Chartered Tax Advisor

In the world of finance and taxation, expertise and guidance are invaluable assets. Chartered Tax Advisors (CTAs) play a crucial role in navigating the complex landscape of tax regulations, offering their specialized knowledge to individuals and businesses alike. This comprehensive guide delves into the world of CTAs, exploring their qualifications, responsibilities, and the significant impact they have on financial decision-making.

The Role of a Chartered Tax Advisor

A Chartered Tax Advisor is a highly skilled professional who possesses in-depth knowledge of tax laws, regulations, and practices. Their primary role is to provide strategic tax advice and ensure compliance with relevant tax authorities. CTAs work closely with clients, understanding their financial circumstances and goals to devise tailored tax solutions.

The expertise of a CTA is particularly valuable in today's dynamic tax environment, where regulations are constantly evolving. With their up-to-date knowledge, CTAs help clients optimize their tax positions, minimize liabilities, and make informed financial decisions. Whether it's for personal wealth management or corporate tax planning, CTAs bring a level of precision and expertise that is essential in the modern financial landscape.

Qualifications and Credentials

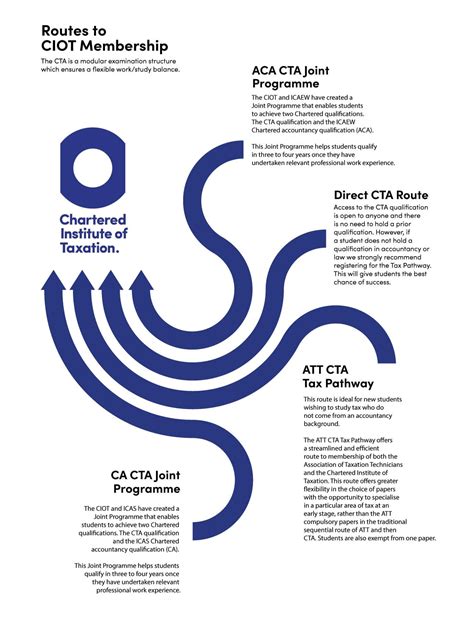

Becoming a Chartered Tax Advisor is a rigorous process that demands extensive education, training, and practical experience. In most jurisdictions, aspiring CTAs must undergo a comprehensive program of study, typically offered by professional bodies or universities, covering a broad range of tax-related topics.

The curriculum for CTA qualifications often includes modules on income tax, corporate tax, international tax, tax planning, and ethics. Students delve into the intricacies of tax legislation, learning how to interpret and apply complex tax laws. They also develop skills in research, analysis, and critical thinking, which are essential for navigating the ever-changing tax landscape.

Upon completing their academic studies, candidates are required to gain practical experience under the supervision of experienced CTAs. This on-the-job training provides an opportunity to apply theoretical knowledge to real-world scenarios, fostering a deep understanding of the practical aspects of tax advisory work.

To become fully qualified, candidates must also pass a series of rigorous examinations set by the relevant professional body. These exams assess not only the candidate's knowledge but also their ability to apply tax principles in complex scenarios. Successful completion of these exams, coupled with the required practical experience, leads to the coveted title of Chartered Tax Advisor.

| CTA Exam Topics | Description |

|---|---|

| Income Tax | Comprehensive understanding of personal income tax laws and regulations. |

| Corporate Tax | In-depth knowledge of corporate tax structures and strategies. |

| International Tax | Familiarity with cross-border tax issues and global tax planning. |

| Tax Research & Ethics | Skills in ethical tax research and advisory practices. |

Key Responsibilities and Services

Chartered Tax Advisors offer a wide range of services tailored to meet the diverse needs of their clients. Here are some of the key responsibilities and services they provide:

Tax Planning and Compliance

CTAs are experts in tax planning, helping clients structure their financial affairs to minimize tax liabilities. They ensure compliance with tax laws, regulations, and reporting requirements, guiding clients through the complexities of tax returns and other compliance obligations.

Personal Tax Management

For individuals, CTAs provide comprehensive personal tax management services. They assist with income tax returns, capital gains tax, inheritance tax planning, and pension tax optimization. By understanding their clients’ unique financial situations, CTAs offer tailored strategies to maximize tax efficiency.

Corporate Tax Advisory

In the corporate sector, CTAs play a vital role in tax strategy development. They advise businesses on tax-efficient structures, transfer pricing, international tax planning, and mergers and acquisitions. Their expertise helps corporations navigate complex tax landscapes and optimize their tax positions.

Specialist Tax Areas

CTAs often specialize in specific tax areas, such as property tax, trust and estate planning, or tax litigation. This specialization allows them to provide highly specialized advice and solutions to clients with unique tax requirements.

Tax Controversy and Resolution

In cases of tax disputes or controversies, CTAs act as advocates for their clients. They navigate the complex tax litigation process, representing clients before tax authorities and courts. Their expertise in tax law and negotiation skills help resolve tax issues favorably.

