Understanding Denver Property Tax: A Comprehensive Guide for Homeowners

Imagine navigating a labyrinth where every turn reveals a new layer of complexity—such is the nature of property taxation in Denver. For homeowners, understanding the intricacies of Denver property tax isn’t just about compliance; it’s about empowering oneself with knowledge that directly affects financial health and community engagement. This comprehensive guide delves into the nuanced mechanisms behind Denver’s property tax system, walking through the development, assessment, and appeals processes, alongside strategic considerations for homeowners aiming to optimize their tax obligations.

Decoding the Foundations of Denver Property Tax System

The Denver property tax system functions within a framework established by Colorado state law, calibrated further by local ordinances. At its core, property taxes are levied on real estate based on assessed values, which subsequently influence the tax rate determination. Historically, Denver’s property tax policies have evolved considerably, reflecting shifts in economic priorities, demographic changes, and statewide legal reforms. Understanding these historical shifts provides context for current practices, revealing how policies aim to balance fiscal needs with equitable assessments.

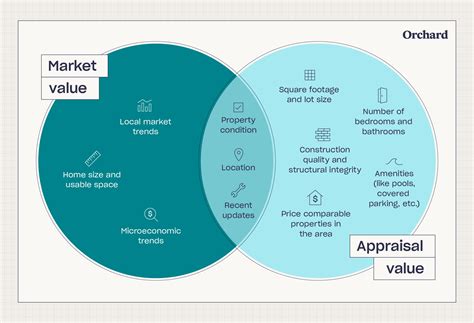

In Denver, property tax assessments are grounded in the "true market value" of a property, typically appraised by the Denver Assessor's Office annually. Recognizing that assessed value profoundly impacts tax liabilities underscores why rigorous assessment accuracy is a focal point for homeowners and policymakers alike. This foundation anchors the entire taxation process, which proceeds through evaluation, rate setting, and collection.

Assessment Process—From Valuation to Confirmation

At the heart of Denver property taxation lies the assessment process, an intricate dance involving valuation techniques, regulatory oversight, and periodic updates. The Denver Assessor’s Office employs mass appraisal methodologies, combining sales data, cost analysis, and income approaches to estimate the fair market value of properties. A key challenge resides in maintaining assessment accuracy amidst fluctuating market conditions and diverse property types.

Mass Appraisal Methodologies and Their Implications

Mass appraisal techniques in Denver leverage statistical models such as multiple regression analysis, enabling assessors to evaluate large datasets efficiently. These models account for variables like location, size, age, and improvements, crafting a comprehensive valuation landscape. Nonetheless, the reliance on statistical models introduces potential for disparities, which homeowners can contest during the appeal window.

| Relevant Category | Substantive Data |

|---|---|

| Assessment Cycle | Annual valuations projected on the prior year's market data, typically updated by May 1st each year |

| Median Assessed Value Increase | Approximately 4.5% annually over the past five years, reflecting market trends |

| Assessment Ratio | For residential properties, generally 7.15% of the true cash value (as of 2023) |

Tax Rate Determination and Its Role in Homeowner Obligations

Following valuation, Denver’s property tax rate—often expressed as a mill levy—is applied to assess the property value to determine actual taxes owed. The mill levy results from budget allocations across municipal departments, schools, transportation projects, and special districts. These levies are set through local government budget processes, which can be subject to political dynamics and fiscal priorities.

Understanding the Mill Levy Structure and Its Fluctuations

Each taxing district in Denver calculates its mill levy independently, with the combined total forming the overall rate. Typically, homeowners encounter combined rates ranging from 70 to 80 mills—meaning 70 to 80 per $1,000 of assessed value. Variations are often attributable to changes in district budgets, voter-approved measures, or shifts in economic conditions.

| Relevant Category | Substantive Data |

|---|---|

| Average Total Mill Levy (2023) | 75.5 mills, translating to approximately 7.55% tax rate on assessed value |

| Annual Rate Variations | ±3% fluctuation based on district budget adjustments and voter measures |

| Impact on Homeowners | $1,000 assessed value at 75 mills results in $75 tax liability; a 5% levy increase adds about $3.75 annually |

The Process of Property Tax Collection and Payment

With assessments completed and levies determined, Denver’s tax collection system channels funds toward public infrastructure, schools, emergency services, and community programs. Taxes are generally billed in the spring, with deadlines around April 30th. The City of Denver offers multiple payment options, including installment plans, which can ease financial burdens.

