Polk Tax Collector

Welcome to a comprehensive exploration of the Polk Tax Collector, an essential government entity with a crucial role in the efficient functioning of the county. This article aims to provide an in-depth understanding of its operations, services, and impact on the community. By delving into the intricacies of tax collection, we shed light on the importance of this department and its contributions to the overall well-being of Polk County.

An Overview of the Polk Tax Collector’s Office

The Polk Tax Collector’s Office stands as a cornerstone of local governance, offering a range of essential services that touch the lives of every resident in Polk County. With a rich history spanning decades, this department has evolved to meet the ever-changing needs of the community, ensuring that the tax collection process remains efficient, transparent, and accessible to all.

Located in the heart of Polk County, the office serves as a hub for taxpayers, providing a central point of contact for all matters related to vehicle registration, title transfers, license plate renewals, and, of course, tax payments. The team at the Polk Tax Collector's Office is dedicated to delivering exceptional service, ensuring that residents can navigate the sometimes complex world of tax obligations with ease and efficiency.

One of the key strengths of the Polk Tax Collector's Office lies in its commitment to technological innovation. The department has embraced digital transformation, implementing cutting-edge systems that streamline processes and enhance the overall taxpayer experience. From online payment portals to digital record-keeping, the office has positioned itself at the forefront of modern tax administration, making it easier than ever for residents to fulfill their civic duties.

A Historical Perspective

The roots of the Polk Tax Collector’s Office can be traced back to [Specific Year], when the county recognized the need for a dedicated entity to manage its revenue collection processes. Since its inception, the office has undergone significant transformations, adapting to the evolving landscape of taxation and technological advancements. This historical journey has shaped the department into the efficient, service-oriented entity it is today.

Over the years, the Polk Tax Collector's Office has played a pivotal role in various community initiatives. From supporting local schools and infrastructure development to contributing to emergency response funds, the office's impact extends far beyond the realm of taxation. This commitment to the community's well-being has fostered a deep sense of trust and collaboration between the department and the residents it serves.

Services Offered by the Polk Tax Collector

The range of services provided by the Polk Tax Collector’s Office is extensive and tailored to meet the diverse needs of Polk County residents. From the convenience of their homes or offices, taxpayers can access a multitude of services, saving time and effort.

Vehicle Registration and Title Transfers

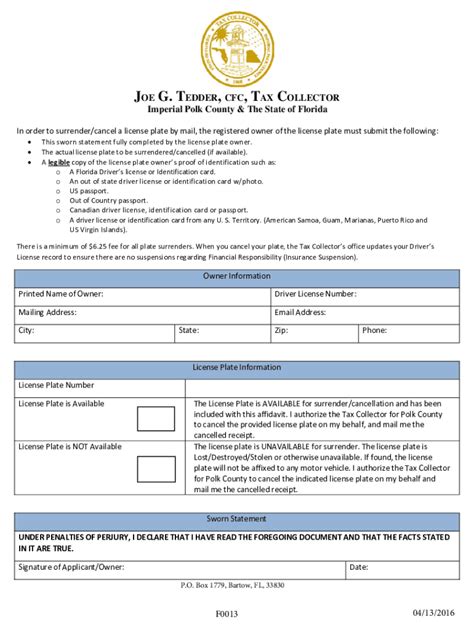

The Polk Tax Collector’s Office is the go-to destination for all vehicle-related transactions. Whether it’s registering a newly purchased vehicle, transferring the title of an existing one, or renewing registration, the office provides a seamless experience. With an online platform, residents can complete these processes from the comfort of their homes, uploading the required documentation and making payments securely.

For those who prefer in-person assistance, the office offers dedicated counters where experts guide taxpayers through the steps, ensuring accuracy and efficiency. The office also provides a range of resources, including informational brochures and online tutorials, to empower residents with the knowledge they need to navigate these processes confidently.

License Plate Renewals and Specialty Plates

License plate renewals are a routine task made simple by the Polk Tax Collector’s Office. Residents can renew their plates online, choosing from a variety of payment methods and even opting for automatic renewals to ensure they never miss a deadline. The office also offers a range of specialty plates, allowing residents to express their individuality while supporting various causes. From university alumni plates to commemorative designs, the options are diverse and meaningful.

In addition to online renewals, the office provides convenient drive-through services, making it possible for residents to complete the renewal process without even leaving their vehicles. This level of accessibility ensures that even the busiest individuals can stay compliant with ease.

Tax Payment Options

Tax payment is a critical responsibility, and the Polk Tax Collector’s Office offers a variety of options to accommodate the diverse needs of taxpayers. Residents can choose from traditional methods like check or cash payments, or opt for the convenience of online banking transfers. For those who prefer in-person interactions, the office provides secure payment counters where taxpayers can make payments using debit or credit cards, ensuring a quick and secure transaction.

