Franklin County Real Estate Taxes

In Franklin County, Ohio, real estate taxes are a vital component of the local government's revenue stream, funding essential services and infrastructure. These taxes are a responsibility for property owners, and understanding how they work is crucial for both homeowners and investors. This article delves into the specifics of Franklin County real estate taxes, covering the assessment process, tax rates, exemptions, and the impact on property owners.

Understanding the Real Estate Tax System in Franklin County

The real estate tax system in Franklin County is designed to ensure a fair and equitable distribution of the tax burden among property owners. The process begins with the assessment of property values, which is conducted by the Franklin County Auditor’s Office. This office is responsible for determining the taxable value of each property within the county, taking into account factors such as location, improvements, and market conditions.

The Assessment Process

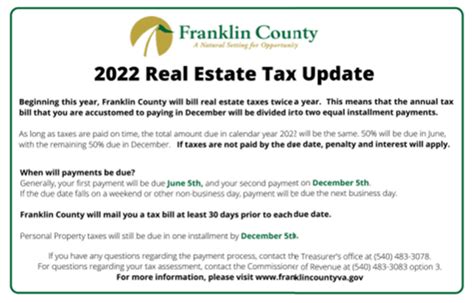

Property assessments in Franklin County occur on a triennial basis, with the most recent reassessment taking place in 2022. During this process, the Auditor’s Office utilizes a combination of physical inspections, market data analysis, and computer-assisted mass appraisal techniques to determine the fair market value of each property. This value, known as the taxable value, forms the basis for calculating the real estate taxes owed.

To ensure accuracy, the Auditor's Office employs a team of experienced appraisers who are well-versed in the local real estate market. They consider various factors, including recent sales of comparable properties, construction costs, and any improvements made to the property. This comprehensive approach aims to provide a fair and consistent valuation for all properties within the county.

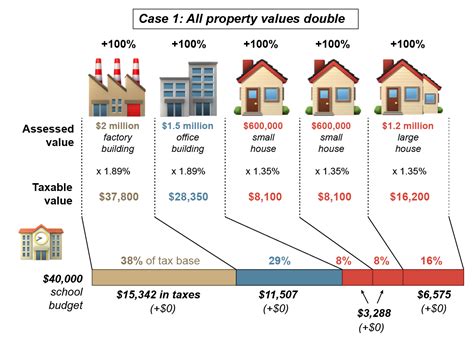

Tax Rates and Calculations

Once the taxable value of a property is determined, the real estate taxes are calculated using a formula that considers both the property’s value and the applicable tax rate. In Franklin County, the tax rate is expressed in mills, where one mill equals one-tenth of a cent per dollar of valuation. For example, a tax rate of 100 mills would equate to 1.00 per 1,000 of taxable value.

The tax rate itself is set by various taxing authorities within the county, including the county government, cities, townships, school districts, and special districts. These entities use the tax revenue to fund a wide range of services, such as education, public safety, infrastructure maintenance, and social programs. The specific allocation of tax revenue varies depending on the needs and priorities of each taxing authority.

| Taxing Authority | Millage Rate |

|---|---|

| Franklin County | 10.50 |

| City of Columbus | 13.50 |

| Columbus City School District | 33.97 |

| Franklin County Children Services | 0.97 |

| Ohio State University Extension | 0.28 |

| Total Millage Rate | 60.42 |

To illustrate the tax calculation process, consider a residential property with a taxable value of $200,000. Using the total millage rate of 60.42, the real estate taxes for this property would be calculated as follows: $200,000 x 0.06042 = $12,084. This means the property owner would owe $12,084 in real estate taxes for the year.

Exemptions and Reductions

Franklin County offers several exemptions and reductions to alleviate the tax burden for eligible property owners. These exemptions are designed to provide relief to specific groups, such as senior citizens, disabled individuals, and veterans.

- Homestead Exemption: Eligible homeowners can apply for a homestead exemption, which reduces the taxable value of their primary residence by $25,000. This exemption is particularly beneficial for homeowners on fixed incomes, as it lowers their real estate tax liability.

- Senior Citizen and Disability Exemption: Senior citizens aged 65 and older, as well as disabled individuals, may qualify for an additional exemption. This exemption further reduces the taxable value of their property, resulting in lower real estate taxes.

- Veteran Exemption: Veterans who meet certain criteria, such as being honorably discharged or having served during a period of armed conflict, may be eligible for a veteran's exemption. This exemption provides a reduction in the taxable value of their property, offering financial relief to those who have served their country.

The Impact of Real Estate Taxes on Property Owners

Real estate taxes in Franklin County can have a significant impact on property owners, both financially and in terms of their overall property ownership experience. Here’s a closer look at some of these impacts:

Financial Considerations

Real estate taxes represent a substantial expense for property owners, often constituting a significant portion of their annual property-related costs. For homeowners, these taxes are typically included in their monthly mortgage payments, while for investors, they are a separate expense to be factored into their investment calculations.

The financial impact of real estate taxes can be especially pronounced for properties with higher taxable values, as the tax liability increases proportionally. This can affect an owner's cash flow and overall financial planning, particularly if they are on a fixed income or have other significant financial obligations.

Planning and Budgeting

Understanding the real estate tax system and staying informed about tax rates and assessments is crucial for effective financial planning. Property owners should factor in the annual tax liability when budgeting for their property expenses. This includes not only the tax payments themselves but also any potential increases in tax rates or property values, which can lead to higher tax bills in subsequent years.

Additionally, property owners should be aware of the exemption and reduction opportunities available to them. By taking advantage of these benefits, they can reduce their tax liability and improve their overall financial position.

Property Ownership Experience

The real estate tax system in Franklin County influences the overall property ownership experience in several ways. For homeowners, the annual tax bill can be a significant reminder of their financial commitment to their property. It serves as a tangible representation of the services and infrastructure they benefit from as part of the local community.

For investors, real estate taxes are a critical component of their investment strategy. They must carefully consider the tax implications when evaluating potential properties, as these taxes can significantly impact the property's overall profitability. Investors may also need to navigate the complexities of tax laws when dealing with rental properties or commercial real estate.

Conclusion

Franklin County’s real estate tax system is a complex yet essential aspect of local governance and property ownership. By understanding the assessment process, tax rates, and available exemptions, property owners can navigate this system more effectively and plan their financial strategies accordingly. The real estate tax revenue plays a crucial role in supporting the county’s services and infrastructure, making it a vital component of the local economy and community well-being.

How often are property assessments conducted in Franklin County?

+Property assessments in Franklin County occur on a triennial basis, with the most recent reassessment taking place in 2022. This means that property values are reviewed and adjusted every three years to ensure accuracy and fairness.

What factors are considered in determining the taxable value of a property?

+The taxable value of a property is determined based on factors such as location, improvements made to the property, and market conditions. The Auditor’s Office utilizes physical inspections, market data analysis, and computer-assisted mass appraisal techniques to assess these factors and arrive at a fair market value.

How can property owners stay informed about changes in tax rates and assessments?

+Property owners can stay informed by regularly checking the Franklin County Auditor’s Office website for updates and announcements. Additionally, local news outlets often cover changes in tax rates and assessments, providing valuable information for property owners.