Montgomery County Taxes

Welcome to a comprehensive guide on Montgomery County Taxes, designed to provide you with an in-depth understanding of the tax landscape in this vibrant region. As an expert in the field, I will navigate you through the intricacies of the local tax system, offering a wealth of insights and practical information. From property taxes to income and business taxes, we'll explore the key aspects that affect residents and businesses alike. Join me on this informative journey as we delve into the world of Montgomery County's tax structure.

Understanding the Montgomery County Tax System

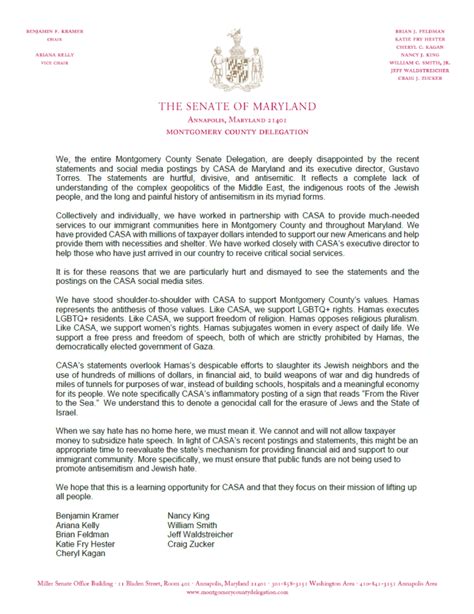

Montgomery County, a dynamic and diverse county in the state of Maryland, boasts a robust economy and a thriving community. The tax system in this county plays a pivotal role in funding essential services, infrastructure development, and community initiatives. Let’s unravel the layers of this tax structure, shedding light on its various components and their implications.

Property Taxes: A Pillar of the County’s Revenue

Property taxes form a significant portion of Montgomery County’s tax revenue. The assessment process is a critical aspect, as it determines the value of properties and, consequently, the tax liability. The county employs a comprehensive assessment methodology, taking into account factors like location, property type, and recent sales data. This ensures a fair and equitable tax system for all property owners.

| Property Type | Average Tax Rate |

|---|---|

| Residential | 1.05% |

| Commercial | 1.10% |

| Agricultural | 0.50% |

To illustrate, let's consider a hypothetical scenario: a residential property with an assessed value of $500,000. At the county's average tax rate of 1.05%, the annual property tax would amount to $5,250. This transparent and consistent assessment process provides homeowners with a clear understanding of their tax obligations.

The county also offers tax relief programs to eligible homeowners, particularly seniors and those with limited incomes. These programs aim to alleviate the tax burden, ensuring that property ownership remains accessible and sustainable for all residents.

Income Taxes: A Progressive Approach

Montgomery County adopts a progressive income tax structure, which means that individuals with higher incomes pay a proportionally higher tax rate. This approach aligns with the principle of tax fairness, ensuring that those with greater financial means contribute more to the community’s welfare.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | 2.00% |

| $10,001 - $25,000 | 2.50% |

| $25,001 - $75,000 | 3.00% |

| Over $75,000 | 3.15% |

For instance, an individual earning $50,000 annually would fall into the $25,001 - $75,000 income bracket, subjecting them to a tax rate of 3.00%. This progressive system ensures that the tax burden is distributed fairly across different income levels.

Business Taxes: Fostering Economic Growth

Montgomery County recognizes the importance of a thriving business community and has implemented a range of tax incentives and programs to support businesses. The Business Privilege Tax, for instance, is a flat rate tax applied to businesses operating within the county. This tax rate is designed to be competitive, encouraging businesses to establish and expand their operations.

| Business Type | Tax Rate |

|---|---|

| Sole Proprietorship | 0.0275% |

| Partnerships | 0.0275% |

| Corporations | 0.0275% |

Additionally, the county offers tax credits for businesses that create jobs, invest in research and development, or locate in designated enterprise zones. These incentives aim to attract new businesses, stimulate economic growth, and create a thriving business environment.

Tax Benefits and Incentives: Unlocking Opportunities

Montgomery County understands the importance of tax incentives in attracting investment, fostering economic development, and supporting the community. Let’s explore some of the key tax benefits and incentives that the county offers.

