Sales Tax In New Jersey On Cars

When it comes to purchasing a car in New Jersey, understanding the sales tax process is crucial. The Garden State, known for its diverse landscapes and vibrant cities, has a unique sales tax system that can impact your car-buying experience. In this comprehensive guide, we'll delve into the specifics of sales tax on cars in New Jersey, providing you with all the information you need to make informed decisions.

Unraveling the Sales Tax Mystery

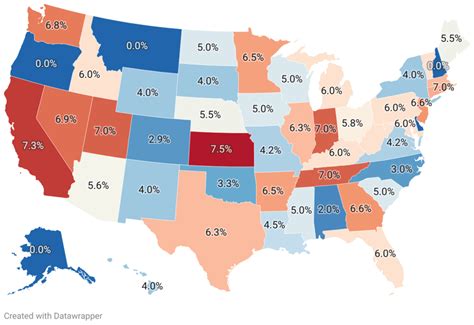

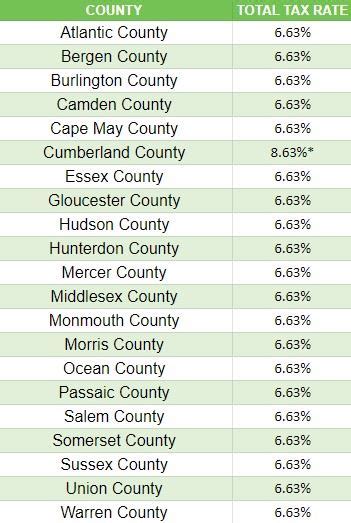

Sales tax in New Jersey, including that on cars, is a state-level tax, which means it is governed by the New Jersey Division of Taxation. The state imposes a uniform sales tax rate, but it’s important to note that certain localities may also levy additional taxes, which can vary from one municipality to another.

The base sales tax rate in New Jersey is 6.625%, as of January 2024. This rate is applicable to most retail sales, including the purchase of vehicles. However, it's crucial to understand that this base rate can be subject to change, so it's advisable to stay updated with the latest tax information.

Breaking Down the Car Sales Tax Process

When you’re ready to buy a car in New Jersey, the sales tax process begins with the dealer. During the purchase, the dealer will calculate the sales tax based on the vehicle’s purchase price and any applicable additional fees. This calculation is a straightforward multiplication of the sales tax rate by the purchase price.

For instance, if you're purchasing a car for $30,000 and the current sales tax rate is 6.625%, the sales tax amount would be $2,000.25 (30,000 x 0.06625). This tax is added to the purchase price, making the total cost of the vehicle $32,000.25.

However, it's essential to be aware of potential additional taxes that may apply. New Jersey allows localities to impose additional taxes on vehicle purchases, often known as "miscellaneous" taxes. These taxes can vary significantly, with some localities charging as little as $0, while others can impose taxes upwards of $300.

Understanding the “Miscellaneous” Tax

The “miscellaneous” tax is an additional charge that can be levied by local governments on vehicle purchases. It’s important to note that this tax is not uniform across New Jersey; each locality has the authority to set its own rate, if any. This means that the amount you pay in “miscellaneous” tax can vary greatly depending on where you reside or where you purchase the vehicle.

To illustrate, let's consider an example. If you live in a municipality that charges a $100 "miscellaneous" tax, and you purchase a $30,000 car, your total sales tax liability would be $2,162.50. This is calculated by adding the base sales tax of $2,000.25 (6.625% of $30,000) and the "miscellaneous" tax of $100.

| Tax Type | Rate | Amount |

|---|---|---|

| Base Sales Tax | 6.625% | $2,000.25 |

| Miscellaneous Tax | $100 | $100 |

| Total Sales Tax | N/A | $2,162.50 |

In this example, the total sales tax liability of $2,162.50 is added to the purchase price of $30,000, resulting in a final cost of $32,162.50 for the vehicle.

Strategies for Minimizing Sales Tax

While the sales tax on cars in New Jersey is a mandatory expense, there are strategies you can employ to minimize your tax liability. One effective approach is to compare tax rates across different localities. By doing so, you may discover municipalities with lower tax rates or even those that do not impose additional “miscellaneous” taxes.

For instance, if you live in a municipality with a high "miscellaneous" tax rate, consider exploring dealerships in nearby localities that have more favorable tax rates. This strategy can significantly reduce your overall tax burden and make your car-buying experience more cost-effective.

Comparative Analysis: Tax Rates by Municipality

To illustrate the potential savings, let’s compare the tax rates of two hypothetical municipalities, City A and City B. City A has a “miscellaneous” tax rate of $150, while City B has no additional tax.

| Municipality | Miscellaneous Tax Rate | Total Tax Rate |

|---|---|---|

| City A | $150 | 6.775% |

| City B | $0 | 6.625% |

Assuming you're purchasing a car for $30,000, the total tax liability in City A would be $2,077.50 (30,000 x 0.06775 + $150), while in City B, it would be $2,000.25 (30,000 x 0.06625). This simple comparison highlights a potential savings of $77.25 by choosing a dealership in City B.

Conclusion: Navigating the Sales Tax Landscape

Understanding the sales tax system in New Jersey is crucial for anyone looking to purchase a car. By familiarizing yourself with the base sales tax rate, the potential for additional “miscellaneous” taxes, and the strategies to minimize your tax liability, you can make informed choices that align with your financial goals.

Remember, the key to a successful car-buying experience is research and comparison. Stay updated with the latest tax rates, explore different dealerships, and consider the impact of tax rates on your overall budget. With this knowledge, you'll be well-equipped to navigate the sales tax landscape and make a confident decision when purchasing your next vehicle in New Jersey.

Frequently Asked Questions

Are there any exceptions to the sales tax on cars in New Jersey?

+

Yes, there are certain exceptions and exemptions to the sales tax on cars in New Jersey. For example, purchases made by government entities or non-profit organizations may be exempt from sales tax. Additionally, certain types of vehicles, such as those used for commercial purposes, may also qualify for tax exemptions. It’s advisable to consult with a tax professional or the New Jersey Division of Taxation for specific details on exemptions.

Can I negotiate the sales tax with the dealership?

+

The sales tax is a mandatory charge set by the state and local governments, so it’s unlikely that you can negotiate the tax rate itself. However, you can negotiate the purchase price of the vehicle, which indirectly affects the overall sales tax liability. By negotiating a lower purchase price, you can reduce the amount of sales tax you owe.

How often does the sales tax rate in New Jersey change?

+

The sales tax rate in New Jersey is subject to change, but it typically remains stable for extended periods. Major changes to the sales tax rate are relatively rare. However, it’s always a good practice to stay updated with the latest tax information, as minor adjustments or special assessments can occur. The New Jersey Division of Taxation is a reliable source for the most current tax rates.

Do I have to pay sales tax if I’m a non-resident purchasing a car in New Jersey?

+

Yes, non-residents who purchase a car in New Jersey are generally required to pay the applicable sales tax. The sales tax obligation is based on the location of the sale, not the residency of the buyer. However, non-residents may have different tax obligations in their home state when they register the vehicle, so it’s important to understand the tax laws in both jurisdictions.

Can I deduct sales tax on my car purchase from my taxes?

+

The deductibility of sales tax on a car purchase depends on various factors, including your tax filing status, income level, and other deductions you claim. Generally, sales tax is considered a personal expense and is not directly deductible. However, there may be situations where you can claim a deduction for sales tax, such as if you itemize deductions and meet certain criteria. Consulting with a tax professional can help you understand your specific tax situation and potential deductions.