax liability.

How do property taxes impact the real estate market in New Jersey?

+

High property taxes in New Jersey can deter potential buyers, especially those on a tight budget. This can lead to slower sales and a shift in market dynamics. In the rental market, high property taxes often result in increased rents as landlords pass on the tax burden to tenants.

What are the potential future developments in New Jersey’s property tax landscape?

+

Potential future developments include tax reform proposals to cap property tax increases or implement a flat tax rate. Additionally, technological advancements in tax assessment may lead to more efficient and accurate assessments, potentially reducing variability in tax rates. Population trends and urban development patterns will also continue to influence property values and taxes.