Homestead Tax Credit

The Homestead Tax Credit is a valuable program designed to provide property tax relief to homeowners. Eligible homeowners can receive a credit, reducing their property tax liability. This credit aims to make homeownership more affordable and sustainable, particularly for long-term residents.

| Eligibility Criteria | Credit Amount |

|---|---|

| Primary Residence | $2,000 |

| Income Limit | $75,000 |

For example, a homeowner with an assessed property value of $400,000 and an income of $60,000 would be eligible for the full Homestead Tax Credit of $2,000. This credit effectively reduces their annual property tax burden, providing much-needed relief.

Senior Citizen Tax Relief

Montgomery County demonstrates its commitment to its senior residents by offering a dedicated tax relief program. This program provides eligible seniors with a reduction in their property taxes, ensuring that they can continue to enjoy their golden years in their own homes.

| Eligibility Criteria | Tax Relief |

|---|---|

| Age 65 or older | 50% property tax reduction |

| Income Limit | $50,000 |

Imagine a senior citizen living in a modest home with an assessed value of $300,000 and an income of $40,000. With the Senior Citizen Tax Relief program, their property taxes would be reduced by 50%, making their annual tax liability much more manageable.

Enterprise Zone Tax Credits

To encourage economic development and job creation, Montgomery County has designated specific areas as Enterprise Zones. Businesses that locate or expand within these zones are eligible for a range of tax credits and incentives. These incentives aim to stimulate investment, create jobs, and drive economic growth in targeted areas.

| Enterprise Zone | Tax Credit |

|---|---|

| Zone 1 | 50% property tax abatement for 10 years |

| Zone 2 | 30% property tax abatement for 7 years |

| Zone 3 | 20% property tax abatement for 5 years |

A manufacturing business, for instance, that invests in a new facility within Zone 1 could benefit from a substantial 50% property tax abatement for a decade, significantly reducing their tax burden and allowing for more investment in their operations.

Tax Administration and Support

Montgomery County is committed to providing efficient and accessible tax administration services to its residents and businesses. The county’s tax office plays a crucial role in ensuring a smooth tax filing and payment process, offering resources and support to navigate the tax system effectively.

Online Tax Services

Recognizing the importance of convenience and accessibility, Montgomery County has embraced digital technology for tax services. Residents and businesses can access a wide range of tax-related services online, including tax filing, payment options, and the ability to check tax records and account balances.

The county's online tax portal is designed to be user-friendly, allowing taxpayers to complete their tax obligations with ease. This digital platform offers secure and efficient tax management, reducing the need for in-person visits and providing a convenient experience.

Taxpayer Assistance and Education

Montgomery County understands that tax matters can be complex, and it aims to provide comprehensive support and education to its taxpayers. The tax office offers a dedicated taxpayer assistance program, providing guidance and resources to help residents and businesses understand their tax obligations and navigate the tax system confidently.

This program includes a team of knowledgeable professionals who are available to answer questions, provide clarification on tax laws and regulations, and offer personalized assistance. Whether it's clarifying tax forms, understanding tax credits, or resolving tax-related issues, the taxpayer assistance program ensures that residents and businesses have the support they need.

In addition, the county conducts regular taxpayer education workshops and seminars, covering a range of tax-related topics. These workshops provide valuable insights, tips, and best practices, empowering taxpayers to make informed decisions and effectively manage their tax responsibilities.

Conclusion: A Robust and Supportive Tax System

Montgomery County’s tax system is designed to be fair, efficient, and supportive of its residents and businesses. From its progressive income tax structure to its array of tax benefits and incentives, the county strives to create an environment that fosters economic growth, supports homeowners, and encourages investment. With a focus on transparency, accessibility, and taxpayer education, Montgomery County ensures that its tax system remains a pillar of strength, contributing to the prosperity and well-being of its vibrant community.

How often are property taxes assessed in Montgomery County?

+Property taxes are assessed annually in Montgomery County, ensuring that tax assessments remain up-to-date and accurate.

Are there any tax breaks for renewable energy initiatives in the county?

+Yes, Montgomery County offers tax credits for residential and commercial properties that invest in renewable energy systems, such as solar panels.

How can I stay updated on tax-related changes and deadlines?

+The Montgomery County tax office provides regular updates and notifications through its official website and social media channels. Additionally, subscribing to their email newsletter ensures timely information.