Payment Options and Potential Incentives

Homeowners can opt for early payment discounts, installment plans, or deferments under specified conditions—such as financial hardship or senior exemptions. Properly managing payment deadlines and understanding available programs ensures compliance and avoids penalties. Furthermore, timely payments maintain good standing, fostering trust with local authorities and enabling future negotiations or appeals if discrepancies emerge.

| Relevant Category | Substantive Data |

|---|---|

| Default Payment Deadline | April 30th annually |

| Installment Plan Availability | Yes, typically split into four payments from April to July |

| Interest on Delinquent Payments | 1% per month after the deadline, up to a maximum of 12% annually |

Challenging and Appealing Denver Property Tax Assessments

Assessments, while grounded in methodology, are not immune to inaccuracies. Homeowners dissatisfied with their valuation have the right to protest through a formal appeals process administered by the Denver Assessor’s Office. This process begins with a protest within a specific window—usually from May 1st to June 8th—and involves submitting supporting evidence.

Crafting an Effective Assessment Protest

An effective protest requires comprehensive documentation, including recent comparable sales, inspection reports, and property condition records. The process involves an informal review, which often resolves discrepancies quickly. Should disagreements persist, homeowners can escalate to a formal hearing, where an independent review panel evaluates the evidence, comparing it against current market data.

| Relevant Category | Substantive Data |

|---|---|

| Protest Window | May 1st to June 8th |

| Success Rate | Approximately 45% of protests lead to assessed value reductions in recent years |

| Average Reduction | 1.5% decrease in assessed value upon successful protest |

Historical Trends and Evolving Policies in Denver’s Property Tax Landscape

The history of Denver’s property taxes reflects shifts motivated by economic cycles, demographic changes, and legislative reforms at both the state and city levels. Notably, reforms introduced in the early 2000s aimed at increasing assessment accuracy and providing taxpayer protections, such as the property tax exemption for seniors and disabled persons.

Furthermore, recent trends point toward increased reliance on digital valuation tools, real-time data integration, and community engagement initiatives. These efforts aim to improve transparency, reduce assessment disparities, and facilitate fair taxation aligned with current market conditions.

Key Points

- Accurate assessment methodology significantly impacts overall tax fairness; homeowners should understand valuation techniques.

- Legislative reforms continually shape the landscape, with recent policies emphasizing transparency and taxpayer rights.

- Community engagement can influence levy decisions and assessment practices, underlining the importance of civic participation.

- Proactive management of appeals and payment options helps mitigate unforeseen financial impacts.

- Technology integration plays an increasingly vital role in maintaining assessment accuracy and transparency.

Strategic Considerations for Homeowners Navigating Denver Property Tax

Homeowners seeking optimal tax management should adopt a multifaceted approach—monitoring assessed values annually, staying informed about local levies, and engaging in the protest process when justified. Additionally, understanding potential exemptions, such as the homestead exemption, can significantly reduce liability in specific circumstances.

Participation in community meetings or public hearings concerning budget allocations can also influence tax rates and levies. Long-term strategies encompass maintaining detailed property records, considering appeals proactively, and leveraging legal or professional advice for complex cases.

How often does Denver re-assess property values?

+The Denver Assessor’s Office conducts annual reassessments, with updates typically arriving in late spring, based on the previous year’s market data.

What common reasons lead to assessment protests being successful?

+Protests often succeed when homeowners provide recent comparable sales, demonstrate discrepancies in property condition, or identify errors in data used for evaluation.

Are there any exemptions available for Denver homeowners?

What protections exist against rising taxes?

+Yes, exemptions such as the Homestead Exemption reduce taxable value, especially for primary residences. Additionally, certain safeguards limit the amount of increase year-over-year for qualifying homeowners, offering some predictability amid assessment growth.