What Is Sales Tax In Virginia

Sales tax in Virginia is a vital aspect of the state's revenue generation and fiscal policy. It is a consumption tax imposed on the sale of goods and services within the state, with the primary purpose of generating funds for essential government services and infrastructure development. The sales tax rate in Virginia is relatively competitive compared to other states, making it an attractive feature for businesses and consumers alike. This article will delve into the specifics of sales tax in Virginia, exploring its rates, exemptions, collection processes, and its impact on the state's economy.

Sales Tax Rates and Structures

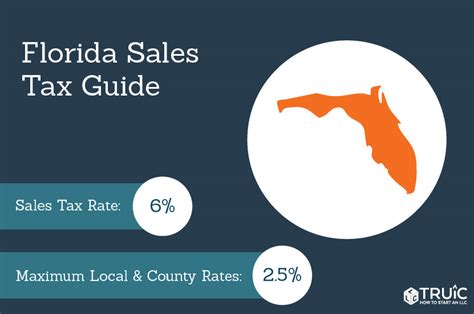

Virginia employs a statewide sales and use tax rate of 4.3%, which applies to most tangible personal property and certain services. This base rate is consistent across the state, ensuring uniformity in tax collection. However, it is important to note that local jurisdictions have the authority to impose additional sales tax rates, which can vary depending on the specific locality.

These local sales tax rates are typically imposed by cities, counties, or both, and they are added to the state's base rate. The combined state and local sales tax rates can significantly impact the total tax burden on consumers. For instance, in certain areas of Virginia, the total sales tax rate can exceed 7%, making it one of the higher rates in the region.

Virginia also imposes a meals tax, which is an additional sales tax specifically applicable to the sale of prepared food and beverages. The meals tax rate is set at 1.5%, bringing the total sales tax on meals to 5.8% in areas with a 4.3% state sales tax rate. This tax is a significant source of revenue for the state and is used to fund various public services.

Examples of Local Sales Tax Rates in Virginia

| Locality | Sales Tax Rate |

|---|---|

| Arlington County | 0.5% |

| City of Alexandria | 1% |

| Fairfax County | 0.5% |

| City of Richmond | 1.5% |

| Loudoun County | 0.25% |

Sales Tax Exemptions and Special Considerations

While the sales tax in Virginia applies to a wide range of goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of.

Exemptions

Some items are exempt from sales tax in Virginia. These include:

- Food and Drugs: Most non-prepared food items and over-the-counter drugs are exempt from sales tax.

- Clothing and Footwear: Clothing and footwear items priced under $100 per item are exempt from sales tax.

- Educational Materials: Sales of textbooks, school supplies, and other educational materials are exempt.

- Certain Services: Services such as professional services, repairs, and some entertainment services are not subject to sales tax.

Special Considerations

Virginia also has specific rules and regulations for certain transactions. These include:

- Remote Sellers: Out-of-state sellers who make remote sales to Virginia residents must register with the state and collect sales tax. This is particularly important for online retailers.

- Use Tax: Virginia residents who purchase items from out-of-state or online and do not pay sales tax are required to pay a use tax on those purchases.

- Resale Exemption: Businesses that purchase goods for resale are exempt from sales tax on those purchases, provided they have a valid resale certificate.

Sales Tax Collection and Compliance

Sales tax collection in Virginia is managed by the Virginia Department of Taxation (VADOT). The department provides comprehensive guidelines and resources to assist businesses in understanding their sales tax obligations and ensuring compliance.

Registration and Reporting

Businesses operating in Virginia or making sales into the state must register with the VADOT and obtain a sales and use tax certificate of registration. This certificate allows businesses to collect and remit sales tax on behalf of the state.

Businesses are required to report and remit sales tax on a monthly, quarterly, or annual basis, depending on their sales volume and the type of business. The VADOT provides online tools and resources to facilitate this process, making it easier for businesses to meet their tax obligations.

Audit and Enforcement

The VADOT conducts regular audits to ensure compliance with sales tax laws. Businesses that fail to register, collect, or remit sales tax may face penalties and interest charges. The department also works closely with the Virginia Department of Criminal Justice Services to investigate and prosecute cases of tax evasion.

Impact on Virginia’s Economy

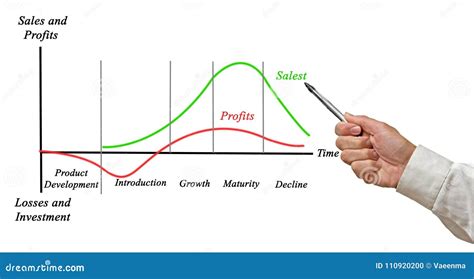

Sales tax is a significant source of revenue for the state of Virginia, contributing to its overall fiscal health and the provision of essential public services. The revenue generated from sales tax supports various sectors, including education, healthcare, infrastructure development, and public safety.

Revenue Generation

In the fiscal year 2022, Virginia collected $4.77 billion in sales and use tax revenue, accounting for a substantial portion of the state’s total tax revenue. This revenue is critical for funding state programs and initiatives, particularly in times of economic uncertainty.

Economic Impact on Businesses and Consumers

The sales tax rate in Virginia can influence business decisions and consumer behavior. A competitive sales tax rate can attract businesses to the state, leading to job creation and economic growth. Additionally, consumers may be more inclined to make purchases within the state, as opposed to seeking out lower tax rates in neighboring jurisdictions.

Regional Variations

The varying local sales tax rates across Virginia can create economic disparities between different regions. Areas with higher local sales tax rates may experience slower economic growth compared to those with lower rates, as businesses and consumers may opt for lower-tax alternatives.

Frequently Asked Questions

What is the current sales tax rate in Virginia for the state and localities?

+The current state sales tax rate in Virginia is 4.3%. However, local jurisdictions have the authority to impose additional sales tax rates, which can vary depending on the specific locality. These local sales tax rates are typically imposed by cities, counties, or both, and they are added to the state’s base rate. As a result, the total sales tax rate can vary significantly across the state.

Are there any items exempt from sales tax in Virginia?

+Yes, there are certain items that are exempt from sales tax in Virginia. These include non-prepared food items, over-the-counter drugs, clothing and footwear items priced under $100, educational materials like textbooks and school supplies, and certain services such as professional services, repairs, and some entertainment services. These exemptions are designed to provide relief to consumers and promote certain economic activities.

How does Virginia handle sales tax for remote sellers and online purchases?

+Virginia has implemented regulations for remote sellers and online purchases to ensure sales tax compliance. Out-of-state sellers who make remote sales to Virginia residents must register with the state and collect sales tax on those transactions. Additionally, Virginia residents who purchase items from out-of-state or online and do not pay sales tax are required to pay a use tax on those purchases. These measures help level the playing field for in-state businesses and ensure fair tax collection.