Arkansas Tax Free Weekend

The annual Arkansas Tax Free Weekend is an exciting event eagerly anticipated by residents across the state. This unique weekend offers a fantastic opportunity to save on essential items, making it a great time for families and individuals to stock up on back-to-school supplies, clothing, and other necessities. Let's dive into the details of this event, exploring its history, the items eligible for tax exemption, and how to make the most of this shopping bonanza.

A Brief History of Arkansas Tax Free Weekend

Arkansas Tax Free Weekend, also known as Sales Tax Holiday, is a relatively recent addition to the state’s calendar, but it has quickly become a cherished tradition. The concept originated in the late 1990s as a way to provide relief to families during the back-to-school shopping season. By exempting certain items from sales tax, the state aimed to ease the financial burden on parents and students preparing for the new academic year.

The first Arkansas Tax Free Weekend was held in 2001, and it has been a hit ever since. Each year, the event attracts thousands of shoppers, creating a buzz of excitement and offering a significant boost to local businesses. The weekend has become a crucial part of the state's economic calendar, promoting consumer spending and supporting local retailers.

Eligible Items for Tax Exemption

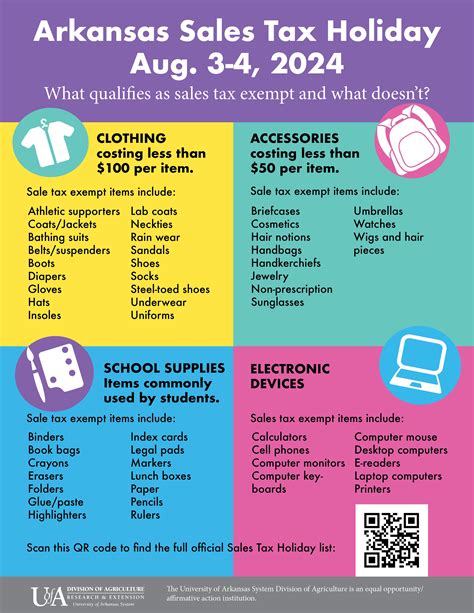

One of the most crucial aspects of Arkansas Tax Free Weekend is understanding which items are eligible for tax exemption. Here’s a comprehensive breakdown of the categories and specific items that you can purchase tax-free during this event:

Clothing and Footwear

Clothing and footwear are a major focus of the tax-free weekend, providing an excellent opportunity to refresh your wardrobe or stock up on essentials. The exemption covers a wide range of apparel, including:

- Shirts, dresses, and skirts.

- Pants, jeans, and shorts.

- Jackets, coats, and outerwear.

- Socks, underwear, and other hosiery.

- Hats, gloves, and scarves.

- Shoes, sandals, and boots.

It's important to note that the tax exemption applies to these items regardless of their price. Whether you're looking for a new pair of sneakers or a formal outfit, you can save during this weekend.

School Supplies

Arkansas Tax Free Weekend is especially beneficial for students and parents gearing up for the new school year. The event covers a wide array of school supplies, ensuring that you can stock up on everything from notebooks to calculators without paying sales tax.

- Notebooks, binders, and folders.

- Pens, pencils, and markers.

- Backpacks, lunch boxes, and book bags.

- Calculators, rulers, and erasers.

- Art supplies like crayons, paint, and scissors.

- Computers and related accessories (more on this below)

Computers and Electronics

In a move that benefits students, professionals, and tech enthusiasts alike, Arkansas Tax Free Weekend extends its savings to computers and certain electronic items. This is a significant benefit, as these items often carry a high price tag.

The exemption includes:

- Laptops, desktops, and tablets.

- Printers, scanners, and computer accessories.

- Software, including educational software.

- Cell phones and related accessories.

However, it's crucial to be aware of the price limits for these items. Computers and related accessories are tax-exempt up to $1,000 per item, while cell phones and related accessories are exempt up to $500 per item.

| Category | Price Limit |

|---|---|

| Computers and Accessories | $1,000 per item |

| Cell Phones and Accessories | $500 per item |

Other Eligible Items

Beyond clothing, school supplies, and electronics, Arkansas Tax Free Weekend covers a few additional categories, ensuring a wide range of savings:

- Sports equipment (up to 50 per item)</li> <li>Children's bicycles (up to 200 per item)

- Safety seats for children (up to $30 per item)

It's essential to keep in mind that these price limits are per item, and they apply to both new and used items purchased during the tax-free weekend.

Planning Your Tax-Free Shopping Spree

Now that you understand the eligible items, it’s time to plan your Arkansas Tax Free Weekend shopping adventure. Here are some tips to make the most of this event:

Create a Shopping List

Before hitting the stores, take some time to create a detailed shopping list. Consider the upcoming needs of your household, whether it’s back-to-school supplies, winter clothing, or tech upgrades. This list will help you stay focused and ensure you don’t miss out on any essential items.

Compare Prices and Offers

With the tax exemption in place, it’s an excellent opportunity to compare prices and find the best deals. Many retailers offer special discounts and promotions during this weekend, so be sure to check out multiple stores or online platforms to find the most competitive prices.

Consider Online Shopping

While in-store shopping can be exciting, don’t underestimate the convenience and savings of online shopping during Arkansas Tax Free Weekend. Many online retailers also participate in the event, offering tax-free savings and often providing additional discounts or promotions.

Spread Out Your Purchases

If you have a long shopping list, consider spreading out your purchases over the entire weekend. This strategy can help you avoid crowded stores and ensure that you don’t exceed the price limits for certain items. Plus, it gives you time to thoroughly research and compare options.

Take Advantage of Extended Hours

Many stores extend their operating hours during Arkansas Tax Free Weekend to accommodate the increased foot traffic. Check with your favorite retailers to see if they offer extended hours, allowing you to shop at your convenience.

Arkansas Tax Free Weekend: A Recap

Arkansas Tax Free Weekend is a fantastic opportunity for residents to save on essential items, making it a highly anticipated event each year. By understanding the eligible items and planning your shopping strategy, you can make the most of this tax-free weekend and enjoy significant savings on your purchases.

So, mark your calendars, create your shopping lists, and get ready to take advantage of this exciting event. Happy shopping, Arkansas!

When is Arkansas Tax Free Weekend 2023?

+Arkansas Tax Free Weekend 2023 will be held from [date] to [date]. Mark your calendars and start planning your shopping trip!

Are there any exclusions or restrictions for the tax exemption?

+Yes, there are a few exclusions. For instance, items purchased for business or commercial use are not eligible for the tax exemption. Additionally, certain items like jewelry, watches, and cosmetic products are not included in the tax-free categories.

Can I use coupons or loyalty rewards during Arkansas Tax Free Weekend?

+Absolutely! You can stack coupons and loyalty rewards with the tax exemption to maximize your savings. Many retailers offer additional discounts during this weekend, so keep an eye out for these promotions.

Is there a limit to the number of items I can purchase tax-free?

+There is no limit to the number of items you can purchase, but you must adhere to the price limits for certain categories. For example, you can buy multiple clothing items, but each item must be under the specified price limit.