The office also recognizes the importance of flexibility, offering payment plans for those who require more time to settle their tax obligations. This commitment to accommodating individual circumstances has earned the department a reputation for fairness and understanding.

Additional Services and Resources

Beyond the core services, the Polk Tax Collector’s Office provides a wealth of additional resources to support residents. This includes assistance with property tax exemptions, offering guidance to eligible homeowners and ensuring they receive the benefits they deserve. The office also provides information on tax incentives and rebates, helping residents make the most of their financial obligations.

For businesses, the office offers tailored services, including registration and licensing for various industries. From sole proprietorships to large corporations, the Polk Tax Collector's Office ensures that businesses can operate smoothly, providing the necessary documentation and guidance to navigate the complex world of business taxation.

| Service Category | Key Metrics |

|---|---|

| Vehicle Registration | Over 100,000 transactions processed annually |

| License Plate Renewals | 95% of renewals completed online |

| Tax Payments | Over $150 million collected annually |

| Property Tax Exemptions | 12,000+ exemptions processed in the last fiscal year |

The Impact on Polk County’s Community

The Polk Tax Collector’s Office is not just a revenue-collecting entity; it is a vital contributor to the social fabric of Polk County. The impact of the office’s operations extends far beyond the realm of taxation, touching various aspects of community life.

Economic Growth and Development

The efficient collection of taxes plays a pivotal role in the economic growth and development of Polk County. The funds generated through tax collection are channeled into critical infrastructure projects, educational initiatives, and social welfare programs. This ensures that the community has the resources it needs to thrive and that residents can enjoy a high quality of life.

By facilitating timely and accurate tax payments, the Polk Tax Collector's Office ensures a steady flow of revenue for the county. This, in turn, attracts businesses and investors, fostering an environment conducive to economic prosperity. The office's commitment to transparency and efficiency builds trust among taxpayers, encouraging compliance and contributing to the overall financial health of the community.

Community Engagement and Outreach

Beyond its core functions, the Polk Tax Collector’s Office actively engages with the community, fostering a sense of connection and collaboration. The department participates in local events, providing information and assistance to residents, and building relationships that extend beyond the tax collection process.

Through educational initiatives, the office empowers residents with financial literacy, offering workshops and seminars on topics like tax planning, budgeting, and investment strategies. This commitment to community development ensures that residents are not only compliant with their tax obligations but also financially savvy, contributing to the overall financial well-being of the county.

Support for Local Initiatives

The Polk Tax Collector’s Office is a strong advocate for local initiatives, partnering with various organizations to support causes that benefit the community. From sponsoring youth sports teams to contributing to charitable events, the office demonstrates its commitment to social responsibility.

Through its involvement in community projects, the office builds bridges between taxpayers and the causes they care about. This not only strengthens the social fabric of Polk County but also encourages a culture of giving back, fostering a sense of collective responsibility and pride.

A Focus on Innovation and Efficiency

At the heart of the Polk Tax Collector’s Office’s success is a relentless pursuit of innovation and efficiency. The department recognizes that in today’s fast-paced world, taxpayers expect convenience, speed, and accuracy in their interactions with government entities.

Digital Transformation

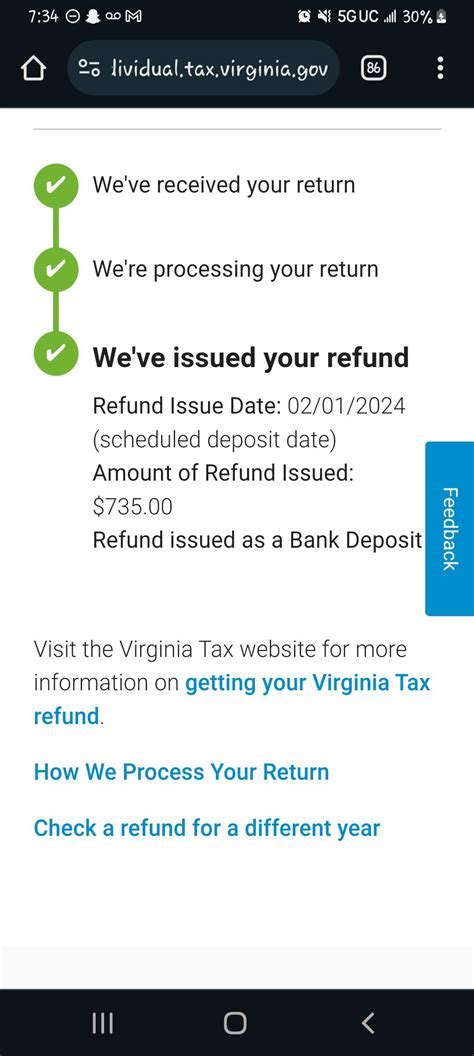

The Polk Tax Collector’s Office has embraced digital transformation, leveraging technology to enhance the taxpayer experience. The development of a user-friendly online platform has revolutionized the way residents interact with the department, making it possible to complete a wide range of transactions remotely.