The Impact of Chartered Tax Advisors

The work of Chartered Tax Advisors has a significant impact on the financial well-being of individuals and businesses. By providing strategic tax advice, CTAs enable their clients to make informed financial decisions, optimize tax liabilities, and enhance their overall financial position.

For individuals, CTAs help manage personal wealth, ensuring compliance with tax laws while maximizing tax efficiency. This allows individuals to retain more of their hard-earned income, which can be reinvested in personal goals or used to enhance their quality of life.

In the corporate world, the impact of CTAs is equally profound. Their expertise in tax planning and strategy development helps businesses reduce their tax burden, freeing up resources that can be reinvested in growth, innovation, and job creation. Additionally, CTAs assist corporations in navigating complex tax regulations, ensuring compliance and mitigating the risk of penalties.

Moreover, CTAs play a crucial role in promoting economic growth and stability. By encouraging tax compliance and providing tax-efficient strategies, they contribute to a fair and sustainable tax system. This, in turn, supports government revenue generation, which is vital for funding public services and infrastructure development.

Future Trends and Developments

The field of tax advisory is continuously evolving, driven by changing economic landscapes, technological advancements, and evolving tax policies. Here are some key trends and developments that are shaping the future of Chartered Tax Advisors:

Digital Transformation

The tax industry is embracing digital technologies, with CTAs leveraging advanced software and analytics to enhance their services. Digital platforms streamline tax compliance processes, making it easier for clients to manage their tax affairs. Additionally, CTAs are utilizing data analytics to identify trends and patterns, providing more accurate and efficient tax planning.

Global Tax Reforms

The global tax landscape is undergoing significant reforms, with initiatives such as the OECD’s Base Erosion and Profit Shifting (BEPS) project aiming to address tax avoidance and ensure a fair global tax system. CTAs will need to stay abreast of these reforms to provide accurate and compliant advice to their clients.

Sustainability and Social Impact

There is a growing emphasis on sustainable and socially responsible tax practices. CTAs are increasingly advising clients on how to align their tax strategies with environmental, social, and governance (ESG) considerations. This trend is expected to gain momentum, shaping the future of tax advisory services.

Continuous Professional Development

To stay at the forefront of the industry, CTAs must commit to ongoing professional development. This includes staying updated on tax law changes, attending industry conferences and workshops, and pursuing advanced certifications. Continuous learning ensures that CTAs can provide the highest level of expertise and service to their clients.

Collaborative Approach

The future of tax advisory is likely to involve increased collaboration between CTAs and other professionals. Working alongside accountants, financial advisors, and legal experts, CTAs can offer a holistic approach to financial planning, ensuring that tax considerations are integrated into a client’s overall financial strategy.

How can I become a Chartered Tax Advisor?

+Becoming a CTA involves a rigorous process of education, training, and practical experience. It typically starts with obtaining a relevant degree in finance, accounting, or a related field. After graduation, candidates should pursue a professional qualification program offered by a recognized tax body, such as the Chartered Institute of Taxation. This program includes comprehensive studies and examinations on various tax topics. Candidates must also gain practical experience, often through internships or assistant roles, before they can apply for CTA status.

What are the benefits of hiring a Chartered Tax Advisor?

+Hiring a CTA offers numerous benefits. They provide expert advice on tax planning, compliance, and strategy, helping individuals and businesses optimize their tax positions and minimize liabilities. CTAs ensure compliance with complex tax laws, reducing the risk of penalties. Their services can lead to significant financial savings and enhanced financial well-being. Additionally, CTAs bring peace of mind by handling complex tax matters, allowing clients to focus on their core activities.

Are Chartered Tax Advisors in high demand?

+Yes, CTAs are in high demand due to the increasing complexity of tax laws and the need for specialized tax expertise. As tax regulations continue to evolve, businesses and individuals seek professionals who can navigate these complexities. The demand for CTAs is particularly strong in sectors with complex tax structures, such as international trade, mergers and acquisitions, and complex financial transactions. Their expertise is invaluable in ensuring compliance and optimizing tax strategies.

How do CTAs stay updated with changing tax laws and regulations?

+CTAs are committed to continuous professional development to stay updated with changing tax laws and regulations. They attend industry conferences, workshops, and seminars to learn about the latest tax developments. They also subscribe to professional publications and use online resources provided by tax authorities and professional bodies. Additionally, CTAs often collaborate with other professionals, sharing knowledge and insights to ensure they are providing the most accurate and up-to-date advice to their clients.

In conclusion, Chartered Tax Advisors are vital professionals in the financial industry, offering invaluable expertise and guidance in the complex world of taxation. With their rigorous qualifications, specialized knowledge, and commitment to continuous learning, CTAs help individuals and businesses navigate the ever-changing tax landscape, ensuring compliance, minimizing liabilities, and maximizing financial opportunities. As the field continues to evolve, the role of CTAs remains crucial, impacting not only financial decision-making but also contributing to a fair and sustainable society.