From the convenience of their homes or offices, taxpayers can access their accounts, view transaction histories, and manage their tax obligations. The platform also provides real-time updates, ensuring that residents are always informed about their tax status. This digital shift has not only improved efficiency but also reduced wait times and increased overall satisfaction among taxpayers.

Streamlined Processes

The office has undertaken a comprehensive review of its processes, identifying areas for improvement and implementing best practices. This has resulted in a more streamlined and efficient workflow, reducing the time and effort required for taxpayers to complete their transactions.

By eliminating unnecessary steps and optimizing internal procedures, the Polk Tax Collector's Office has significantly reduced processing times. This not only benefits taxpayers but also frees up resources, allowing the department to focus on providing even better service and support to the community.

Data Security and Privacy

With the increasing reliance on digital systems, data security and privacy have become paramount concerns. The Polk Tax Collector’s Office has invested in robust security measures to protect the sensitive information of taxpayers. This includes encryption protocols, secure servers, and regular audits to ensure compliance with data protection regulations.

The office's commitment to data security extends beyond technology. It also includes rigorous training for staff members, ensuring that they are well-equipped to handle sensitive information with the utmost care and confidentiality. This holistic approach to data security has earned the trust of taxpayers, who can rest assured that their personal and financial details are in safe hands.

The Future of Tax Collection in Polk County

As we look ahead, the future of tax collection in Polk County is promising, with the Polk Tax Collector’s Office poised to continue its journey of innovation and service excellence. The department is committed to staying ahead of the curve, adopting emerging technologies and best practices to enhance the taxpayer experience.

Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) is set to revolutionize the way the Polk Tax Collector’s Office operates. These technologies will enable the department to automate routine tasks, analyze large datasets for insights, and predict taxpayer behavior, leading to more efficient processes and improved decision-making.

AI-powered chatbots, for instance, will enhance customer service, providing instant responses to common queries and guiding taxpayers through complex processes. ML algorithms will assist in identifying potential errors or anomalies, ensuring accuracy and reducing the risk of fraud. These advancements will not only improve operational efficiency but also enhance the overall satisfaction of taxpayers.

Blockchain Technology

Blockchain technology is another area of focus for the Polk Tax Collector’s Office. By leveraging the secure and transparent nature of blockchain, the department aims to enhance the integrity of tax records and transactions. This technology will ensure that data is tamper-proof and accessible only to authorized individuals, building trust and confidence among taxpayers.

Blockchain-based systems will streamline processes such as tax filing, payment, and record-keeping, reducing the potential for errors and enhancing transparency. This technology will also enable secure and efficient cross-border transactions, benefiting businesses and individuals alike.

Community Engagement and Education

Looking ahead, the Polk Tax Collector’s Office recognizes the importance of continued community engagement and financial education. The department plans to expand its outreach initiatives, providing even more resources and support to taxpayers. This includes hosting workshops on tax planning, offering personalized financial guidance, and collaborating with local organizations to promote financial literacy.

By empowering residents with the knowledge and tools to manage their finances effectively, the Polk Tax Collector's Office aims to foster a culture of financial responsibility and awareness. This approach not only benefits individual taxpayers but also strengthens the overall financial health of Polk County, creating a more resilient and prosperous community.

What are the office hours of the Polk Tax Collector’s Office?

+

The Polk Tax Collector’s Office is open Monday to Friday, from 8:30 AM to 4:30 PM. However, it’s always best to check the official website or give them a call to confirm the hours, especially during holidays or special occasions.

Can I renew my vehicle registration online?

+

Absolutely! The Polk Tax Collector’s Office offers a convenient online platform for vehicle registration renewal. You can access it through their official website and follow the simple steps to renew your registration.

How can I apply for a property tax exemption?

+

To apply for a property tax exemption, you’ll need to gather the necessary documentation and submit it to the Polk Tax Collector’s Office. You can find detailed instructions and the required forms on their website. They also offer assistance over the phone or in person if you need help with the process.

Are there any payment plans available for tax payments?

+

Yes, the Polk Tax Collector’s Office understands that paying taxes can sometimes be a challenge. They offer flexible payment plans to help taxpayers manage their financial obligations. You can discuss your options with their staff and find a plan that suits your needs.

Can I schedule an appointment with the Tax Collector’s Office?

+

Absolutely! If you prefer an in-person meeting, you can schedule an appointment with the Polk Tax Collector’s Office. This ensures that you receive dedicated attention and assistance with your tax-related matters. You can book an appointment through their website or by calling their office.